Large Cap vs Small Cap

In this analysis, we will be examining the performance of small-cap index versus the large-cap index in the stock market. We will look at historical data and recent trends to gain a better understanding of how these two segments have fared over time.

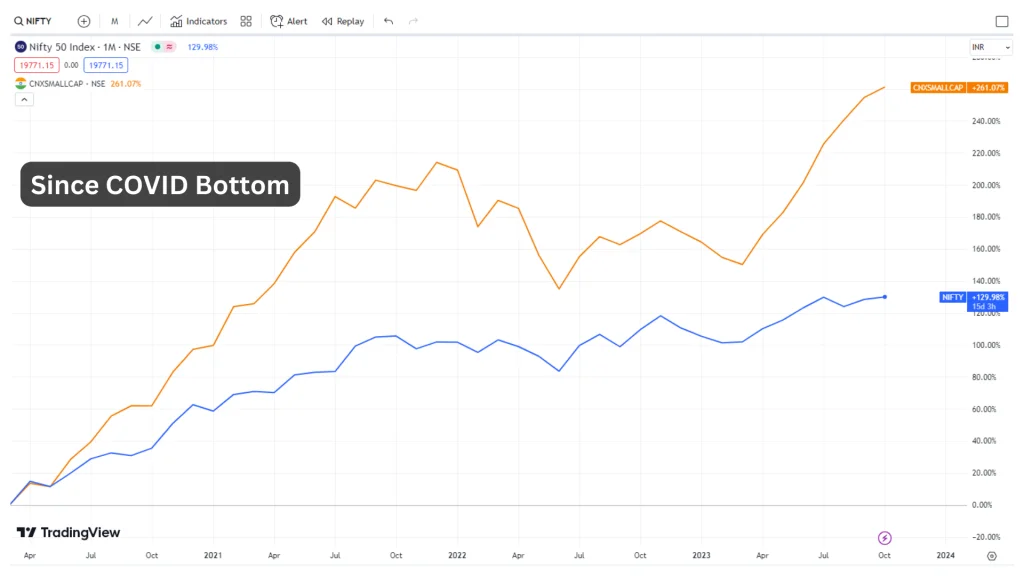

Looking at the chart given above, we can see the Nifty index represented by the blue line and the CNX small cap index represented by the orange line. The COVID-19 pandemic in March 2020 serves as the reference point for this analysis.

Since the market bottomed out in March 2020, small caps have experienced an impressive growth of 260%, while the Nifty index has grown by 129%. If we focus on the recent performance, from March 2021 to the present, small caps have outperformed the Nifty index with a growth of 44% compared to 13% for large caps (also referred to as Nifty).

Over the past few years, there has been a prevailing belief that small cap stocks consistently outperform large caps, leading some investors to overlook the advantages of investing in large caps. However, a closer examination of long-term charts reveals a more nuanced picture.

If we go back to 2010, we can observe that the returns on both the small cap and large cap indices are quite similar.

Examining the performance from 2004, we find that small caps have seen a growth of 1459% compared to 997% for the Nifty index.

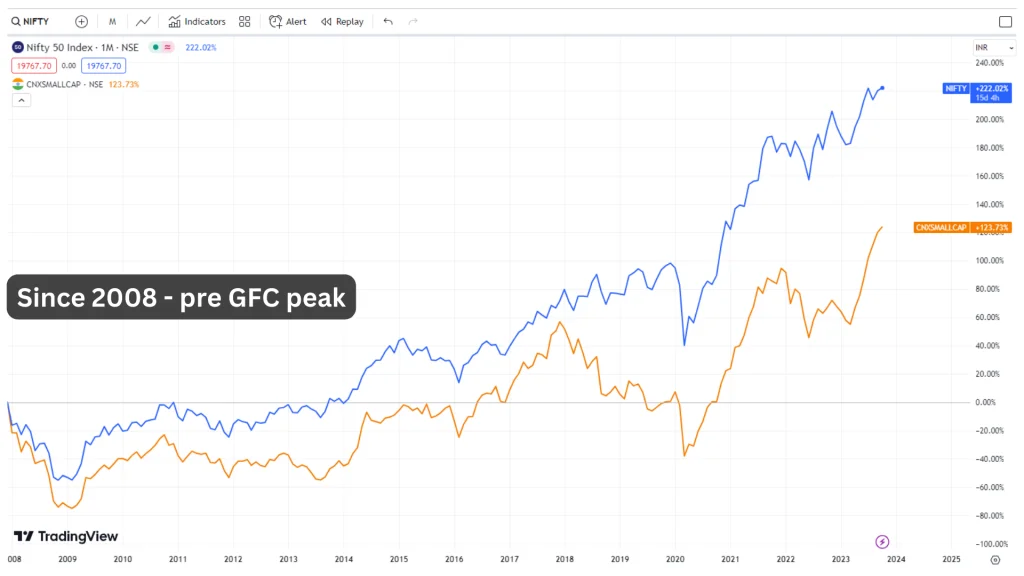

However, if we consider the market peak in 2008, small caps have only grown by 123% compared to Nifty’s 222%.

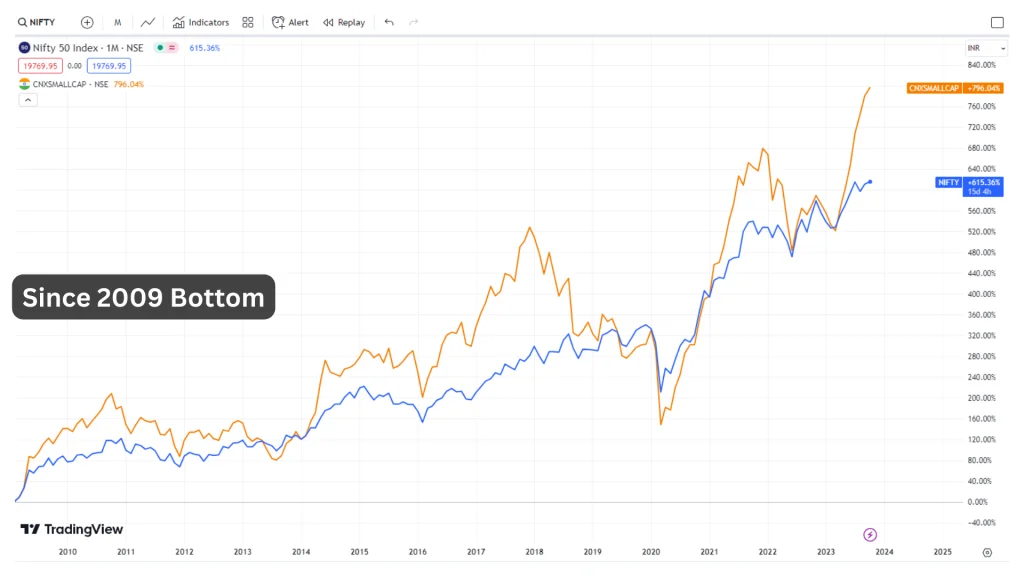

From the 2009 bottom, small caps have marginally outperformed the Nifty index.

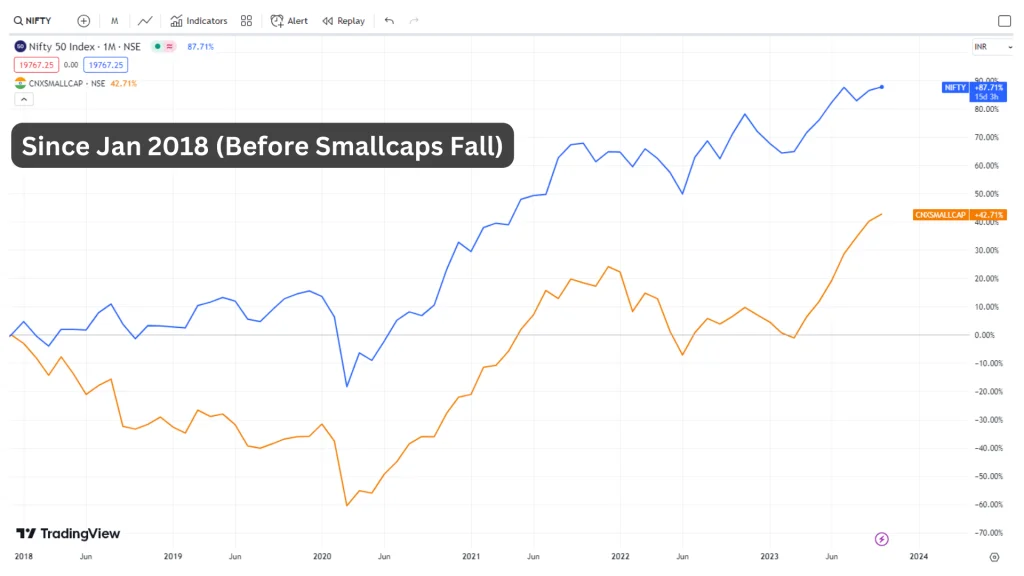

In the last four or five years, , specifically since 2018 when small caps reached a peak, they have seen growth of 42% compared to 87% for the Nifty (large caps).

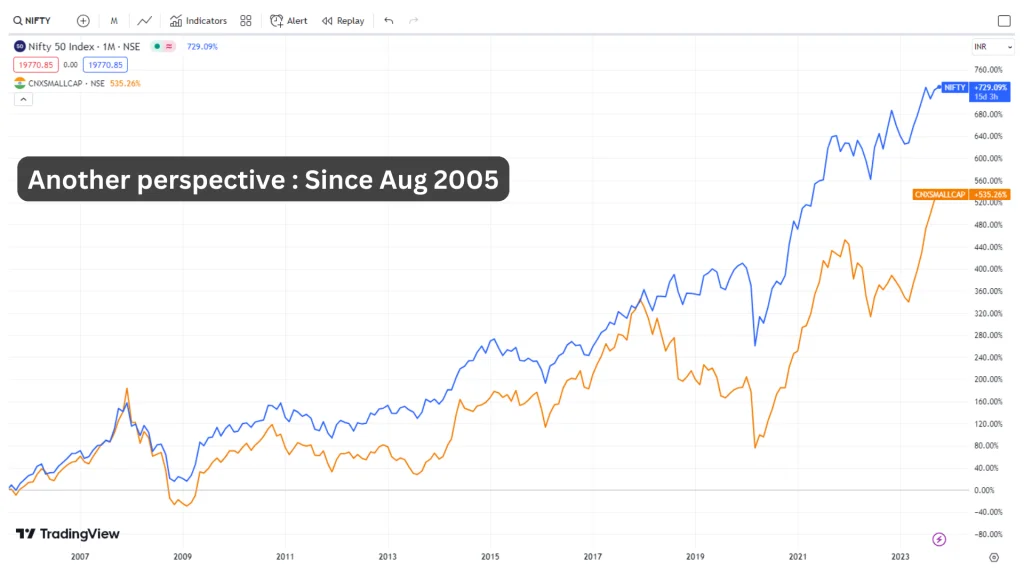

Another perspective compared from Aug 2005 suggests that large caps have comfortably outperformed smallcaps clocking 729% compared to 525% on the latter.

Therefore, it is clear that the performance of small caps relative to large caps heavily depends on the starting point of analysis. Over a reasonably long-term view, small caps have not consistently outperformed the Nifty index. It is important to dispel the notion that small cap indices will always outperform large cap indices over the long term.

Another factor to consider is that many small caps eventually transition into mid caps, and mid caps may then become large caps. This constant shuffling of companies, as they grow or decline in size, leads to significant changes in the structure of the small cap index.

Consequently, the best-performing small cap stocks frequently exit the index, while the Nifty index retains its top-performing companies.

Benefits of following a rule based smallcap strategy

A well constructed rule based strategy effectively utilises the volatility of small cap stocks while keeping the downside minimal to create a strong alpha. Consequently, the performance of small cap-oriented strategies compared to the small cap index can display significant outperformance.

Rule based, non discretionary approach may also excel at avoiding deep drawdowns, as illustrated by the downward movements in the chart below.

Mi 25 which is an upto 25 stock absolute momentum strategy based on the smallcap 250 universe has managed to clock such a solid outperformance by cashing in on the volatile nature of this index and also via avoiding deep drawdowns. This is an important consideration for investors who seek to minimise risk and capitalise on the potential of small cap index. As such, complementing a core large cap or mid cap portfolio with small cap strategies can be a wise addition.

In conclusion, when analysing the performance of small caps versus large caps, we find that the long-term performance of small caps is not always superior to that of large caps. The belief that small caps consistently outperform large caps is a misconception. Nonetheless, rule based & risk managed strategies on the small cap index can potentially extract reasonable alpha by utilising the volatility and avoiding deep drawdowns. One can potentially explore incorporating small cap strategies alongside core large or mid cap holdings for that extra alpha boost to your portfolio.

Explore Mi20 smallcase here

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary. Refer to our disclosures page, here.