Predictions for the Budget – 2023

The 2023 Budget is around the corner, and everybody is wondering what major announcements we’ll witness in the next few weeks. The 2023 budget can make and break the country’s finances when the global economy is taking a downturn.

While many think that the government will keep the themes of infrastructure spending and manufacturing in focus, others believe that the government will push for more welfare spending, given that this is the last budget before the Union Elections. On the other hand, some warn that excessive spending when the global economy is in turmoil is not the best strategy.

Read the full story on Wright Research’s blog.

So what are the expectations from this budget?

Budget 2023 is likely to focus on capital expenditure as a growth driver and give an impetus to manufacturing while continuing with the post-pandemic fiscal consolidation. The finance minister will try to boost capital expenditure from the current 2.9% GDP to nearly 3.5%. She might also rationalise personal income-tax rates to lift demand. The focus will also be to improve the ease of doing business. The Budget is expected to continue focusing on domestic manufacturing revival, and PLI schemes for labour-intensive sectors are likely. Most importantly, instead of going populist, the Budget is expected to continue to focus on post-Covid fiscal consolidation and focus on divestment and reduction of subsidies.

Which sectors will benefit from the budget?

With the budget coming at the beginning of 2023, the sectors that the government is looking to focus on – manufacturing, capital goods, defence, sustainability, railways, and public sector banks are already seeing fresh investments. So we expect these sectors to continue to be in the spotlight.

The theme of chasing stocks getting government Capex and incentives from the PLI scheme will outperform in the run-up to the budget. Even though this is the last budget before elections, we might not see the government go populist but instead focus on fiscal consolidation in light of global volatility.

How will the markets react?

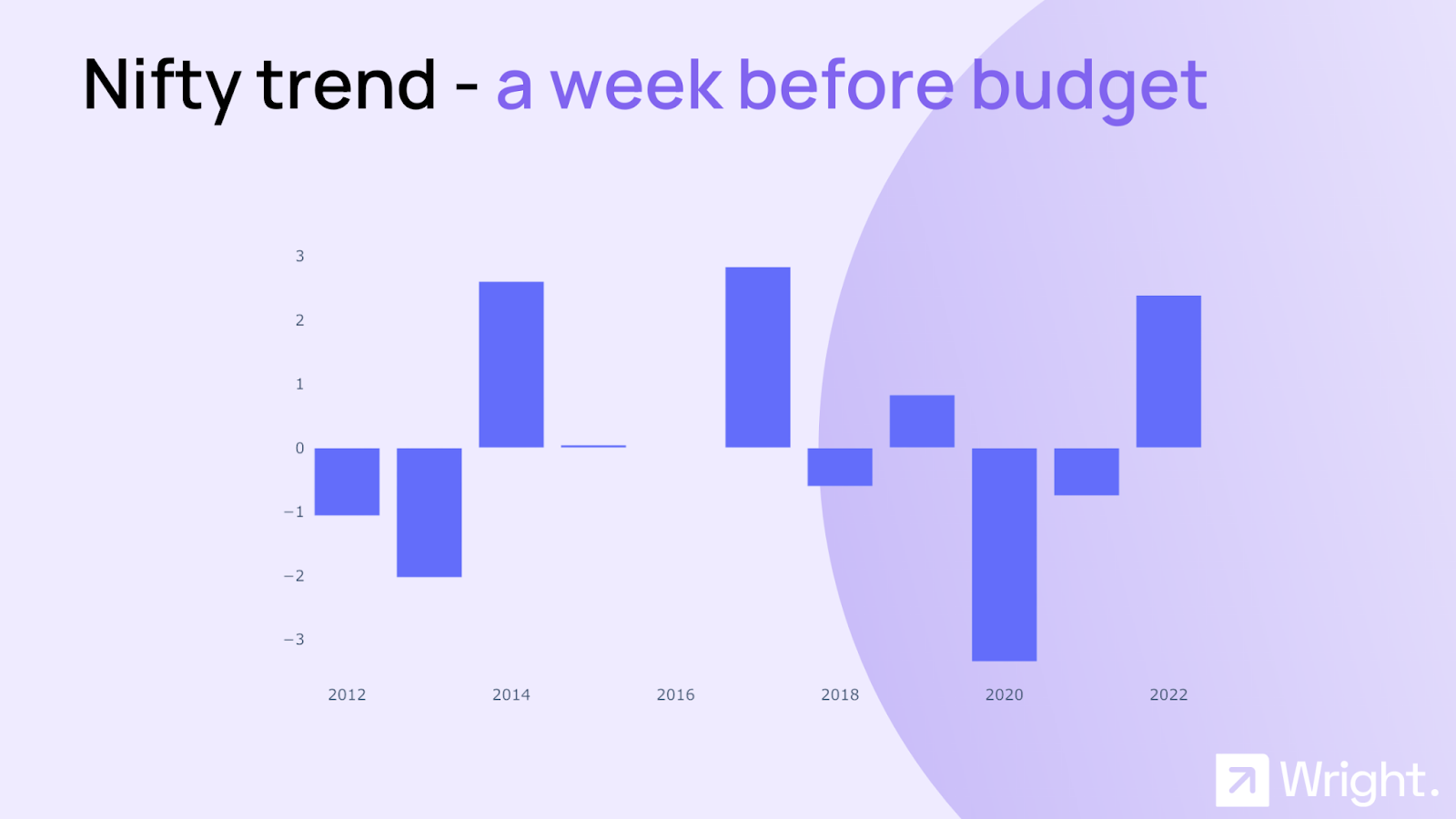

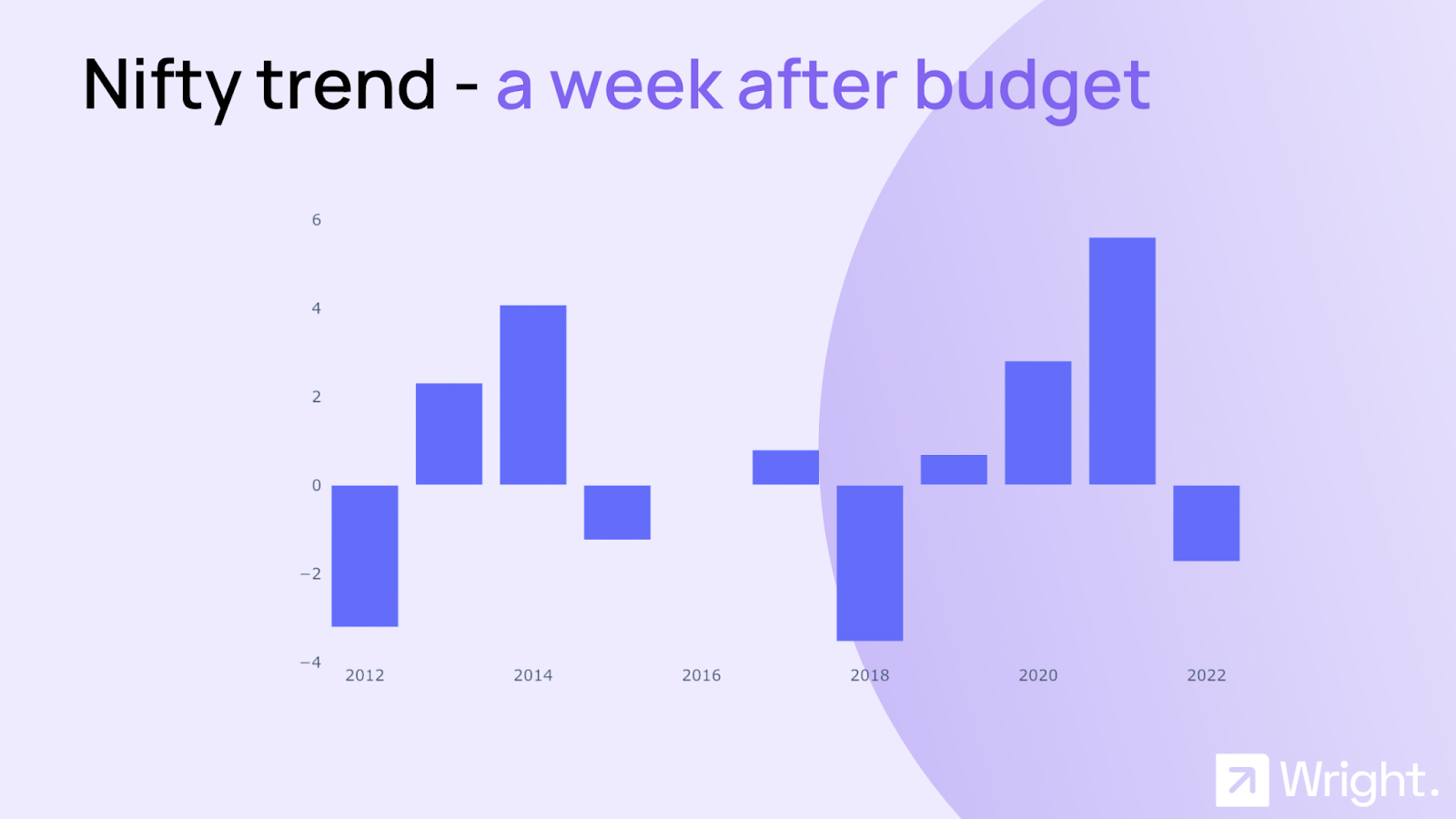

The market has fallen five times while gaining six times in the month ahead of the Union Budget in the last 11 years and has oscillated between -3 and +3%. However, the budget day has been joyous most of the time, and the post-budget has been more positive than negative.

This year we see a pre-budget buying in stocks that the budget might favour, but the volatility could persist on the broader market level. The announcements in the budget could be crucial – if the budget is too populist, it might hurt sentiments, while a more cautious budget might be more welcome.

The ten big themes for budget 2023

Here are 10 Wright Predictions for the 2023 Budget that we think will play a critical role:

- PLI Schemes

The PLI schemes can be significant drivers of incremental revenues for India Inc in the next few years. We expect the scope of PLI schemes to expand and include more sectors, incentivising industries that are seeing a positive impact of PLI, like mobile phone manufacturing, chemicals and auto components.

- Manufacturing

Investing in roads, railways, defence manufacturing, and other infrastructure products is also essential to support emerging industries.

- Rural Sector

The rural sector has been struggling since the pandemic, and many call the recovery K shaped – where the rural sector did not recover, but the urban sector did.

- Connectivity

We should expect better connectivity, digital inclusion, and credit expansion to the rural economy and support struggling industries. The Budget 2023 should not overdo the welfare spending for the rural market with an eye on the election.

- Tax relief for MSMEs/GST

We are also expected to see the tax relief for MSMEs expanding, rationalising GST and boosting credit growth in small and medium enterprises. In addition, we should know the scope of the Emergency Credit Line Guarantee Scheme (ECLGS) expanding for emergency help for SMEs.

- Capitalisation

The measures in the last few budgets have helped improve India’s non-performing assets problem and have improved profitability and asset quality in the banking system.

We might not see any further capitalisation in this sector but instead a focus on further credit expansion. This is because the scheduled commercial banks are adequately capitalised and have a vast scope for further credit expansion.

- Use of technology

The use of technology is expected to be incentivised to expand the credit in the economy and prioritise tools like OCEN (Open Credit Enablement Network) for accelerating the credit economy.

- Green Financing

The Budget might focus intensely on sustainability and green financing, ensuring that India is walking towards a more sustainable future.

The aim is to make the country Net Zero by 2070, halve our greenhouse gas emissions, and transition to non-fossil-based energy sources by 2030. Therefore, investments in renewable energy, electric vehicles, green hydrogen, and other related sectors should be a priority.

- Ease of doing business

We should also see an improvement in India’s overall ease of business. India needs to be ranked better in ease of doing business rankings, which can make it difficult for companies to operate and invest in the country.

In addition, the Budget 2023 should streamline regulations and procedures for starting and running a business and invest in infrastructure to improve connectivity and logistics.

- The clear glide path to reduce the fiscal deficit

Lastly, we believe the government will be fiscally conservative instead of populist in the budget announcements. They suggest a clear glide path to reduce the fiscal deficit to a target of 4.5%, trim subsidies and push for asset monetisation.

Even though we have a general election next year and several state elections soon, we should not see a lot of spending on welfare but try to keep the books strong for India Inc in a high-interest rate environment where the rest of the world is struggling.

Where to invest in anticipation of the budget?

Wright New India is a specialised portfolio that bets on the sectors gaining from the Government schemes to boost manufacturing. The term ‘Atma-Nirbhar’ has evolved from a buzzword to a solid profitable strategy. It has become essential to evaluate the impact of policy reforms and drill down into their effects on the markets. We look at the themes of Make in India or Atmanirbhar-Bharat,

Profit Linked Incentives and China plus One to pick stocks, and we expect this theme to shine in anticipation of the budget.

Wright Research

Wright Research