The Good Bad and Ugly weekly review : 24 Oct 2023

Introducing “The WeekendInvesting Newsletter”

Another brand new initiative from our Research Desk is The WeekendInvesting Newsletter. This is a daily newsletter that summarizes all the stories we cover during the day(market nuggets), including the daily byte that we shoot every evening. This newsletter will be delivered to your email every evening on market days, providing you with a wealth of market-related information. The newsletter includes both summaries and long-form blogs for all the market nuggets covered. These blogs are also linked to the videos we shoot, so you can choose to watch or read the content according to your preference.

Markets this week

Nifty, as indicated by the chart, experienced a downturn and remained soft throughout the week. The external environment has been challenging, with the US market falling, US yields rising, and crude oil prices fluctuating. These factors have contributed to the downward movement of the Nifty. If the support levels at 19,300 or 19,250 are broken, further down moves are possible.

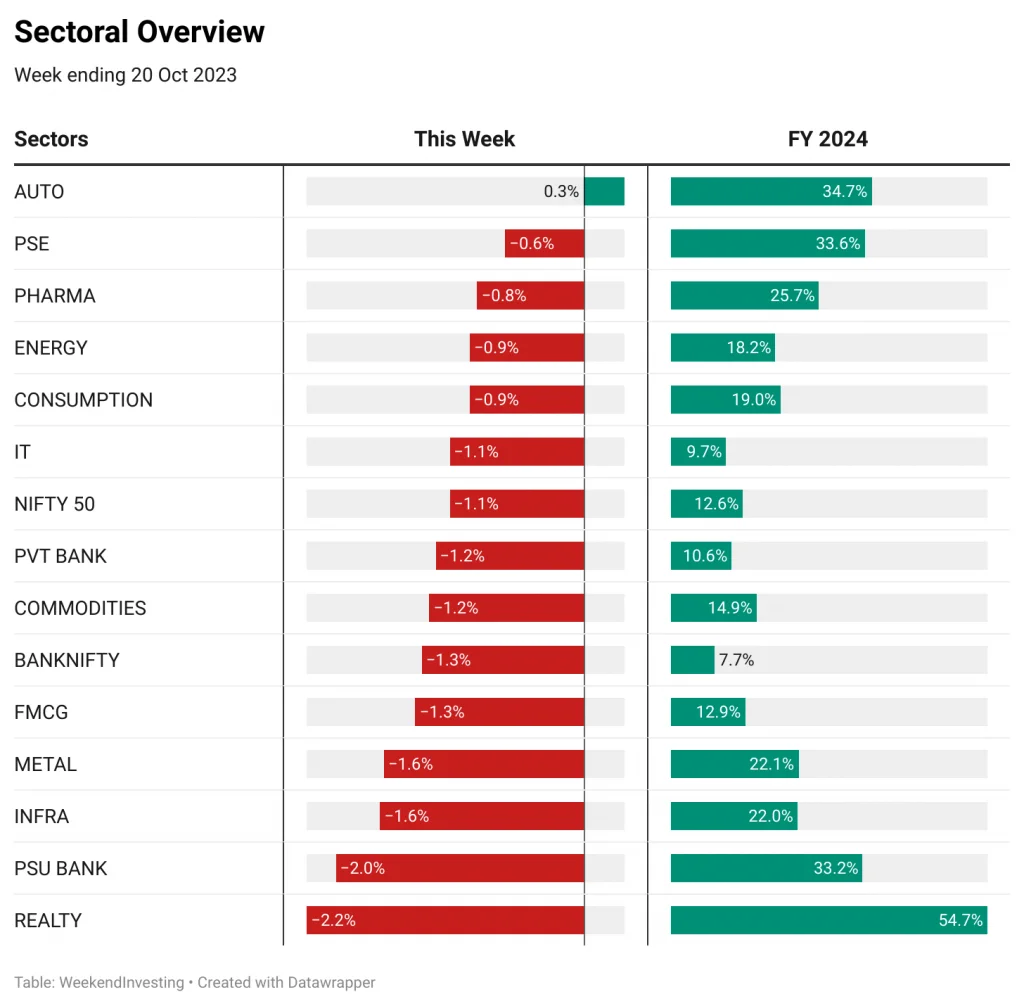

Sectoral Overview

In terms of sector performance, real estate, PSU, and infra metals experienced losses after a period of strong performance. For instance, despite the recent decline, real estate is still up 54%. Autos, on the other hand, were the only sector that saw marginal gains of 0.3% this week and is up 34% for the financial year. Public sector enterprises and public sector banks also experienced some losses but remained up by 33% each for the year. Banking, as a sector, has been the slowest performer this year, with only a 7% return compared to double-digit returns in most other sectors.

When considering sectoral momentum over different periods, we observed shifts in performance. Autos, media, and gold have seen improvements, while real estate, energy stocks, consumption, FMCG, PSU banks, and metals have experienced declines. Pharma is a space that may be showing signs of improvement.

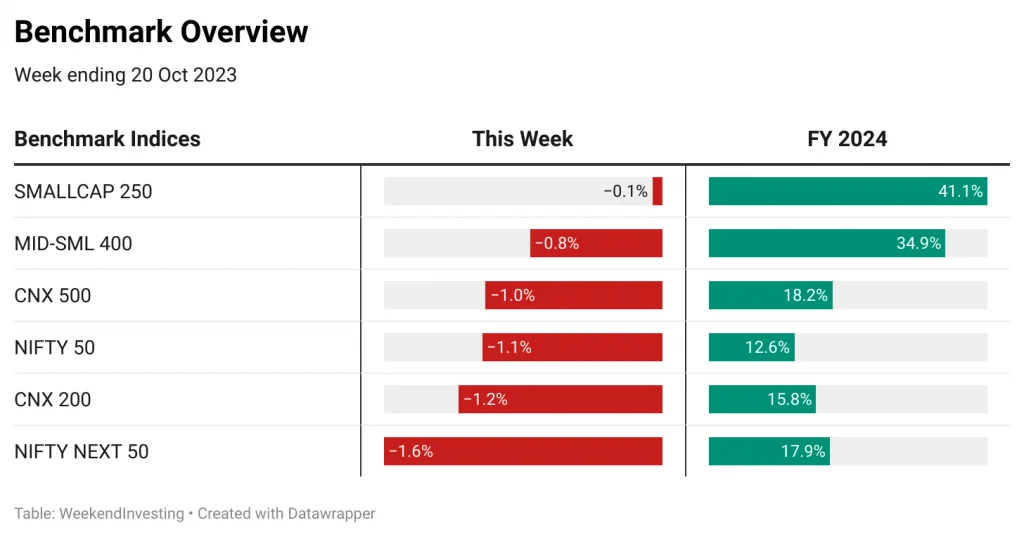

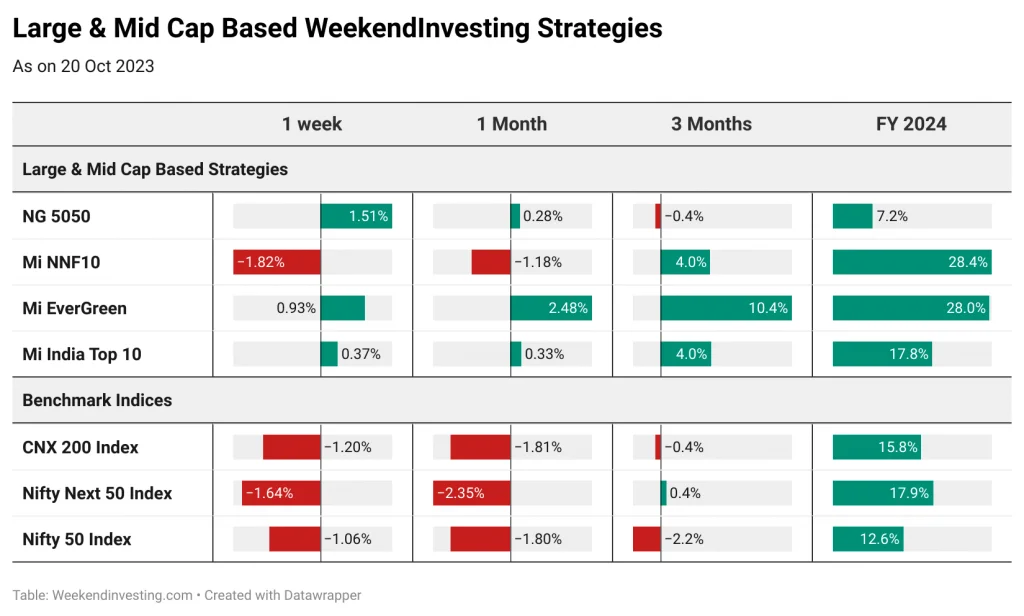

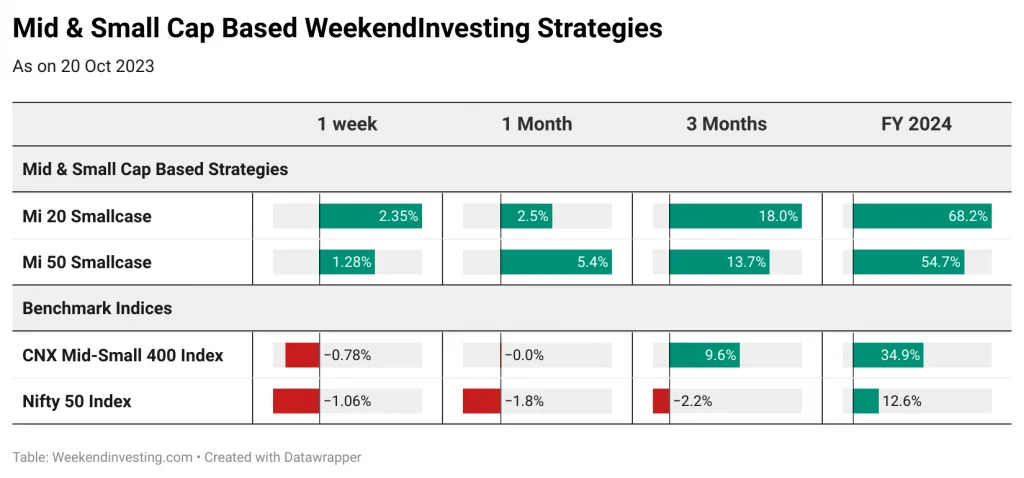

Benchmark Indices Overview

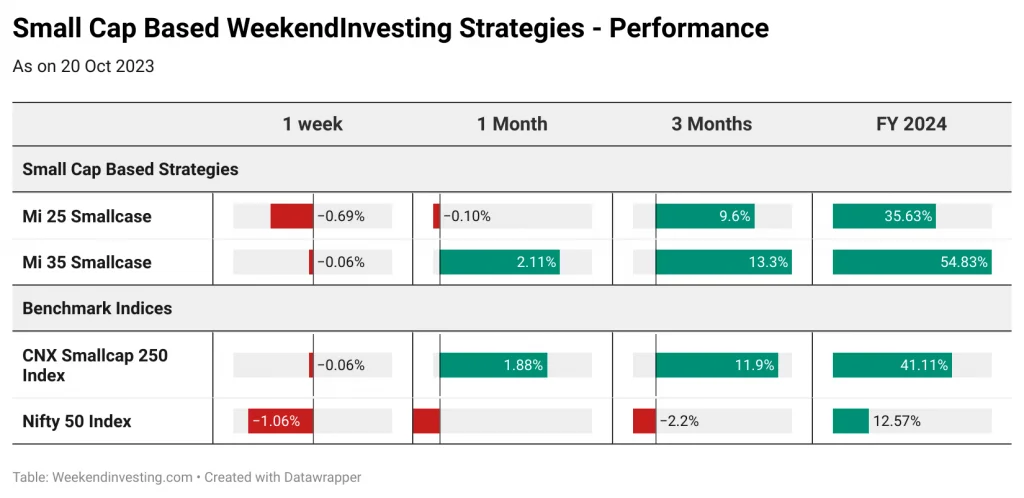

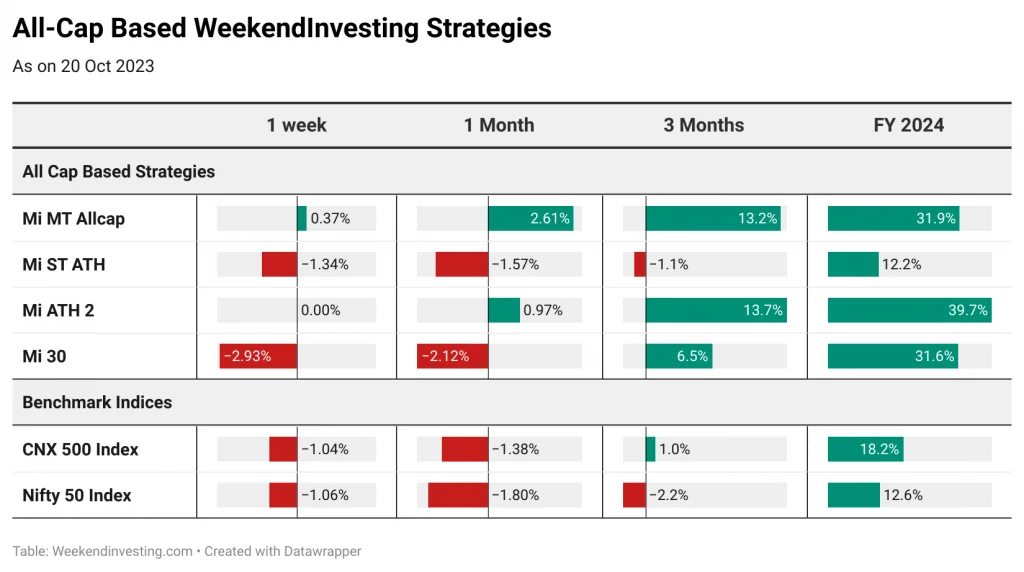

In terms of index movement, small caps remained relatively stable throughout the week, with mid and small caps experiencing a 0.8% decline. CNX 500 and Nifty 50 both saw declines of nearly 1%, while CNX 200 decreased by 1.2%. The Nifty Next 50 was the worst hit, with a 1.6% decline. Despite this weekly decline, small caps are still up 41% for the financial year, while mid and small caps maintain a 34.9% gain. The Nifty, on the other hand, has achieved a 12.6% increase.

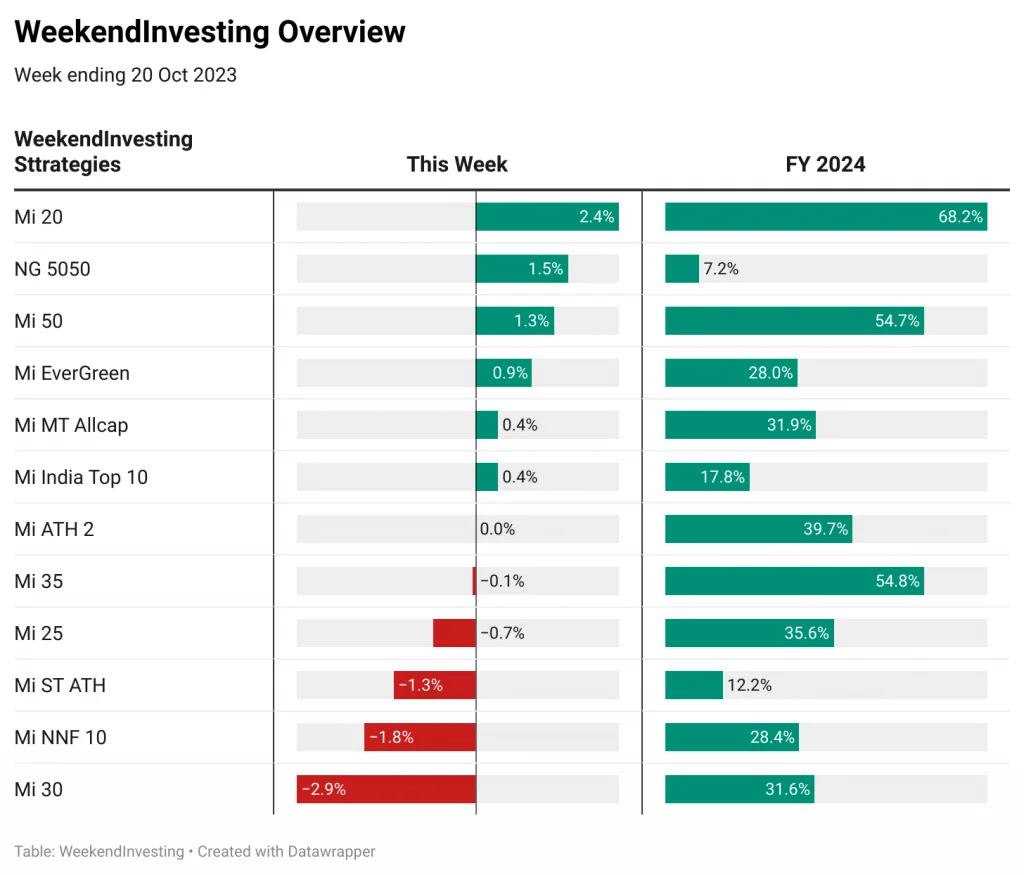

WeekendInvesting Overview

Now let’s turn our attention to the performance of Weekend Investing strategies. Mi 20 continues to be the standout performer, with a 2.4% increase for the week and a remarkable 68% gain for the financial year. Compared to the mid and small cap index, Mi 20 is nearly double in terms of returns. Mi 50 saw a 54% increase compared to the 41% gain on small caps and achieved a 1.3% increase for the week. Mi Evergreen and Mi MT All Cap strategies both outperformed their respective benchmarks, with gains of 28% and 32% compared to 15% and 18% on the CNX 200 and CNX 500, respectively.

While some strategies may not have performed well in the previous year, they have shown signs of improvement. Mi India Top Ten, for example, saw an 18% increase compared to the Nifty’s 12% gain. Mi 30 has achieved a remarkable performance of 54.8%, while Mi ATH 2 is close behind with a 40% increase. Mi ST ATH, on the other hand, has been the slowest performer with a modest 12.2% gain.

Spotlight : IRCON in Mi 25

In this week’s stock spotlight, the focus is on IRCON stock. Mi 25 saw IRCON enter the portfolio at Rs74 in April through Mi 25, and the stock has doubled in just six months. Despite the stock already doubling before the entry point, following the strategy’s rules and exit criteria mitigated the difficulties associated with conventional entry points.

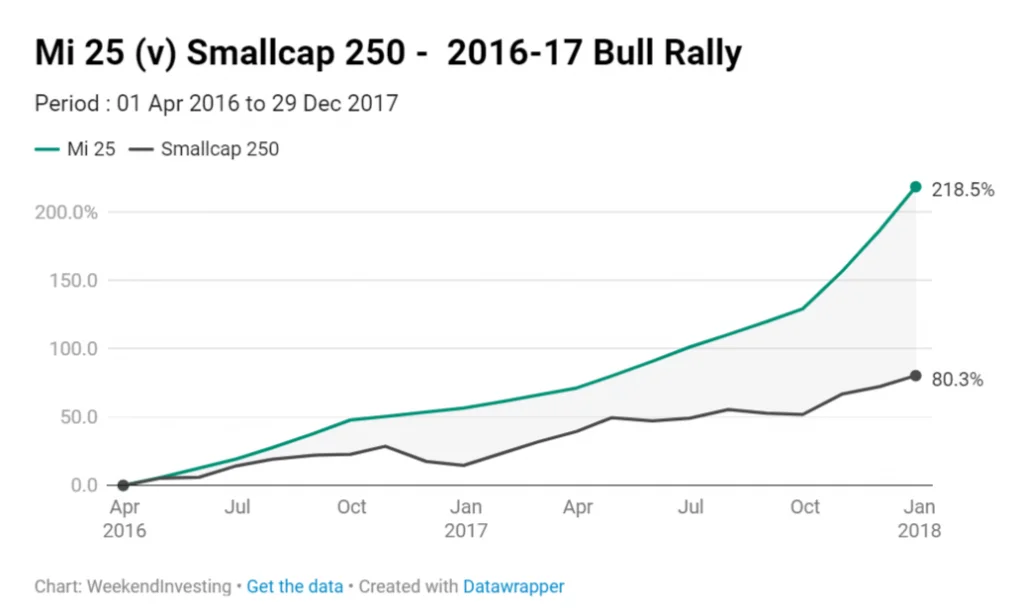

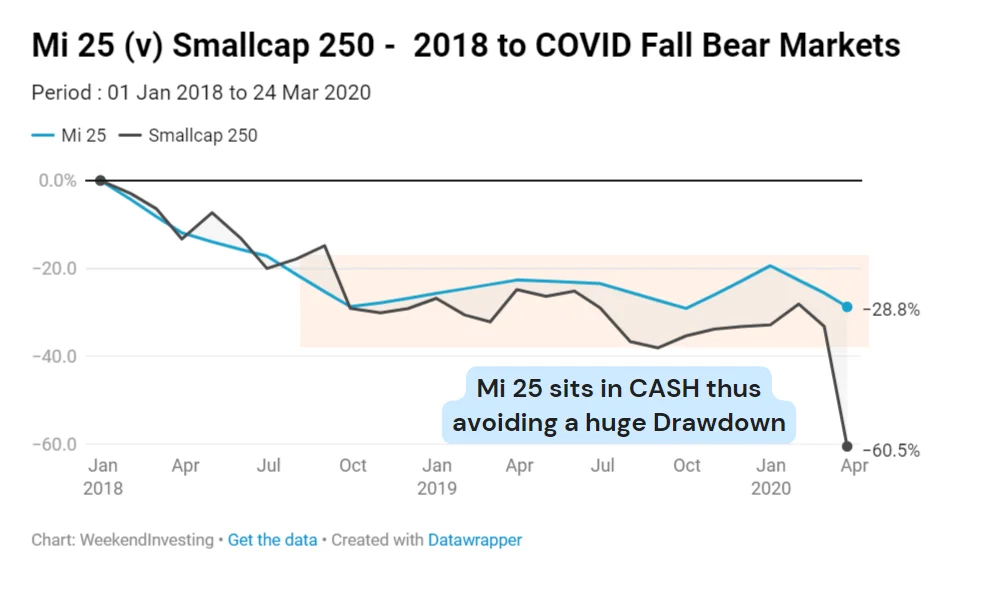

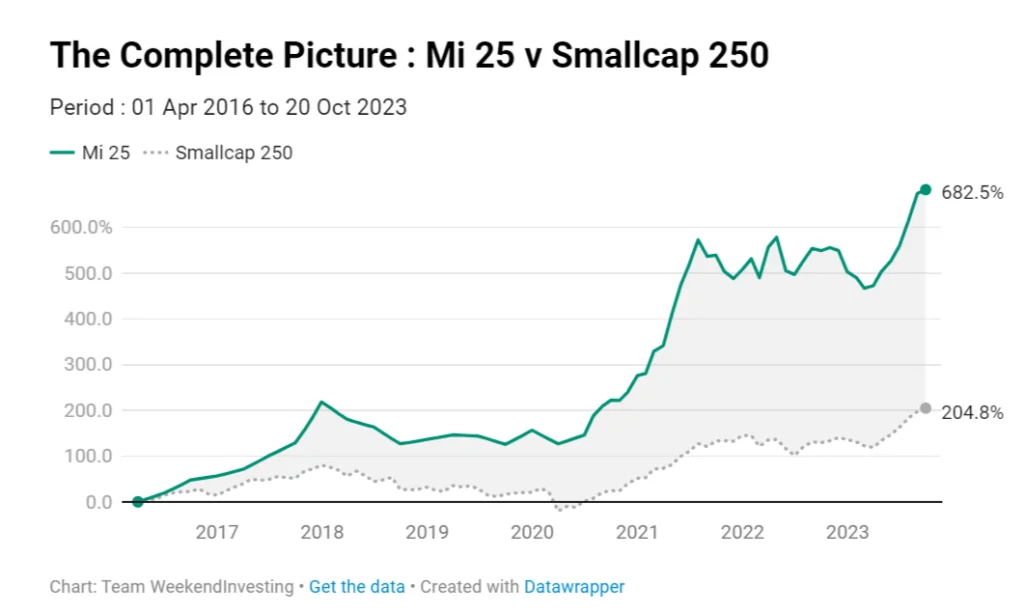

We also conducted a case study on Mi 25, which highlighted its performance in three different phases of the market. In the first phase, during a bull rally, small caps were up 80%, while the strategy realized a robust gain of 280%.

The second phase, marked by a market downturn, saw the strategy outperforming by limiting its drawdown to 28.8% compared to the market’s decline of 60%.

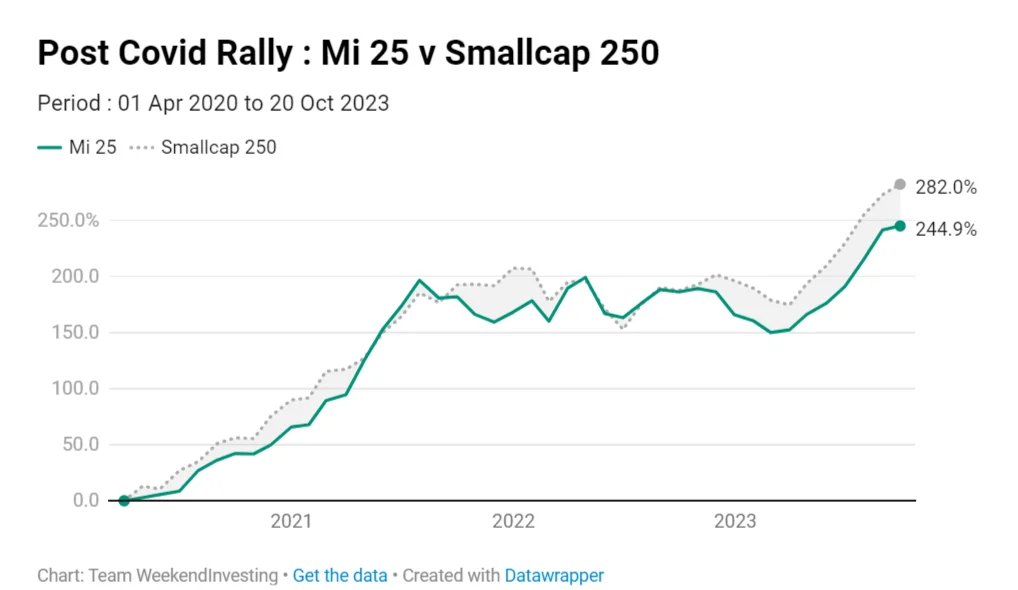

In the third phase, the strategy slightly underperformed the underlying index but still achieved a substantial gain.

When we combine the results of all three phases, Mi 25 yielded a cumulative gain of 682% compared to the small cap index’s gain of 204%.

Rebalance Update

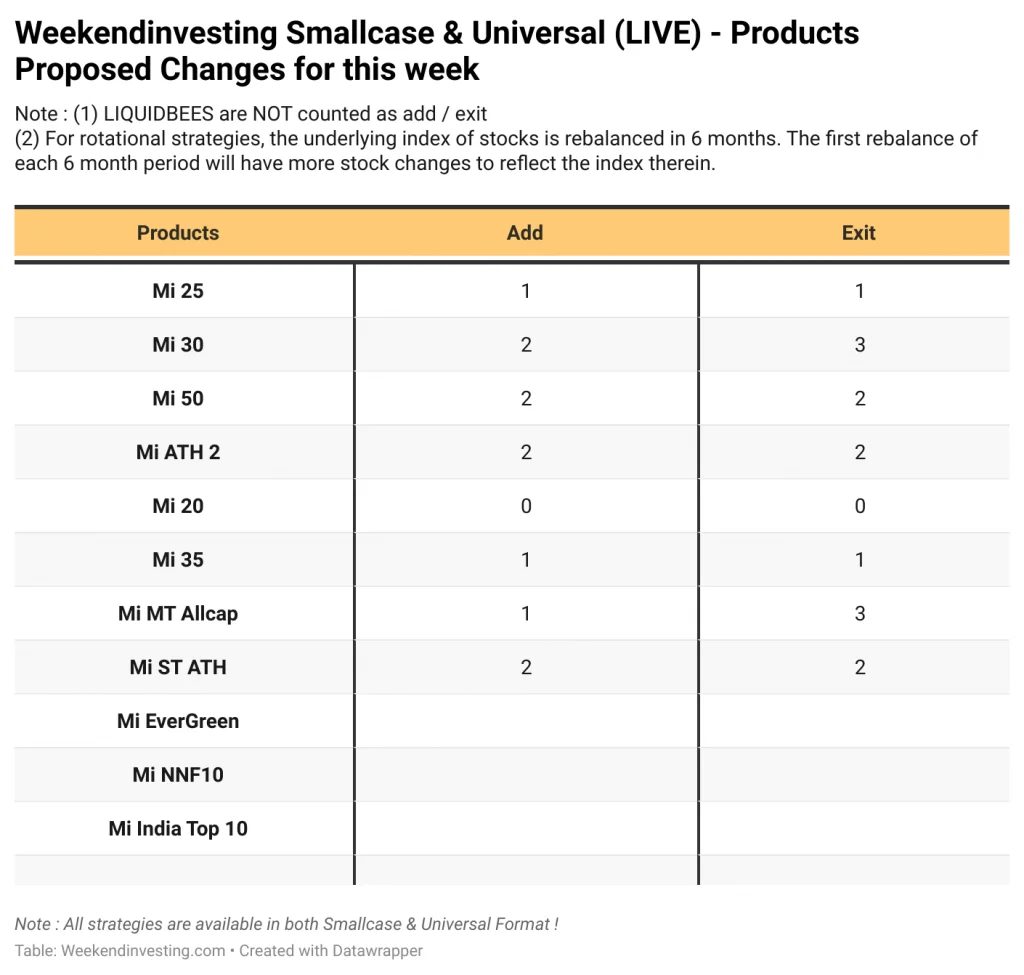

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

WeekendInvesting Products – LIVE Index Data

Many of you had asked us to make the index series of all WeekendInvesting Products available so that you could perform your own analysis and studies. You can find a link to the LIVE sheet here and also on the HUB under the support column in the content tab.

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst