Capitalizing on Capital Goods: A Data-Driven Guide for Equity Investors

As the global economy recovers from the pandemic, capital goods stocks have emerged as a viable theme for equity investors looking for robust returns. These stocks have outperformed benchmark indices such as the S&P BSE Sensex and Nifty50, with several of them even delivering multibagger returns.

In this blog post, we will delve into the reasons behind this trend, focusing on data-driven insights to provide a comprehensive view of the current landscape and future projections for the capital goods sector.

Read the full story on Wright Research’s blog.

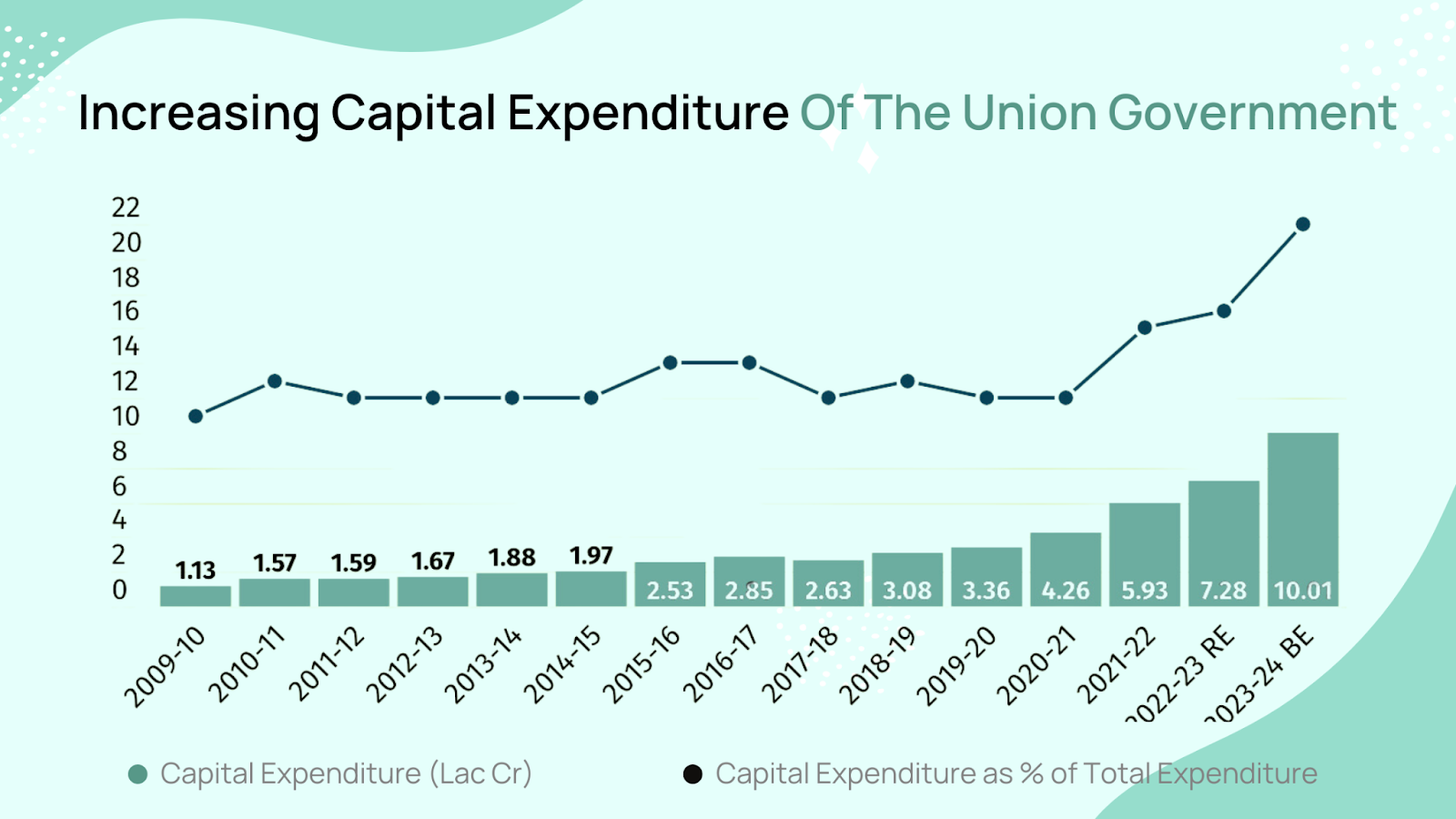

Strong Government Focus on Capex

The capital goods and infrastructure sectors are benefiting significantly from the government’s focus on capital expenditure (capex). Governments around the world, particularly in emerging markets like India, are ramping up infrastructure spending to boost economic growth and create jobs. This increased capex is driving growth and margins for companies operating within the capital goods sector, creating attractive investment opportunities for equity investors.

For example, India’s Union Budget for 2023-2024 allocated a significant portion of funds to infrastructure development, including roads, railways, and ports. This focus on capex has translated into strong order inflows and robust execution for capital goods companies, leading to impressive stock performance.

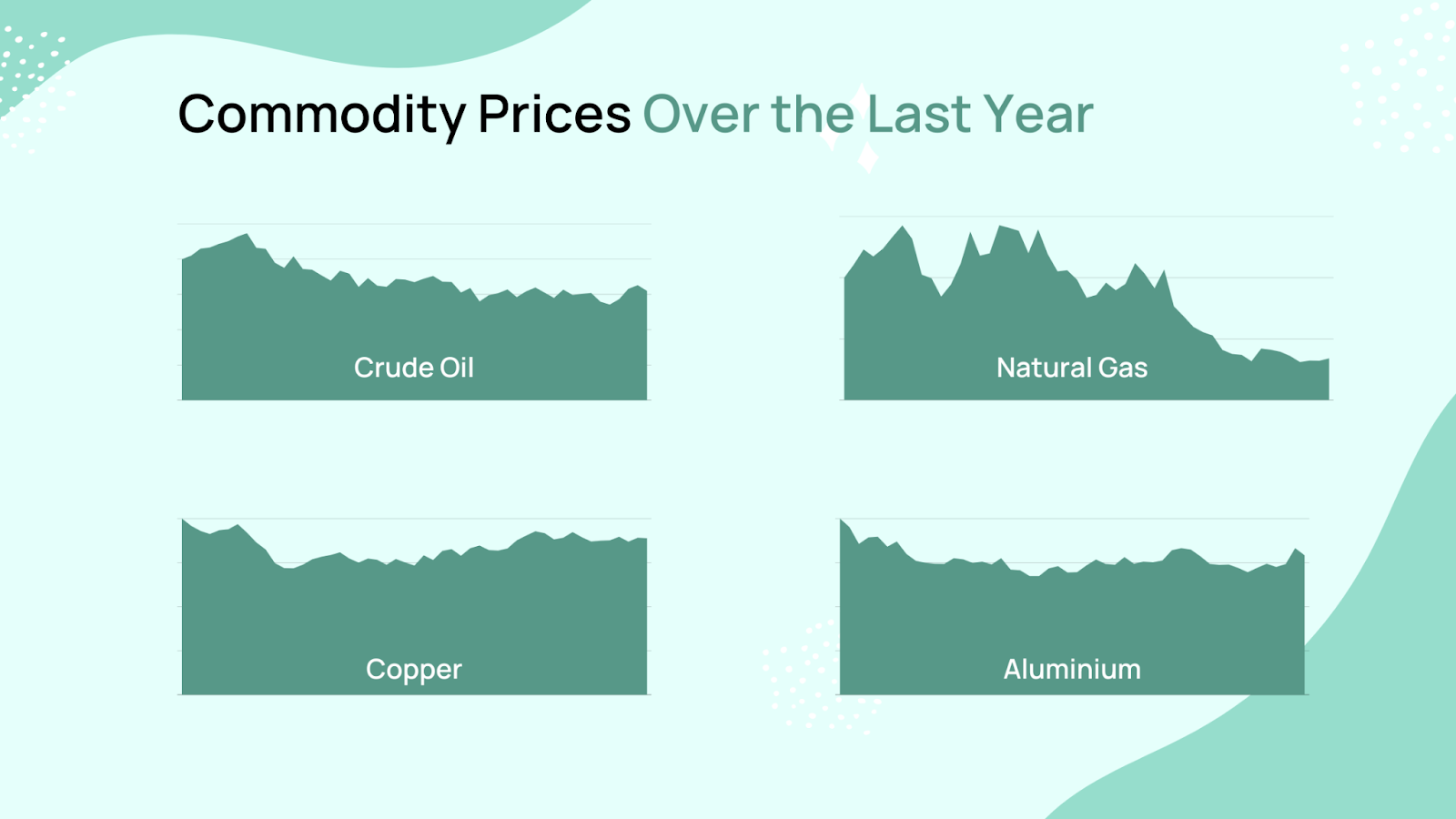

Softening Commodity Prices and Operating Leverage

Another factor contributing to the attractiveness of capital goods stocks is the softening of commodity prices, which benefits the earnings before interest, taxes, depreciation, and amortisation (EBITDA) margins of these companies. Lower input costs lead to higher profitability, making these stocks appealing to investors.

Additionally, capital goods companies tend to have high operating leverage. This means that as demand increases and companies utilize their production capacity more efficiently, their fixed costs are spread across a larger volume of output. Consequently, their operating margins improve, leading to higher profitability and, ultimately, greater returns for equity investors.

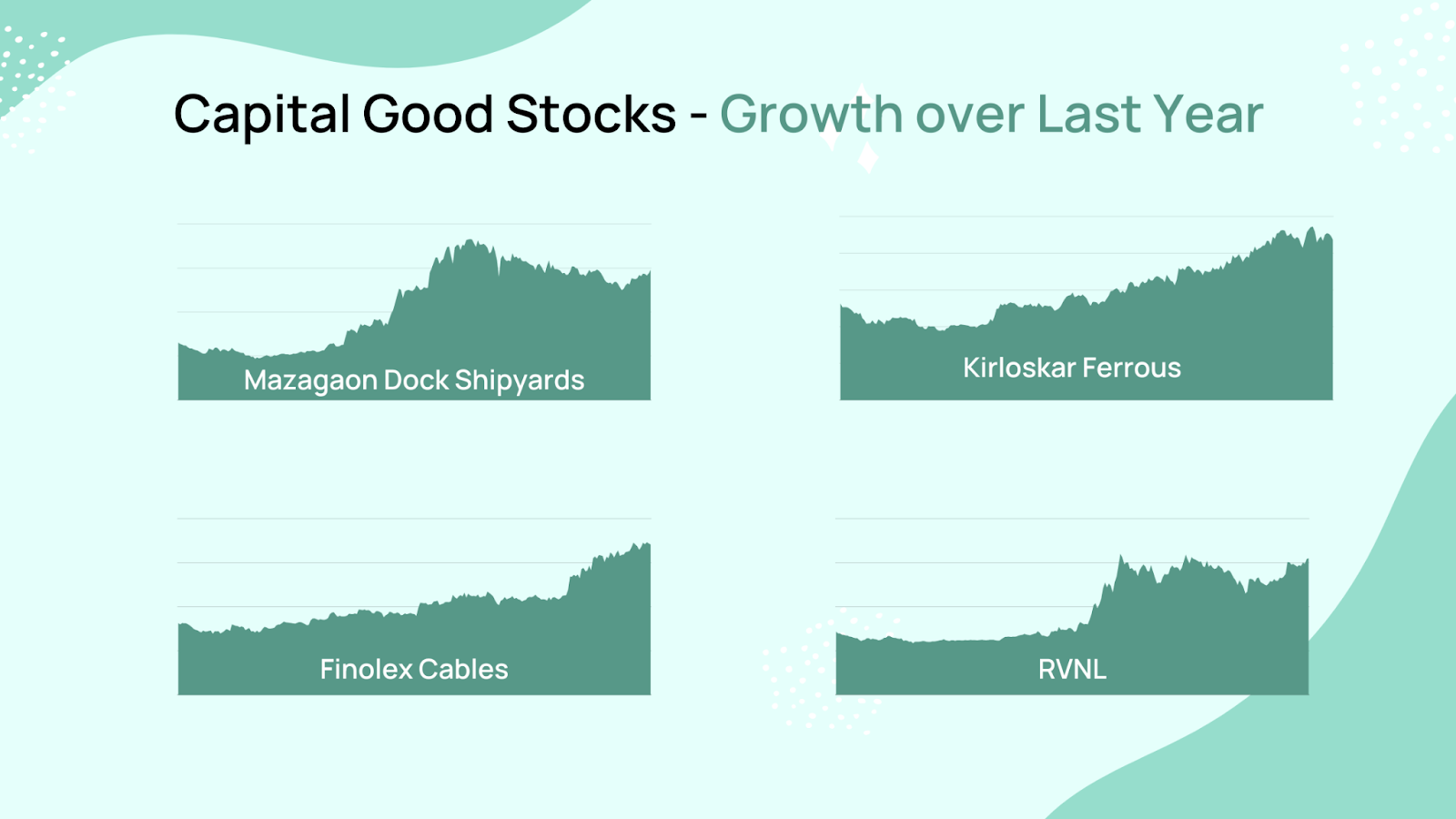

Outperformance of Capital Goods Stocks

A recent MarketSmith India report highlighted that 30 capital goods stocks outperformed Indian benchmark indices. Among these, eleven stocks delivered returns between 60% and 164% during FY23, with four yielding multibagger returns exceeding 100%. These include Mazagon Dock Shipbuilders (164%), Kirloskar Ferrous Industries (111%), Finolex Cables (106%), and Rail Vikas Nigam (106%).

Furthermore, companies like Garden Reach Shipbuilders & Engineers, Data Patterns (India), Hindustan Aeronautics, and Bharat Dynamics provided returns ranging between 60% and 97% during the same period. This outperformance demonstrates the potential for impressive returns when investing in capital goods stocks.

Future Projections

Capital goods companies are well-positioned to benefit from the ongoing global economic recovery. As governments continue to focus on capex and infrastructure development, the demand for capital goods is expected to remain strong. Additionally, as input costs moderate and operating leverage improves, these companies’ profitability should continue to rise, making them attractive investment options for equity investors.

Moreover, the increasing focus on automation, digitization, and renewable energy is expected to provide further growth opportunities for capital goods companies in the coming years. Companies that can capitalize on these trends, such as ABB and Siemens, are well-placed to benefit from this shift, creating potential investment opportunities for investors.

Conclusion

In conclusion, capital goods stocks present a viable theme for equity investors, driven by strong government capex focus, softening commodity prices, high operating leverage, and impressive historical performance. The sector’s future prospects look promising, with opportunities for growth in areas such as automation, digitization, and renewable energy. By carefully selecting capital goods stocks with strong fundamentals and growth potential, investors can benefit from the sector’s robust performance.

Where to Invest?

Wright New India Manufacturing portfolio capitalized on the capital goods space. With an impressive long-term expected return of 30% and risk levels at par with the Nifty index, you can witness diversified growth and ride the wave of India’s transformation into a global manufacturing and innovation hub. Check it out!

Wright Research

Wright Research