Is Momentum investing for you?

There is recurring doubt among investors that Momentum might not be a strategy suited for the long term as it is trying to capture short-term trends. But if you look at the data, you’ll find that Momentum is, in fact, an excellent strategy for the long term.

Momentum trading is often called the buy high, sell higher technique. A Momentum investor is not directly betting on fundamental value change but on the consensus formation about the upswing in a given sector or industry.

Read the full story on Wright Research’s blog.

Let’s study the performance of the Momentum strategy in various scenarios.

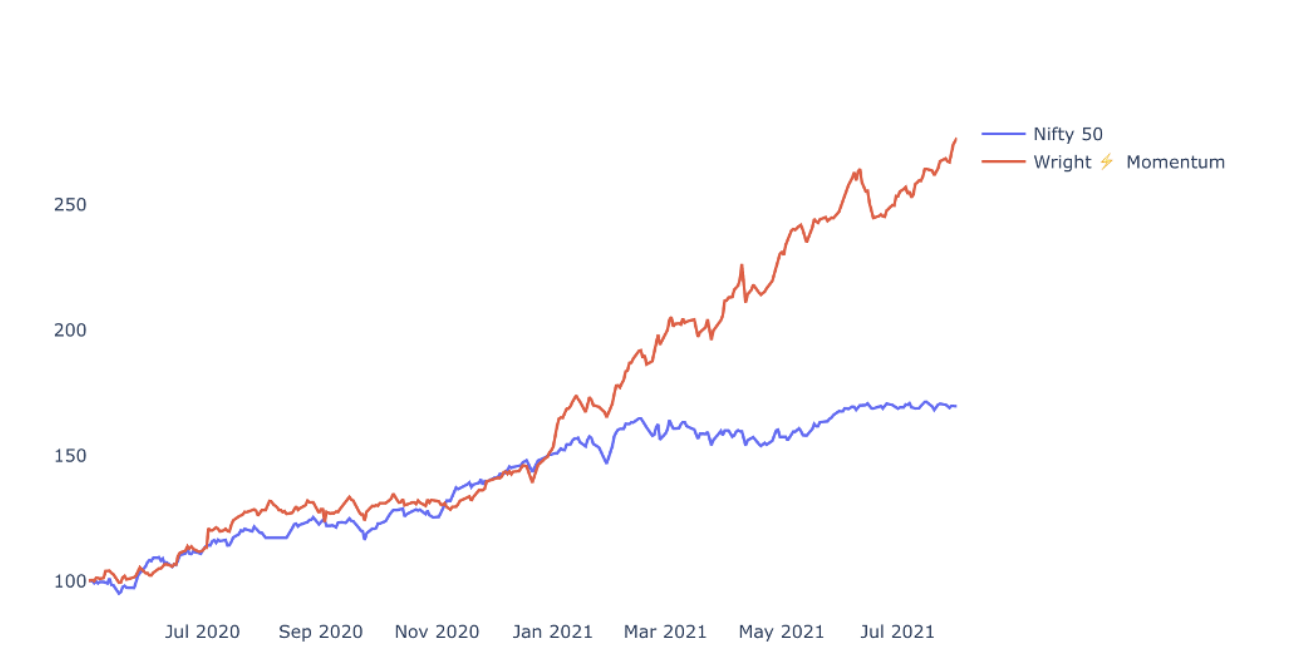

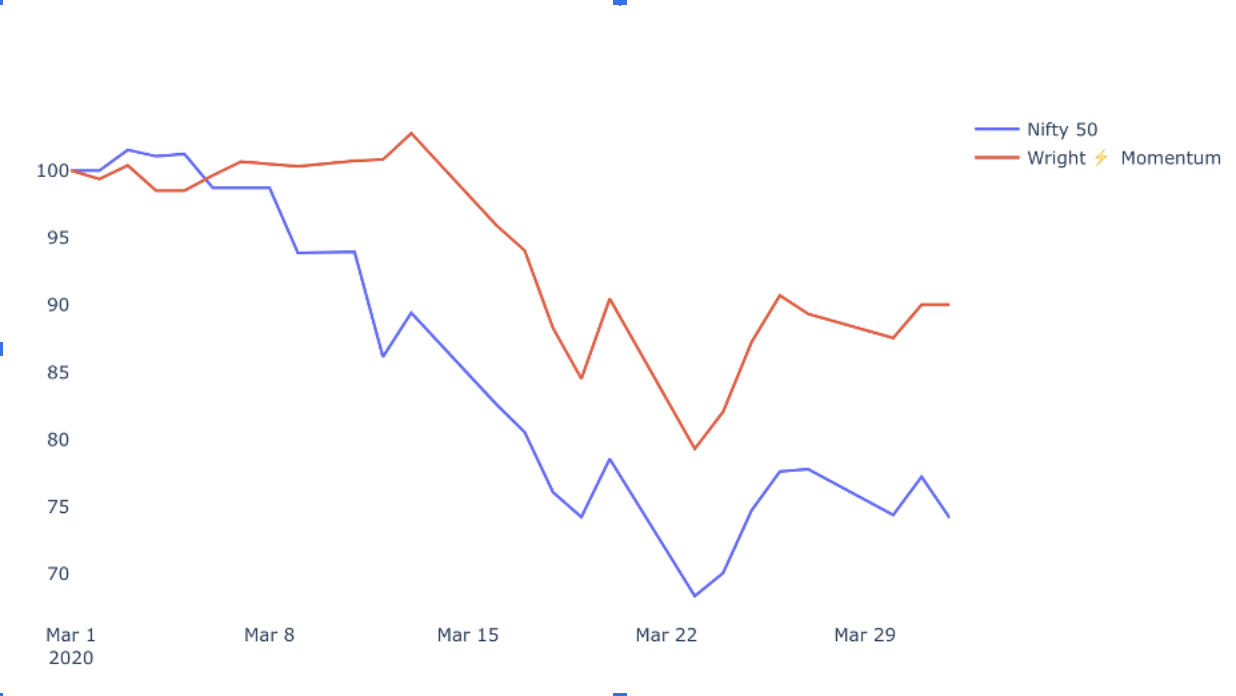

Momentum in the bull market

Bull markets are the best times to bet on momentum. So here we look at the performance of Momentum vs the Nifty index from May 2020 to Sep 2021. You’ll see the massive outperformance that Momentum has given concerning the index. While the index gave 69% returns, momentum gave a whopping 177% returns, which is a lot to its long-term dominance.

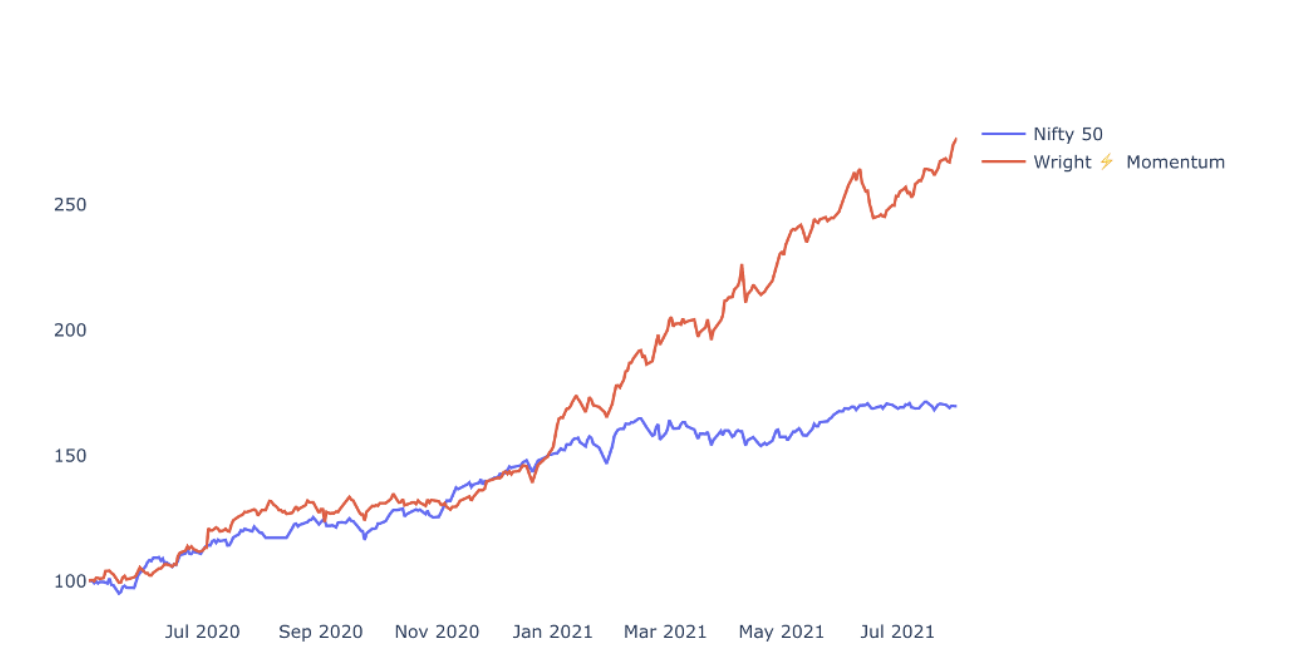

Momentum in volatile times

In volatile times like last year, you’ll see that Momentum would reflect the risk in the market. Still, even in such volatile times, you can see Momentum giving a minor outperformance over the market due to its dynamic nature.

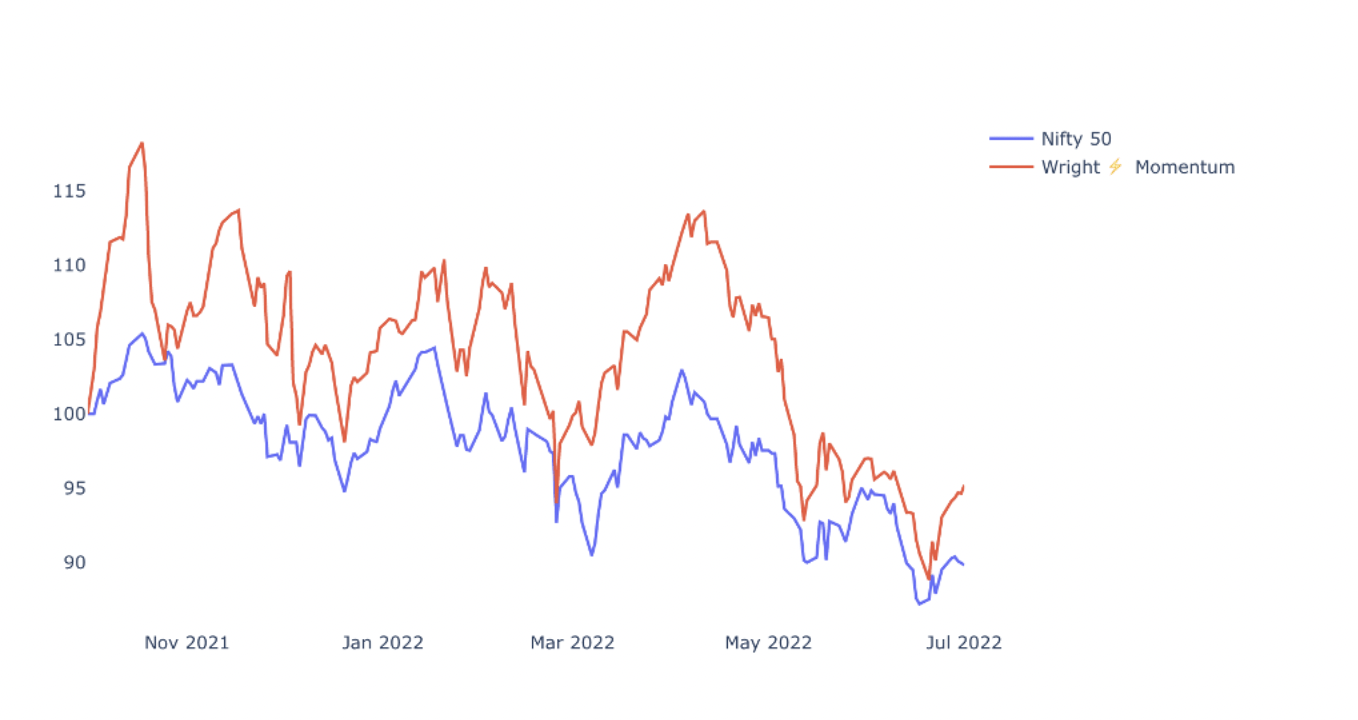

Momentum during market crashes

During market crashes, Momentum is also in trouble. To counter this, risk management in the strategy comes into play. We deallocate some parts of the portfolio to cash and reduce portfolio risk, which leads to a lower drawdown than the market.

Is the market overbought? Where to invest now?

It is no secret that the Nifty has underperformed its global peers for some time.

In 2023 Chinese and Asian markets are leading the pack, while the US and European markets are also relatively buoyant. Nifty, on the other hand, has turned negative this year. This might be because of the high valuation that the Nifty commands, due to which the re-opening Asian economies look much more attractive value buys.

We do expect the volatility to continue till the budget. The market has fallen five times while gaining six times in the month ahead of the Union Budget in the last 11 years and has oscillated between -3 and +3%. The budget day has been joyous most of the time, and the post-budget has been more positive than negative. The announcements in the budget could be crucial – if the budget is too populist, it might hurt sentiments, while a more cautious budget might be more welcome.

Still, in a long time, we expect India to remain attractive, backed by solid growth momentum and reasonable valuation.