The Deep Value of PSUs and Why Rerating is Imminent!

What is a Public Sector Unit (PSU) and how different is a PSU from a private enterprise?

Business enterprises globally are run by either large industrial conglomerates, financial powerhouses or even large families, for e.g., Chaebols in South Korea, or Keiretsu in Japan. However, in many countries, the respective Governments have, for historical reasons, also, willingly or unwillingly, started businesses especially in strategic areas like Defence production, Banking, Insurance, Mining, Oil & Gas etc. Such units where the Government has a controlling stake, are called PSUs. In India, Tata Steel is an example of private sector enterprise while Steel Authority of India (SAIL) is a PSU.

According to fundamental analysts, the core nature of a business DOES NOT change just because the owner of the business is different. Simply put, and all things being equal, the intrinsic value of a business (and thus its valuation per share) should be the same whether it is a private enterprise or a PSU; the sole difference being style of management.

What is the origin of PSUs in India?

Bharat’s Past Glory-the envy of all! …

Let me share some perspective first. Forget going as far as the highly progressive Indus Valley Civilisation (2500 BC to 1900 BC), let us retrace back to the Mauryan Empire of 4th and 3rd Century BC and subsequently the GOLDEN Age under the Gupta Empire (mid to late 3rd Century BC to 543 BC). There is no doubt, that India was a dominant global economic power then (Sone ki Chidiya) for which, it had to bear the brunt of several invasions.

… led to 750 years of invasions and thus, its decline!

The Gupta Empire collapsed in the 6th century and India was again fragmented into numerous regional kingdoms. Successive foreign invasions started, from the year 1200 onwards First, by Mahmud of Ghazni, later, Central Asian invaders, the Mughal Rule and subsequently the British Rule till Independence. 750 years of loot and plunder left the country, largely bereft of its past material riches. India chose to be a Sovereign Socialist Secular Democratic Republic in 1947, but the partition of India, successive natural calamities and a broken treasury, did not help the noble intentions of the newly-born Republic.

Challenges Post Independence:

India thus had to

embark on a path of rapid industrialisation and the Five-Year Plan approach was

the only option. But how could it achieve this with limited private sector

capital? The Government of India, had no option but to step in and promote /

takeover businesses (read Nationalisation). This laid the foundation of the

entry of the government in businesses in India.

PSUs: from 5 to 348 in just 40 years …

In 1951, there were just 5 PSUs in India, but in March 2019 this had increased to 348, PSUs operated across sectors, viz Fertilizers, Airlines, Refineries to Shipping etc. These PSUs represented a total investment of ₹16.41 lakh crore as on 31 March 2019 and total paid up capital was ₹2.76 lakh crore. PSUs collectively earned a whopping ₹25.43 lakh crore during FY 2018–19, and thus command a dominant position in Corporate India.

… but PSUs market valuations lag private peers by a huge margin

Several PSUs (also called Maharatnas, Navaratnas or even Mini Ratnas) today, command dominant positions in most core-sectors and have fundamentals at par with some of their best-run private sector corporates. Yet, ironically; the total worth of listed PSUs (excluding Banks) on the Bombay Stock Exchange is less than 6.2% of the total market capitalization. Not all PSUs have strong fundamentals, but many which are currently loss making, sit on extensive reserves of prime real estate/property carried in their books at close to zero historical costs. Market seems to be “least interested”.

Why is investor confidence lacking towards PSUs? How extreme is it?

Given a choice, any global investor would prefer to invest in an enterprise where there is “minimal” risk for each unit of potential reward. Despite attractive valuation, the most common push-back from investors towards PSUs is the risk of management continuity, interference by bureaucrats, relatively lower transparency and monopoly-led lethargy.

Right or wrong, this

apprehension, unfortunately, determines market valuation. It is not unusual, to

see a few darling private sector stocks trade even at 100+ P/E ratios while their

PSU peers struggle sometimes in the sub-10 range. Likewise, on P/BV ratios

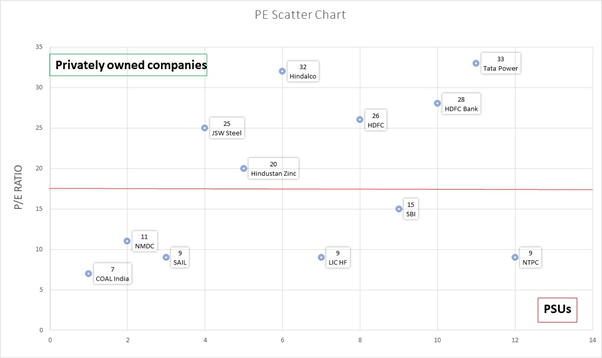

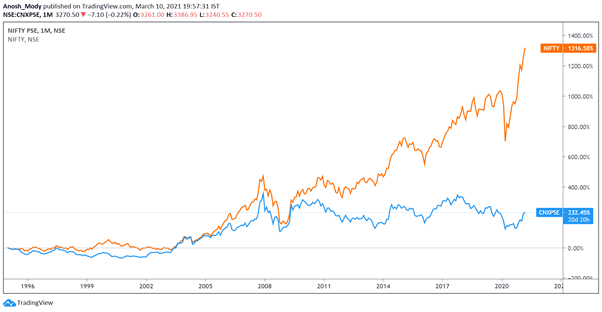

Below graphs show the extreme valuation differentials using a few comparable examples.

1) A scatter chart showing the stark difference in P/E multiples of PSUs and Private Companies.

2) Long term performance of Nifty50 (orange) vs Nifty PSE index (blue)

Is the above demonstrated lack of confidence justified?

They say, the market is ALWAYS right, but we beg to differ…

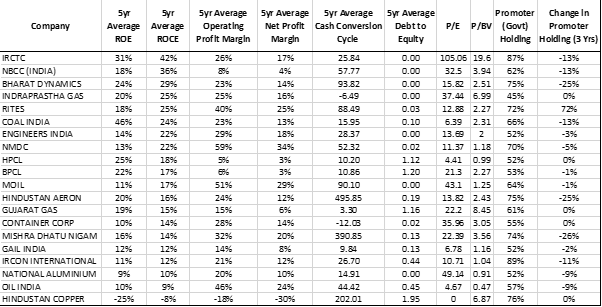

Using pure fundamentals, i.e., the business’s cash flow generating capacity etc, the table below provides a peek into some leading listed PSUs. Observe 5-year average ROEs, ROCEs, and key operating margins. Note the near absence of Debt in the Balance Sheets.

Clearly, there is a significant mismatch between fundamentals and market valuation of PSUs.

Source: Tijori Finance

The Biggest Challenge to rerating of the PSU valuations in India is… “Overhang”

While investor concerns regarding PSUs stated above are worth considering, according to me, the biggest hurdle to rerating, is the high level of government holding in most of them. This is because each financial year, the Govt of India announces a formal divestment target in the Union Budget. This implies that Govt, HAS TO RAISE MONEY by selling bits and pieces of its shareholdings across PSUs. Like a dangling sword, this thus, creates an “overhang” of stake sale, which any investor would hate to deal with on an ongoing basis.

…but, maybe an out-of-the-box solution is right in front of us?

As eminent market expert, Jayakumar, MD, Prime Securities recently suggested in his column, the Govt of India can solve the problem of “stock sale overhang” and thus put a stop to the value destruction of PSU stock prices in the market. According to him, if just the top 13 PSUs issued bonus debentures (BDs) by capitalizing their reserves the Govt of India could raise up to Rs 1.45 trillion. Jayakumar argues strongly that subject to certain financial conditions, this will:

1. Take away the pressure of compulsive stake sales by the Govt

2. Send a strong signal about the future cash flows to investors (as the debentures will at some point have to be repaid)

3. BDs issued at a reasonable coupon rate (say 6%) will be readily accepted by retail investors directly or via Bharat Bond ETF wrap structures- maybe even by Foreign Investors and by Indian banks {which are currently sitting on excess liquidity with appx Rs 8 trillion parked by them with the RBI at 3.4% coupon}

4. Energise secondary bond market trading as these BDs will be listed

5. Most importantly, increase the profitability of issuing PSUs as they save on Dividend Distribution Tax and get tax deduction on the interest which they pay to BD holders

So, is there finally light at the end of a dark tunnel?

In what probably seems like one of the boldest decisions since 1992 reforms, the Hon Finance Minister has announced its clear agenda of “strategic sale” of select PSUs. The Hon Prime Minister also recently reiterated the Cabinet’s firm resolve in this regard, stating clearly on the floor of the parliament, that THE GOVERNMENT HAS NO BUSINESS TO BE IN BUSINESS. These are GOLDEN words which investors have waited for more than two decades, and that too coming from none other than the highest echelons of decision making in the Government. A re-rating of PSUs closer to their intrinsic value (or maybe higher) is NOW Imminent.

Conclusion: Patience will pay!

As the world returns to post-pandemic business, the race for quality assets will commence!!

One needs to weigh fundamentals vs sentiment (read liquidity) when investing. Pessimists may argue that a mere statement of intent even by the highest levels in power, mean nothing if there is no buyer at the right price, Air India for example. I agree partially, but the fundamental point here is that, in a world where there is paucity of good solid businesses up for sale, PSUs offer a great opportunity to any long-term foreign buyer looking to expand his footprint in what will be potentially, the world’s 3rd largest economy after US and China. Indian entrepreneurs are not far behind in the race to acquire good quality assets. Tatas have demonstrated their mettle in turning around Jaguar Land Rover and even the state owned VSNL. The Mittals did the same with East European Steel cos in the 1990s and Vedanta promoters successfully turned around Hindustan Zinc- the results are for all to see.

Eventually, as they say, “Beauty lies in the eye of the beholder” …

Look at many deals done globally. It is not uncommon to see private equity / angel investors put money in “ideas” even at the inception stage, hoping the business will succeed SOME DAY. There is NO / very limited track-record, business models are generally on paper to start with, no real cash flows, or dividends to rely on but multibillion-dollar deals are done using Valuation metrics; jokingly known as “Price to Fantasy” ratios

If via strategic sale, investors get a chance to own, manage and control dominant businesses (read, PSUs for sale) which have stable, time tested business models, which are high cash flow generating, and consistently dividend paying, that too at reasonable valuations, wont it be logical for them to BID smartly/aggressively?

Call me old school, but if you SHOW ME THE MONEY, I will INVEST my hard-earned capital. I need to see strong brand equity, dominant positioning, a light Balance Sheet (if possible), high return ratios and consistent dividend track record rather than rely on “we hope the business will make money after 10 years” kind of talk… Profitable PSUs fit the bill very well for my long-term investing style.

After all, as the saying goes, The Slow but Steady Tortoise Always Wins over the Quick but Hasty Hare!

Ethical Advisers

Ethical Advisers