2022 Econ Nobel that saved the world

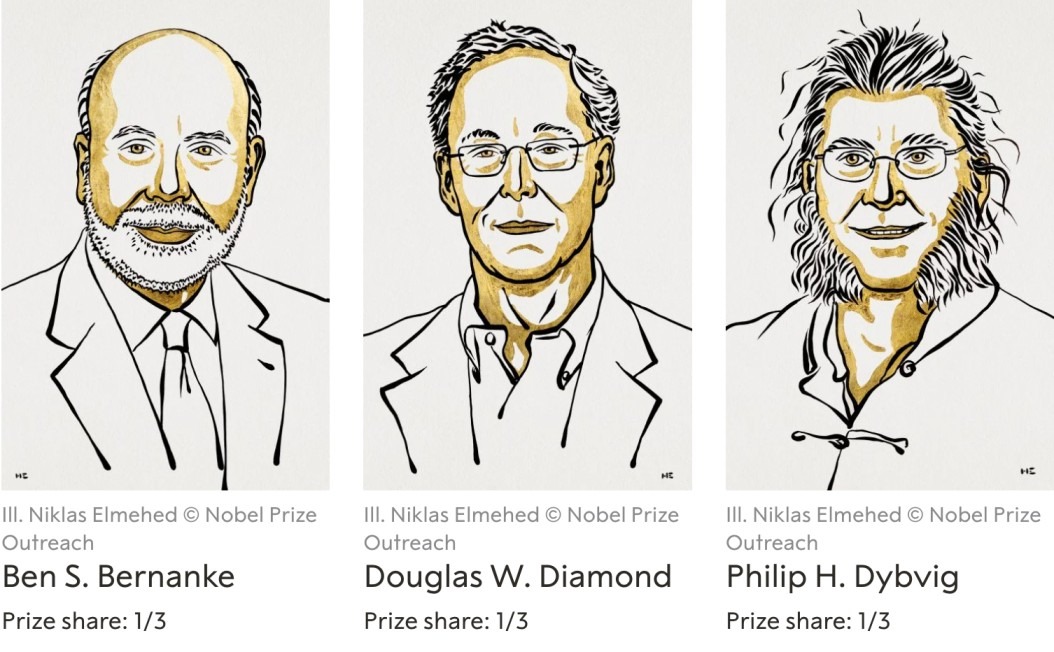

The 2022 Sveriges Riksbank Prize in Economic Sciences in memory of Alfred Nobel was awarded to Ben S Bernanke, Douglas W Diamond and Philip H Dybvig, “for research on banks and financial crises”, at the Royal Swedish Academy of Sciences in Stockholm on Monday.

Alfred Nobel, the Swedish polymath and inventor of dynamite, 1895 in his will, bequeathed the majority of his estate to create five prizes (Chemistry, Physics, and Physiology/Medicine plus one in literature and one for peace), recognizing “those, who during the preceding year, have conferred the greatest benefit to humankind.”

In a press release, the academy said, “Modern banking research clarifies why we have banks, how to make them less vulnerable in crises and how bank collapses exacerbate financial crises. The foundations of this research were laid by Ben Bernanke, Douglas Diamond and Philip Dybvig in the early 1980s. Their analyses have been of great practical importance in regulating financial markets and dealing with financial crises.”

Usually, the economic Nobel is awarded for developing a new research method, not a specific discovery. The famous Diamond-Dybvig model, and Bernanke’s work on financial macroeconomics, have generated substantial follow-on literature. Diamond and Dybvig developed a financial model of the banking crisis that explains why banks tend to collapse. Bernanke showed how those collapses could bring down the real economy.

The Diamond and Dybvig Model

The Diamond and Dybvig model was first outlined in 1983, in a famous Journal of Political Economy piece, “Bank Runs, Deposit Insurance, and Liquidity.”

This model as our most fundamental understanding, in modelled form, is how financial intermediation works. It is a foundation for how economists think about deposit insurance and also the lender of last resort functions of the Fed.

Diamond and Dybvig developed a model of a banking crisis that explains the basic reason why banks tend to collapse. Bernanke showed how those collapses could bring down the real economy. Those insights were then successfully applied to save the economy from a second Great Depression in 2008-10 — in part by Bernanke himself.

Why do banks fail?

Usually, a bank run occurs when a large group of depositors withdraw their money from banks, based on the fear that the bank will become insolvent. Bank runs have been said to run throughout history, including the Great Depression and the 2008-9 financial crisis.

But why does a bank run happen? Why can’t banks just give everyone their money if they all want it back at the same time? The answer is that u003cemu003ethey don’t have itu003c/emu003e. Click To TweetDo financial failures cause economic crises?

If banks fail, does it matter for the whole country? It’s true that big waves of bank failures tend to be followed by recession, but it doesn’t mean that they cause a recession.

Ben Bernanke was one of the first macroeconomists who put this language of mathematical models based on clear assumptions about individual economic behaviour. These aren’t the kind of models you can use to make quantitative predictions; instead, they’re just very detailed explanations of forces you think could be at work in the economy. The Great Recession began with the fall of Lehman Brothers and the financial crisis of 2008, Americans were furiously debating whether banks were facing a liquidity crisis or a solvency crisis. Bernanke realized that these were one and the same. Thanks to Diamond-Dybvig-style bank runs and financial accelerator effects, fear of a solvency crisis could generate a liquidity crisis, which could then quickly become an actual solvency crisis. The key was to provide liquidity and ensure solvency at the same time, thus short-circuiting the vicious cycle.

Thanks to the direct application of macroeconomic theories, we did better than in the 1930s Great Depression.

This week we’ve been;

Reading Local Woman Missing, by Mary Kubica, is a thriller and suspenseful book filled with twists and turns. Shelby Tebow is the first to disappear, soon after Meredith Tebow and her six-year-old daughter, Delilah disappear. Now, 11 years later, Delilah shockingly returns, with no memory whatsoever.

Watching people cry over the line-up of Lollapalooza India.