Are your investments ‘Atmanirbhar’ yet?

TL;DR –

The Government of India has been promoting schemes like Atmanirbhar Bharat and Make in India to boost and incentivise the production sector. The aim is to build a Bharat that is fiscally and operationally self-dependent.

This is great news for several companies – are you invested in them yet?

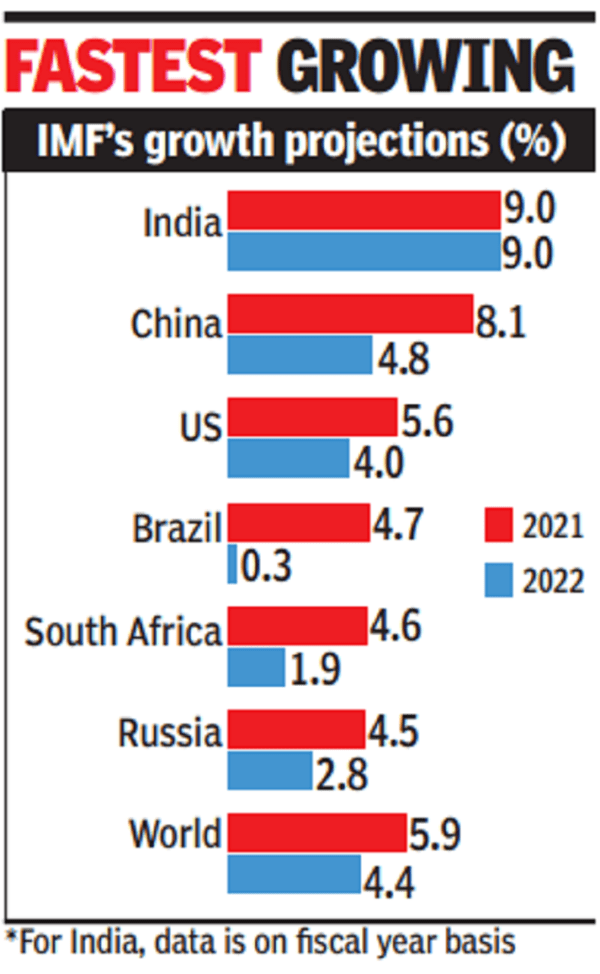

Where is India headed currently?

The formalisation of several sectors of the economy, supported by various schemes and incentives, has now accelerated pace as the pandemic led to the K-shaped recovery. A gradual economic expansion is finally happening, heading towards the $5 trillion figure. All of this, thanks to measures like PLI, Make in India, and Atmanirbhar Bharat.

In the context of stock markets, there has been stupendous growth despite the not-so-stellar economic growth on the ground. The bigger, more established players of the markets are delivering better products and services by capturing the markets from unorganised players. This is evident from the increase in the tax collections – FY22 gross tax revenues are expected to reach ₹25.1 lakh crores, up from ₹20.2 lakh crores in FY21 and ₹20.1 lakh crores in FY20, the last “normal” year. This 25% growth is phenomenal, considering the fact that the revised FY22 estimates are 13% above the figure of ₹22.1 lakh crores estimated for the year in the previous budget.

Why are India’s largest companies important?

Larger companies play a pivotal role in the economic growth and development of the country. They come with truckloads of money – in fact, some of these companies, also known as international, stateless, or transnational corporate organisations, may have more extensive budgets than some smaller countries.

These companies are believed to be especially beneficial for developing countries because they bring in employment opportunities and new technologies that domestic firms can then use. Furthermore, these companies make profits due to government subsidies and incentives that are in turn linked to investment in local firms and the development of the local community through employment opportunities and CSR activities.

What’s this PLI they’ve been talking about?

The Production-Linked Incentive Scheme or PLI is a key element of the Atmanirbhar Bharat package. It was introduced to transform the manufacturing landscape of the Indian economy and integrate it with the global supply chains. 13 sectors stand to benefit from this scheme on the basis of their growth, employment, and export potential. It offers a production subsidy of 4-6% on incremental sales for products manufactured in India.

A self-reliant Indian economy is on the rise

Atmanirbhar Bharat Abhiyan is a mission started by the Government of India in 2020, and focuses on making India self-reliant. It is focused on 5 components – Economy, Infrastructure, Systems, Vibrant Demography and Demand.

Our Finance Minister further announced Government Reforms and Enablers across Seven Sectors under Aatmanirbhar Bharat Abhiyaan, during Budget ‘22. Several bold reforms such as Supply Chain Reforms for Agriculture, Rational Tax Systems, Simple & Clear Laws, Capable Human Resource and Strong Financial System were covered.

Our Government has constantly tried to leverage the ease of doing business and liberalised regulatory environment as incentives for global companies to come in. Among various initiatives, the Government has slashed the corporate tax rates, liberalized Foreign Direct Investment (FDI) policies and norms in several sectors, and vehemently rationalized the regulatory compliance burden for them. You can read more here.

Opportunities galore!

The government supported the Atmanirbhar Bharat Abhiyaan with concepts like Make in India, which urges users to produce and consume indigenously. Plus, the concept of China Plus One, which many companies are now looking at, is a business strategy to avoid investing only in China and diversify business into other countries. Many companies are looking to diversify their manufacturing into countries like India as a part of their de-risking strategy, especially post the Covid-19 fiasco that the country was associated with.

Moreover, the Union Budget 2022 seems to be a visionary and simplified budget showcasing the long term focus of the government to take India @75 to India @100.

How do I invest in India’s glorious growth story?

Well, as enticing as this looks to you, there’s a lot of nuance to selecting companies that stand to benefit most from these incentives. It must be getting overwhelming just with the sheer number of sectors getting a boost from this. So, would you like a ready-made package to invest in India’s economic growth story?

Presenting to you, the High Quality, Right Price smallcase!

This smallcase aims to invest in stocks that will benefit from Atmanirbhar Bharat and Make in India themes. These “High Quality, Right Price” companies have strong balance sheets and low debt on books; all this while maintaining good management integrity, capability and performance track record. It’s a multi-cap strategy that invests in companies at reasonable prices despite all the perks.

Who has curated this smallcase?

The investments team at Green Portfolio are the ones to thank!

The SEBI-registered portfolio management company was founded by Divam Sharma and Anuj Jain, who come with 17 years of market experience. The team’s collective passion for investing, commitment to innovate and provide customized investment solutions, and constantly evolving research standards set them apart .

Their core value at Green Portfolio is to create long-term, sustainable investment management solutions through discipline, passion, innovation, integrity, customer focus, teamwork, and continuous improvements.

Growth at reasonable valuation is at the core of their research philosophy, which gave birth to the High-Quality Right Price smallcase.

Further details

To check out more such unique smallcases by Green Portfolio, visit https://www.smallcase.com/manager/greenportfolio

Green Portfolio’s offerings come with a small subscription fee that you can check out on the above website. The subscription includes access to Green Portfolio’s official Telegram channel; weekly newsletters covering various sectors, current affairs, macro setups, performance, factsheets, and the likes; latest updates through emails, and resources on how to subscribe, archive, rebalance, and more.

Atmanirbhar Bharat does not mean that the dependence on import is reduced and every good is produced within the country. Import and export are the integral parts of a good economy. Over the period of time, when economies of scale begin to develop which are lacking in the present environment and labor reforms which are being undertaken along with boost to skill generation, the PLI would be withdrawn and cost competitive advantage would lead to export. It is the expanded meaning of Atmanirbhar Bharat which would not be criticized as Protectionist as well as ignoring exports, but it has to come in the long run with enforced policy.

So, have you made your investments Atmanirbhar yet?

High Quality Right Price

High Quality Right Price