Dynamic Asset Allocation with Wright Research

- A portfolio of equity, bond, and gold gives better risk-adjusted returns than only equities

- This smallcase combines Smart Beta factor investing with ETF asset allocation

- Wright Research smallcases are managed by Sonam Srivastava, a SEBI Registered Investment Advisor

Read the full story on Wright Research’s blog.

Asset Allocation Rationale

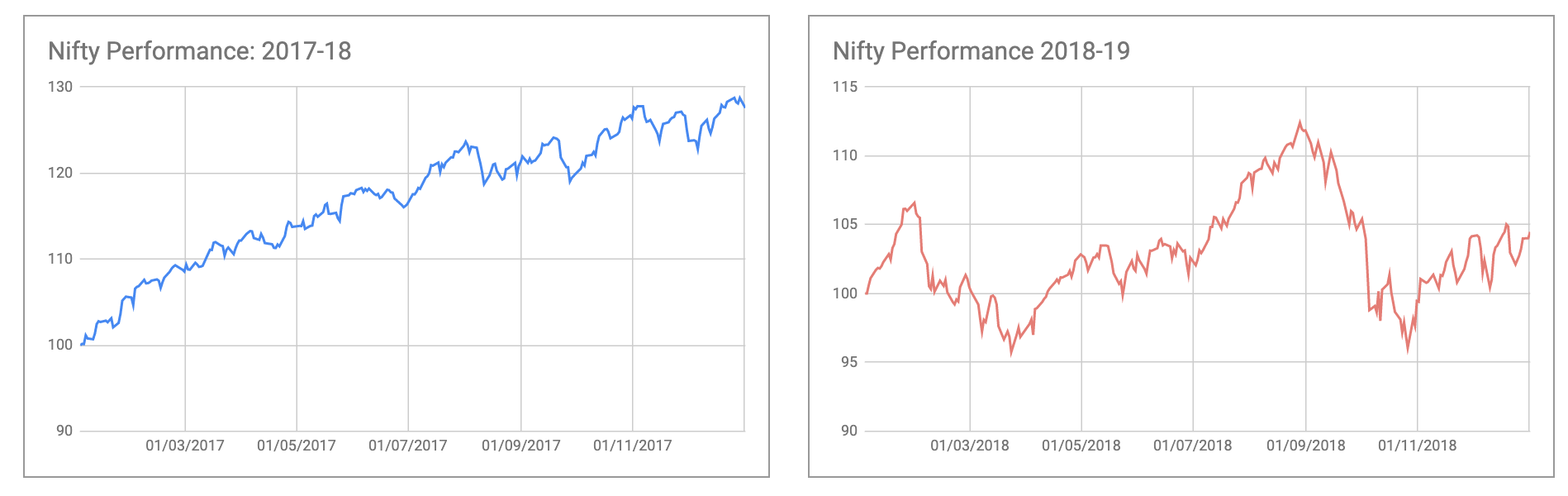

Let us look at the equity markets in the two recent time periods – the year 2017 and 2018.

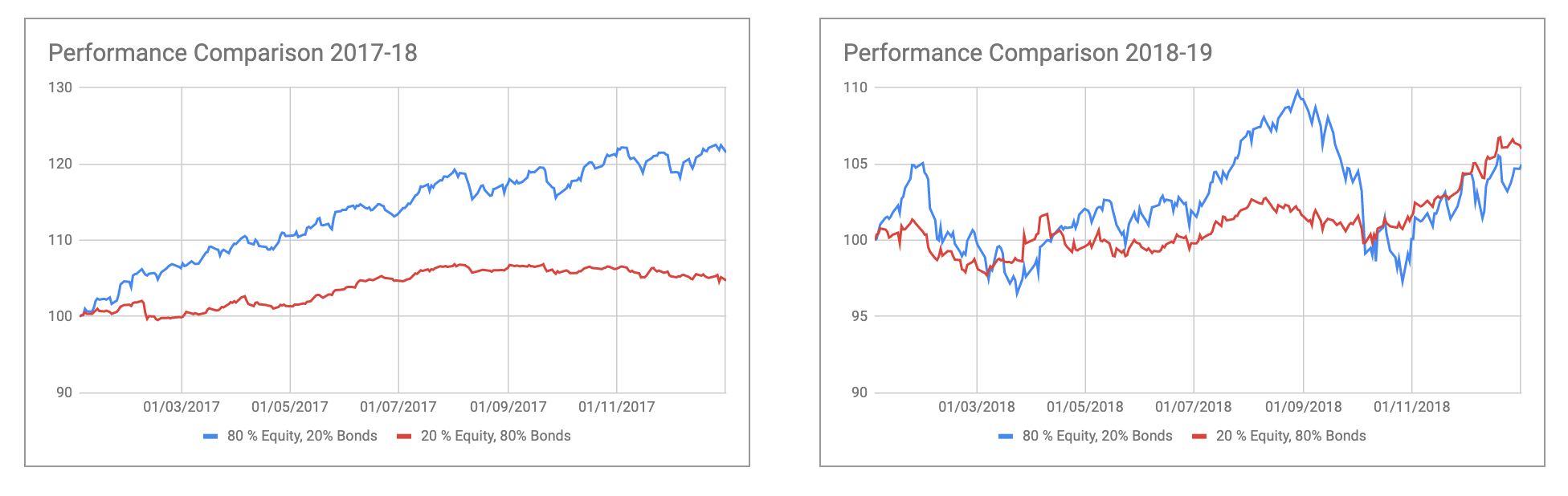

Now, look at 2 portfolios:

- One with 80% allocation to equities and 20% to bonds

- The other with 20% to equities and 80% to bonds

The equity majority portfolio has better performance in 2017 but the bond majority portfolio gives better risk adjusted returns in 2018.

Multi Asset Tactical Asset Allocation

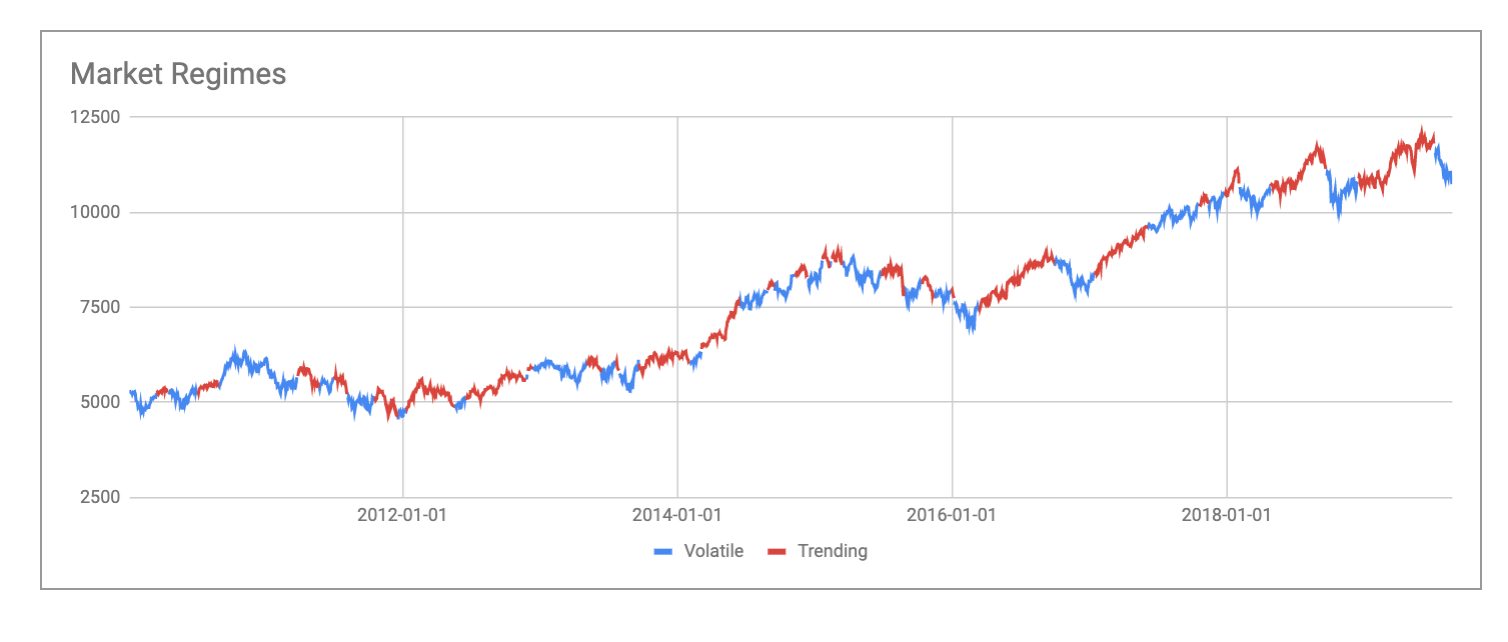

The strategy Multi Asset Tactical by Wright Research chooses the best asset mix using stocks along with bond and gold ETFs in the two different types of market regimes.

Regime modelling: The regimes are predicted using a model that looks at short term and long term price patterns and economic data. We chase the equity market trend when the market is favourable and try to control the risk when it is not

Stock Selection: While we trade bonds & commodities through ETFs, the choice of stocks in the portfolio comes from equity factor strategies or the popular name smart-beta. The individual equity buckets chase factors like:

- Momentum or trend following

- Value or choosing the undervalued stocks

- Growth or choosing high growth stocks

- Quality or choosing the stocks with good earning quality

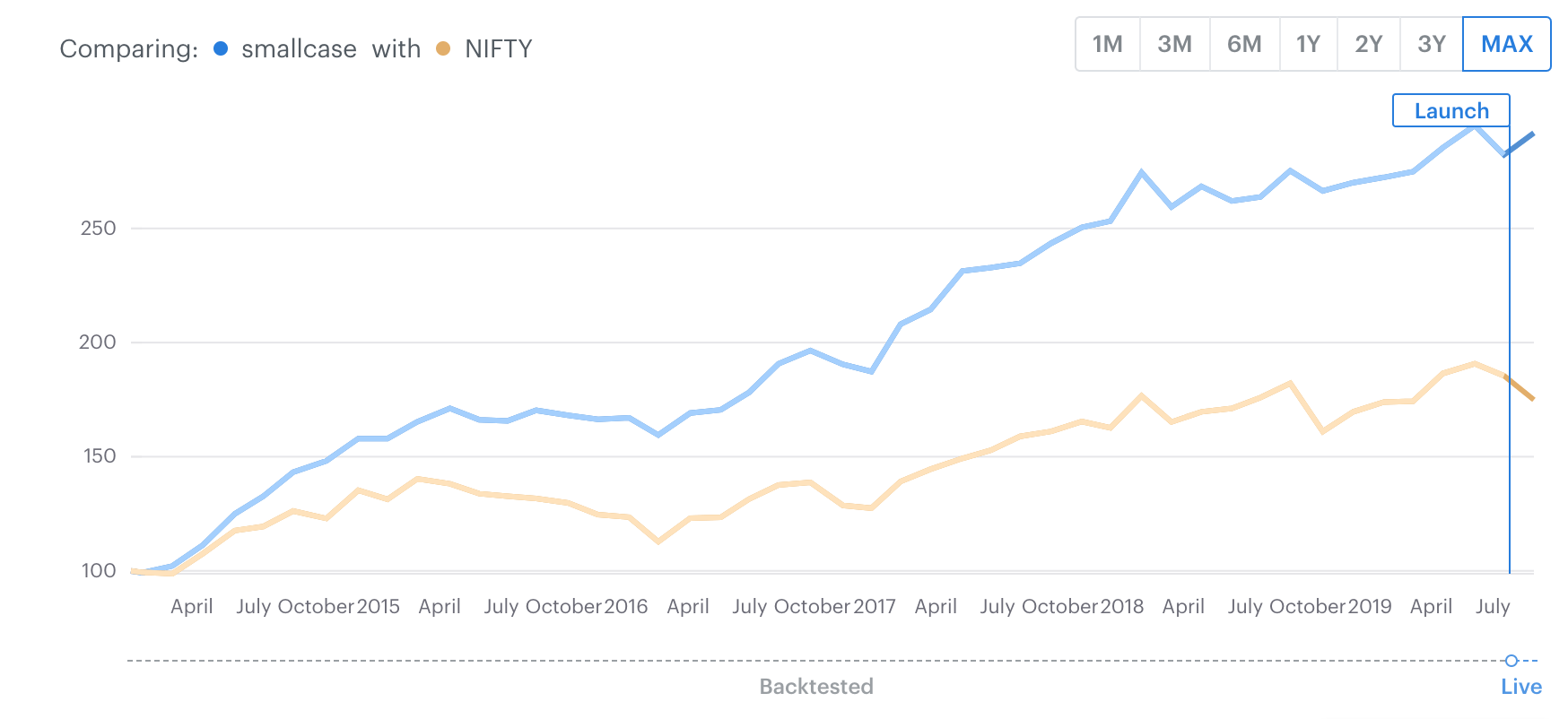

Historical Performance: shows that the portfolio has performed well is all market conditions.

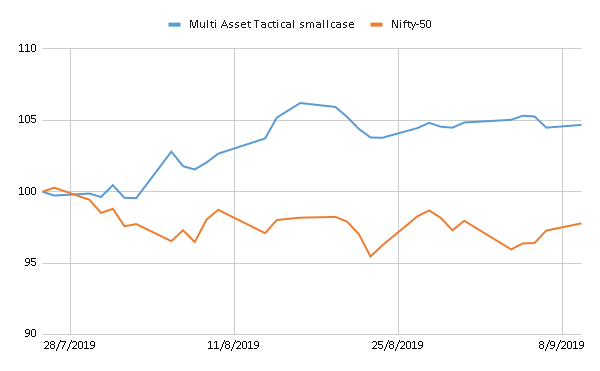

Live Performance

The Multi Asset Tactical smallcase by Wright Research went live on 26th July 2019. Since then, the performance has also been excellent and encouraging – as the smallcase has outperformed the Nifty by almost 7%! It has gained 4.68%, while Nifty-50 has actually lost -2.21% over the same period.

Multi Asset Tactical Live Performance, since launching on 26th July 2019

We also have another strategy following the same rationale, with smaller minimum capital requirement.

Check out both these smallcases at: https://wrightresearch.smallcase.com/.

Happy investing!

Multi Asset Tactical smallcase by Wright Research

Multi Asset Tactical smallcase by Wright Research