New smallcase from the House of Wright Research: Alpha Prime smallcase

What is ‘Alpha’?

Let us start this week’s newsletter by understanding what does ‘Alpha‘ mean in the world of investing?

In the realm of investing, ‘Alpha’ is a term that signifies a strategy’s ability to outperform the market, giving it a distinct ‘edge.’ Alpha measures the active return on an investment, or in other words, its performance relative to a benchmark market index. If we are talking about generating ‘Alpha’, we are essentially discussing the potential to surpass market averages.

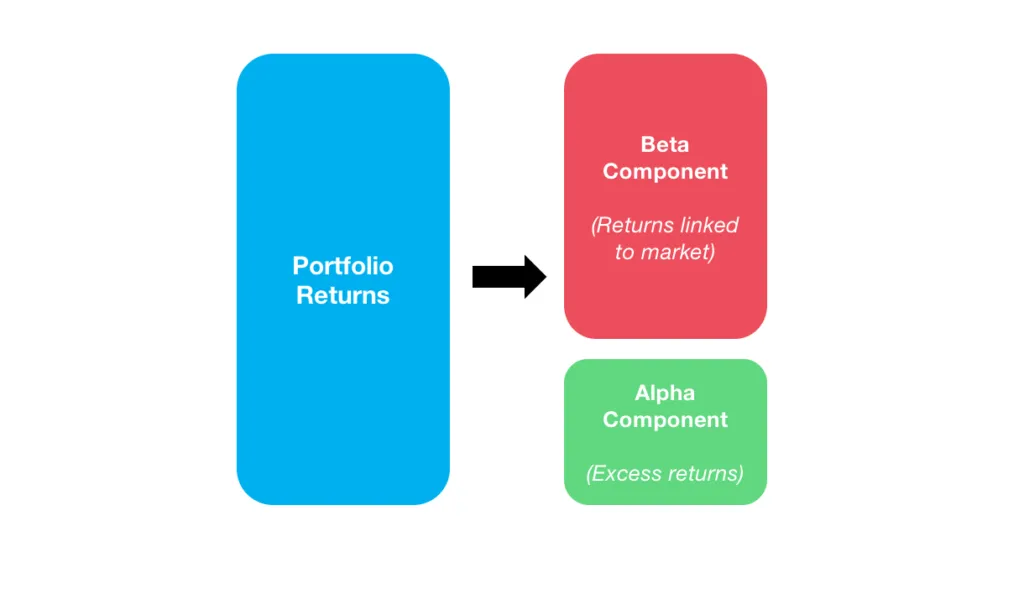

This image below will give you absolute clarity on the meaning of Alpha.

What is the investment strategy of Alpha Prime smallcase?

This smallcase is designed to leverage the power of concentrated momentum investment and generate high alpha returns, offering substantial value for our investors.

Key Highlights:

- Concentrated portfolio provides potential for concentrated returns

- More actively managed with frequent bi-weekly rebalancing

- Wider universe, including high quality smallcap stocks

- Aggressive strategy with high return potential along with high risk

- All of this at an affordable price of Rs.3600 for 6 months

Alpha Prime’s Investment Universe: The Basis for Generating Alpha

The potential to generate alpha in our Alpha Prime strategy comes from a blend of expert portfolio design, experienced investment management, sophisticated quantitative models, and the use of AI technology for advanced market forecasting. We consciously forego certain diversification benefits to unlock higher potential returns for our investors. The following components form the core of our investment universe:

- High Momentum Stock Focus: We focus on high-quality, high momentum stocks that are more likely to generate higher returns.

- Selection Process: We select 10 standout stocks from the top 500 companies based on a comprehensive evaluation of the company’s fundamentals, industry position, and growth potential.

- Use of AI Technology: AI and machine learning algorithms help us identify market trends, anticipate market shifts, and adjust our portfolio strategy.

- Risk Optimization: We balance the potential for high returns with the associated risks, using sophisticated risk management strategies and techniques.

- Diversification: Even though our portfolio is concentrated, we practice diversification among our chosen 10 stocks to spread the risk – Portfolio remains well-rounded and not overly reliant on any single stock or sector.

- Systematic De-Allocation: In high-risk market scenarios, we systematically de-allocate our investments to mitigate risk exposure.

Who Is Alpha Prime For?

Alpha Prime is designed for investors who are comfortable taking on higher risk levels in exchange for the potential for higher returns. It is especially suited for those seeking exponential growth and comfortable with the higher churn associated with a high-momentum strategy.

This is an aggressive strategy, with a high portfolio churn requiring bi-weekly rebalancing. Equity strategies such as these are high risk. Such portfolio strategies will see drawdowns depending on market conditions. Investments in the stock market should be considered for the long term, as short-term market fluctuations are normal and expected. The value of your investment can go up and down over time, and it’s possible to experience losses. You have to make sure that the high risk nature of this portfolio suits you before you invest.

Use the code ‘ALPHA25‘ to get a 25% discount on the subscription to this smallcase. Don’t miss this opportunity!

Check out Alpha Prime smallcase

Unleashing the Power of Momentum: Factors to Consider before Investing in Small Caps

Join us for an insightful live webinar featuring Sonam Srivastava, Founder of Wright Research. We will deep dive into the exciting world of Momentum Investing and Small Caps. Sonam will share invaluable tips, essential strategies, and the critical factors that every investor must consider.

Whether you’re a seasoned investor or just starting, this 1 hour session will equip you with the knowledge and insights to navigate the momentum investing landscape and leverage the potential of small-cap stocks. Don’t miss this opportunity to learn from an industry expert and enhance your investing acumen.

Event Date: 16th July 🕚 Timing: 11AM

Join us live on YouTube this Sunday, tap to set a reminder here

Check out Wright Research smallcases here

Liked this story and want to continue receiving interesting content? Watchlist Wright Research smallcases to receive exclusive and curated stories.

Disclosure:

This is not an investment advise.

Disclosures: https://www.smallcase.com/manager/wright-research#disclosures

SEBI Registration Details: Corporate Registered Investment Advisor | Company Name: Wryght Research & Capital Pvt Ltd Reg No: INA100015717 | CIN: U67100UP2019PTC123244. For more information and disclosures, visit our disclosures page here.