Gulaq Turns 3!

We are delighted to share that Gulaq has completed 3 years track record and celebrating the 3 years’ work anniversary.

The story of Gulaq started in 2020. We wanted to develop a well-diversified portfolio which would stand the test of time. A product which we could recommend to our own friends and family. Hence, we spent years working on our algos, fine tuning them, and when we were completely confident, we launched our first portfolio – Gulaq Gear-6.

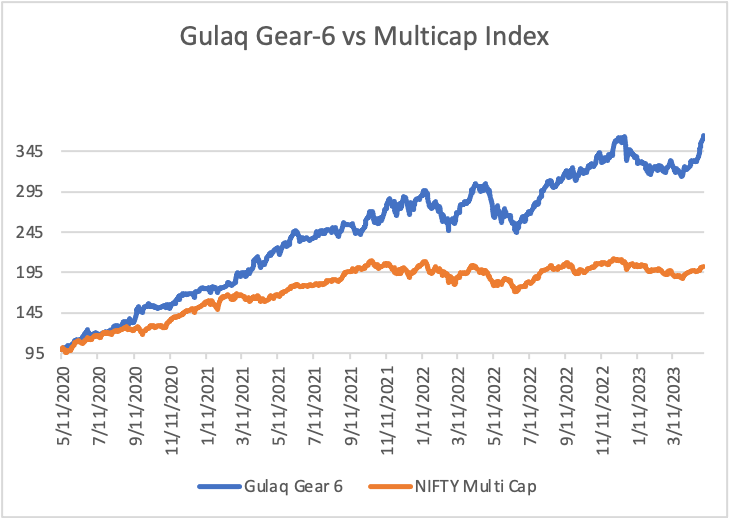

Since our launch in May 2020, we have been able to deliver huge alpha to our investors. We generated 264% returns since launch, compared to Nifty Multicap Index’s approximately 100% returns.

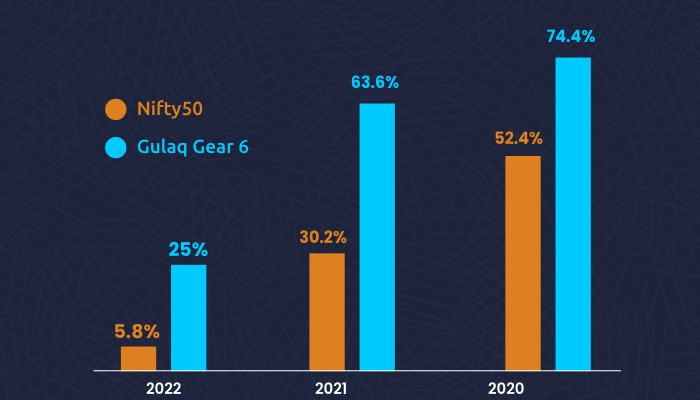

The last 3 years have tested our systematic investing abilities, and we are proud of our performance during these recent volatile market cycles. Each of the last three financial years we have been able to consistently outperform the index.

Wondering how we achieved such performance?

We employ a proprietary multi-factor approach in which we rank all the stocks based on more than 130 factors from technical, fundamental, and global macro-factors. This approach helped us develop a balanced portfolio and deliver consistent performance.

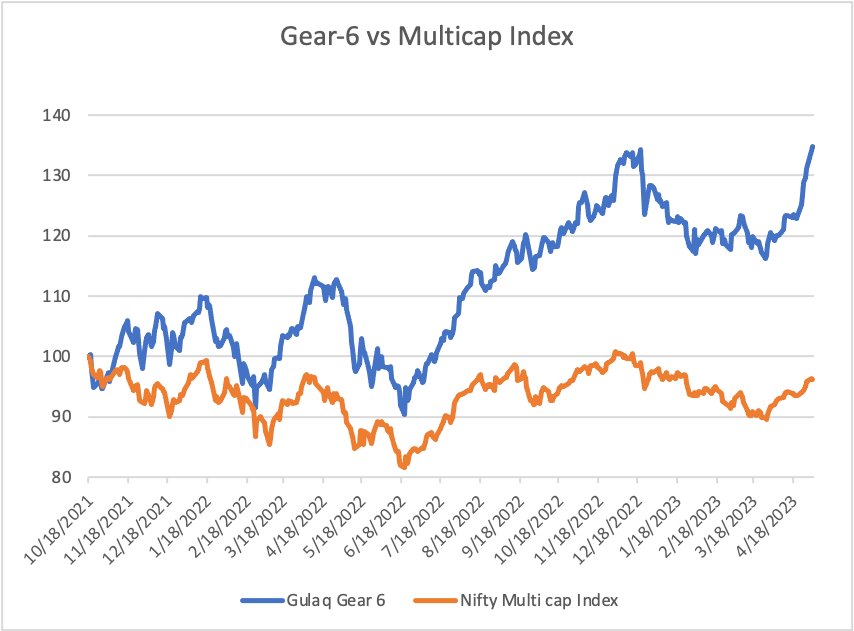

If we have to pick the most impressive performance. Since October 2021, when markets made a high, the Nifty Multicap index is down by 4%. During this period, Gulaq Gear 6 has given 35% returns despite the negative market sentiments. The following graph shows the performance comparison during recent flat markets.

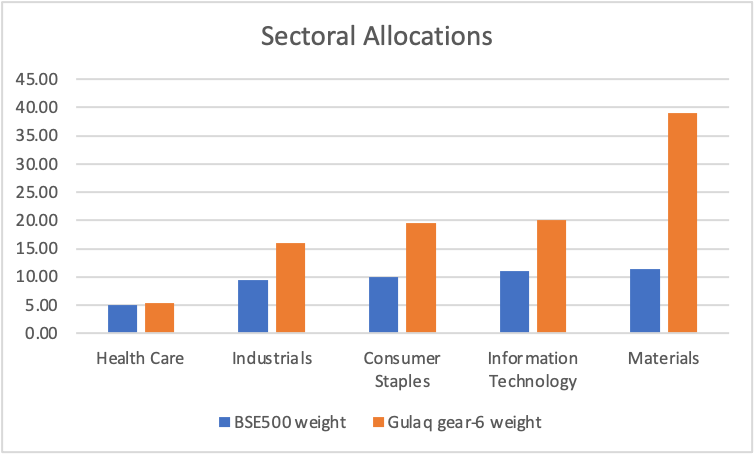

Gulaq gear-6 is a market cap agnostic portfolio. Even then the allocations have been pretty balanced.

| Allocation in 2023 | |

| Large cap | 43% |

| Mid cap | 24% |

| Small cap | 33% |

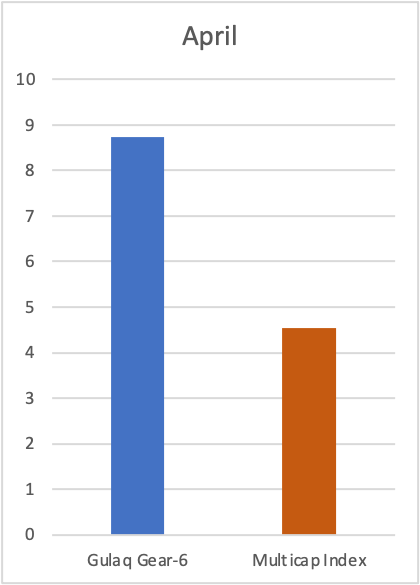

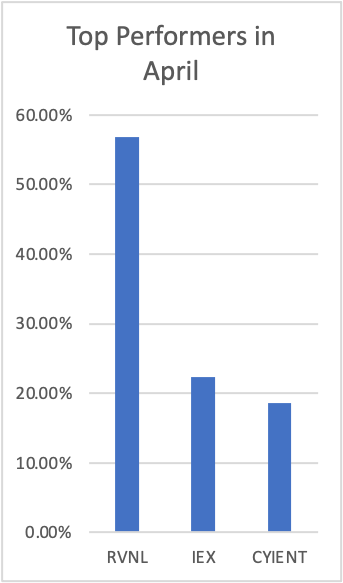

April 2023 was spectacular for Gulaq portfolios. Gulaq Gear 6 has given 8.7% returns in that month.

Here is our Top 3 stocks in Gulaq portfolios in April’23.

Many investors ask us about our entry and exit timing of stocks. We picked 2 stocks with good holding period in our portfolio to explain the same.

First one is ITC which we added to our portfolio in July’22 when the price was 273. Since then, the price has increased by 55%. We exited from ITC in the Month of January’23 but again added back in Feb just before the move up.

We added RVNL in December 2022, when it was trading at 74. We increased our allocation to it in April month (at Rs 70) and since April 1st the stock has given more than 75% returns.

Curious about how our portfolio looks like after recent rebalance update? Let’s have a look at our portfolio for May.

We are overweight on Materials, IT, Consumer staples and Industrials sector.

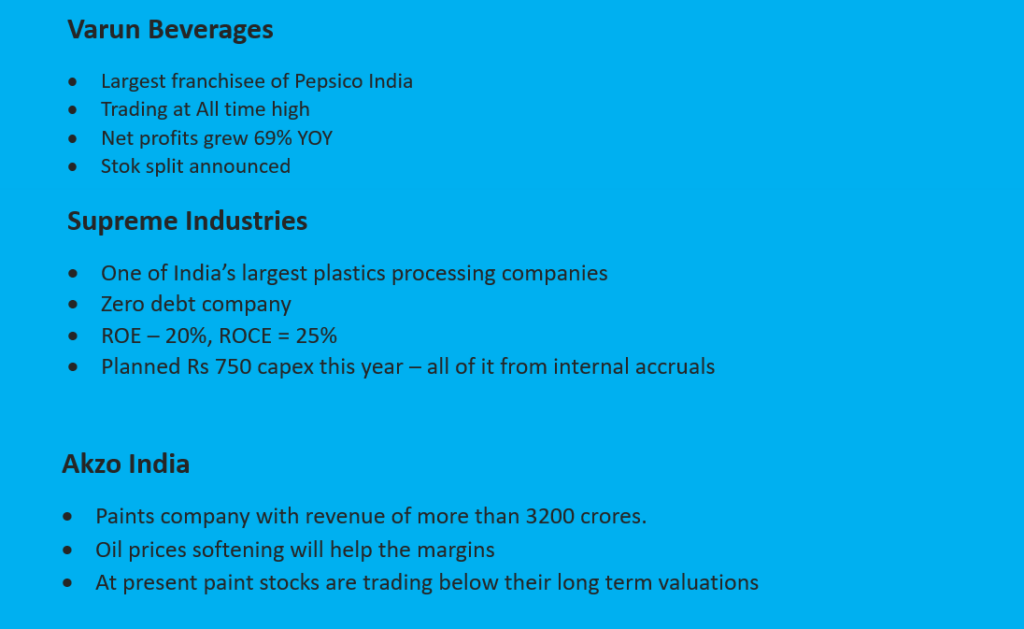

Varun Beverages, Supreme Industries and Akzo India are our top holdings for May.

Estee Advisors

Estee Advisors