Markets snap 2-week losing streak

It was a short trading week for the stock markets – Monday and Friday was off. In the truncated trading week that was, the stock markets ended the week in green. The financial year-end led mutual funds to go on a buying spree during the week to make sure the net asset value (NAVs) of their respective funds ended on a higher note and this fueled optimism. Positive global cues, better than expected US macroeconomic data – GDP and jobs report – also uplifted markets.

Anyway, here’s a little detour from market updates to look at an interesting quote from a famous American writer – Mark Twain.

Quote of the week

u0022October: This is one of the peculiarly dangerous months to speculate in stocks. The others are January, February, March, April, May, June, July, August, September, November and December.u0022 ~ Mark Twain Click To TweetOctober: This is one of the peculiarly dangerous months to speculate in stocks. The others are January, February, March, April, May, June, July, August, September, November and December.

Mark Twain

Markets Update

|

|

|

|

The Big Picture

- External debt is a part of the total debt that is owed to creditors outside the country. India’s external debt stood at $563.50 billion in the 4th quarter of 2020 from $556.70 billion in the 3rd quarter.

- India’s fiscal deficit, which measures the difference between government revenues and expenses, widened to a fresh all-time high of ₹14.06 trillion in April-February 2020-21 from ₹10.36 trillion in the corresponding period of the previous fiscal year.

- India’s trade gap widened to $14.11 billion in March of 2021 from $9.76 billion a year earlier.

- Foreign Exchange Reserves in India decreased to $579.30 billion on March 26 from $582.30 billion in the previous week.

Ok, so?

India is getting its newest bank!

The covid-19 pandemic has impacted all facets of business, and the infrastructure sector was impacted like no other. Because of this, commercial banks and other private institutions became wary of lending to the infra sector.

The govt has come up with a possible solution – setting up what is called a Development Finance Institution (DFI). It will be fully backed by the government, of course. But the aim is to, over the next couple of years, reduce the government’s stake to 26%. This has far-reaching implications. Okay, so how does this impact us? Click below to find out!

Inside smallcase

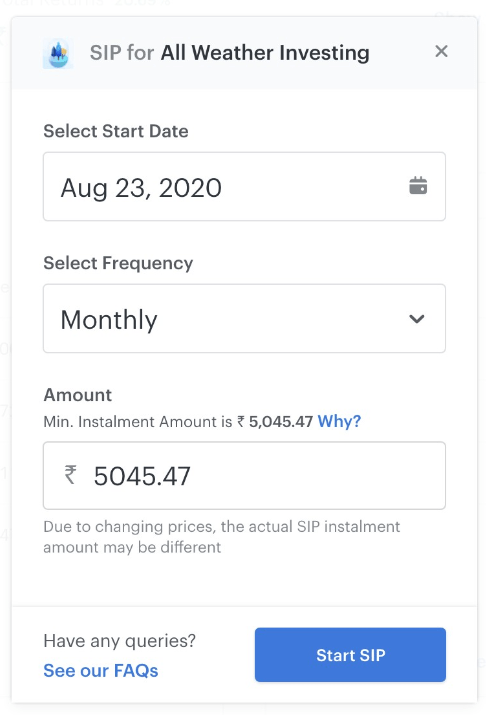

SIPs with smallcase

SIP stands for Systematic Investment Plan. As the name suggests, it helps the investor allocate funds in a smart and disciplined manner. Timing the markets is a difficult task, but SIP eliminates that worry. With SIP, you can invest fixed amounts at regular intervals. You, then, stand to have an advantage over market volatility and do not need to monitor the markets constantly.

Buy more when the price is low, less when the price is high. If on the SIP date, the stock price is high, you will be able to buy a lesser number of shares. And vice versa. This ensures that you invest more at lower prices and less at higher prices, and hence your overall cost of acquisition gets averaged out. Try out investing with SIPs in smallcases for passive, long-term wealth creation. Read more about SIPs, here.

That’s a wrap for this week. Happy Investing! 🙂