Should You Add Gold To Your Portfolio This Diwali?

As Diwali approaches, investors are exploring new investment opportunities. Traditionally, gold has been a popular choice, but there’s a growing trend of investing in stocks for potentially higher returns. When comparing equity and gold returns, it’s evident that gold serves as an effective hedge against inflation and a strong dollar. Equities, despite occasional crashes, have demonstrated resilience and capacity for robust recovery.

The debate between gold and equity investments is longstanding. Some investors prefer the security of gold, while others seek the higher returns of equities, albeit with greater risk. Over the past decade, the value of 1 gram of 24 karat gold rose from ₹2960 in 2013 to ₹6248, a significant 111% increase. In contrast, the Nifty index showed over 200% returns, rising from 6,299 in October 2013 to 19,406.70.

Focusing on shorter periods, gold has outperformed equities. In the one-year span from October 2022 to October 2023, gold yielded nearly 22% returns, while the BSE Sensex managed just over 5% and Nifty 50’s 7.09%. Over two years, from October 2021 to October 2023, gold returns were 28%, compared to the Sensex’s 7.7%. However such an analysis is limited since equities carry much higher risks than gold.

So today’s question for this Diwali season is: should individuals invest in gold this Diwali and Dhanteras, especially considering the significant price increase to over ₹60,000 per 10 grams?

History of Gold & Its Demand – When Does It Do Well?

Gold’s demand has historically remained significant, partially driven by its use in jewellery. According to the World Gold Council, jewellery accounted for nearly 47% of total gold demand in 2022, down from around 56% in 2021. The limited industrial use of gold, despite its excellent properties, is primarily due to its rarity and softness. Beyond jewellery and industrial use, a substantial portion of gold’s demand comes from investments. In 2022, investment demand constituted nearly 24% of total gold demand. Historically, gold has been valued as a universal form of money due to its durability, non-fragility, and chemical inertness. Its consistent supply and high density further cemented its role as a premium monetary form. Even after the link between gold and paper money weakened post-World War I, gold continued to be perceived as a safe haven, particularly during economic or political crises.

Gold’s performance as an investment has been noteworthy, especially during turbulent times. For instance, from the end of 2006 to the end of 2012, gold yielded returns of 231% in rupee terms and 162% in US dollar terms, outperforming the BSE Sensex. This period encompassed the 2008 financial crisis, during which investors increasingly turned to gold. More recently, from the end of 2019 until October 31, gold has provided returns of over 56%, comparable to the BSE Sensex, driven by events like the pandemic, the Russia-Ukraine war, and the recent conflict between Hamas and Israel .

Indian Rupee, US Dollar & Gold

If you buy Gold in India, it will be Indian Rupee. However, globally gold is traded in US Dollar. And this means there is an impact on the returns of an investor trading gold in India – since the Indian Rupee & US Dollar exchange rate fluctuations will fundamentally influence gold returns. Here’s an example: on September 5 and 6, 2011, the price of gold peaked at $1,895 per ounce (with one ounce being equivalent to 31.1 grams). If an investor had bought gold in dollars at that time, their return as of October 31 would have been just 5.4%, with the price at $1,997 per ounce. This return, in dollar terms, is relatively low. However, when considering the returns in rupee terms, the picture changes dramatically. During the same period, gold provided a return of 117% in rupee terms. This stark difference is largely due to the depreciation of the rupee against the dollar. On September 5, 2011, one dollar was valued at ₹45.7, while by October 31, the exchange rate had shifted to ₹83.3 per dollar.

The tendency for higher returns in rupee terms can be attributed to the consistent devaluation of the rupee against the dollar. Moreover, with inflation rates in the US typically lower than those in India, this trend of enhanced returns in rupee terms due to currency depreciation may persist even as the Indian economy strengthens . Therefore, for gold investors in India, understanding and monitoring this exchange rate relationship between Indian Rupee & US Dollar is imperative when assessing real returns of investing in gold.

Why Are Central Banks Buying Gold?

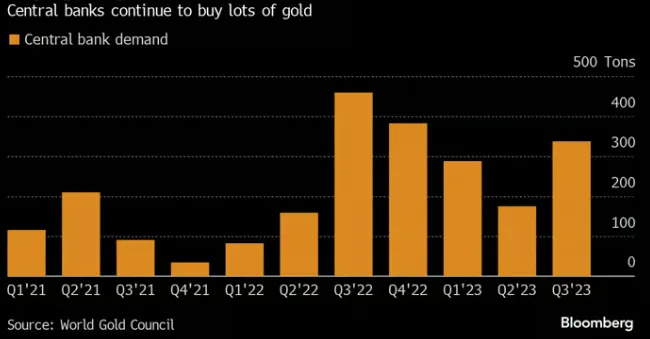

Unlike cryptocurrencies, governments and central banks like purchasing gold. And in a year marked by global economic tightening, central banks have significantly increased their gold reserves, surpassing previous expectations and increasing gold prices. The World Gold Council reported a substantial acquisition of 337 tons in the 3rd quarter, following a revised increase of 175 tons in the 2nd quarter.

In 2022, RBI , global central banks and other institutions contributed to nearly 23% of gold demand, up from 11% in 2021. Central banks bought 800 tonnes of gold in the first 9 months of the year, led by significant purchases from China, Poland, and Singapore, along with other undisclosed buyers. This was a 14% increase year-on-year.

This aggressive accumulation has been crucial in maintaining gold prices, particularly as they surpassed the $2,000 mark recently, a level not seen since May. The trend indicates a shift where gold prices are less influenced by inflation-adjusted Treasury yields, traditionally a major factor for its valuation. Recent geopolitical tensions have also played a role in the heightened demand for gold as a safe haven asset. The conflict involving Hamas and Israel contributed to this surge, with gold prices nearing the 2020 record of approximately $2,075.

Gold vs Equity – What is better?

Gold is renowned for its role as a hedge against inflation and a stronger dollar, while equities, despite their volatility and occasional crashes, have shown resilience and a strong capacity for recovery. The debate between these two investment forms is longstanding, with some investors favouring the safety of gold and others preferring the higher, albeit riskier, returns of equity markets.

Over the past decade, the price of 10 grams of 24 karat gold has increased from ₹29,600 in 2013 to ₹62,480, a 111 percent return. In comparison, the Nifty index has delivered over 200 percent returns in the same period. However, it’s crucial to note that equities carry a higher risk compared to gold.

Looking at long-term returns, gold has yielded 419% over 15 years, while the BSE Sensex returned about 553% in the same period. The 16-year returns are 222% for the BSE Sensex and 511% for gold. In a 10-year timeframe, gold provided a 99% return, and the BSE Sensex returned 202%. These figures illustrate the importance of diversifying investments across both gold and stocks, as precise timing of investments is challenging.

Gold’s performance, particularly during financial crises, highlights its role as a hedge and a form of insurance against economic instability. In this context, continuous investment in gold, similar to a systematic investment plan (SIP), can be a prudent strategy. For example, the Kotak Gold Fund (regular) over 12 years offered an 8.1% annual return through SIP, with even better returns over 10-year and 5-year periods.

Negative Correlation between Gold & the stock market

Typically Gold tends to perform well when the market isn’t doing well. But let’s look at a few instances over the last 10-20 years and see the correlation between gold and Indian stock markets.

2007-2009: Market Crash

- In May 2007, if you bought index funds at Nifty50’s 4,296 level and gold ETFs at 8.82. During the subprime mortgage crisis, Nifty50 fell by 35%, while gold ETFs rose by 69%.

2010-2013: Volatile Market

- Volatility in the stock market drove investors towards the stability of gold. The stock market saw significant fluctuations. Nifty50 rose by 17.7% from January 2010 to January 2011 and then fell by 26.2% by December 2011.

- Gold ETFs increased by 59.8% from January 2010 to December 2011 and continued to appreciate by 13.4% from January 2012 to August 2013.

2014: Bullish Stock Market

- The stock market was optimistic before and after the general elections, which brought Modi to power.

- Before the election results, despite a cautious stock market increase of 5.5%, gold ETFs surged by 11.45%.

- After the election, with increased market confidence, Nifty50 rose by 23.7% while gold ETFs decreased by 12.3%.

This case study demonstrates that gold often acts as a stabilizing asset during market downturns and uncertainty, while equities tend to perform better in times of economic confidence and stability. The balance between the two can provide a diversified investment portfolio that harnesses the strengths of both asset classes.

3 Reasons to Buy Gold As Investors This Diwali

The implication is clear: gold tends to perform well in challenging times and can protect the returns of an overall investment portfolio. However, predicting when gold prices will rise is challenging, so maintaining a proportion of gold in an investment portfolio is advisable, with the percentage depending on individual risk appetites. While the timing of investing in Gold, like during Diwali, may not be as critical and may require a deeper analysis, including gold in your investment portfolio this diwali could be a necessary check to ensure your portfolio is optimised and performing at its peak.

1. Gold is highly liquid

Gold, similar to a few limited investments, is traded around the world 24 x 7. With gold, you possess an international currency which can always be sold around the world at any time. Plus, with Gold ETFs, now you can buy and sell gold on the stock exchanges, as easily as you buy or sell your stocks.

2. Worried about the rising geopolitical tensions?

The deteriorating conditions in the Middle East, revolts in the US and Europe, the nuclear ambitions of North Korea, India vs China geopolitical tensions, growing conflict between the US and China and other such geopolitical issues are often unpredictable. And in such cases of unpredictability, Gold has proven as a strong hedge for your investment portfolio.

3. Gold for risk management

Investment in gold is a safety net that offset poor performance of equities when there are unpredictable and unfavourable global and macroeconomic events such persistently high inflation.

Well, it’s also an auspicious occasion to buy gold 🙂.

Should You Add Gold To Your Investment Portfolio?

Investing in gold is viewed as a hedge against volatility in the stock market, offering moderate, steady returns over multiple years. Gold is anticipated to perform well, benefiting from the economic slowdown in the US expected in 2024. The global economy is facing high interest rates and potential recessions, which could lead to higher gold prices. Indian equity markets might see upsides till the 2024 general elections , but state elections could introduce volatility.

A healthy mix of gold (typically 5-10%) and equity is recommended, considering the positive trajectory of Indian markets. This mix depends on individual risk tolerance, with equities offering higher potential returns but also higher risk, while gold provides safer but lower yields.

How Can You Add Gold To Your Investment Portfolio?

Each of these investment options has its pros and cons, and the choice depends on the investor’s objectives, risk tolerance, and preference for physical ownership versus other forms of investment. There’s also a difference in tax treatment for each method, so please do detailed research to find an appropriate method for you. Here are 6 options to add gold as an investment to your existing portfolio:

Physical Gold

This is the most traditional method, involving the purchase of tangible items like jewelry, coins, or bars. It provides the satisfaction of physical ownership but comes with risks such as theft and costs like making charges, which are lost upon selling.

Gold ETFs (Exchange-Traded Funds):

These funds track the price of domestic physical gold and are traded on stock exchanges. Each unit typically represents one gram of high-purity gold. They offer a more secure and theft-proof investment compared to physical gold.

Gold Mutual Funds:

These are mutual funds investing directly or indirectly in gold reserves, including physical gold, shares of mining companies, and other gold-related entities. The performance of these funds is linked to the prevailing gold prices.

Sovereign Gold Bonds (SGBs):

Issued by the government, these bonds are substitutes for holding physical gold. They pay a semi-annual interest and are redeemed in cash at the market value of gold at maturity. SGBs have investment limits based on investor type.

Digital Gold:

This modern investment option allows you to buy gold online without the need to store it physically. It’s a convenient and quick way to invest in gold through various online platforms.

Decoding Diwali Muhurat Hour with Sonam Srivastava

Join us live on Diwali as we discuss the Market Trends during Muhurat Hour with the insightful Sonam Srivastava – Founder, Wright Research.✨

Why Attend?

Gain valuable insights into the significance of Muhurat Hour for the Stock Market.

Understand investor patterns and market behaviour during Muhurat.

Planning to Invest this festive season? Ask Sonam Srivastava for insights live during the Q&A

🔔Set a reminder, mark your calendar, and join us live for an enlightening session with Sonam Srivastava! Let’s celebrate Diwali together! 🪔✨

Liked this story and want to continue receiving interesting content? Watchlist Wright Research’s smallcases to receive exclusive and curated stories!

Explore Alpha Prime smallcase by Wright Research here, use code DIWALI2023 for FLAT 30% Off

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary.

Wright Research

Wright Research