smallcase launches industry report with Zinnov

Recently, we launched an industry report titled ‘Rise of the Indian Retail Investor’ in association with Zinnov.

With the changing preferences of Indian retail investors due to the adoption of internet, increasing mobile penetration and financial literacy, the Indian investor is not just shifting larger financial transactions to digital mediums but also being thoughtful on portfolio construction, both from risk profile and investment horizon perspectives. Regulatory progress has also democratized investing. Savvy investors with varied savings are designing their portfolio using smart, new-age investment avenues like smallcase.

I. Retail Investor Landscape in India

Some interesting data points:

- 93% of retail investors show interest towards investment in new-age financial products such as REITs, smallcases, NFTs, and digital gold

- 50% of the retail investors started investing in stocks less than 3 years ago and 38% are interested in actively investing in new IPOs

- More than 70% of retail investors save up to 30% of their monthly income for investments, demonstrating low to medium risk appetite, showing a vital shift in their mindset

- Investment in REITs gained significant momentum, with its portfolio constituency up to 2% in 2022 since the launch of the first REIT in 2019

- Direct equity allocation has grown to 8.1% in 2022 from 7.3% in 2017

- ETFs have seen a dramatic rise in folio numbers and Assets Under Management (AUM) grew by 58% YoY since 2018

- Even though traditional investment products like fixed deposits constitute the biggest slice of the allocation pie at 29.2%, they are less flexible but tax efficient, compared to the other asset classes. However, their share has declined since 2017 as is the case with Public Provident Funds (PPFs), primarily due to the stagnant interest rates.

II. Decoding the Indian Retail Investor

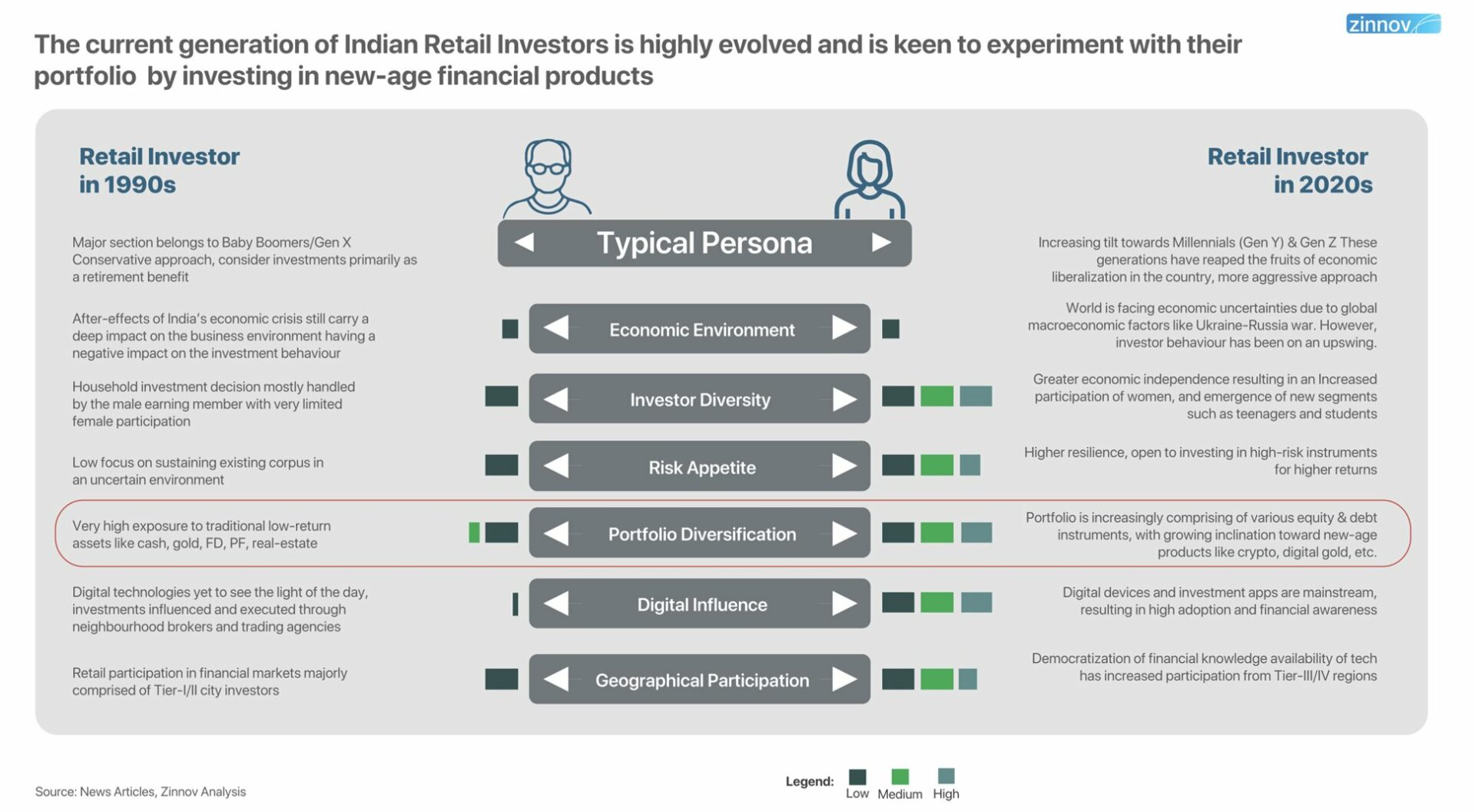

Socio-economic advancements have led to massive shifts in the investor persona, risk appetite & portfolio construction in the last 2 decades with retail participation going beyond the top few cities & hubs.

1. Family & friends top avenue to learn about wealth management

73% of retail investors are well informed about financial products with family and peers being their primary source of information, while 52% turn to financial influencers as a key avenue to learn about wealth management.

2. SIPs gaining popularity, partly fuelled by rise in digital assets

55% prefer SIP as an investment route, majorly owing to the rise in digital apps. Interestingly, word of mouth plays a key role in the selection of an investment app, along with a user-friendly interface and the availability of multiple product offerings

3. Seeking paid financial advice

61% of retail investors prefer not to pay for financial advice. Among those who are ready to pay:

- 93% have a portfolio size of INR 10-20 Lakhs

- fall between 45-60 years of age

- and have more than 20% in monthly savings.

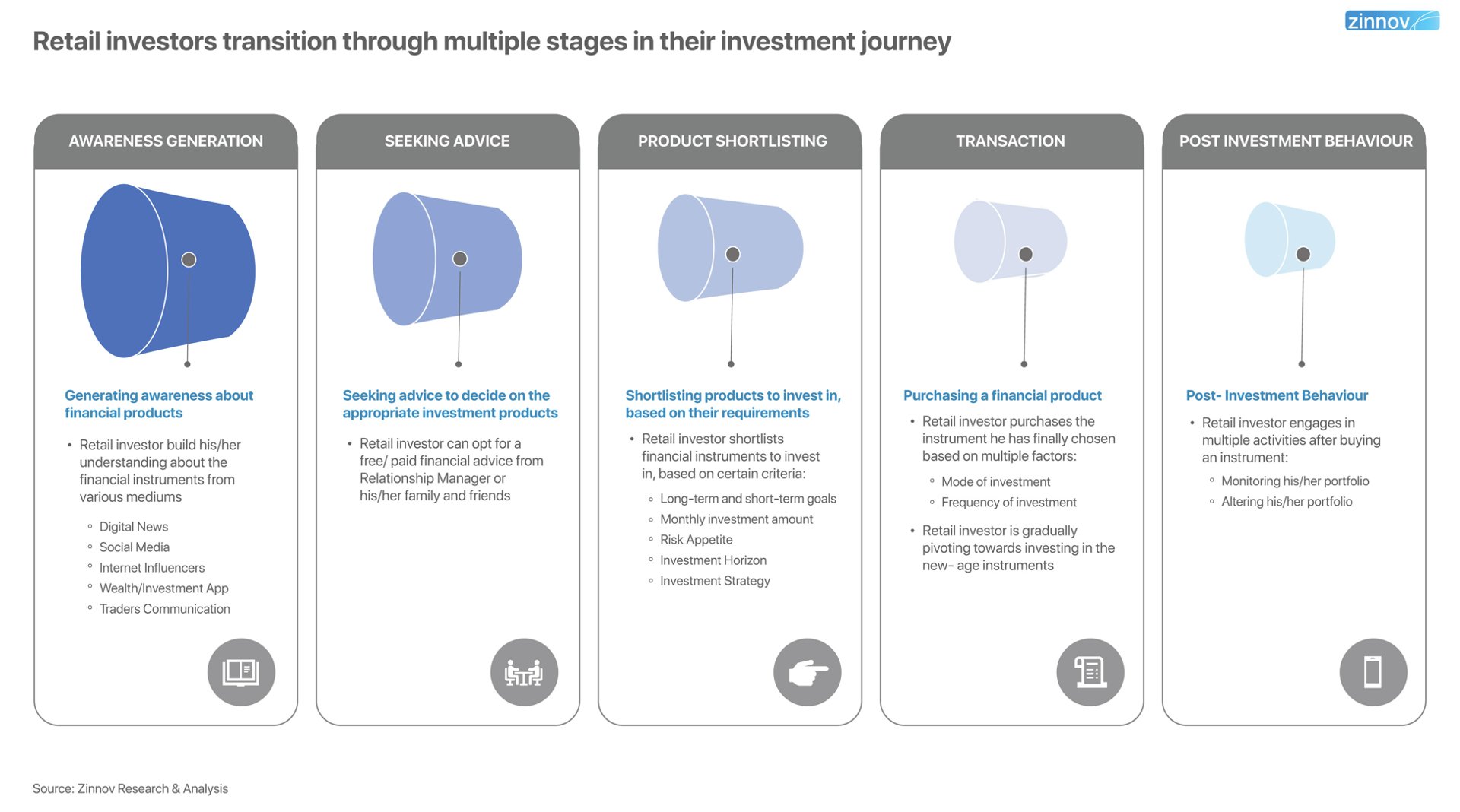

4. Investors are monitoring and altering portfolios

Overall, 29% of investors monitor their portfolio monthly and 25% prefer to alter their investments on a quarterly basis. Interestingly, younger investors monitor their portfolio weekly, whereas a majority of the investors between 45-60 years monitor monthly.

III. Key Investment Trends Shaping the World

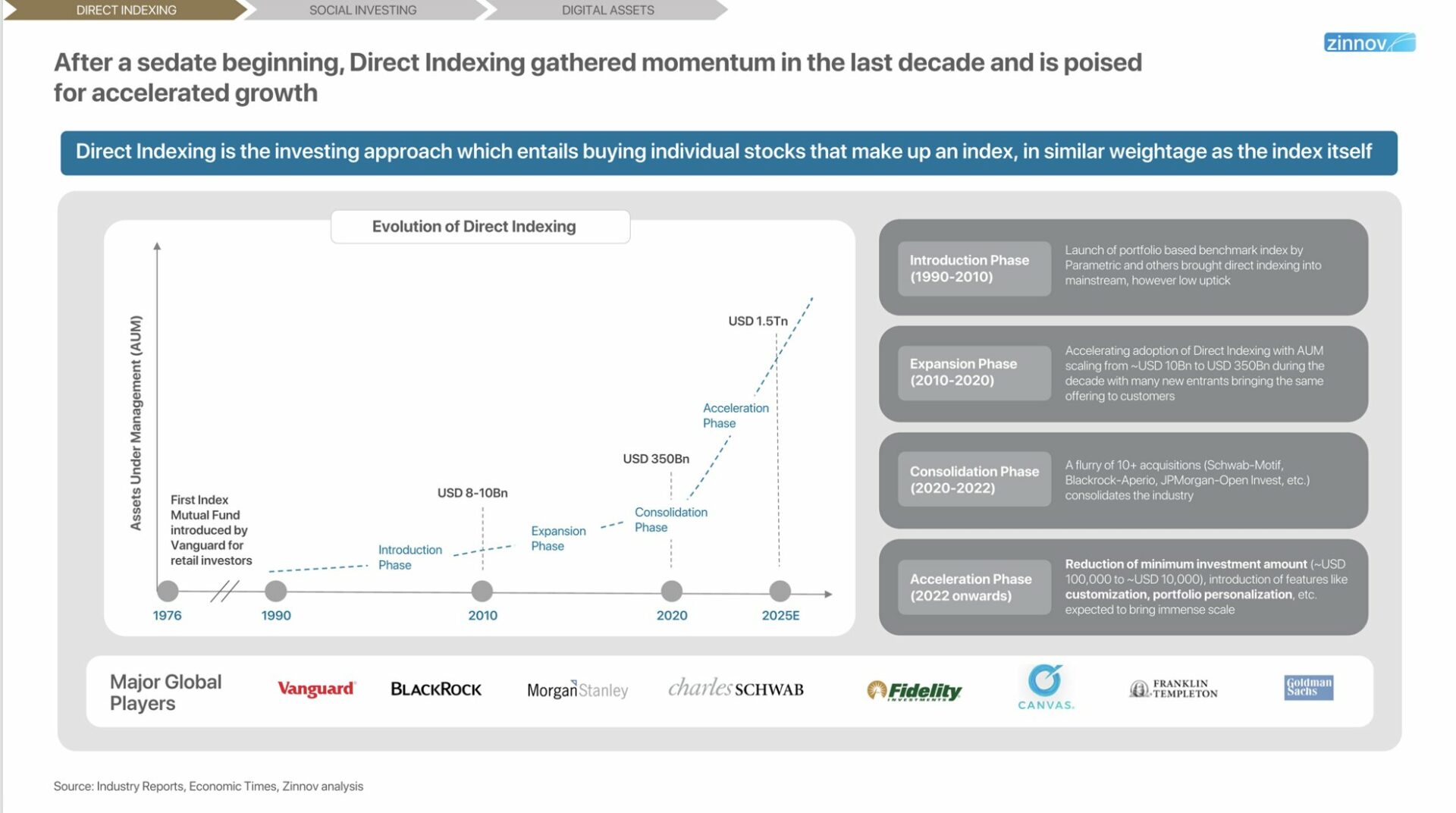

The report further explores three major investment trends which are gaining traction across the globe – Direct indexing, Social investing and alternatives like Digital assets.

Global trends are pointing to what the Indian landscape could expect this decade. Direct/custom indexing is set to accelerate with every major player building/buying capabilities, growth of alts & digital assets in the portfolio and more.

Given the pivotal shift we have seen in the recent past we hope this report will help understand today’s retail investor, the current investment landscape and support the ecosystem with insights to offer better investment experiences to Indian retail investors.

For access to the full report, write to: press@smallcase.com