What are Demat Accounts? Use, Features & Benefits of Opening a Trading Account

Just like the bank account that allows you to deposit and withdraw your physical money into digital currencies for easy transactions, demat accounts allow you to deposit and transact in shares.

Demat accounts are electronic accounts that hold securities and is safe for the shares you’ve bought. Thus, opening an online demat account keeps your securities in a digital format and enables you to track price movements. Further, in this blog, we will discuss what is a demat account, its types, and certain other aspects.

What is a Demat account?

A Demat Account, also known as a Dematerialized Account, is an electronic account that holds an individual’s securities in a dematerialized form. These securities include stocks, bonds, mutual funds, exchange-traded funds (ETFs), and government securities.

Dematerialization process involves converting physical share certificates into electronic format, which can be stored in a demat Account. Thus, a demat Account is essential for investors like you who want to invest in securities such as stocks, bonds, and mutual funds. It provides easy access to account statements, reduces paperwork, and offers cost-effective trading options, eliminating the risk of theft, loss, or damage. It is important to learn about Dematerialization now that we have explored an introduction to demat accounts.

Now that we have understood ‘What is a demat account?’, let’s try to understand better with an example.

For example,

Let’s say Rahul wants to buy 100 shares of Britannia Industries. With a demat account, he can receive shares in electronic format from the DP (Depository Participant) rather than receiving paper certificates. Thus, when Rahul wants to sell his shares, he can instruct his DP to debit from his account, and the DP will transfer the shares to his demat account.

What is Dematerialization of Securities?

Dematerialisation is the process of handling shares by converting physical certificates into electronic form. To engage in online trading, investors establish a Demat account with a Depository Participant (DP). This eliminates the need for physical certificates, streamlining the tracking and monitoring of holdings globally.

Previously, issuing share certificates was laborious and time-consuming. The process of Dematerialization has expedited this process, storing certificates digitally. Upon activating your Demat account, convert paper certificates to digital by submitting them with a Dematerialization Request Form (DRF). Remember to deface each physical certificate with ‘Surrendered for Dematerialization.’ Upon surrender of the documents and the dematerialised form, an acknowledgement slip is provided.

Features of a Demat Account

A demat account makes transactions easy and convenient. Thus, let’s look at the other following features as to why you should open a demat account online:

- Safe and secure storage of securities: A Demat Account provides a safe and secure way to store securities in electronic form. This eliminates the risk of loss, theft, or damage that physical certificates may face.

- Access to account statements: A Demat Account holder can easily access their account statements, transaction history, and other relevant information online, anytime and anywhere.

- Paperless transactions: A demat account is a paperless mode of trading and investing in securities. It eliminates the need for physical share certificates and makes transactions faster and more convenient.

- Lower costs: Holding securities in a basic service demat account is cost-effective compared to traditional physical certificates. The fees for opening and maintaining a demat account are also relatively low.

- Quick and easy transfer of securities: Securities can be easily and quickly transferred from one demat account to another, simplifying the buying and selling proces.

- Tracking corporate actions: A demat account holder can easily track corporate actions such as bonus shares, stock splits, and dividends. The account is updated automatically, and the securities are credited directly to the account.

Details of a Demat Account

After opening your Demat Account, obtain essential details from your DP:

- Demat Account Number: Also referred to as ‘beneficiary ID’ in CDSL, it consists of 16 characters.

- DP ID: Issued to the depository participant, it forms a segment of your Demat Account number.

- POA Number: Part of the Power of Attorney agreement, it grants your stockbroker permission to manage your account based on provided instructions.

Additionally, you will receive a distinct login ID and password for online access to both your Demat and Trading Accounts.

Opening a Demat Account

You can open a demat account at a central depository like the National Securities Depository Limited (NSDL) or Central Depository Services Limited (CDSL). Thus, you can easily open a demat account online in 4 easy steps:

Choosing a Depository Participant (DP)

You can freely choose which financial entity you may like to open a demat account with. In India, NSDL and CDSL websites have a listed set of DPs to choose from. Thus, you can also check with independent entities if they are registered for a demat account opening.

Open an account

Your registered DP will provide an account opening information of demat account form. Thus, to complete that form, you need the following documents:

- A PAN card,

- An Aadhaar card,

- A copy of a cancelled bank cheque or bank passbook

- Last six months’ salary slips or Income tax returns document

- Passport-size photographs for in-person verification

However, if you want to sell or purchase stock market demat shares, you’ll need a trading account or a broker account with a SEBI- registered broker. A trading account is an additional account provided by stockbrokers for buying and selling securities.

Activation of the Account

Once your demat account is activated, you’ll receive the following information via notifications.

- Your DP identification code: You’ll receive an 8-digit code allotted by all the DPs.

- Demat account number: This 16-digit code is a unique combination of all the DP ID and client ID.

- A CMR copy: A Client Master Report is a digitally signed PDF certificate issued by brokers to clients.

- Login ID & password: A unique login ID and password are generated when opening an account.

- Power of attorney document: It is a document that serves as an authorization letter without which a broker cannot do any trading for the client.

Thus, once your demat account is open, you can purchase and buy stocks, receive corporate benefits like dividends, and much more. Additionally, you can also apply for IPOs of the listed companies and hold other government securities in your account.

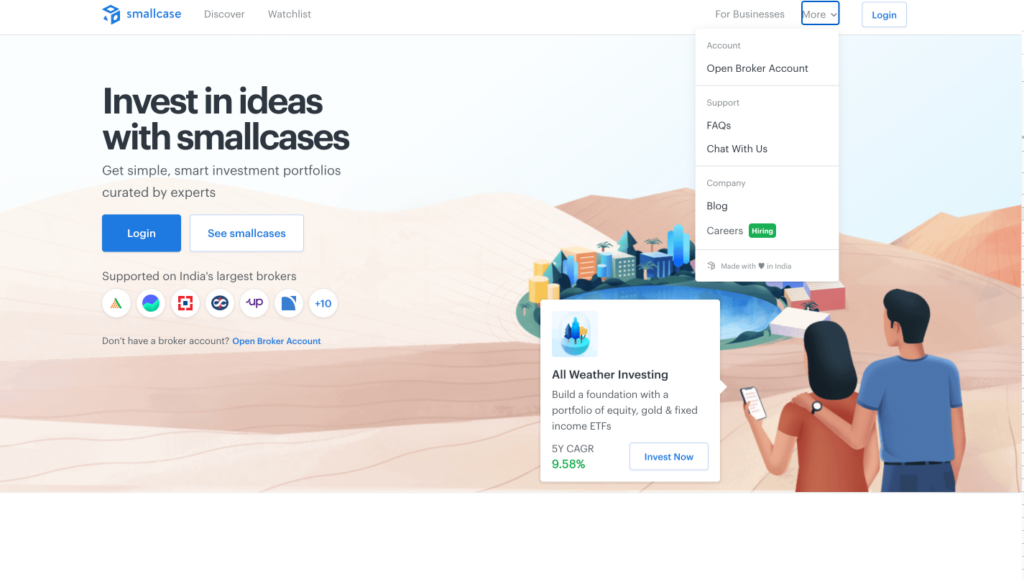

Want to Open a Demat Account Today? smallcase Can Help!

smallcase has partnered with India’s top brokers, like Zerodha, Angel One, 5Paisa, Groww, HDFC securities, Kotak Securities and other top 10 other brokers to give you the most seamless experience.

Therefore, to open a demat account with smallcase, you can follow these steps:

Visit the smallcase website or app, under More section, click on the “Open Account” button.

Fill in your mobile number and enter the OTP received.

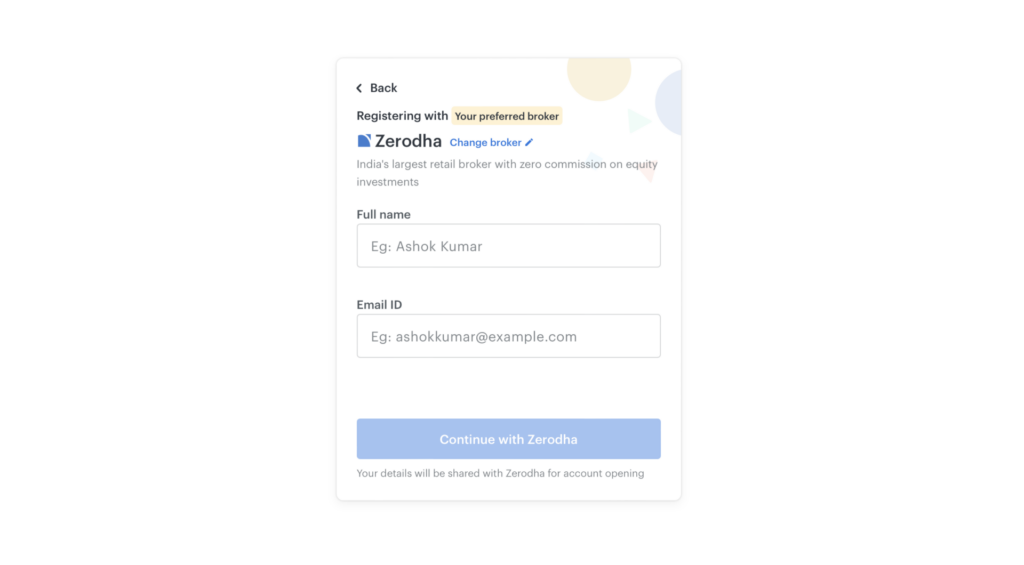

Next, register from the list of the top Indian brokers by adding your name and email ID.

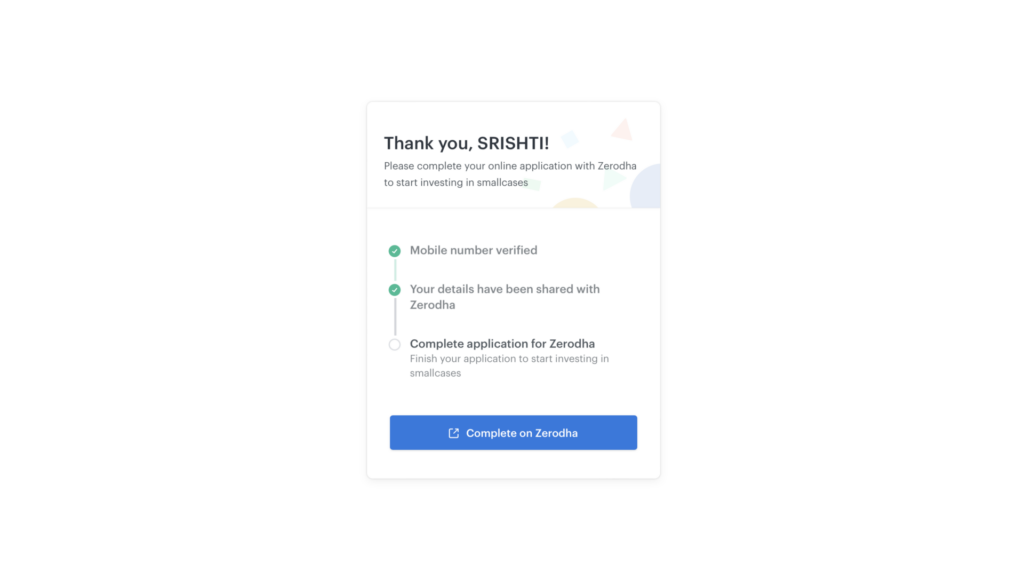

Once the details have been entered, complete your application process at the brokerage platform.

Charges Associated with Opening a Demat Account

Understanding the costs involved in opening a demat account is crucial when we explain demat accounts. Demat account holders are subject to service and maintenance charges imposed by their Depository Participants (DPs). The DPs, such as NSDL or CDSL, charge management fees, which are then passed on to investors. Central bodies regulate the uniform rates charged to DPs, who can, in turn, structure their own fee systems.

A Basic Services Demat Account, capped at INR 2,000,000, incurs five specific charges:

Demat Account Opening Charges

Opening charges, which used to be up to INR 1000, are now predominantly nonexistent. However, some providers may still impose fees.

Demat Account Custodian Fees

While physical securities used to attract custodian fees, demat accounts have largely eliminated this need. Some DPs may still charge a nominal fee based on the number of securities held.

Demat Account Annual Maintenance Charges (AMC)

DPs charge AMC based on transaction volume. For instance, Kotak Securities charges varying rates depending on the number of debit transactions. Annual maintenance charges widely differ among DPs.

Demat Account Transaction Charges

Transaction charges, varying between INR 1.5 to INR 20 per transaction, are crucial for investors to understand. These charges can be a flat fee or a percentage of the transaction amount.

Dematerialization and Rematerialization Charges

Converting physical share certificates to digital records (dematerialization of shares) or vice versa (rematerialisation meaning) incurs specific charges. Additionally, investors may face nominal fees for courier/postal services or re-issuance of delivery instruction booklets.

Documents Required for Opening a Demat Account in India

Opening a Dematerialised account is a straightforward process, requiring essential documents. Here’s a concise list:

Identity Proof with Photo

- Aadhaar card

- PAN card

- Voter ID card

- Driving license

Proof of Residence

- Registered lease agreements

- Driver’s licenses

- Passports

- Landline telephone bills

- Electricity bills

- Apartment maintenance bills (if applicable)

- Copy insurance

- Gas bills

Bank Account Details

- Bank passbook or account statement (not older than three months)

Proof of Income (mandatory for currency and derivatives segment)

- Payslips or taxes

If you’ve been wondering how to buy shares through the purpose of demat accounts, look no further. Learn how to invest in smallcases with a basket of stocks with your demat account. No need to wonder about how to use a demat account, just read on.

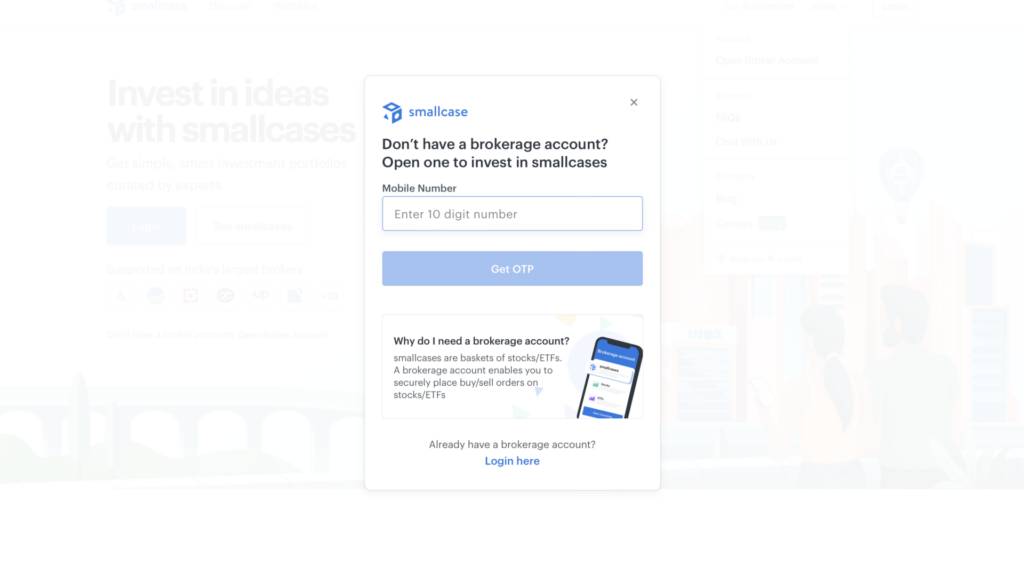

Invest in smallcases with a Demat Account

Don’t have a brokerage account yet? Open one to invest in smallcase.

Investing in a smallcase, a basket of stocks not only gives favourable returns but also diversifies risks with an existing demat account is a straightforward process. Here are the steps to open a demat account online with smallcase:

- Register on smallcase: Once you have a demat account, you need to register on the smallcase platform via a website or by downloading the mobile app.

- Choose a smallcase: Browse through the available smallcases on the platform and choose one that aligns with your investment goals and risk profile.

- Add funds: You need to add funds to your smallcase account to invest in a smallcase. You can do this by linking your bank account with the smallcase account.

- Invest in smallcase: Once you have added funds, you can invest in the selected smallcase by clicking on the “Invest Now” button. You will be prompted to confirm the investment amount and provide your DP details.

- Confirm and Execute the Order: The order will be executed once you have confirmed the investment amount and provided your DP details. The units of the smallcase will be credited to your dematerialisation account, and the investment amount will be debited from your smallcase account.

- Monitor your investment: You can track the performance of your investment in the smallcase by logging in to your smallcase account. You can also receive regular updates and notifications about your investment performance.

Types of Demat Accounts

There are different types of Demat accounts based on the specific needs of an individual or organization. The four main demat account types are:

- Basic Demat Account: A basic demat account is a simplified version of a regular demat account, mainly designed for individuals who wish to hold a small number of securities. This type of demat account is used for basic investment plans and usually has lower maintenance fees and account opening charges.

- Regular Demat Account: A regular demat account is the most common type of a demat account is used to and by individuals, traders, and investors to hold and trade securities. This type of account has no restrictions on the number of securities that can be held or the value of transactions that can be done.

- Repatriable Demat Account: A Repatriable Demat account meaning is designed for non-resident Indians (NRIs) who want to invest in securities in India and repatriate the funds back to their home country. This type of account is subject to certain regulations and requires approval from the Reserve Bank of India (RBI) for opening and maintenance.

- Non-Repatriable Demat Account: A Non-Repatriable account is also designed for NRIs who want to invest in securities in India but do not want to repatriate the funds back to their home country. This type of account is also subject to certain regulations and requires approval from the RBI for opening and maintenance.

Participants of Dematerialization

Let’s delve into the key participants in the Demat process:

Investors

In the world of Demat, investors, whether individuals, firms, or companies, own electronic securities through Demat accounts. These accounts, linked to depositories such as NSDL and CDSL, empower investors to seamlessly trade securities.

Depositories

Think of depositories as digital banks for your investments. NSDL and CDSL, the primary depositories in India, securely hold electronic securities, eliminating the need for traditional paper certificates. Their crucial role lies in connecting companies issuing shares with investors, ensuring secure and regulated management of investments.

Depository Participants (DPs)

Acting as intermediaries registered by SEBI, Depository Participants (DPs) are the linchpin between investors and depositories like NSDL and CDSL. They simplify the process of managing digital securities by facilitating the opening of Demat accounts. DPs play a vital role in ensuring the smooth functioning of India’s securities market.

Issuing Company

The issuing company, a registered legal entity with a depository, takes center stage in the Demat process. Its primary role is to create, register, and offer securities to the public, such as bonds and shares, as a means of raising funds. The issuing company is pivotal in providing investment opportunities for growth and development in the financial market.

How Does a Demat Account Work?

- Account Opening: To open a demat account, you need to choose a Depository Participant (DP) and complete the account opening process, which includes providing personal and bank details, ID and address proof, and signing an agreement with the DP.

- Dematerialization: Dematerialization can begin once your account is opened with the DP. Upon confirmation, the DP credits your demat account details with electronic securities from the issuer or Registrar and Transfer Agent (RTA).

- Trading: Using an online demat account, the account holder can place buy or sell orders online through a broker, and the transaction gets settled automatically.

- Holding Securities: With the best demat account for beginners in India an electronic format eliminates the need for physical shares to demat, and the account holder can view their securities holdings and transactions online.

- Charges: The DP will charge you for account opening, annual maintenance, transaction fees, and other charges. The demat account charges vary depending on the DP and the type of account.

- Corporate Actions: As a demat account holder, you will receive dividends, bonus split shares, and rights issues directly into the account, making the process more efficient and convenient.

- Transfer of Securities: A demat account holder may transfer securities from one demat account to another through the off-market transfer process or the internal transfer process.

How to Use a Demat Account?

To initiate the utilization of a Demat account, commence by selecting a reputable financial institution or broker for account opening. Furnish the requisite documents, including proof of identity and address. Once activated, link your Demat account with your trading account, enabling the smooth transfer of securities between the two.

Your Demat account serves as a secure electronic depository for holdings such as stocks and bonds. Execute trades through the linked trading account, and post-transaction, securities are automatically credited or debited to your Demat account. Regularly monitor your portfolio within the account to stay abreast of performance.

Additionally, be aware of corporate actions like dividends or bonus issues, which are directly credited to your Demat account. Lastly, prioritize security measures, safeguarding your account details and employing additional security features provided by your service provider for a secure and efficient trading experience. Stay informed about any regulatory changes or updated features for a seamless navigation of the dynamic financial landscape.

How Does an NRI Demat Account Work?

Regrettably, non-resident Indians cannot open standard demat accounts. They must opt for either a repatriable demat account, connected to a NRE (non-resident external) account facilitating international money transfers, or a non-repatriable demat account, linked to a NRO (non-resident ordinary) account without the capability to transfer funds abroad. NRI investors are required to designate a power of attorney for transactional activities. The aims and objectives of demat account being established, let’s find out how to choose the ideal demat account for yourself.

How to Choose the Best Demat Account for Yourself?

Now that we know what is demat account in share market, let’s see how you can choose an ideal one for yourself.

Ensure the Cost-Effectiveness of Account Maintenance Charges

Demat accounts incur annual charges regardless of your transactions. To optimize costs, examine the fee structure and select the most economical option.

Simplify the Account Opening Process

Choose a depository account type participant with a quick and hassle-free Demat account opening process, aligned with SEBI guidelines. E-KYC can streamline this procedure.

Seek a Unified Platform for Broking and Banking

Opt for a Demat account that doubles as a trading account, facilitating seamless money transfers during share transactions via the Demat app. This integration not only simplifies transactions but also reduces costs.

Explore Customized Analytics for Account Holdings

Enhance earnings with online analytics tailored to your choice of shares and investment habits. When selecting Demat account examples, consider value-added features like personalized analytics.

Evaluate the DP’s commitment through quick Dematerialization Turnaround Time

Assess the Depository Participant’s dedication to investors by checking features such as a shorter turnaround time (TAT) for share Dematerialization.

Demat Account and Trading Account

A Demat Account is essential for managing your shareholdings, while a Trading Account is necessary for executing buy and sell orders in the stock market. It’s crucial to distinguish between the two. A Demat Account holds your share and securities details, while a Trading Account facilitates share transactions. Banks and brokers often provide online Trading Accounts, simplifying stock market participation for everyday investors.

Benefits of a Demat Account

A Demat account offers several benefits to investors, including:

- Safe and Secure: A demat account makes buying, selling, and holding securities easy and convenient. The account eliminates the risks associated with physical certificates, such as loss, theft, or damage.

- Easy and Convenient: A joint demat account methodology makes it easy and convenient to buy, sell, and hold securities. You can access your account online and make transactions from anywhere at any time.

- Reduced Transaction Costs: With a demat account, you can avoid the high transaction costs associated with physical securities, such as courier charges, stamp duty, and handling fees.

- Faster Settlement: This enables you to take advantage of market movements quickly and reduces the time to complete a trade.

- Multiple Investment Options: With a Demat account, you can access a wide range of investment options, including equity shares, bonds, mutual funds, and exchange-traded funds (ETFs).

- Loan Against Securities: A Demat account also allows you to avail loans against the securities, providing liquidity and flexibility to meet your financial needs.

- Corporate Benefits: Investors holding securities in a Demat account are also eligible for various corporate benefits, such as dividends, bonus shares, and rights issues.

Things to Remember When Opening a Demat Account

Here are a few things to remember if you are considering opening a Demat Account::

- Choose a Trusted Depository Participant (DP): Opt for a reliable DP, like a well-established bank or reputable brokerage firm, to ensure the security of your Demat account.

- Understand the Fees: Be aware of account opening charges, annual maintenance fees, transaction fees, and other associated costs. Compare these fees across different providers for an informed decision.

- Check Services and Offerings: Evaluate the DP’s services, including online access, customer support, research reports, and additional features. Ensure the DP aligns with your needs and provides the necessary tools for effective investment management.

- Review Terms and Conditions: Thoroughly read and grasp the terms, rights, and obligations linked to the Demat account. Pay special attention to clauses regarding account closure, freezing, or any restrictions impacting your investment activities.

- Complete Documentation: Provide accurate and complete documentation required for Demat account opening, including identity proof, address proof, PAN card, and other specified documents.

- Secure Account Credentials: Safeguard your Demat account details and login credentials with the same level of security as your banking login details to protect your investments.

What is the Importance of a Demat Account?

A Demat account offers a secure and convenient way to digitally hold shares and securities, eliminating concerns like theft, forgery, and physical certificate damage. It enables immediate securities transfer upon trade approval. Events such as stock bonuses and mergers automatically reflect in your account.

Accessing your Demat account information is effortless through an online login. Trading can be done on-the-go via smartphone or desktop, eliminating the need to visit the stock exchange. Reduced transaction costs result from the absence of stamp duty. These features foster increased trade volume, enhancing the potential for lucrative returns.

The Demat account has streamlined stock handling, aligning with the T+2 settlement cycle on Indian exchanges. Following this cycle, payment to the seller occurs on the second business day, and purchased securities are automatically credited to your Demat account. This makes the security trading process seamless and hassle-free.

To Wrap It Up…

To conclude, a demat account has become an essential requirement for anyone interested in trading or investing in the Indian stock market. Thus, by replacing physical share certificates with digital ones, it has revolutionized the way we trade and invest.

Additionally, demat accounts offer a range of benefits such as faster settlements, easier access to company information, and the ability to buy and sell securities online. Overall, a demat account is a must-have for anyone looking to invest in the Indian stock market.

So, if you are looking to invest in smallcase, open a demat account today!

FAQs

A Depository Participant (DP) receives a distinctive 8-digit code known as DP ID from the Depository. This code is crucial for identifying the DP within a demat account, where an investor’s securities are stored electronically, ensuring seamless and secure share transfers.

Opening a Demat account is free, but there are some additional charges. After the initial year, there’s a nominal Annual Maintenance Charge (AMC) of Rs 20 per month plus taxes.

To initiate your stock investment journey, open a Demat and trading account with a registered DP/broker. Link your Demat account to your bank account for fund transfers, and provide purchase instructions for the desired stocks.

In addition to the Demat account opening fees, you may need to cover an annual maintenance charge. These fees, billed yearly, typically range from Rs. 300 to 800, depending on your Depository Participant (DP) and transaction value.

To transfer money from your demat account to your bank account:

1. Log in to your trading account.

2. Navigate to the “Fund Transfer” or “Withdrawal” section.

3. Select the demat account.

4. Enter transfer details, including the amount and bank information.

5. Review and confirm the transaction.

6. Authorize the transfer, which may involve an OTP.

7. Receive confirmation via the platform and check your email or transaction history.

All About Demat Accounts on Smallcase –

Learn what are demat accounts, how to use them, process to open a new demat account with the multiple broker supported on smallcase platform. Below is the list of such articles to help you with the Demat process –