Musings with Analyst: June 2023

As an investor, keeping track of the performance of your portfolio is essential for making informed decisions. You may have come across terms like CAGR (Compound Annual Growth Rate) and XIRR (Extended Internal Rate of Return) in discussions about investment returns. While both provide insights into your investment performance, XIRR offers a more comprehensive and accurate picture. In this blog post, we’ll explain CAGR and XIRR and explore why it makes more sense for investors to track their portfolio XIRR rather than CAGR. We’ll also shed light on the limitations of CAGR.

Understanding CAGR:

Let’s imagine a scenario where you invested ₹10,000 into stock A on 1st Jan 2018. The current value of that investment is ₹17,492. Absolute returns earned can be calculated as –

( Current Value of investment / initial investment ) -1.

Using this formula one can deduce that the absolute returns earned is 74.92%. However absolute returns do not provide any information about the growth rate during each year of investment. In such a scenario where the investment was made for more than a year one should use the compounded annual growth rate metric to calculate returns (CAGR).

CAGR smooths out any fluctuation, in returns, that might have occurred within each period and provides the annualized rate of return of an investment. CAGR represents the smooth average annual growth rate of an investment, assuming that it has grown at a steady rate over the specified period. In the above example the CAGR returns is 10.7%. It means that on average the investment grew by ~10.7% each year. This is calculated as –

Start Value – 10,000

End Value – 17,492

Time Period – 2006 days (From Jan 1 ‘18 to June 30 ‘23)

CAGR – [(End Value/Start Value)^(365/2006)]-1

CAGR is a useful measure for comparing the growth rates of different investments over equal time periods and with no intermittent cash flows.

Exploring XIRR:

The CAGR metric is useful when only 2 dates are involved, the date of initial investment and the present day when you want to understand the returns earned on the investment.

Imagine a scenario where you started investing on 1st Jan 2018 and have continued to do so on a monthly basis. In this case, your investment is not growing at a constant rate each year, and that’s where XIRR comes into play. XIRR is used to calculate the annualized rate of return for a series of cash flows. XIRR takes into account the timing and amount of each investment or withdrawal you make. It considers the cash flows and calculates the annualized rate of return basis the inflows and outflows in conjunction with time periods.

It would be opportune here for me to explain the concept of the Time Value of Money. The time value of money (TVM) is a concept that says money today is worth more than money in the future. This is because money today can be invested and earn interest, which means it will grow in value over time. Money in the future, on the other hand, has less potential to grow because it has less time to earn that interest. For example, if you have ₹100 today and you invest it at a 5% interest rate, it will be worth ₹105 in one year. But, in case you were given an option between receiving ₹100 today versus ₹104 next year, one would definitely go for the former. Because you can use that ₹100 to invest and earn more than ₹104. In other words, a rupee today is worth more than a rupee in the future. XIRR takes into account the time value of money when calculating the returns on your investments. It considers not only the timing and amounts of your investments but also the growth or decrease in the value of your money over time.

Why Track XIRR Instead of CAGR?

CAGR has its limitations, and that’s why XIRR provides a more accurate reflection of your investment performance. Here’s why tracking XIRR makes more sense for investors –

For instance, you invest ₹2 lakhs into the Dividend – Smart Beta smallcase in July ‘2018. Post that, you continue investing ₹20,000 in the smallcase every month via the SIP route until June ‘2023. That would be 61 months of disciplined investing. Therefore, in this process, you would have ended up investing ₹13,80,000. And your investment value would have grown to ₹19,40,444.

Now, the easiest way to assess your portfolio performance would be to calculate the absolute returns, which come out to be ~41% [(19.4L/13.8L)-1]. This calculation methodology only takes into account the total investment amount and the end investment value, completely agnostic of timelines. However, that isn’t an accurate representation of your performance. Remember about the ₹20,000 that is going on every month? Shouldn’t you account for the time value of those SIP investments? One cannot calculate the CAGR in this case because there are SIPs involved leading to various cash flows between the final investment value and the initial point of time when the investment journey started. However, XIRR would come out to 12.1% which is calculated by accounting for the initial investment along with all the monthly investments juxtaposed with the timing of those SIPs.

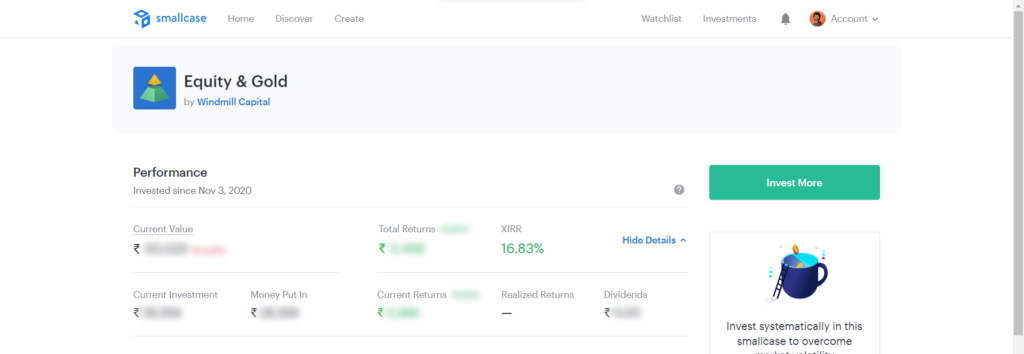

This is where XIRR tips CAGR in terms of sophistication. Due to the inherent limitation of CAGR, it is unable to give you a true representation of your portfolio performance as it completely dismisses the time aspect. On the other hand, XIRR plugs the gap and is able to factor in time and separate cash flows to provide a truer representation of your portfolio’s success. On the smallcase investments page, you can see the XIRR on the individual smallcase investments.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary. Refer to our disclosures page, here.

Windmill Capital Private Limited – Research Analyst - SEBI reg. no: INH200007645; Compliance Officer – Ajoy Bharadwaj, Phone Number – 8296014433; Email Id - compliance@windmill.capital; Support email id - notifications@windmill.capital