Top Fertilizer Stocks in India: Definition, Features & Best Fertilizer Shares List 2024

Imagine a world without fertilizers.

No more juicy, ripe tomatoes, no more fresh, crispy lettuce, and no more fragrant flowers. Sounds bleak, doesn’t it?

Not only this, but it could also lead to food shortages, higher fertilizer company share prices, and potentially even famine in some areas. Additionally, without fertilizers, farmers may need to clear more land for farming. Which could contribute to deforestation and other negative environmental impacts.

See, that’s the role of fertilizers in our lives. Although we don’t use them directly daily, their absence would drastically affect our daily lives. Now, we hope that the investor within you understands the unbeatable growth potential of the fertilizer and the FMCG sector.

So, let’s understand in-depth about the fertilizer sector stocks through this blog and our curated and educational fertilizer share list.

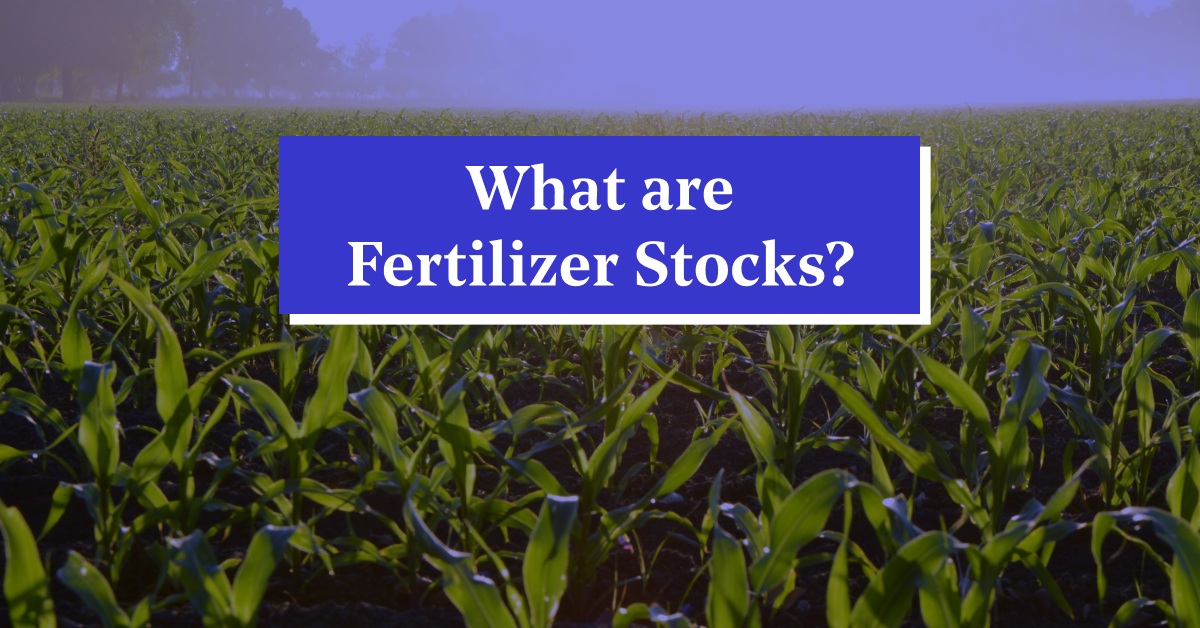

What are Fertilizer Stocks?

Fertilizer stocks refer to the shares of companies that produce, manufacture, or distribute fertilizers.

These listed fertilizer companies in India are typically engaged in producing and selling various types of fertilizers, such as nitrogen-based, phosphate-based, and potash-based fertilizers, as well as other agricultural inputs and products.

The fertilizer sector is an important component of the agricultural industry, and fertilizer stocks can be a good investment option for those interested in the agriculture or commodities market. Let us now explore our curated fertilizer stock list.

Growth of Fertilizer Stocks in India

India, an agricultural powerhouse, sees high demand for fertilizers owing to extensive crop cultivation. Fertilizer companies play a pivotal role in fortifying the agricultural sector by enriching the soil with vital nutrients. Dominated by urea, DAP, and complex fertilizers, the Indian fertilizer industry has undergone a significant transformation, spurred by government backing and the influx of private entities. Forecasts suggest a promising trajectory for the Indian fertilizer market, buoyed by population expansion, evolving dietary preferences, and heightened agricultural yields. Key players in this sector include Tata Chemicals, Coromandel International, National Fertilizers Limited, and Chambal Fertilizers and Chemicals.

List of Best Fertilizer Stocks in India 2024

These listed top 10 fertilizer stocks in India have the best fertilizers stocks in India. Here are the top fertilizer companies in India, with the fertilizer stocks share prices:

| Popular Fertilizer Shares in India | Market Cap (in Cr) | Share Price |

|---|---|---|

| Coromandel International Limited | ₹31,057 | ₹1,053.4 |

| Chambal Fertilizers and Chemicals Limited | ₹13,658 | ₹337.5 |

| Gujarat Narmada Valley Fertilizers & Chemicals Limited | ₹8,997 | ₹610.5 |

| Deepak Fertilizers & Petrochemicals Corporation Limited | ₹6,136 | ₹484.1 |

| Fertilizers & Chemicals Travancore Limited | ₹41,409 | ₹634.6 |

| Tata Chemicals Limited | ₹28,555 | ₹1,046.85 |

| National Fertilizers Limited (NFL) | ₹4,268 | ₹86.3 |

| Rashtriya Chemicals & Fertilizers Limited | ₹6,948 | ₹124.8 |

| Madras Fertilizers Limited | ₹1,304 | ₹80.7 |

| Pradeep Phosphates Limited | ₹5,470 | ₹67.1 |

Disclaimer: Please note that the above list is for educational purposes only, and is not recommendatory. Please do your own research or consult your financial advisor before investing.

Note: The organic fertilizer stocks list data is from 20th March, 2024. However, for real-time updates on Indian fertilizer share prices and market trends, visit the smallcase stocks collection today!

Why Should You Invest in Fertilizer Stocks in India?

India is an agricultural country, with around 60% of its population engaged in agriculture-related activities. The fertilizer industry in India plays a crucial role in boosting agricultural productivity and improving food security.

As per the ‘first budget of the Amrit Kaal’ the Government of India is all set to empower farmers, economically weaker sections, and women. In the 2023 budget, it is clearly mentioned that the agriculture sector will receive direct capital and resource investment from the central government.

Moreover, to give a boost to Agriculture oriented start-ups, the Agriculture Accelerator Fund is going to be set up. Now you can assume the kind of growth that the fertilizer stock in India is going to witness in the upcoming years.

Top 10 Largest Fertilizer Companies in India: An Overview

Here is a brief overview of the top 3 stocks from the fertilizer stocks list shared above. These are predicted to be the top 3 fertilizer stocks to buy today in India from our shares list.

Chambal Fertilisers and Chemicals Limited

Chambal Fertilisers and Chemicals Limited is a manufacturer of Urea and di-ammonium phosphate (DAP). The Company’s segments include Fertilisers and other Agri inputs, Own Manufactured Phosphoric Acid, Textile, Shipping, and Software & others. The Kota, Rajasthan-based firm is a member of the KK Birla group of companies. Established in 1985, it stands as one of the largest urea manufacturers in India. Presently, the fertilizer company in India holds a market capitalization of Rs. 11,000 crore, although it has experienced a nearly 40% value decline in the past year.They are the top manufacturer of fertilizer in India and can be considered the best fertiliser stocks in India to invest in, potentially.

Coromandel International Limited

Coromandel International is engaged in the manufacture and trading of farm inputs consisting of fertilizers, crop protection, specialty nutrients and organic compost. It was founded over six decades ago by US-based IMC and Chevron in collaboration with India’s EID Parry. This Hyderabad-based company is one of India’s oldest fertilizer firms, making it also the top fertiliser stocks in India. It currently holds a market capitalization exceeding Rs. 25,000 crore and specializes in manufacturing nutrients, pesticides, and its core product, fertilizers.

Gujarat Narmada Valley Fertilizers & Chemicals Ltd

Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC) manufactures and sells various fertilizers, such as urea, ammonium nitro phosphate under the brand NARMADA. GNFC, established in 1976, is a collaborative effort between Gujarat State Investment Ltd and Gujarat State Fertilizers and Chemicals Ltd. With a market capitalization of Rs. 8,000 crore, it ranks among India’s top fertilizer and chemical stocks in India.

Deepak Fertilisers and Petrochemicals Corp Ltd

Deepak Fertilisers and Petrochemicals Corporation Ltd (DFPCL) leads in producing industrial chemicals like Nitric Acid, Iso Propyl Alcohol (pharma and industrial grades), and food-grade Liquid Carbon Dioxide in India. It also imports and distributes IPA and other chemicals domestically. DFPCL operates manufacturing facilities in Maharashtra, Andhra Pradesh, Haryana, and Gujarat, with a total capacity of nearly 3 million MT per year. It is also one of the top fertilizer stocks in India on our fertilizer share price list.

Fertilisers And Chemicals Travancore Ltd

In 1943, The Fertilisers And Chemicals Travancore Limited (FACT) was established as India’s inaugural large-scale fertilizer plant in Udyogamandal. Production of Ammonium Sulphate commenced in 1947 with an initial capacity of 10,000 MT per annum at Udyogamandal near Cochin. By 1960, it transitioned into a Kerala State PSU and in 1962, the Government of India became its major shareholder.

Tata Chemicals Ltd

Tata Chemicals Limited (TCL) ranks third in global soda ash and sixth in sodium bicarbonate production. Its roots trace back to the Okhamandal Salt Works established in 1927, later becoming part of the Tata Group in 1939 under JRD Tata’s leadership. Originally focused on industrial salt and soda ash, TCL has since expanded its product range to include various science-based items.

TCL’s market presence extends across Asia, North America, Europe, and Africa. In 2008, one of the best fertilizer company in India to invest in formed a joint venture with JOil (Singapore) Pte Ltd, a jatropha seeding company, through its subsidiary Tata Chemicals Asia Pacific Pte Ltd.

National Fertilizers Ltd

National Fertilizers Limited, a prominent public sector entity, stands as India’s second-largest urea producer, boasting an impressive installed capacity of 35.68 lakh metric tonnes. This accounts for a significant 16% of the nation’s total urea production. The company specializes in manufacturing and marketing various agricultural products, including neem-coated urea, four strains of bio-fertilizers. Furthermore, a range of allied industrial items such as ammonium nitrate, ammonia, nitric acid, sodium nitrite, and sodium nitrate. It is also one of the top listed fertilizer company in India on our list.

Rashtriya Chemicals and Fertilizers Ltd

Rashtriya Chemicals & Fertilizers Limited (RCF), a government-owned enterprise under the Ministry of Chemicals and Fertilizers, specializes in chemical and fertilizer production. Approximately 75% of its equity is owned by the Government of India. Notably, RCF attained Navratna status in August 2023, becoming the first PSU in the fertilizer sector to achieve this recognition.

Madras Fertilizers Ltd

Madras Fertilizers Limited (MFL) operates as a Public Sector Undertaking under the governance of the Department of Fertilisers, Ministry of Chemicals and Fertilisers. It holds the distinction of being the first PSU in the fertilizer sector to achieve ISO 9002 accreditation. MFL originated as a joint venture between AMOCO India and the Government of India.

Paradeep Phosphates Ltd

Paradeep Phosphates Limited (PPL) stands as India’s second largest privately-owned fertiliser manufacturer, specializing in phosphatic fertilisers. Founded in 1981 in Bhubaneswar, Odisha, it emerged through a joint venture between the Indian government and the Republic of Nauru with the aim of establishing a phosphatic fertiliser unit in Paradeep. PPL commands approximately 8% of the market share in India’s phosphatic fertiliser segment.

How to Invest in Fertilizer stocks via smallcase?

If your interest has been piqued by the best fertilizer stocks in India, look no further! We are here for you with exciting popular fertilizer sector smallcases!

Rising Rural Demand

The Rising Rural Demand was created by Windmill Capital. This smallcase is a portfolio of stocks designed to capitalize on the growing demand for consumer goods and services in India’s rural areas.

The smallcase includes a mix of fertilizer companies listed in NSE in various sectors. Including consumer goods, financial services, healthcare, and agriculture, that are well-positioned to benefit from the rising income and consumption levels in rural India.

House of Murugappa

The House of Murugappa was also created by the Windmill Capital. This smallcase is a portfolio of stocks that invests in companies belonging to the Murugappa Group.

They are one of India’s leading business conglomerates with interests in a wide range of sectors such as engineering, financial services, and agro-products.

Who Should Invest in Fertilizer Stocks?

Investing in fertilizer stocks can be suitable for a variety of investors. Especially including those seeking exposure to the agricultural sector and looking for diversification in their portfolio. Farmers and agricultural professionals may find investing in fertilizer stocks beneficial as they are directly involved in the industry and understand its dynamics. Additionally, investors interested in industries that support global food production and agriculture may also consider investing in fertilizer stocks. Overall, anyone looking to participate in a sector that plays a vital role in food security and agricultural productivity may find fertilizer stocks worth considering.

Want to Build Your Investment Portfolio? Invest in smallcases!

Picking fertilizer stocks for your portfolio and investing in them is a time-consuming process. Wouldn’t it be great if you get a ready-made portfolio for you to invest in?

Aren’t you nodding your head?

Well, we have some good news for you as now you invest in ready-made portfolios via smallcase. smallcases are portfolios of stocks or exchange-traded funds (ETFs) created around a particular investment theme or strategy. They are designed to offer you an easy and affordable way to invest in a diversified portfolio of stocks or ETFs that align with their investment goals and values.

However, if you’re confused about which stocks to pick, you can explore smallcases:

- smallcases are readymade portfolios of stocks/ETFs, that are based on a theme idea or strategy

- They’re created and managed by SEBI-registered experts

- smallcase.com offers over 200+ stock portfolios, created by 180+ managers

- Some of the popular smallcases among new investors are as follows:

Disclosures for aforementioned smallcases

Disclosures for aforementioned smallcases

Factors to Consider When Investing in Fertilizer Stocks

- Market Condition: The overall market condition directly influences the performance of fertilizer sector stocks. Therefore, you should analyze the current market condition, economic indicators, and stock market trends before investing in fertilizer penny stocks.

- Competitive Landscape: As an investor, you should evaluate the competitive landscape of the fertilizer industry. This includes the market share of each player, pricing strategies, and production capacity.

- Agricultural Trends: The agricultural sector’s growth and trends are vital indicators of fertilizer demand. Hence, you should track the crop production cycle, crop prices, and government policies related to agriculture.

Apart from this, it is essential to evaluate the future prospects of the fertilizer industry. Especially including new product launches, mergers and acquisitions, and technological advancements.

Features of Fertilizer Stocks in India

Fertilizer stocks in India exhibit several key features that investors should consider:

- Market Demand: Fertilizer stocks are influenced by the demand for agricultural products, which, in turn, is driven by factors like population growth and food consumption patterns.

- Government Policies: Government regulations and policies regarding subsidies, pricing, and import/export controls significantly impact fertilizer stocks. Changes in these policies can affect the profitability of fertilizer companies.

- Raw Material Prices: Fertilizer production depends on raw materials like natural gas, phosphates, and potash. Fluctuations in the prices of these raw materials can affect the cost structure and profitability of fertilizer companies.

- Seasonal Variations: The demand for fertilizers is seasonal, with peak demand during planting seasons. Fertilizer stocks may experience fluctuations in earnings and stock prices based on seasonal variations in demand.

- Technological Advancements: Innovation and technological advancements in fertilizer production methods, such as the development of new fertilizers and enhanced production processes, can impact the competitiveness and growth prospects of fertilizer companies.

How to Select the Best Fertilizer Stocks in India?

When selecting the best fertilizer stocks in India, consider factors such as the company’s financial performance, market share, and product portfolio. Conduct thorough research on industry trends, government policies, and global market demand for fertilizers. Analyze each company’s competitive position, distribution network, and technological advancements to assess its growth potential. Look for companies with strong management teams and a proven track record of profitability and sustainability in the fertilizer industry. Additionally, evaluate factors like production capacity, raw material sourcing, and pricing strategies to make informed investment decisions in fertilizer stocks.

Advantages of investing in Fertilizer Stocks

Investing in the fertilizer sector stocks can offer investors several advantages, for example:

- Diversification: This sector provides an excellent means to diversify investment portfolios. This is done by gaining exposure to some of the most promising companies within the industry. This diversification helps balance portfolios that may include bonds, stocks, and mutual funds.

- High Growth Potential: The projected global population increase by over 33% by 2050 will significantly drive up the demand for food. Coupled with rising incomes in emerging markets leading to increased consumption of high-quality food, there’s a growing need for all fertilizers in large-scale production. Consequently, investing in the best fertilizer stocks in India presents substantial growth opportunities.

- Risk Management: The best fertilizer stocks in India often follow trends distinct from other sectors, making them a valuable tool for managing investment risks. This divergence minimizes exposure to Indian fertilizer market risks and aids in portfolio diversification.

- Export Restrictions Awareness: The best fertilizer stocks in India are susceptible to occasional export restrictions. Necessitating investors to stay informed about regulatory changes within the industry and adjust their portfolios accordingly.

- Access to Promising Companies: Investing in this sector grants investors access to some of the industry’s most promising Indian fertilizer companies. This is particularly advantageous for those seeking long-term growth prospects, enabling investments in well-managed firms poised to generate potentially higher returns.

Risks Associated With Fertilizer Stocks in India

Investing in fertilizer stocks in India carries certain risks that investors should be aware of before making investment decisions. Here are some key risks associated with investing in fertilizer stocks:

- Regulatory Risks: Fertilizer companies in India are subject to regulations and policies set by the government, which can impact their operations and profitability. Changes in subsidy policies, pricing regulations, or environmental regulations can affect the financial performance of fertilizer companies.

- Commodity Price Volatility: Fertilizer companies are exposed to fluctuations in the prices of raw materials such as natural gas, phosphates, and potash, which are used in the production of fertilizers. Changes in commodity prices can impact the cost of production and ultimately the profitability of fertilizer companies.

- Weather and Agricultural Risks: The performance of fertilizer stocks is closely linked to the performance of the agriculture sector. Which in turn is influenced by weather conditions and agricultural practices. Adverse weather conditions such as droughts or floods can affect crop yields and demand for fertilizers. Thereby impacting the revenue and profitability of fertilizer companies.

- Currency Risks: Fertilizer companies in India may be exposed to currency risks if they import raw materials or export finished products. Fluctuations in exchange rates can impact the cost of imports or the revenue generated from exports. Thereby affecting the overall financial performance of fertilizer companies.

To Wrap It Up…

India is the second-largest consumer of fertilizers in the world, and the demand for fertilizers is expected to continue to grow in the upcoming years.

Apart from this, the government of India is also encouraging the production and consumption of fertilizers by providing financial support to the producers and farmers.

So, what are you waiting for? Start investing in fertilizer stock portfolios via smallcase.

FAQs

The best fertilizer stocks India are:

1. Chambal Fertilisers and Chemicals Limited

2. Coromandel International Limited

3. Gujarat Narmada Valley Fertilizers & Chemicals Ltd

Note: This fertilizer stocks list is for educational purposes only, and it is not meant to be recommendatory.

You can invest in the Fertilizer sector in India through smallcase! The Rising Rural Demand smallcase and the House of Murugappa smallcase are both fertilizer sector invest opportunities brought to you by the Windmill Capital!

The demand for fertilizers is anticipated to increase in the coming years. Additionally, the Indian government is actively promoting fertilizer production and usage by offering financial incentives to both producers and farmers. Investors must consider their investment goals and risk appetite before investing.

The fertilizers in India play a vital role in the agricultural industry. Thereby making the top fertilizer company in India, an attractive investment option for individuals keen on the agriculture or commodities market. However, one must evaluate their investment goals and risk appetite before investing.

India’s fertilizer sector, while experiencing fluctuations in recent years, offers investors opportunities to profit by investing in Indian fertilizer stocks. Investors should comprehend both growth potential and challenges before investing in Fertilizer Stocks.

Discover Other Collections:

Keep yourself informed and up-to-date on a variety of thematic sectors by reading the articles below: