New-Age Stocks: A Winding Road to Profitability and Investor Confidence

The emergence of new-age stocks, often associated with disruptive start-ups and tech-driven unicorns, has been one of the most exciting developments in the global financial market in the last decade. These companies are shaking up traditional industries, presenting investors with novel opportunities.

Big News to share before we get into the newsletter

Sonam Srivastava, Founder & CEO of Wright Research has been recognized by LinkedIn as one of LinkedIn’s Top Voices on Finance! Here’s what Sonam has to say:

To all my fellow finance professionals in India, here’s a piece of advice to commemorate this awesome milestone – Embrace and nurture your uniqueness and never underestimate the power of your genuine voice. Even when crunching numbers and predicting trends, the financial markets give you an opportunity to use your own unique perspective to cut the signal from the noice.

The world of finance is vast and intricate. It’s crucial to cultivate a growth mindset, stay curious, and keep learning. It’s not about how loud you can be, but how well you can tune into the market’s whispers, understand its signals, and act wisely.

Onwards and upwards, let’s continue learning, sharing, and making a difference in the finance industry. 🚀

To mark this achievement, we are offering 25% off on subscription to Wright Research smallcases only for today! Here’s to creating wealth with industry recognized experts on smallcase!

Use Code TOPVOICE for 25% off on Subscription

New Age Stocks – Price Trends

In the last quarter of 2023, several new-age stocks like Paytm, Zomato, and Policybazaar showed promising operational metrics. While this sparked some investor interest, analysts remain cautious, mainly due to the firms’ struggle to turn a profit consistently.

Recent trends suggest a change in the wind. Investor confidence in new-age stocks like Paytm, Policybazaar, and Zomato has seen a noticeable uptick, with these companies either hitting or nearing 52-week highs. Experts attribute this shift to improvements in financials and the expectation of a turnaround in these companies’ fortunes.

Why are the New Age Stocks Rising?

Recent trends suggest a change in the wind. Investor confidence in new-age stocks like Paytm, Policybazaar, and Zomato has seen a noticeable uptick, with these companies either hitting or nearing 52-week highs. Experts attribute this shift to improvements in financials and the expectation of a turnaround in these companies’ fortunes.

Consider Paytm, the Indian digital payment giant that recently narrowed its net loss by an impressive 78% year-on-year, delivering operational profitability for a second quarter. Despite these positive strides, Similarly, Zomato, an Indian food delivery and restaurant aggregator, reported promising Q4 results. The company achieved adjusted EBITDA breakeven earlier than expected and now aims to turn a profit by Q4FY24. Meanwhile, Policybazaar, India’s popular online insurance aggregator, turned adjusted EBITDA positive in Q4FY23 and drastically narrowed its losses by 96% YoY.

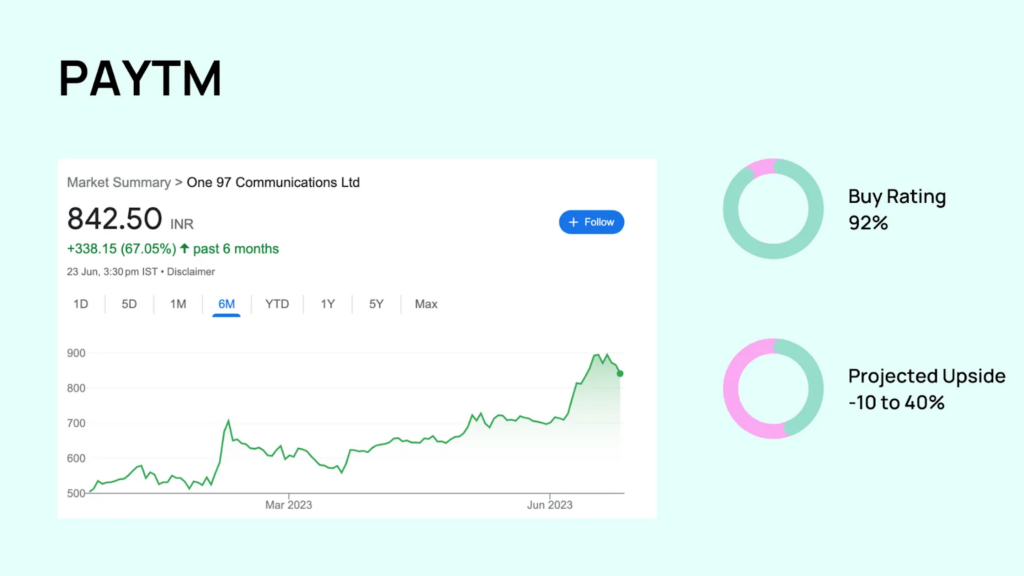

Paytm

Paytm, officially known as One97 Communications, is at the forefront of India’s fintech revolution. The firm’s financials have shown a significant turnaround, with Q4FY23 net loss narrowing by a substantial 78% year-on-year (YoY). This improvement has demonstrated the efficacy of the company’s new credit strategies and the transformative potential of its business model. Paytm, having evolved into a full-stack financial services platform, has broadened its revenue streams beyond digital payments, delving into insurance, lending, and e-commerce. A crucial development has been the resolution of regulatory issues related to the Paytm Payments Bank and online merchant onboarding, anticipated to propel the stock’s growth. With the backing of reputed analysts from Goldman Sachs, Citi, and Macquarie who project an upside of up to 61%, Paytm is well-positioned for sustained growth and a potential path to profitability.

Zomato

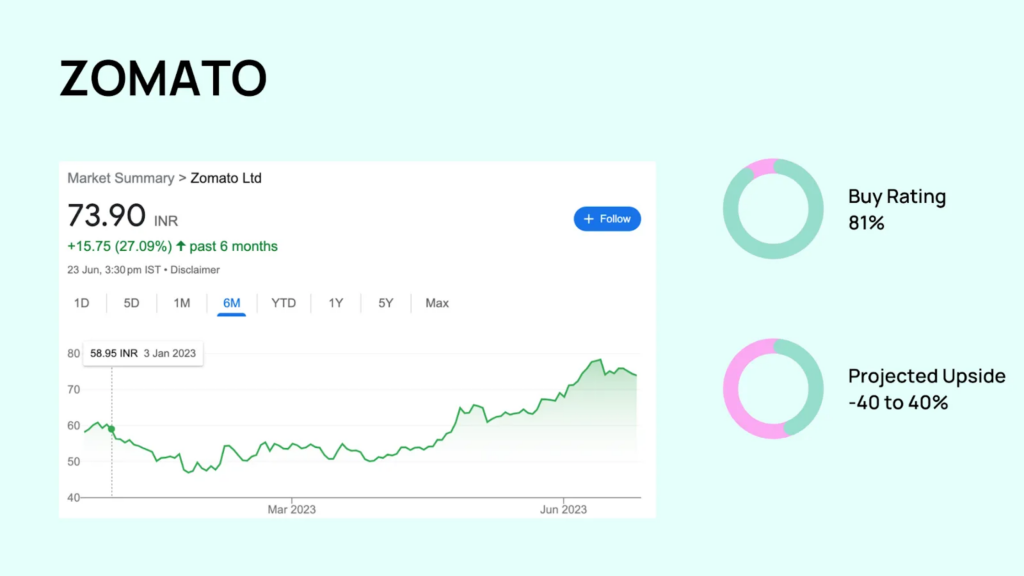

Zomato, a giant in India’s food delivery market, is manifesting considerable resilience on its path to profitability. Despite a challenging operating environment, the company’s Q4FY23 results show a narrowed consolidated loss of ₹187.6 crore, a remarkable improvement from ₹346.6 crore loss in the previous quarter and ₹360 crore in the year-ago quarter. This downturn in losses signals the company’s enhanced operational efficiency and strategic business measures. The highlight was Zomato’s core business achieving adjusted EBITDA positivity in Q4FY23, earlier than anticipated. Moreover, the management has expressed commitment to achieving net profit positivity, including acquired operations of Blinkit, by Q4FY24. With strong revenue growth momentum, operational improvements, and a steady uptick in investor confidence, Zomato is poised for potential profitability and continued growth in the dynamic online food delivery market.

Nykaa

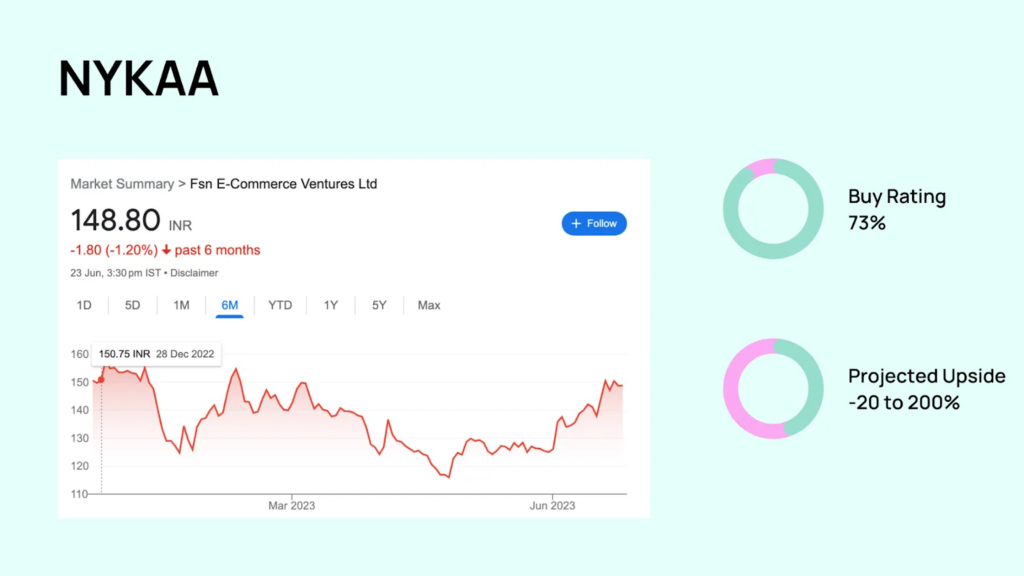

Nykaa, India’s leading beauty and fashion e-retailer, has been demonstrating a mixed performance recently. Despite Q4FY23 profits declining by 72% YoY due to high expenses and weakness in the fashion business, the company presented a sequential improvement in EBITDA margin for the first time in Q4, which was driven by a notable 36% YoY growth in gross merchandise value. Analysts, such as those at JM Financial, have tempered gross merchandise value (GMV) expectations, as the company has seen limited customer additions in its beauty and personal care, and fashion segments. However, they predict limited downside risk with potential gains of 68% on the stock, indicating the strength of Nykaa’s brand and market position. As Nykaa continues to adapt and optimize its operations, investors will keep a keen eye on its profitability trajectory.

Policybazaar

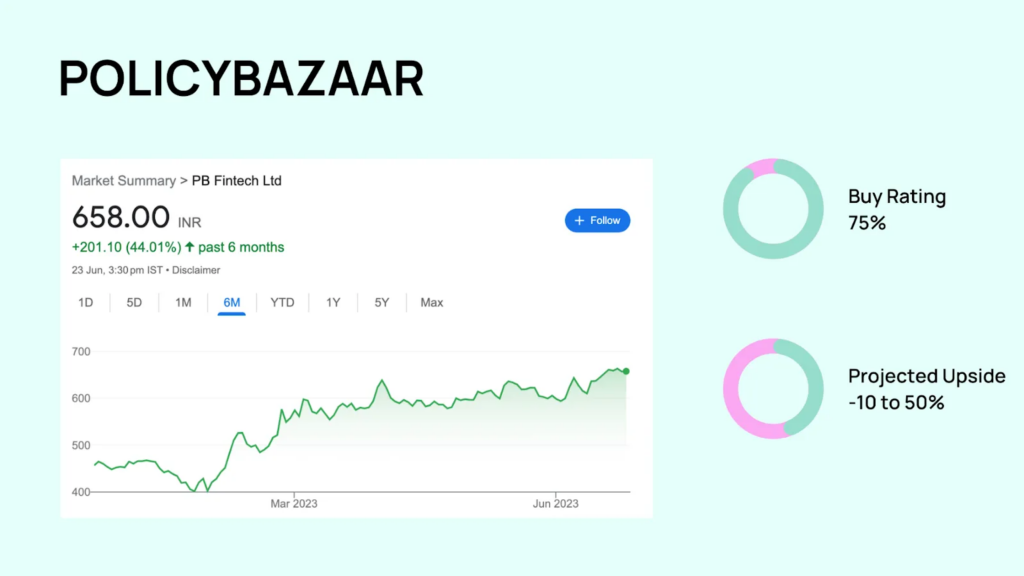

PolicyBazaar, operating under the PB Fintech banner, has shown promise in the new-age stock space, achieving noteworthy strides in its financial performance. In Q4FY23, the company turned EBITDA positive, reporting Rs 28 crore and significantly reducing its losses by 96% YoY. This encouraging result was driven by the growth of their core insurance and credit businesses, as well as lower losses from new initiatives. The path to profitability seems increasingly tangible for the company, with analysts from Morgan Stanley and JM Financial maintaining their buying calls on PolicyBazaar, expecting an upside of up to 57%. The anticipation of a resolution of regulatory issues and an overall high demand for insurance products further strengthen the outlook for PB Fintech, making it a significant player in the new-age stock landscape.

The Top New Age Stocks in India

In the dynamic Indian market, several new-age stocks are exhibiting great potential. These include Nazara Technologies, tapping into the booming online gaming industry; Paytm, a pioneering force in digital payments and fintech; and Zomato, a major online food delivery platform poised to turn profitable soon. PB Fintech (Policybazaar) is disrupting the insurance sector, while CarTrade is modernizing auto trading. RateGain, a SaaS provider, and MapMyIndia, offering digital map data and location-based services, are uniquely positioned in their industries. FSN E-Commerce Ventures (Nykaa) is a major player in online beauty and fashion retail, while Affle is capitalizing on mobile internet usage. Datamatics is facilitating digital transformation and automation, and Tracxn is transforming market intelligence. Investors eyeing these stocks should perform thorough risk-analysis and align investments with their long-term goals.

The Road to Profitability

Yet, despite these encouraging trends, new-age stocks remain a risky bet, given their unsteady march toward profitability. Moreover, stock prices of these firms are still significantly below their listing prices, even with the recent gains.

Despite the cautious optimism and the promising trends, the road to profitability for new-age stocks remains long and winding. In the end, investment decisions should align with individual risk appetites, investment goals, and timelines. These stocks are undoubtedly an exciting addition to the financial market, but it’s essential to remember that even the most promising new-age companies are not immune to volatility and risks.

Investing in new-age stocks, like any other investment, requires thorough research, patience, and a well-calibrated strategy. Understanding the specific industry dynamics, regulatory environment, and the company’s business model can help investors navigate this emerging landscape. And who knows? With the right strategy and a bit of luck, these stocks might just be the next big thing in your investment portfolio.

Free Access to an Online Course on Factor Investing by Sonam Srivastava

Discover the secrets of successful investing with our FREE Investing Course Giveaway for our Loyal Newsletter Readers! Whether you’re a beginner or looking to enhance your investment knowledge, this course is perfect for you. Learn from Sonam Srivastava, Founder Wright Research the fundamentals of investing, stock market strategies, and much more.

With our comprehensive course, you’ll gain the confidence to make informed investment decisions and maximize your returns. Don’t miss this opportunity to learn from the best without spending a dime! – CLICK HERE!

Check out Wright Research smallcases here

SEBI Registration Details: Corporate Registered Investment Advisor | Company Name: Wryght Research & Capital Pvt Ltd Reg No: INA100015717 | CIN: U67100UP2019PTC123244. For more information and disclosures, visit our disclosures page here.