🚢 Sail Towards Value From Mazagon Docks

“The grass is greener on the other side” – a common phrase that has stood the test of time to signify a better tomorrow. A transition to something better – from horses to cars, from kirana stores to 10-minute delivery, from cash to UPI – all providing more value via innovation.

This migration in value can be seen in the stock market too and tagging along with these companies towards greener pastures usually leads in gains! Simply put, if a company manages to tackle a segment and causes improvement for themselves and the industry they operate in, thereby transitioning from an out-dated system, is said to fulfil the definition of value migration.

To oversimplify, it is sort of like when Wolverine got the adamantium claws – made him more lethal, saved him a lot of money on health insurance and if he went to a therapist, it could’ve led to improvements in every field he wished to enter. Now, there is one stock that fits this description that has been in the news lately, can be seen if you take the Eastern Freeway in Mumbai, and has rallied by 5x in the last year

alone – Mazagon Dock Shipbuilders! With its roots dating back 250 years, this is a government-backed company that hoists the Indian flag at seas by creating state-of-the-art warships and vessels for the Indian Navy and Coast Guard – yes, it is a defence company! But, what greener grass is this company a part of and how does it qualify as a play on “value migration”?

Navy Zindabad

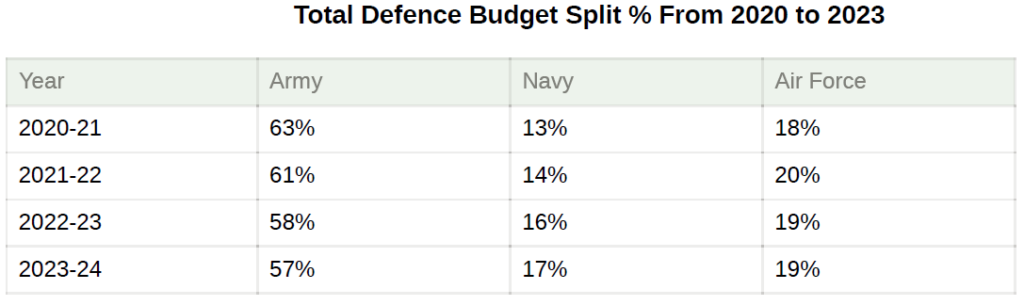

India set aside Rs. 5.94 lakh crore for defence spending in FY23, including a capital outlay which is higher by 8% compared to the previous year. The capital allocation is where money is spent on aircrafts, helicopters, missiles, submarines, warships, etc.

Within this growing budget, there has been a focus being driven towards the Indian Navy in the last few years.

The Rs. 99,000 crore being allocated to the Navy as of the latest budget stands to have grown by 1.6x since 2020, making this the highest growth among all defence segments! With various conflicts around the Indian Ocean and the South China Sea, India’s Naval prowess is the need of the hour, and is likely to result in a sustained growth for the money being spent here for years to come, making this a clear migration in value towards the Navy.

Make In India Pro Max

Another valuable opportunity is the massive transition being witnessed in import substitution, specifically for the defence sector. In fact, the GoI has taken it so seriously, that in the past few years, there have been 4 massive lists of items that are banned from being imported – ranging from arms, ammunition, tankers, jets, ships and even small nuts and bolts. Here is where Mazagon enters as a huge player, since among the 2,000+ items that have been banned, it is responsible for the indigenization of about a 1,000 of them,

making this a huge opportunity in incurring larger orders in the future – both domestic and foreign.

Strong Order Book

The result of all of this is an order book of Rs. 38,500 crore, which is 5x of its FY23 revenue, and is executable over the next 2-3 years. Additionally, its deal pipeline has the potential of further increasing the order book by a whopping Rs. 50,000 crore, led by repeat orders from the P75 line and vessels for the Coast Guard!

With its capacity to build 11 submarines and 10 warships a year simultaneously and a track record of punctual execution, these are what we can expect in terms of order book expansion:

- Repeat orders for P75s (Rs. 4,200 crore per ship) and ships for the Coat Guard (Rs. 1,000 crore per ship)

- Supply of 6 submarines to the Indian Navy (worth around Rs. 43,000 crore) which Mazagon is bidding for, with the German company Thyssenkrupp AG

- Potential order by the US Navy to service and repair a majority of its vessels in its Indo-Pacific fleet

- Potential order for 3 additional Scorpene or Kalvari class submarines from the Ministry of Defence with an order value of Rs. 20,000 crore

The above orders materializing would simply imply a higher order book, which results in higher growth and stronger visibility, potentially leading to further upside in the stock.

Financial Performance

With two strong themes of migration to greener pastures, Mazagon has become a beneficiary of the “right place, right time” situation, with an order book that currently stands at Rs. 38,500 crore, which is 5x of its FY23 revenue, and is executable over the next 2-3 years!

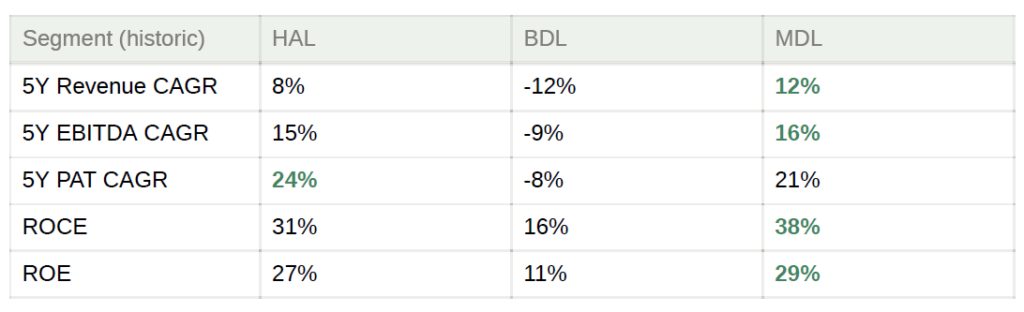

However, even before the current order book, Mazagon Dock’s performance has been better than listed peers – HAL and BDL.

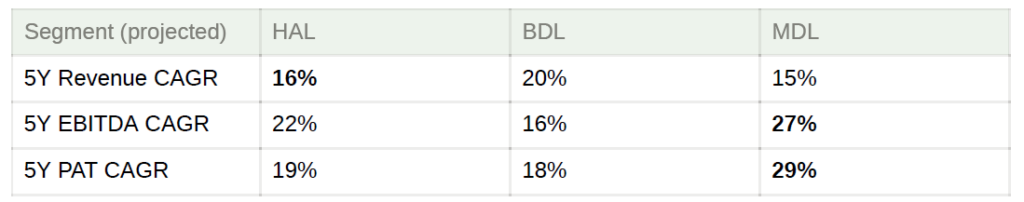

With the recent surge in order book, and potential expansion in the same (as discussed above), the financial performance for Mazagon Dock can be even more superior compared to what it has delivered in the past, and even relative to its peer set.

Despite better performance compared to other defence companies, Mazagon Dock is currently trading at a two-year forward PE of 14x – versus 16x for HAL and 28x for BDL. The deep discount has the potential to wane, and the stock theoretically can trade at valuations equivalent to those that its peers’ command.

Clearly the concept of looking for migration in value works, especially for those that have made money on this stock lately, and as maths professors like the exclaim, “hence proved”! So, the next time someone throws shade at you for looking for something better, just show them this blog. Who knows – they may have a change of heart and make some money along the way too.

Want to explore companies like Mazagon Dock that dominate their respective sectors or industries? Explore the Value Migration smallcase by Rupeeting

Check out Rupeeting’s Value Migration smallcase here

Alphaware Advisory Services Private Limited•SEBI Registration No: INA000015747

1 Janki Centre, Off Veera Desai Road Andheri West, Mumbai 400053