Investing in Cyclicals

We do have to understand the core thesis behind investing in cyclicals is value investing. The idea is to buy a $1 asset for, let’s say 30-40 cents. And then let it appreciate to fair value.

Why is it important to understand cyclicals?

Stocks are much more cyclical than what people think. 90% listed companies are cyclical. The degree of cyclicality can vary, but cyclical they are. There is 3 types of cyclicality which an investor has to comprehend in their investment journey :

- Business cycle

- Market Cycle

- Economic Cycle

During different types of cycles, stocks are valued differently.

Thus, as an investor it becomes very essential to understand how it works. This little attempt of mine is targeted towards the same.

At Aurum Capital, we’ve been investing in cyclical stocks successfully for a very long time, but at the same time being mindful about the price we pay for them. This shall talk about the same.

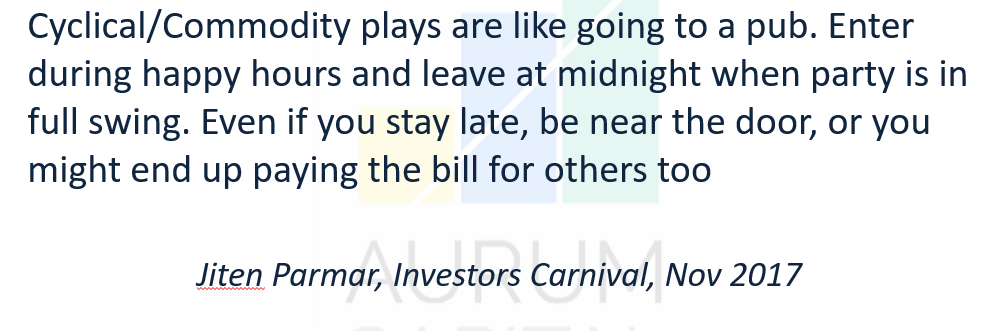

Our philosophy is based on the following simple analogy.

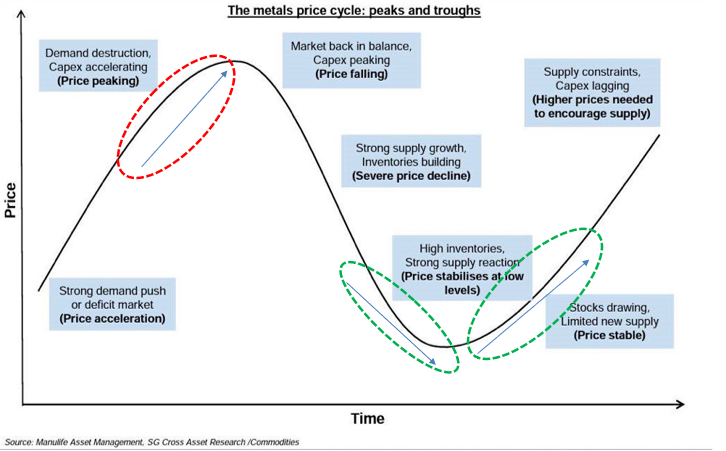

Cyclical companies follow a behavior based on demand-supply situation. It is important to understand this while navigating business cycles. The following graph is for metals, but this does apply to many commodities.

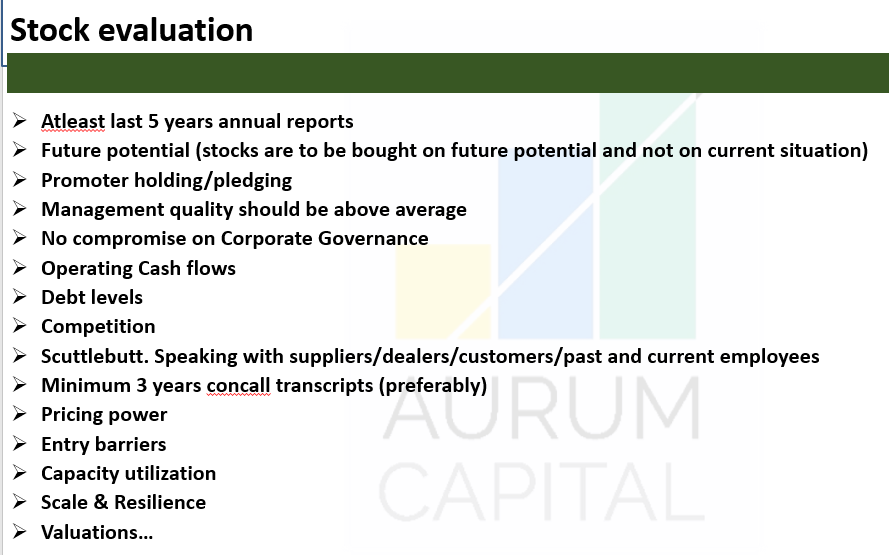

We spend a lot of time researching companies and have a checklist which is as below. We try to tick as many boxes as possible while selecting stocks from an investment view.

How do we evaluate cyclical stocks?

- Triggers show up – In 2015, two of the biggest Sugar producing countries in the world, had a bad monsoon which led to lower sugar production but demand for a commodity like Sugar usually remains intact. Now taking into account basic demand & supply, it became evident that prices would be rising. This is an example of a trigger which makes you stand up and notice the sector.

- Study the past cycles.

- Study production data, supply and demand – The sugar trigger could be applied here as well.

- Check for capacity utilization.

- Check for capex – when numerous companies start to announce capex plans coupled with high prices, it’s a great signal to be alert. High capex would generally mean high supplies which would lead to lower prices

- Check the margins

- Check price to book (current, historical during upcycle and down cycles) – PE is an ideal parameter to use when investing in cyclical companies.

- Check replacement costs

Investment Process

- Prepare a list of stocks – An investor can have a list of companies listed in the targeted cyclical theme.

- Shortlist – One can use a basket approach in investing, wherein from the list, he can narrow down to a few names, at least 2/3.

- Stress test – An investor invests into the future and expects for certain things to happen in the future which shall lead to him making a profit. However, these certain things could take maybe a few months or maybe even a few years. So will the company be able to survive in case the downturn lasts a few years.

- Supply reduction – companies exiting by means of bankruptcy, or few plants closing down is more often than not a great signal to get interested in the sector.

- Check insider buying/selling – All good promoters have a good sense of cycles and you’d notice from their past that they’d be buying when things are taking a turn for the better and selling when turning for the worse.

- Don’t look at PE – Better to look at the P/B or replacement value

- Check if company has cash/manageable debt – can also be considered a part of the stress test

- Start buying at highest pessimism levels – when most things are wrong and companies are performing terribly is when we at Aurum first buy into the company.

- Add as the cycle starts turning – When things start getting better is when we ramp up our investments.

There can be two strategies one can adopt while investing in cyclical/commodities stocks/sectors:

- Cyclical Turnaround strategy

- Cyclical Contra Bets strategy

Contra-cyclical Strategy

This strategy entails buying, when everything is in a terrible shape.

Checklist:

- Buy when financial ratios are worst – Buy when ROE, EBITDA margins, profits are down. Maybe even when the company is making a loss.

- Buy at high P/E, sell at low P/E

- Buy when the sector is neglected, sell when hot – Last year metals were completely neglected and have suddenly become hot in the last few months.

- Buy when no-one is covering the stock, sell when many buy reports start coming

- Demand-supply situation is not very good and supply outstrips demand – This is good as here one will get the best valuation

- A contrarian approach is required – one has to have this approach instilled in his mindset, as there could be long periods of time when prices don’t increase or may even fall, and thus if the approach is clear, one can even make use of such instances and buy.

Cyclical Turnaround Strategy

This strategy entails buying, when we have signs of turnaround. In this strategy, we buy when we are sure about the turnaround and prices are above the lows.

Checklist :

- Buy when EBITDA margins, ROEs, profits/losses have started improving.

- Buy when demand-supply situation is improving

- Buy when prices of products have bottomed out and started showing uptick

Few notable examples of triggers in a few cyclicals we have played in the past :

- Sugar – 2 years of monsoon failure in India and failed Brazil crop in 2015.

- Paper – Largest producer BILT plants closed down in 2015 due to high debt, which led to a lot of supply being taken out from the market.

- Fertilizers – A good monsoon after 2 failed years (2015). So in such a situation, one could’ve done a contra investing in bad monsoons and when there is a good monsoon, one could’ve done a cyclical turnaround investing.

- Polyfilms – increasing delta between RM and finished product (2010)

- Chemicals – China closing many units and anti-dumping duty led to very favorable situations for Indian chemical companies.

- Metals/mining – China closing many units and minimum support price for steel became very favorable for Indian metal companies.

- Cement – Government focus on infra and cement being extremely difficult to import due to its nature became very favorable for Indian cement companies.

Exit strategies

We’ve gotten an idea as to when to get into the cyclicals, but exit is as important as entry. Here are some key points:

- Try to get out before best earnings. Peak prices come before peak earnings. Because once the downcycle starts, you’ll never know how long it’ll be until they’ll be back up again. And most investors are not comfortable selling at a loss.

- Always understand that there are ‘’extra-ordinary’’ earnings in upcycle. For eg – if you see a company in a tremendous upcycle making a 100 rupees profit and with a price of 500 rupees and you’d believe that it’s a 5 P/E stock but it could only be making only a 20 rupees profit in normal times, making it a 25 P/E stock.

- One can employ a strategy like getting in at 0.2-0.5 P/B or replacement and getting us at 1.2-1.6 of these.

- Try to estimate normal EBITDA margins by averaging them over downs cycles and up cycles. Accordingly, calibrate your entry and exit strategies.

- Never repent if prices still go up after you sell, as long as you have made good returns. Because you practically can’t time the market to perfection.

Few Rules to follow

- Always make positional plays. These aren’t necessarily very long-term plays because if you hold for too long, prices come down again.

- Be patient to hold for a couple of years (if doing contra strategy)

- Never allocate more than 25% of your portfolio in a single cyclical sector.

- Don’t change the narrative, just for the sake of holding on to sector/stock

- Be prepared for failures and cut losses to come to it. Not all cycles will work. If 70-80% work, that’s more than enough.

Timing

Timing doesn’t have to be perfect. One can’t enter at the utmost low and exit at the utmost highest point. You primarily have to get the direction right.

What do we have to comprehend?

Within stocks and sectors, you have to comprehend “business cycle’’ as well as “market cycle”. As, they might not coincide, because market cycles come before business cycles.

Key learnings

- There are multiple strategies in investing, pick the one that works the best for you.

- It’s very important to weigh your investments from a risk-reward and margin of safety angle. It’s not worth buying into a stock with 25% upside potential and 50% downside potential.

- Successful investor trait – remove bias, rigidity.

- When good times happen, make it count. Can use trailing “profit protection” to maximize profits during good times.

- Good stock at a bad price may underperform bad stock at a good price. Thus, never overpay.

- Temperament is the most important quality of a good investor.

Several case studies were presented in the webinar, illustrating these points.

The link for the webinar is

Aurum Capital “Cyclical Bets Portfolio” Smallcase

Cyclical Bets Portfolio is primarily focused on the “Cyclical Turnaround Strategy” discussed above. Primary focus is on cyclical sectors which have staged a turnaround and are likely to outperform as the cycle improves and offer the potential of significant re-rating.

We use a basket approach of investing in a particular sector wherever possible.

We look at companies with good corporate governance practices, sustainable balance sheets and which have survived past downcycles

Aurum Capital

Aurum Capital