Dollar index is pointing to a new high in Gold

The Relationship Between Gold Prices and the Dollar Index

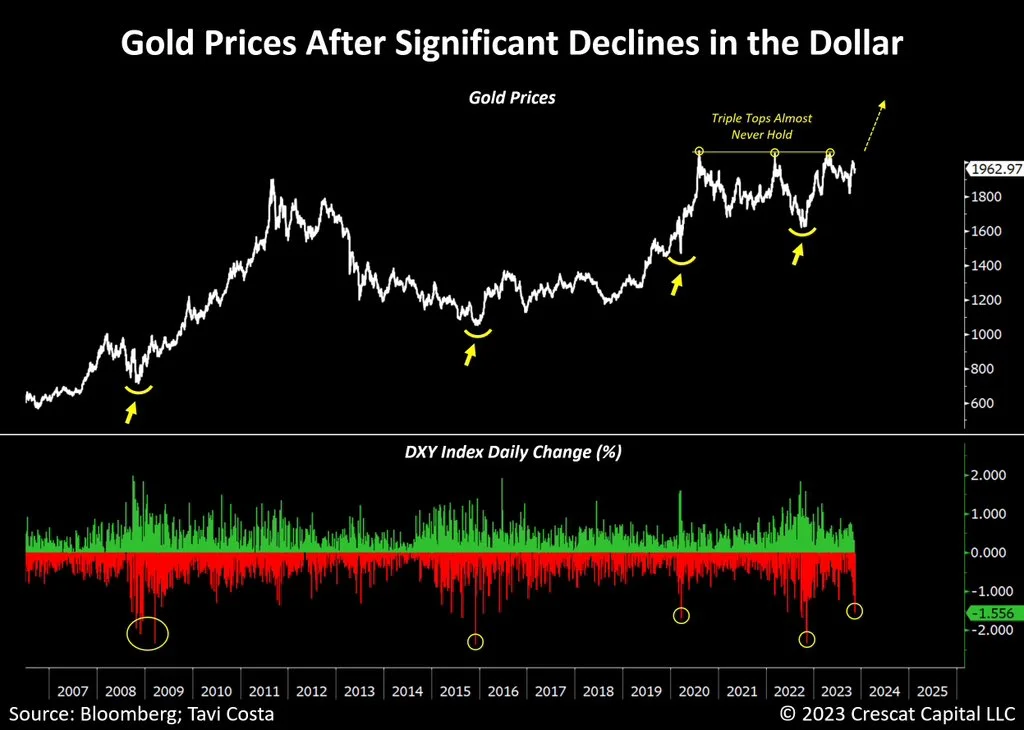

Tavi Costa from Crescat Capital had shared a powerful visual that showcases the relationship between gold prices and the movement of the dollar index over the past 15 years. This chart provides valuable insights into the behavior of gold during periods of sharp dips in the dollar index.

The Historical Pattern

Looking at the chart, we can clearly observe a consistent pattern. Whenever the dollar index experiences significant drops, gold tends to reach a bottom and subsequently experiences a surge in price. Examples of such instances include 2008, 2015, and 2020. Currently, we are witnessing sharp drops in the dollar index, which might indicate another opportunity for gold prices to rise.

Triple Tops and Potential Breakout

Furthermore, the chart reveals that gold is forming triple tops, similar to the patterns observed in the past. These triple tops mark significant price points and have historically been followed by significant movements in gold prices. Therefore, it is reasonable to expect that once the current consolidation phase is broken, gold will continue its upward trajectory, potentially reaching new all-time highs.

The Slow but Solid Nature of Gold’s Movement

Gold is known for its relatively slow-moving nature. However, when it does make a move, it does so in a robust and impactful way. The steady increase in gold prices over the years demonstrates its ability to enter new price paradigms. From trading at $200 to $800, then reaching $1,900, and later consolidating between $1,200 and $2,000, gold has consistently shown its potential for substantial price movements.

The Outlook for Gold Prices

Given the current consolidation phase between $1,600 and $2,000, breaking this range could lead to a significant price move for gold. If the price breaks above $2,000, it is likely to continue rising and possibly reach levels between $2,400 and $2,600. Traders and investors should be prepared for a potentially large move in the gold market in the near future.

It is important to note the relationship between gold prices and the interest rate cycle. When interest rates are decreasing, gold tends to increase in value. On the other hand, when interest rates are rising, gold tends to underperform. This is why the gold market has experienced a consolidation phase in recent years, especially during a period of relatively higher interest rates. However, if easier and more liquid conditions prevail, gold is likely to move upward again.

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Explore Mi Evergreen smallcase here to take exposure to Gold in your portfolio

Weekendinvesting Analytics Private Limited•SEBI Registration No: INH100008717

B- 6/102, SAFDARJUNG ENCLAVE, NEW DELHI South West Delhi, Delhi, 110029

CIN: U72900DL2021PTC380866

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary.

Disclosures: Link