The bull markets will soon be awake!

Mayhem hit the stock markets as the Sensex and the Nifty50 indices hit fresh 52-week lows. With the increasing volatility of markets, geopolitical tensions heating up, and the economic crisis in Ukraine, investors are more cautious than ever. Because when it comes to money, nobody wants to lose it!

The global stock markets have fallen, and there is panic everywhere, even though most companies are reporting record profits. Here’s why–

- The leading cause behind high market volatility is the geopolitical tensions due to the Russia-Ukraine war.

- Due to this, the world economy is stuck in a vicious circle of rising inflation and high-interest rates.

- Supply chain disruptions have caused an exponential increase in commodity prices.

- To control this, central banks around the world are increasing market interest rates. Fed’s recent stance to increase the interest rates by 0.5% has negatively affected investor sentiments.

Recently, the Reserve Bank of India has increased the repo rate to 4.9% amidst rising inflation rates in the economy. This has led to Foreign Institutional Investors (FIIs) pulling out their money from the markets– causing a reduction in demand and high supply, hence a fall in the market price of securities.

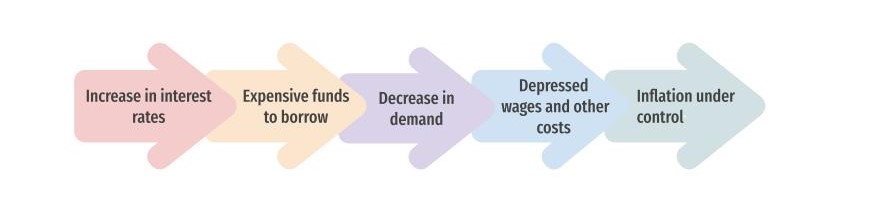

Well, there is a step being taken to normalize and control the rising inflation in the economy– quantitative easing. It is a process that aims at dampening the interest rates and therefore, tapering off the bond-buying program.

The chain given below explains the phenomenon.

After the ban on palm oil export by the Indonesian government in April, the FMCG sector has been impacted severely. The world’s biggest producer and exporter of palm oil took this step to control the rising prices in their country. However, Indonesia lifted the ban in May with policies in place to safeguard domestic supplies.

So, what will the year look like, globally?

- With inflation at an all-time high, the central banks aim to spike interest rates further for economic recovery.

- Covid-19 has renewed the interest of governments globally in China’s “Plus One Policy” to tackle supply chain resilience. India stands out as an attractive option, thanks to its skilled labor, strategic location, and low operating costs.

- New-age technologies and tech-driven businesses around concepts of the metaverse and Web 3.0, are expected to draw investors.

- Talking about India at the domestic level, an increase in trade deficit could hurt domestic producers and their share prices.

- Weakening Indian rupee against the US dollar combined with sky-high valuations may increase the chances of underperformance especially when the markets are subject to corrections.

Amongst all these, India is still performing better than many of the countries and has the potential to do better given its good pool of talent to lead growth. Also, various structural reforms will serve as a booster to the markets as well as its economic growth.

Watch Divam Sharma, Co-founder, Green Portfolio, in discussion with Shashank Udupa as they decode the falling markets.

Keeping all things said aside, it is imperative that you as an investor believe in your investment. Assess all your holdings and keep a calm temperament, because don’t you worry, it always does pass.

Discover more from Green Portfolio

Discover More from Green Portfolio

Discover More from Green Portfolio