What To Expect From India’s Interim Budget for 2024?

The upcoming interim budget for FY25, to be presented on February 1, is expected to forgo major announcements, saving them for the full budget after the Lok Sabha elections. The government will likely maintain its fiscal correction & consolidation path, avoiding populist measures despite the general election. What is the interim budget? It is a partial budget presented to the current government which isn’t complete since general elections are around the corner. A full budget will be presented after the elections.

Fiscal Consolidation: A Key Theme For The Interim Budget

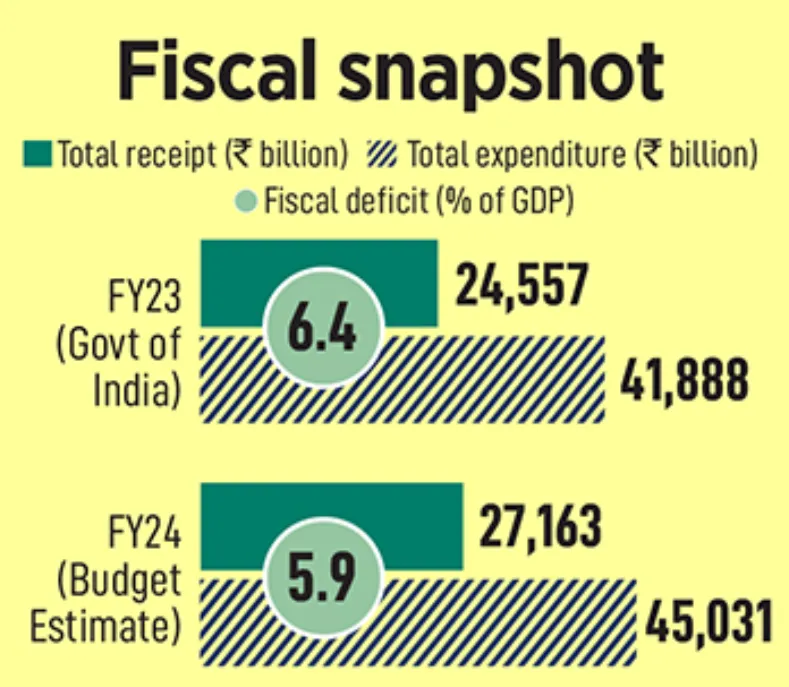

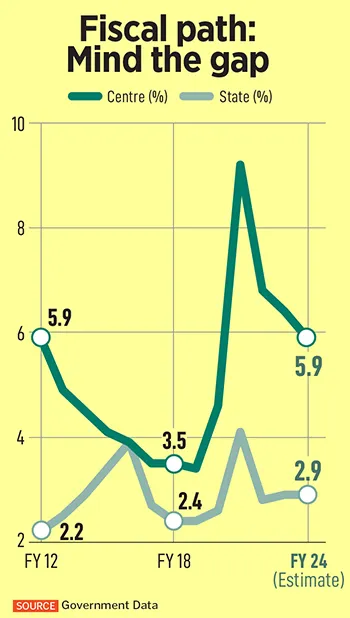

The Government of India is expected to maintain its fiscal consolidation trajectory in the upcoming interim budget to be presented on February 1, despite the approaching general elections. This commitment to fiscal prudence is reflected in the government’s aim to reduce the fiscal deficit to 5.9% in FY24, as part of a broader strategy to narrow the gap to 5.3% and 4.5% in FY25 and FY26, respectively.

Despite potential pressures from election dynamics, financial analysts anticipate the government will meet its fiscal targets. Nirmala Sitharaman has indicated that the upcoming budget will be a vote on account, primarily focused on government expenditure until the post-election government is formed, precluding any major financial announcements.

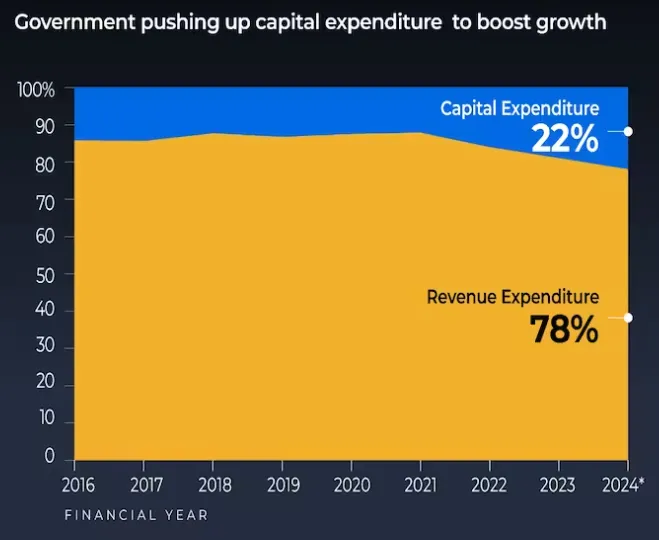

Investors expect the budget to continue promoting investment-driven growth, with a projected 10% increase in capital expenditure, reaching Rs 10.2 lakh crore. This increase is more modest compared to the over 20% hikes observed in the last two years. The government’s strategy emphasizes capital expenditure-led growth over expenditure cuts.

Attention is also likely to be given to the rural economy, which has not fully recovered. The government may implement measures to invigorate investment in rural areas and expand the scope of Production Linked Incentive (PLI) schemes, potentially benefiting sectors such as chemicals. This balanced approach between fiscal discipline and targeted spending is aimed at ensuring sustained economic growth while staying on the path of fiscal consolidation.

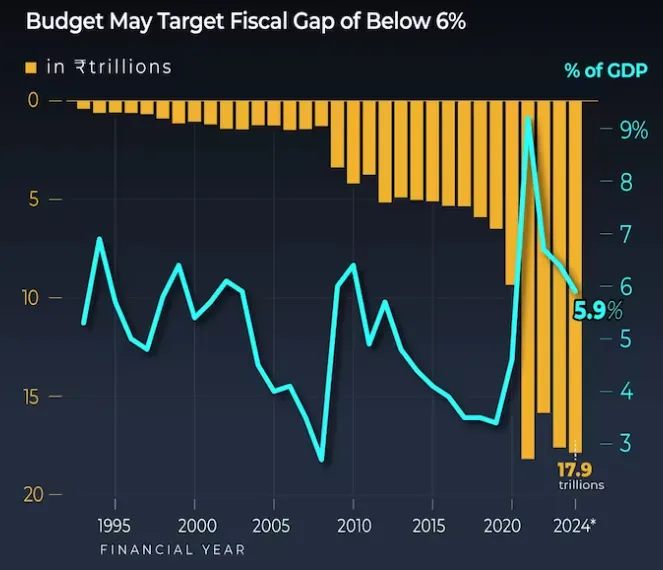

Looking At The Fiscal Gap

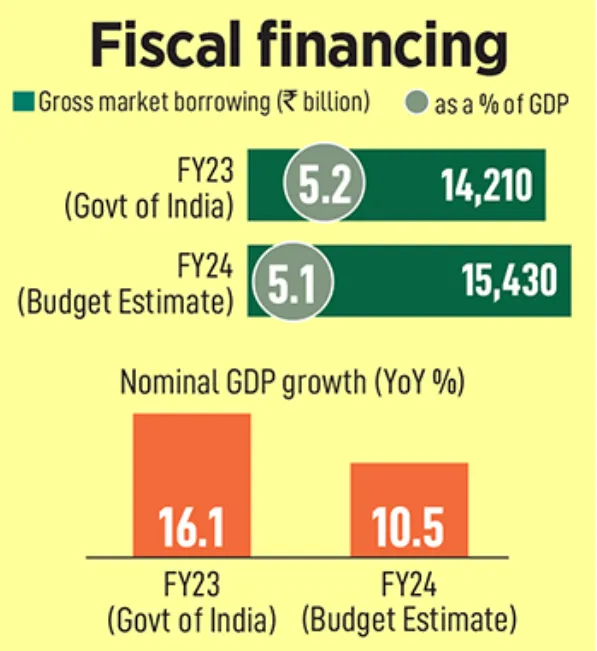

India’s fiscal dynamics show a promising trend, with the government’s coffers benefiting from higher than anticipated tax and non-tax revenues, including dividends from RBI and increased profitability of public sector undertakings. This influx of revenue is set to counterbalance the divestment proceeds’ shortfall and the spike in subsidy bills and other revenue expenditures. The government appears to be on a solid path to meet its fiscal deficit targets of 5.9% for FY24 and 5.3% for FY25. Market estimates suggest that gross market borrowing will hold steady at approximately Rs 15.2 lakh crore in FY25.

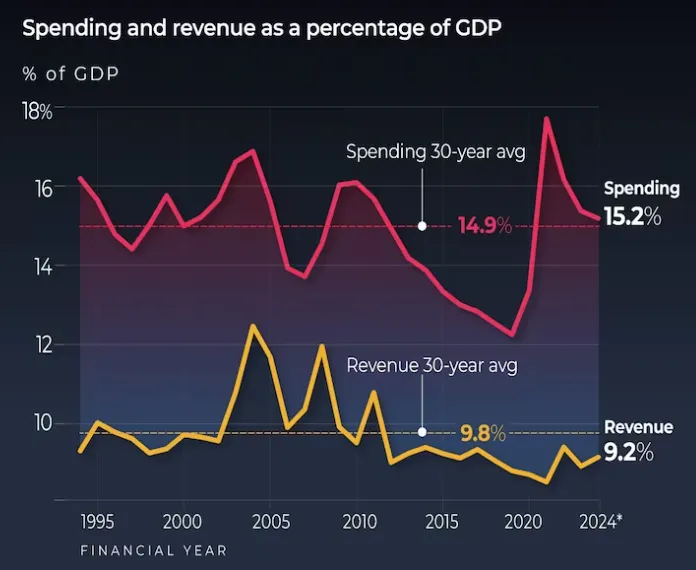

The anticipated revenue for this year is projected at 9.2% of the GDP, which is in line with the 30-year average of 9.8%. Meanwhile, expenditure is on a downtrend from the peak of 17.7% during the pandemic to a projected 15.2%, suggesting a recovery trajectory towards pre-pandemic levels.

The surge in tax revenues, which are currently 0.3% of GDP above the budgeted figures, is expected to cover increased subsidies and potential special packages that may be announced on budget day. Post-election, a normalization in current expenditure and a sustained high level of capital expenditure are anticipated.

The fiscal deficit, a crucial indicator of fiscal health, has exhibited fluctuations, peaking at 9.2% in 2021. However, it is projected to contract to 5.9% by the FY24 budget estimate. This trend is indicative of a tactical approach to managing borrowing and recovery efforts. Despite lower-than-anticipated nominal GDP growth, the government is expected to meet its Rs 17.9 trillion fiscal deficit target for FY24, with the deficit reaching Rs 9.06 trillion by November 2023, which stands at 50.7% of the annual target.

How Does The Indian Government Finance The Fiscal Deficit?

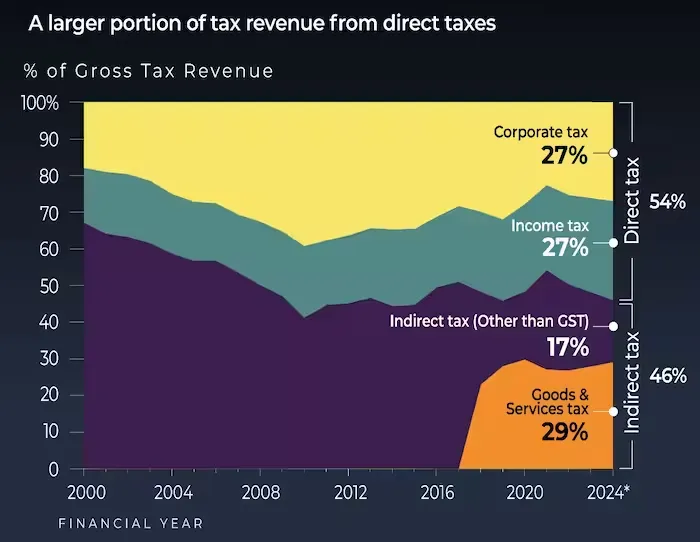

From April to November, the Indian government has used only 50.7% of the budgeted fiscal deficit for the current year, which is significantly less than the typical median usage of around 75%. This has been made possible largely by strong corporate and income tax collections, which have already reached 80% of the budgeted direct tax collection target of Rs 18.23 lakh crore.

India’s GST collections have significantly exceeded expectations, with the FY24 monthly rate reaching Rs 1.66 lakh crore, a substantial increase from Rs 98,000 crore in FY19. This surge is anticipated to push Central GST collections beyond the budget estimate of Rs 8.1 lakh crore by approximately Rs 10,000 crore for the current fiscal year. Strong tax revenue has softened the blow from lower-than-projected excise and customs duties. Despite falling short of the divestment target by Rs 51,000 crore, this is consistent with a historical pattern where divestment proceeds typically do not meet budget estimates.

Analysts project that tax revenue will surpass expectations by Rs 69,300 crore, with non-tax revenue also exceeding by Rs 48,300 crore. However, spending has increased, notably due to a significant rise in interest expenses and subsidy bills. The latter has grown due to extended free grain programs and reduced cooking gas prices, contributing to a projected rise in subsidy expenditures to Rs 4.25 lakh crore in FY25. Capital expenditure, which accounts for 15% of total spending, has been instrumental in India’s fiscal strategy. It has increased from 1.6% of GDP in FY21 to 2.8% in FY24, demonstrating the government’s commitment to capital expenditure-driven growth.

Market borrowings have been the principal method of financing around 65% of the fiscal deficit over the last decade. It is important for the government to roll back pandemic-era stimulus measures, especially given India’s high public debt relative to other emerging markets and the increased international focus on Indian bonds. India’s public debt has escalated from just over 51% of GDP in FY20 to over 80%, presenting a challenge for fiscal consolidation.

What To Expect From The Interim Budget 2024?

The scale of the Union Budget relative to India’s GDP saw an expansion during the pandemic, a time characterized by the government’s efforts to clear subsidy dues and enhance fiscal transparency. However, the trend is reversing, and the budget for FY24 is set to contract to 14.9% of GDP. This reduction signifies a deliberate move towards pre-pandemic fiscal patterns, reflecting the government’s strategic withdrawal from the expansive fiscal stance necessitated by the pandemic’s economic disruptions. This shift towards a smaller budget proportionate to GDP aligns with the broader objectives of fiscal consolidation and sustainable economic management.

In the fiscal year 2023, India experienced a significant post-pandemic economic recovery, with the tax-to-GDP ratio reaching 11.1%, surpassing the pre-pandemic figure of 10.9% in FY19. Despite this recovery, forecasts suggest that this ratio will stabilize and is not expected to surpass the FY18 peak of 11.3% in FY24. The Union Budget’s proportion to GDP expanded during the pandemic due to subsidy dues clearance and increased fiscal transparency. However, it’s now contracting, with the 2024 Budget estimated at 14.9% of GDP, signalling a return to pre-pandemic norms.

Central tax collections have shown remarkable growth, surging by 33.7% in FY22 and revised upwards by 10.3% for FY23. However, this rapid growth is showing signs of slowing down, indicated by a reduction in tax buoyancy and a drop in non-tax receipts. These trends point towards a possible recalibration of India’s fiscal strategy, emphasizing sustainable growth over short-term gains.

On the expenditure side, the government’s strategy is increasingly focused on capital expenditure. There’s a planned 37% increase to Rs 10 trillion in FY24 for capital expenditure, reflecting the government’s intent to bolster long-term asset creation over immediate revenue expenditure, which has seen only a modest rise.

According to the Controller General of Accounts, as of November 2023, the Centre has spent Rs 26.52 trillion, which is 58.9% of the budget estimate for FY24, allocating Rs 20.66 trillion for revenue and Rs 5.85 trillion for capital expenditures. This budget allocation underscores the government’s commitment to enhancing the country’s infrastructure and productive capacity to foster economic growth and stability.

Explore Wright Research smallcases here

Wryght Research & Capital Pvt Ltd•SEBI Registration No: INA100015717

103, Shagun Vatika Prag Narayan Road, Lucknow, UP 226001 IN

CIN: U67100UP2019PTC123244

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary.