The Good Bad and Ugly weekly review : 09 Jan 2024

Markets this week

In terms of market performance, the Nifty had a blockbuster week leading up to the new year, but this week it remained flattish. However, this consolidation is happening near all-time highs, indicating that there are no major concerns regarding levels. Looking at the weekly chart, we can observe that out of the last ten weeks, there have only been two red weeks, and even those were marginal declines compared to the previous week. This suggests that the market rally is strong and may continue. My speculation is that we may see the Nifty reach 24,000 to 25,000 by May, which could be another 10% increase.

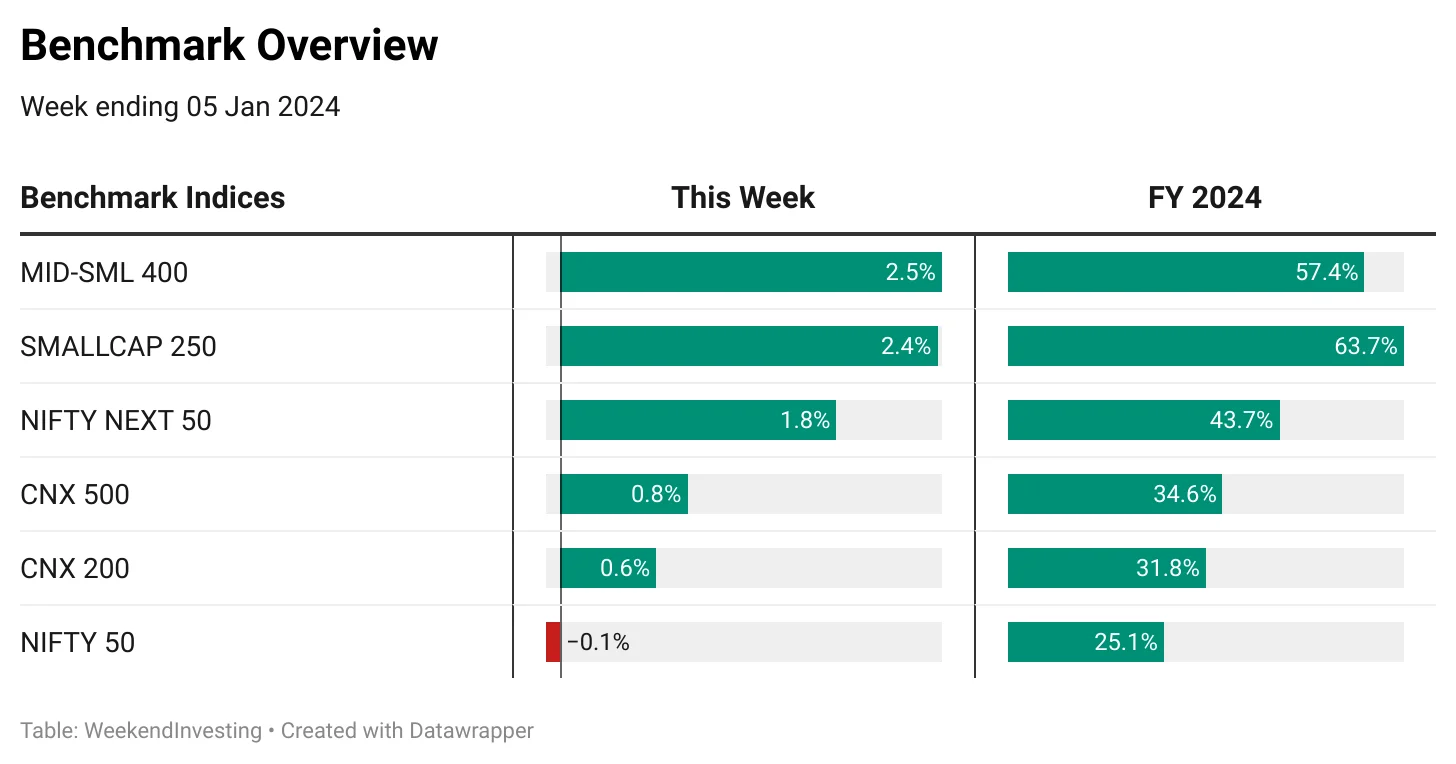

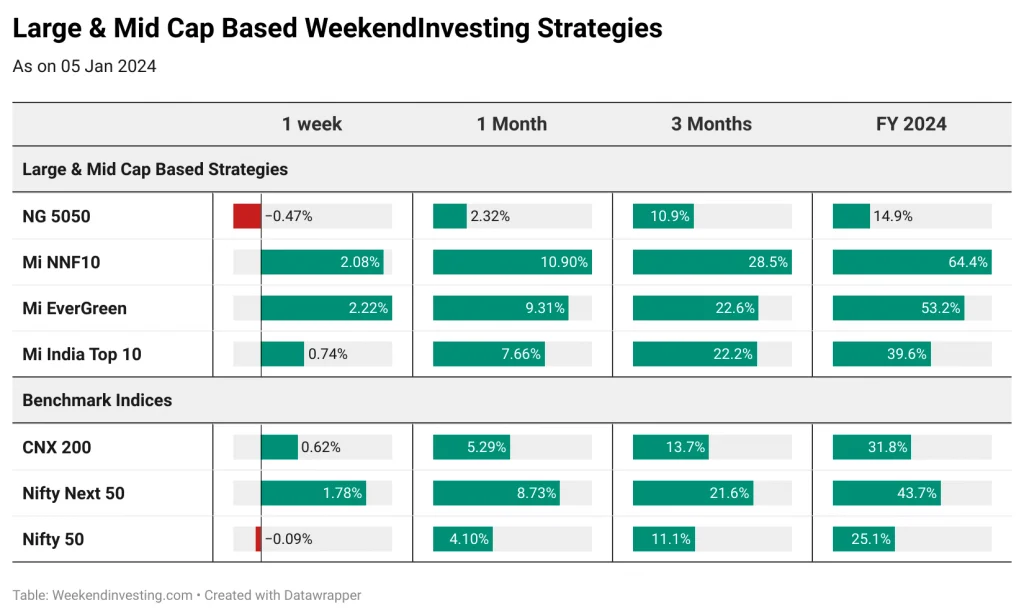

Benchmark Indices Overview

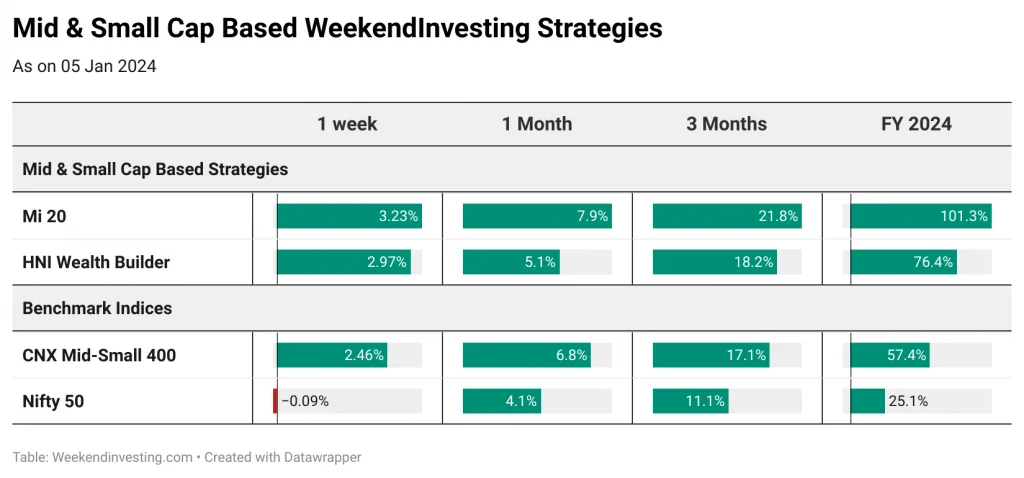

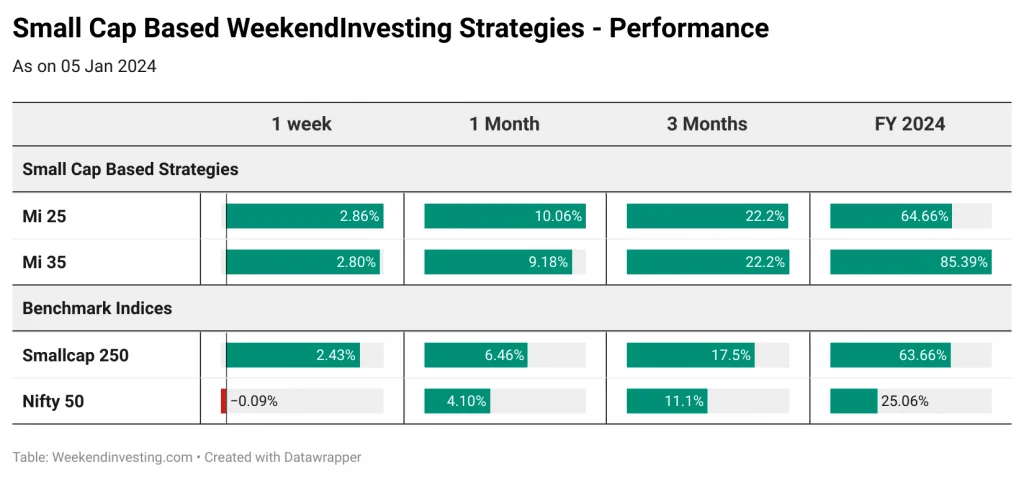

In terms of the broader market, small caps have been leading the way with significant returns. Small caps remain 63.7% up and mid caps are up 57.4% for the financial year. This demonstrates the potential for lumpy returns in the market, where some years may seem quiet, but the following year can make up for it. It’s important for investors to stay invested and have confidence in the market’s ability to deliver returns over time.

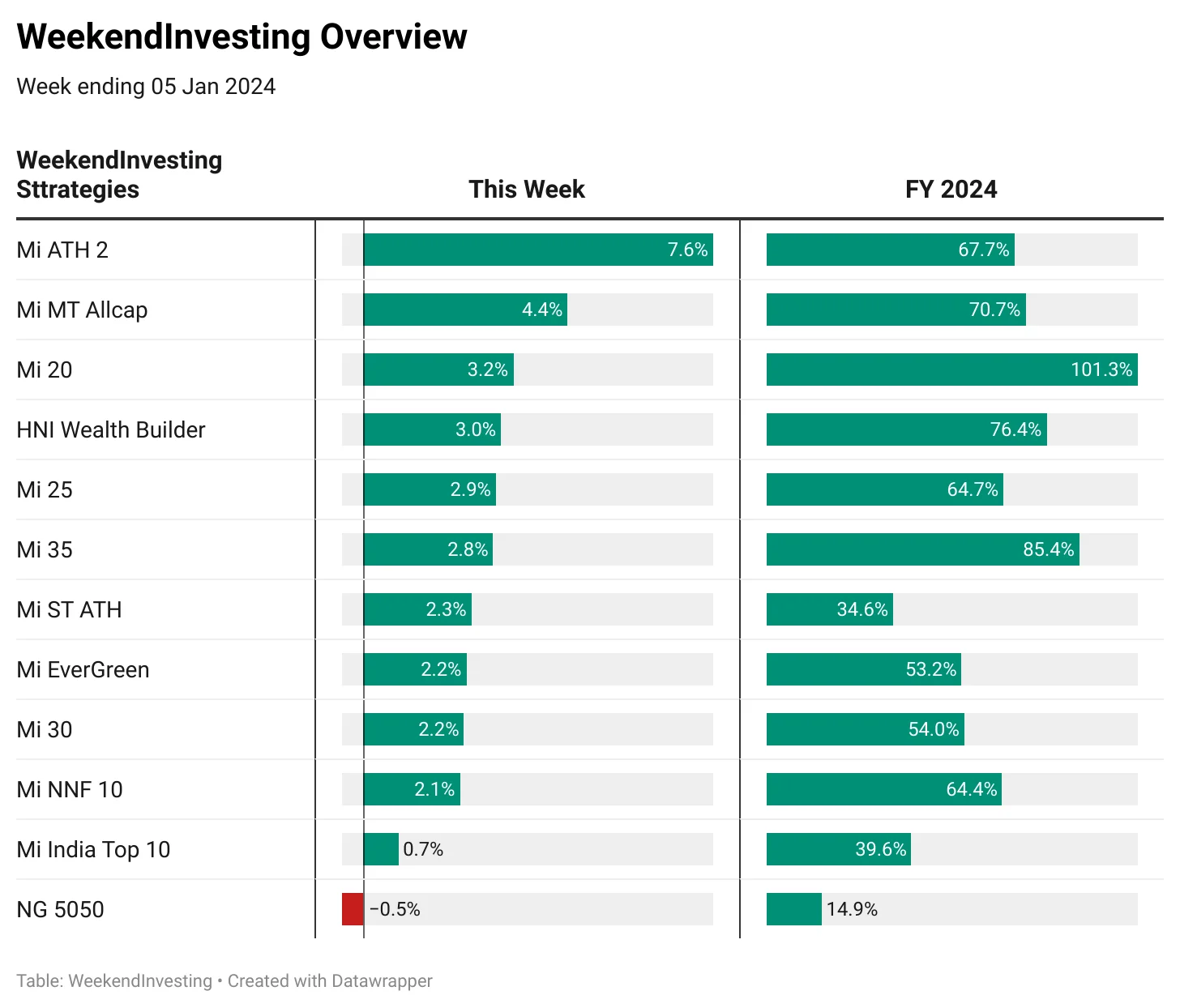

WeekendInvesting Overview

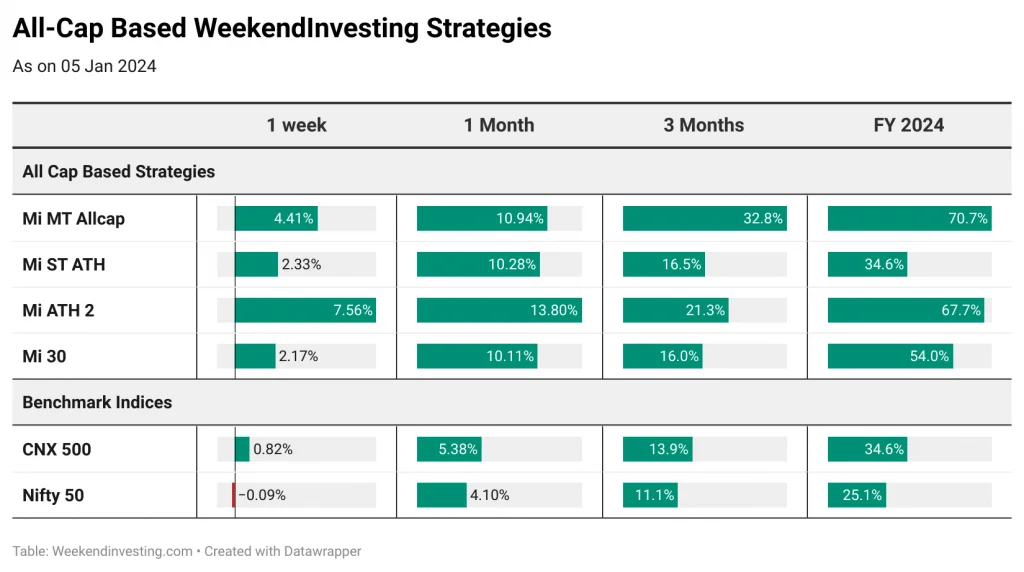

Mi ATH 2 saw a blast with a 7.6% increase, while the Mi MT Allcap strategy was up 4.4%. Both of these strategies have performed exceptionally well, with nearly 70% returns for the financial year. It’s worth noting that these strategies are not even focused on small caps, yet they have achieved impressive results.

Mi 20 was up 3.2%, and the HNI Wealth Builder strategy was up 3%. The Mi 20 reached a remarkable 101% return for the financial year, and subscribers of this strategy have been rewarded for their selection. The Mi 25 and Mi 35 were also up nearly 3%, with returns of 64.7% and 85.4% respectively in FY 24. These strategies are underrated and deserve more attention, especially considering their focus on small caps.

Other strategies such as Mi ST ATH, Mi 30, and Mi NNF 10 also experienced positive returns of more than 2%. In terms of benchmark comparisons, the Mi India Top 10 strategy beat the Nifty with a 0.7% increase and achieved a solid 39.6% return for the financial year.

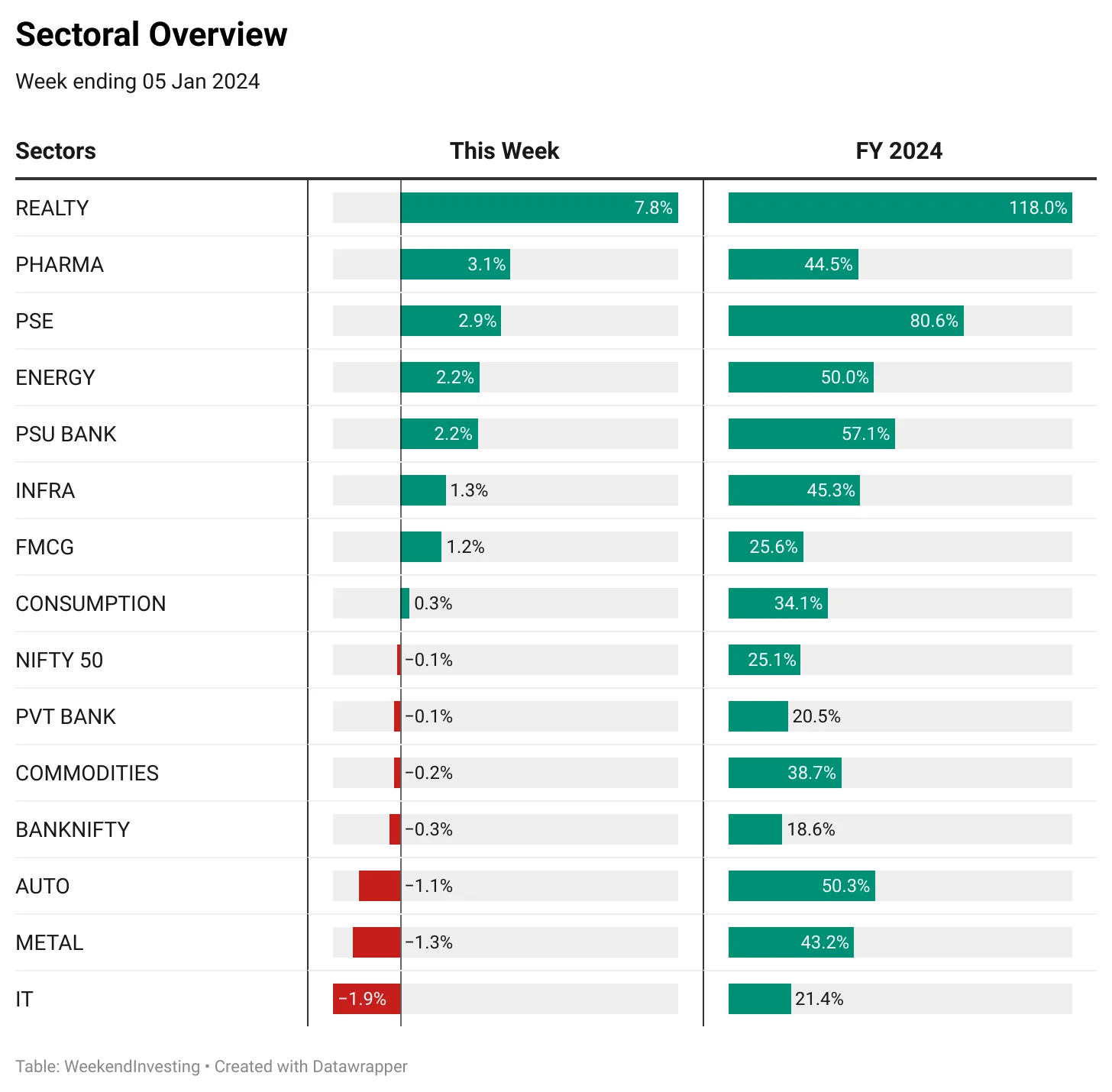

Sectoral Overview

Real Estate and Pharma were the top performers this week, with increases of 7.8% and 3% respectively. Real estate has been a major trend this year, with a whopping 118% increase for the financial year. However, due to limited liquid stocks in the real estate sector, it remains a stock picker’s game and requires careful analysis.

On the other hand, infrastructure and commodities have slipped, while financial services and media have not performed well. It’s important to stay updated on sectoral momentum and adjust investment strategies accordingly.

Spotlight – Mi NNF 10

We did a LIVE AMA covering the importance of large cap exposure in one’s portfolio. We also spoke about how Mi NNF 10 has been a consistent performer for over 3 years of live performance in the markets & concluded the discussion with some exceptional questions from the live audience.

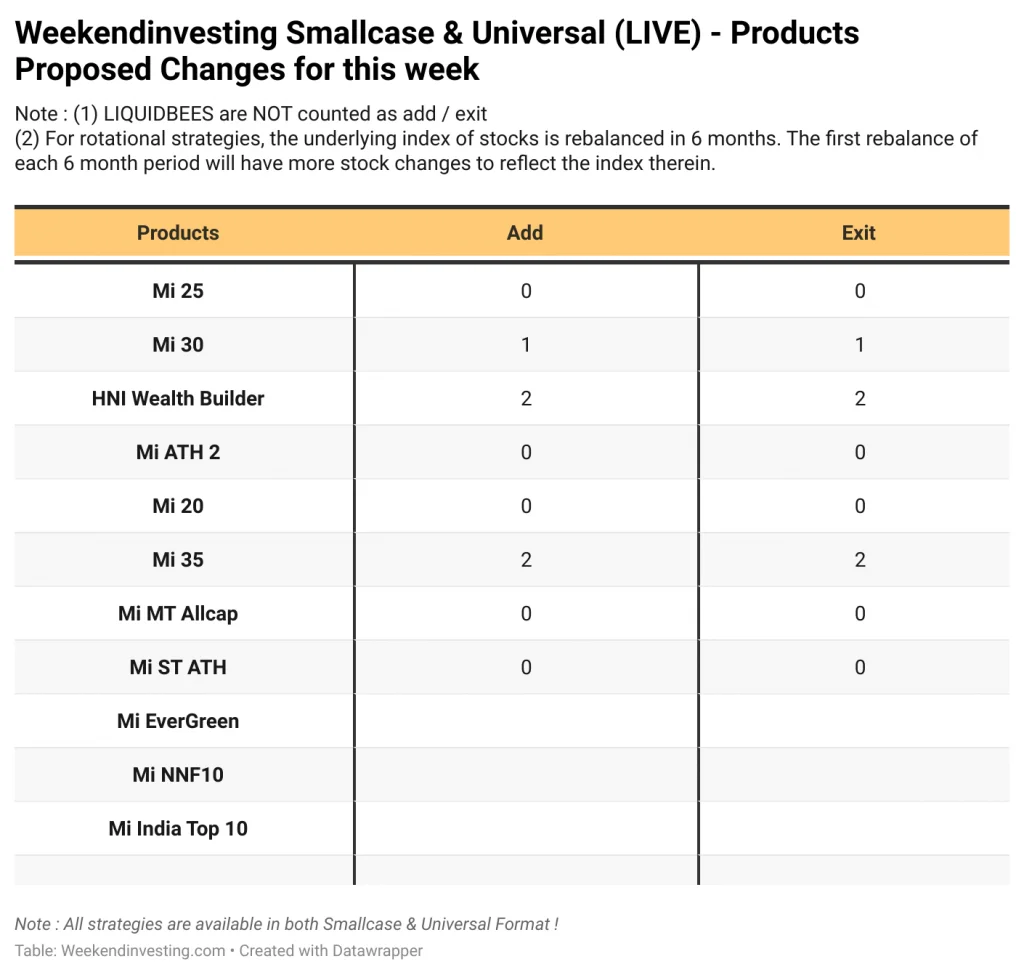

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Use the code ‘NYE2024‘ to get a 20% discount on the Mi_NNF10 Momentum smallcase, offer valid till 10th Jan 2024

Use the code ‘NYE2024’ to get a 20% discount on the Mi_NNF10 Momentum smallcase

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst