INOX India IPO: Unveiling Opportunities in Cryogenic Solutions

Introduction:

INOX India Limited, a leading manufacturer of cryogenic equipment, has recently announced its Initial Public Offering (IPO) with a price band set at ₹627-660 per share. This IPO presents a unique opportunity for investors to tap into the niche sector of cryogenic solutions. In this article, we delve into the fundamental points of the INOX India IPO, offering insights into the company’s financials, business model, and growth prospects.

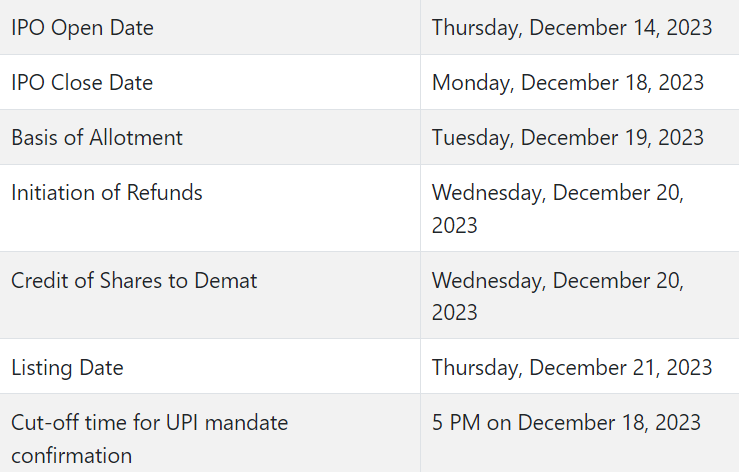

INOX India IPO Timelines:

Image credit: https://www.chittorgarh.com/

Key Offering Details:

The IPO comprises an offer for sale of up to 22,110,955 equity shares, with a face value of ₹2 per share. Prominent selling shareholders include Pavan Kumar Jain, Nayantara Jain, Siddharth Jain, Ishita Jain, and Manju Jain. The lot size is 22 equity shares, and the issue is categorized with 50% reserved for qualified institutional buyers (QIB), 15% for non-institutional investors (NII), and 35% for retail investors.

Financial Performance:

INOX India Limited boasts a robust financial performance, with a 17% surge in net profit to ₹152.71 crore in FY23. The company’s revenues witnessed a commendable growth of 23.4%, reaching ₹965.9 crore in the same period. Despite a slight decline in EBITDA margin, the company’s healthy balance sheet, debt-free status, and significant cash reserves of ₹220 crores enhance its overall financial stability.

Business Overview:

With over 30 years of experience, INOX India has established itself as a key player in cryogenic equipment and system design. The company’s offerings span from design and engineering to manufacturing and installation, with a notable presence in the industrial gas, LNG, and Cryo Scientific segments. INOXCVA, the well-known brand under the Inox Group, further strengthens the company’s reputation.

Management Insight:

In an exclusive interview, Siddharth Jain, promoter and non-executive director, emphasized the company’s sound financial position, debt-free status, and the strategic decision to go public for enhanced visibility. The IPO, driven by a forward-looking approach, aims to support the company’s global market expansion in cryogenics, particularly in clean energy transition.

Grey Market Premium and Growth Prospects:

INOX India’s strong demand in the grey market, commanding a premium of Rs 260-330 apiece, indicates positive investor sentiment. The company’s niche business model, growth prospects, and collaboration with ISRO position it as an attractive investment. Siddharth Jain foresees growth opportunities in industrial gas, LNG, and Cryo Scientific segments, particularly driven by the rising demand for clean energy and space research.

Comparison with Industry Peers:

INOX India stands out as a unique investment prospect, benefiting from the lack of direct Indian or global peers of comparable size and business model within the cryogenic equipment industry. This distinction enhances its market positioning and potential for investors seeking exposure to this specialized sector.

Investment Recommendation:

While the final decision rests with individual investors, the INOX India IPO presents a compelling opportunity. The company’s strong financials, strategic market positioning, and growth potential in emerging sectors make it an attractive proposition. Investors are advised to conduct thorough research, considering their risk appetite and investment goals, before participating in the IPO.

Conclusion:

INOX India’s journey of 30 years, coupled with its commitment to quality and innovation, positions it as a promising player in the cryogenic solutions space. The IPO not only marks a significant milestone for the company but also opens doors for investors looking to align their portfolios with cutting-edge technologies and sustainable practices.

Explore PSU BANKS FOR SIP smallcase here and avail 20% off using code FLAT20

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Visit bit.ly/sc-wc for more disclosures.

ASHISH KUMAR•SEBI Registration No: INH100008939

FIRST FLOOR, D-104, krishna park, New Delhi, South East Delhi, Delhi, 110062

Disclosures: https://www.smallcase.com/manager/stoxbazar#disclosures