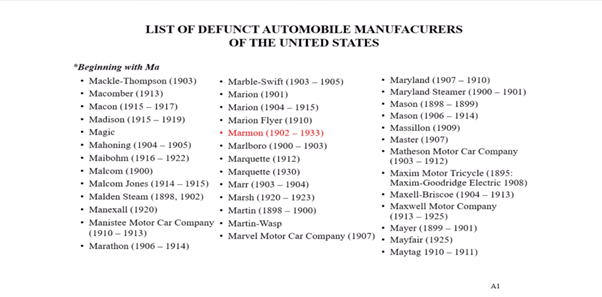

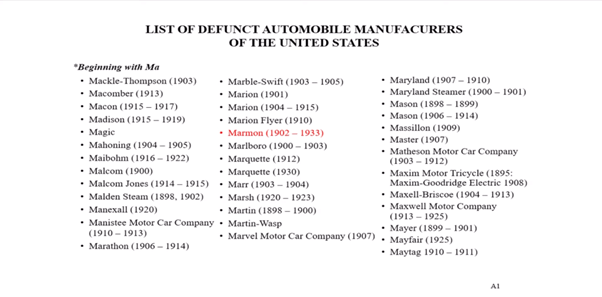

The Good Bad and Ugly weekly review : 13 Jan 2023

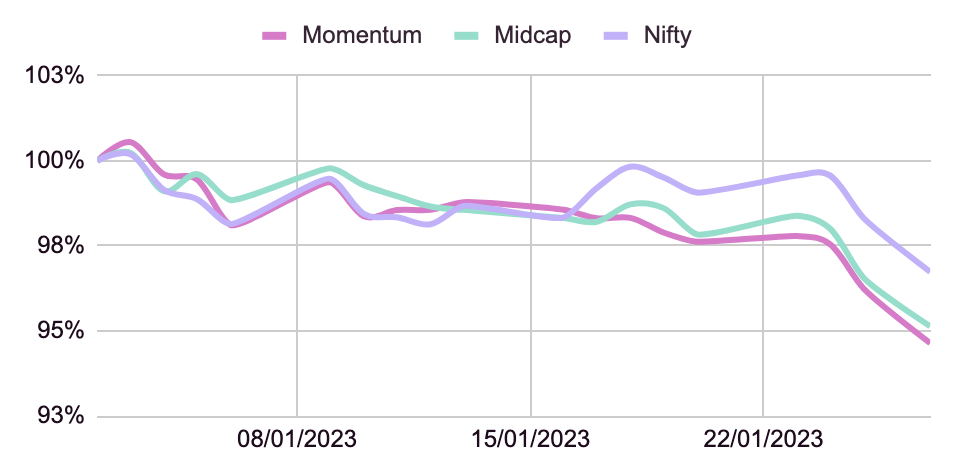

Nifty continues to remain volatile as buyers and sellers continue to battle it out. Every time Nifty takes support from 17750 levels, we immediately see buyers coming in to try and take the markets higher so the same level becomes very crucial going forward. If this level fails to hold on, we may see a continuation of the downward trend. On the other side, Nifty faces resistance at 18200 levels crossing which we may witness a rally towards fresh ATH. RSI dipped to a low of 32 and has bounced from there indicated withering selling pressure. That’s a positive sign too.

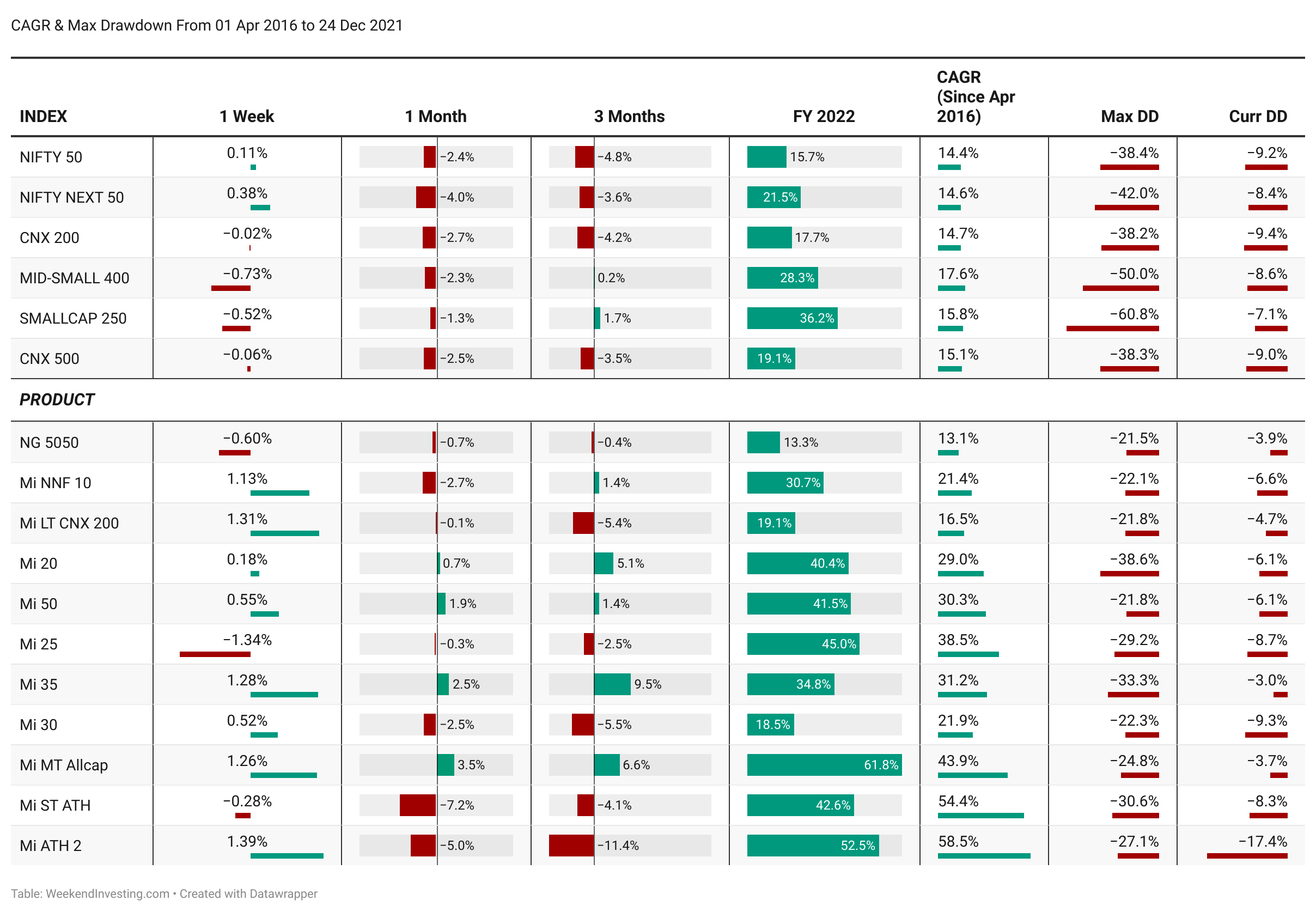

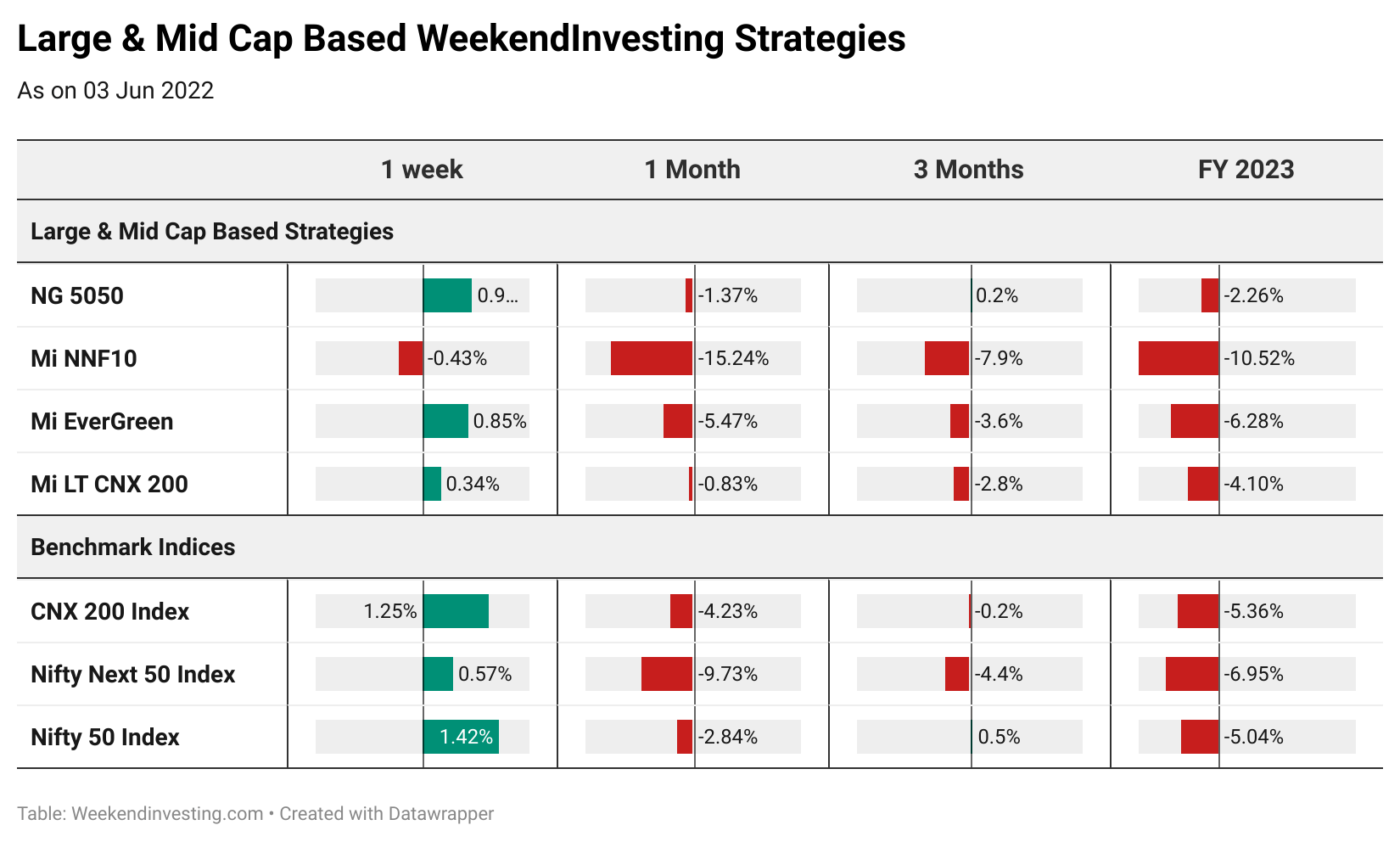

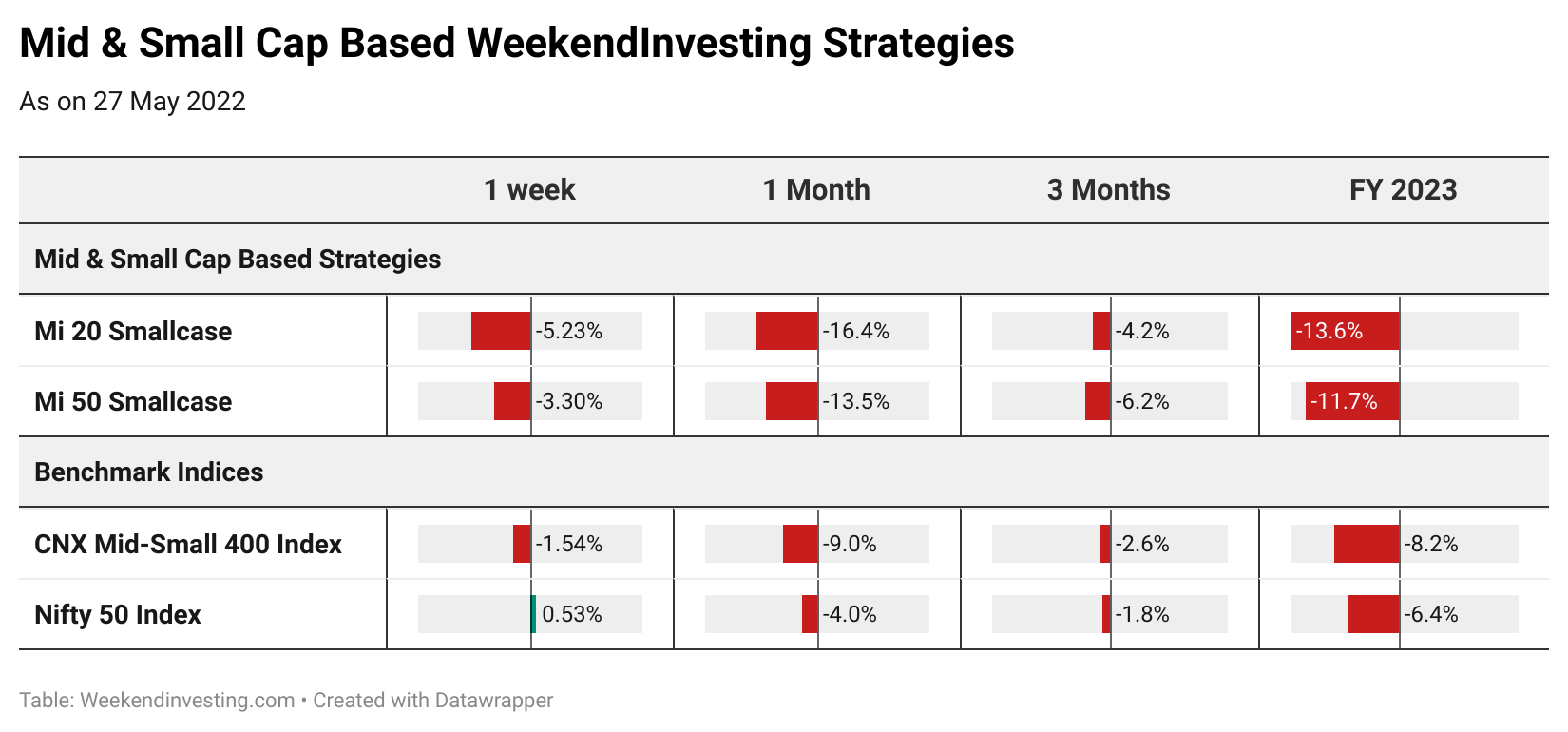

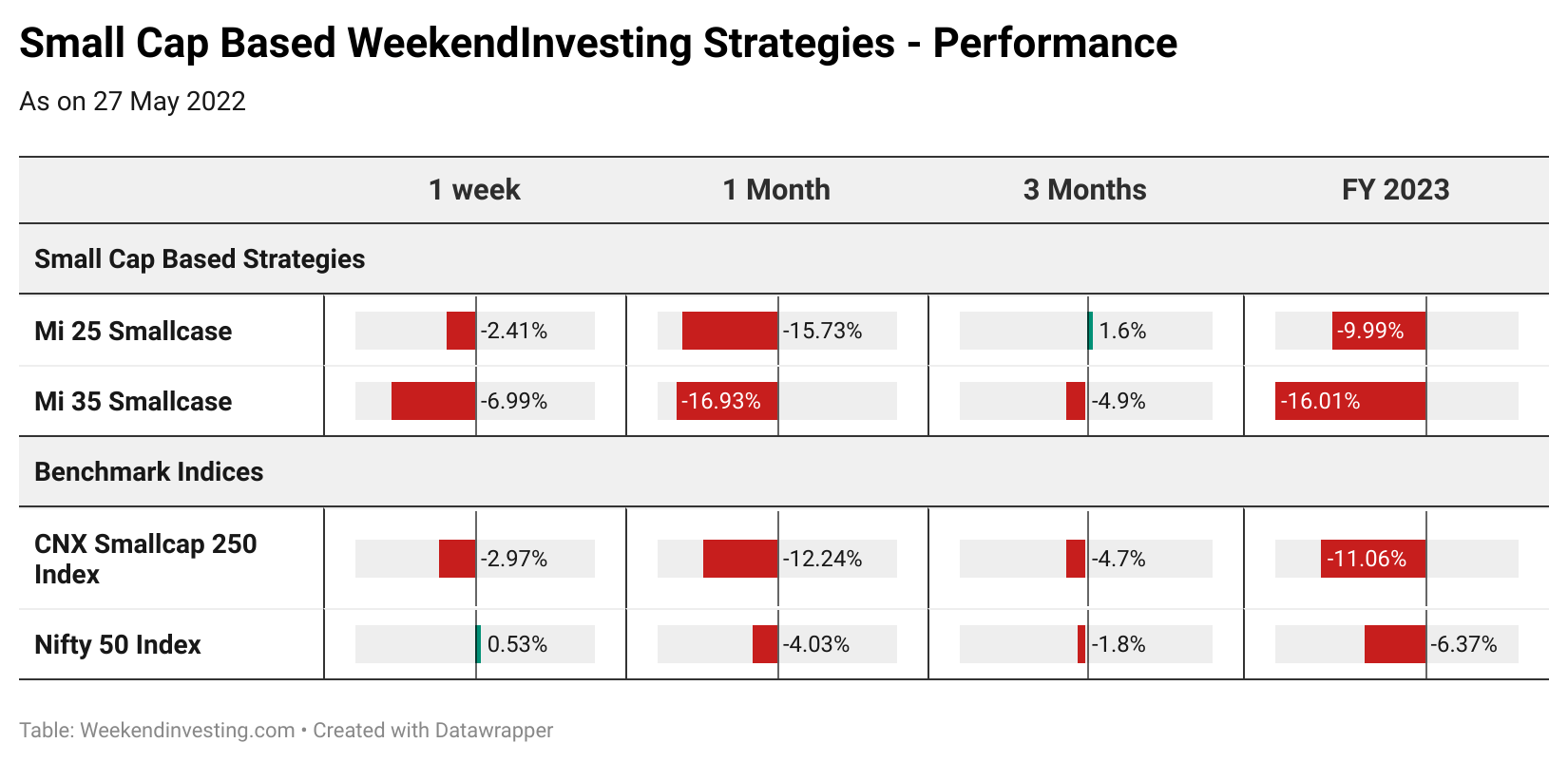

All benchmarks gained marginally about half a percent barring mid-small 400 which stayed flat. What is encouraging is the presence of demand which has arrested the fall till now. Across 3 months all indices have returned between 2% – 4% while in FY 23, all indices are still positive barring Smallcaps.

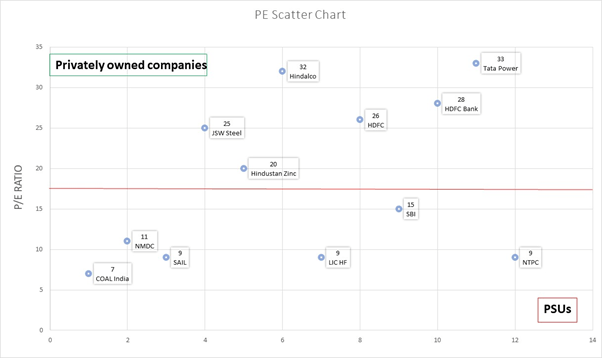

IT turned the tide to top the table with gains of 3.5% this week on the back of optimism around the results. IT has shown positive signs of ending the downward trend clocking returning (+5.19%) in the last 3 months. METALS (+2.58%) , AUTO (+1.62%) & COMMODITIES (+1.32%) also rallied while other sectors remained in the flat to negative territory. PSU BANKS continue to lead the table across larger timeframes despite the profit booking in the last 30 days.

Most WeekendInvesting strategies outperformed the benchmarks this week with Mi ATH 2 topping the table at (+2.45%) gains. Mi NNF 10 also did well to return (+2.35%) while a few strategies performed on par with their benchmarks. Mi 30 and Mi EverGreen are the best performers across last 3 months clocking 10% each as Mi 25 and Mi ST ATH continue to remain slightly weak waiting for strong momentum.

WeekendInvesting Performance Report : Q3 FY 2023

You may access the full report here

WeekendInvesting Loyalty Discounts <W I L D>

We also adopted – Customer Bhagwan Che along with the famous Bhav Bhagwan Che philosophy right since the day we started offering services for retail & we are pumped to launch WeekendInvesting Loyalty Discounts < W I L D > primarily aimed at rewarding WeekendInvestors who have reposed faith in our strategies by staying subscribed for long periods.

This initiative is in the same line of thought as many of our other customer centric initiatives like the Daily Bytes, Daily Insights, User Manual, FAQ Booklet, WeekendInvesting HUB, #askweekendinvesting series, Weekend Chat with WeekendInvestors and also not to forget our lightening quick email responses.

Who is eligible for W I L D ?

WeekendInvestors who have spent 1 year/ 2 years / 3 plus years of continuous time in annual subscriptions.

What are the features of W I L D ?

If you have completed 1 year of annual subscription in any strategy, you shall be eligible to use a special code that gets you a 20% discount , 2 years will unlock a 25% discount and folks who have spent 3 plus continuous years shall get a 30% discount.

You will receive a whatsapp message from Team WeekendInvesting with details of the code at the time of your renewal.

This discount code can be used to

(a) renew your current subscription and

(b) enable you to subscribe to any other strategy(s) of WeekendInvesting at the same discount using the same code which will be valid for a maximum period of 30 days.

A SHORT COURSE to Help you Stay Calm in All Market Conditions

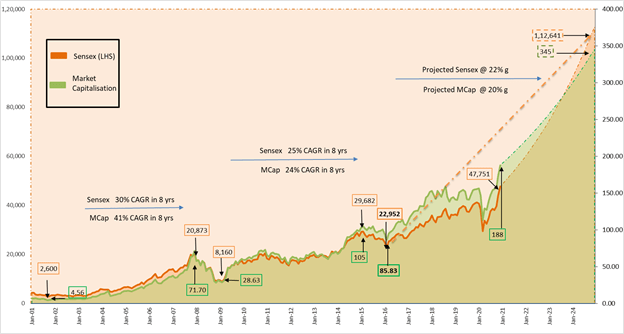

Usually, quick – sharp corrections amidst a Bull Run creates ambiguity in the minds of lots of new investors. The most important question we often get asked is whether markets will crash from here. Should we exit? and a few other questions like these. We have made several videos to help you clarify many such questions and help you have the RIGHT MINDSET for a rewarding journey in investing.

We have put together a few of our previous Daily Bytes which we think might be relevant for times like these. Do have a look and send us your thoughts, questions or comments if any.

The smallcase products are all LONG ONLY products that invest in various subsegments of the markets but have the momentum theme underlying in all of them. The strategies will pick strong outperforming stocks and remove weak ones once a week (except Mi NNF10, Mi EverGreen & Mi India Top 10 which is monthly rebalanced)

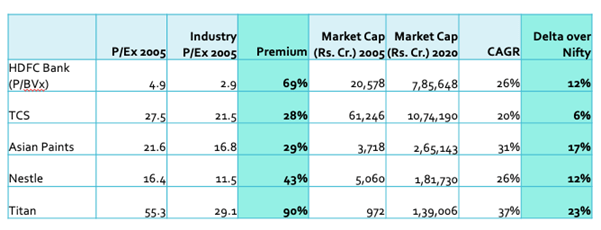

These are all long-term strategies that will create enormous wealth in each upswing and then maybe give some back in the downswing and repeat this process again and again achieving the compounding effect. With patience and grit to follow strategy over ups and downs over the last nearly five years, it has been shown that much superior CAGR returns are possible than the benchmarks.

FY22 was also superb and I will let the numbers speak for themselves. You may read the Consolidated FY22 report.

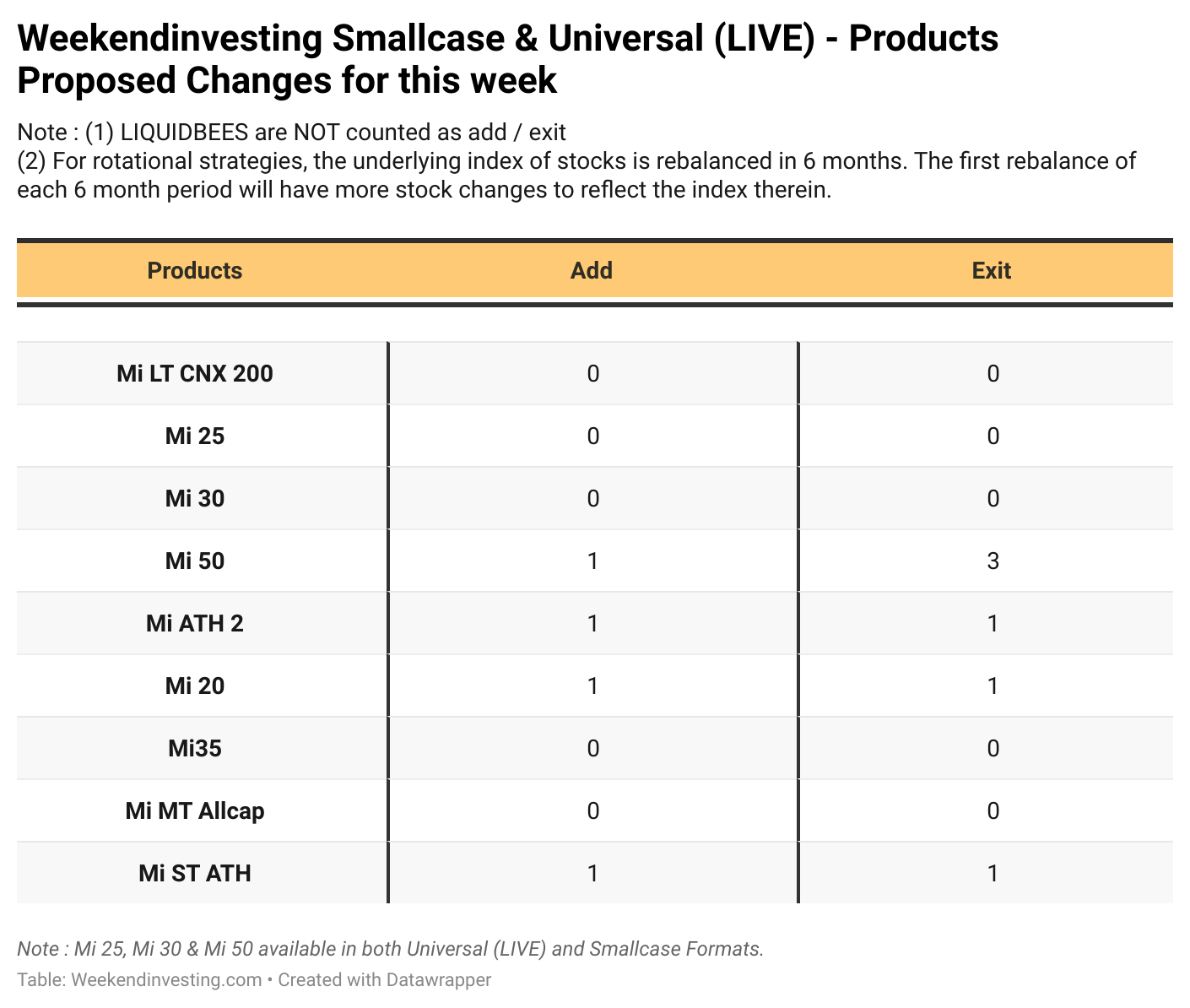

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

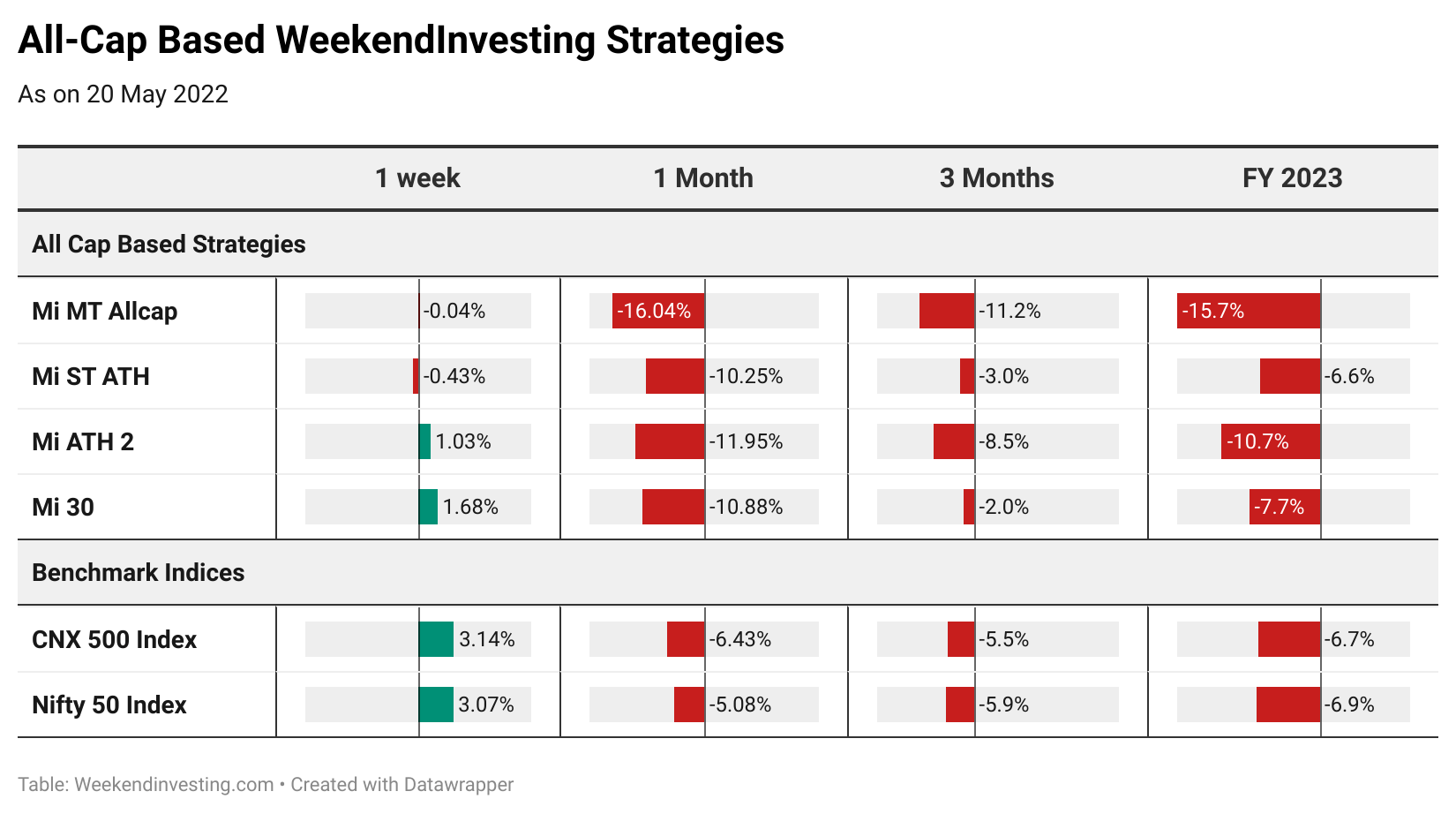

The performance for the week and the month for all the smallcases is presented below.

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

WeekendInvesting Telegram and YouTube Channel

We post daily content related to investing on our Weekendinvesting Telegram Channel and YouTube channel to help our community take stock of the performance of markets, sectors & our products and touch base upon a new topic every day. We look forward to having you all there! Several videos in this blog are from this series.

WeekendInvesting Daily Insights – A New Initiative

We started a new initiative called – WeekendInvesting Daily Insights to share quick 1 minute content that can help you in your investing journey. Please do take a look at this week’s episodes by clicking on the image below.

STAIRS Revamped Models

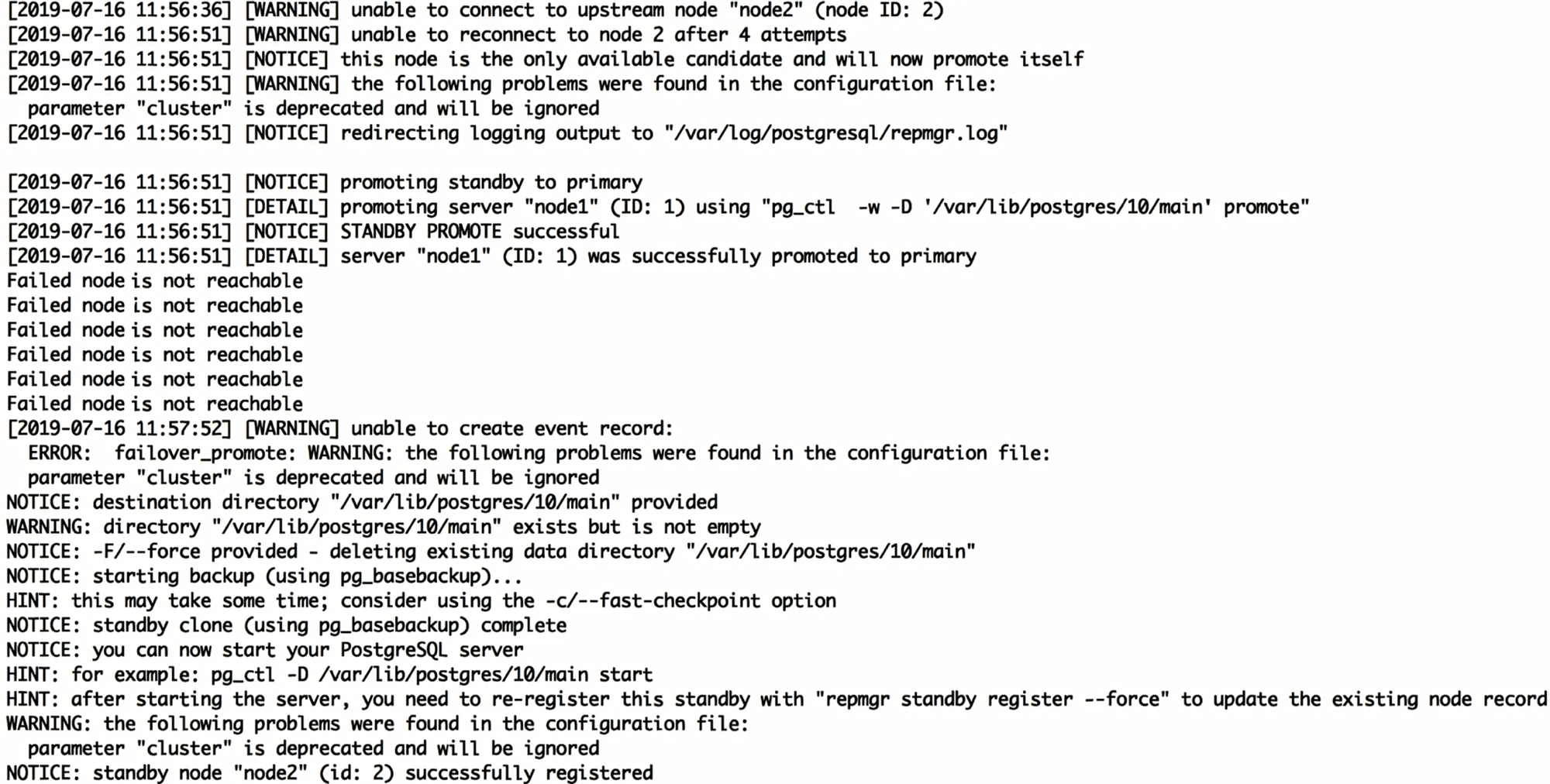

STAIRS is a LONG / SHORT derivative strategy that is designed to offer an uncorrelated diversification option to your equity portfolio. STAIRS will do well when there are up trends & also when there are down trends while giving up some of the gains when markets remain rangebound/volatile.

You may go through our latest weekly report for more details.

STAIRS Weekly Report : 12 Jan 2023

All 4 STAIRS models go in line with our fundamental philosophy of making the most and compounding aggressively when markets give us trends and go very defensive as trends fizzle out and enter a rangebound territory, thus providing robust capital & profit protection.

Effectively – STAIRS is a complete trading system (Futures & Options) that covers each of the following decisions required for a successful trading outcome:

• Markets – What to buy or sell?

• Position Sizing – How much to buy or sell?

• Entries – When to buy or sell?

• Stops – When to get out of a losing position?

• Exits – When to get out of a winning position?

We also run a dedicated telegram channel for STAIRS which you may join using the below link.

Join FREE STAIRS Telegram Channel

STAIRS CY 2022 Performance Report

Testimonials