Analyzing The Indian IT Sector’s Earnings Season: Q1 FY24 Report Card

The Indian Information Technology (IT) sector is poised at a challenging crossroads as we enter the earnings season for the first quarter of the fiscal year 2024. Analysts tracking the sector have observed that the weakening demand, instigated by recession fears in the United States and recent wage hikes, is likely to exert pressure on Q1 earnings.

The banking and financial services sector, contributing nearly 30% to IT companies’ earnings, is yet to see a rebound in orders. Adding to the prevalent scenario, declining consumer spending and weak demand from the North American region make the situation tougher for tech companies.

In this blog post, we will provide an in-depth analysis of the IT sector’s earnings season for Q1 FY24, focusing on three industry giants – Tata Consultancy Services (TCS), HCL Technologies, and Wipro. We’ll discuss their performance, management’s outlook, and the future implications for the sector.

Check out Wright Research smallcases here

IT Sector Overview

The Indian IT sector has faced significant headwinds, resulting in a shrinking share of corporate profits. In Q4 FY23, the sector’s share of overall profits reached a 21-quarter low of 9.7%, down from 34% in Q4 FY20. The sector experienced a slowdown, with quarterly profit contracting by 10.5% YoY and a sequential drop of nearly 7% in the March quarter. Topline growth also slowed to 12% from 26.5% in Q4 FY22. Rising employee costs have further pressured margins. The outlook for the June quarter earnings is not optimistic, with factors such as discretionary spending slowdown, reduced client budgets, higher costs, transition costs, and pricing pressures expected to impact earnings. Revised sales growth outlooks for FY24 are anticipated among major players in the sector.

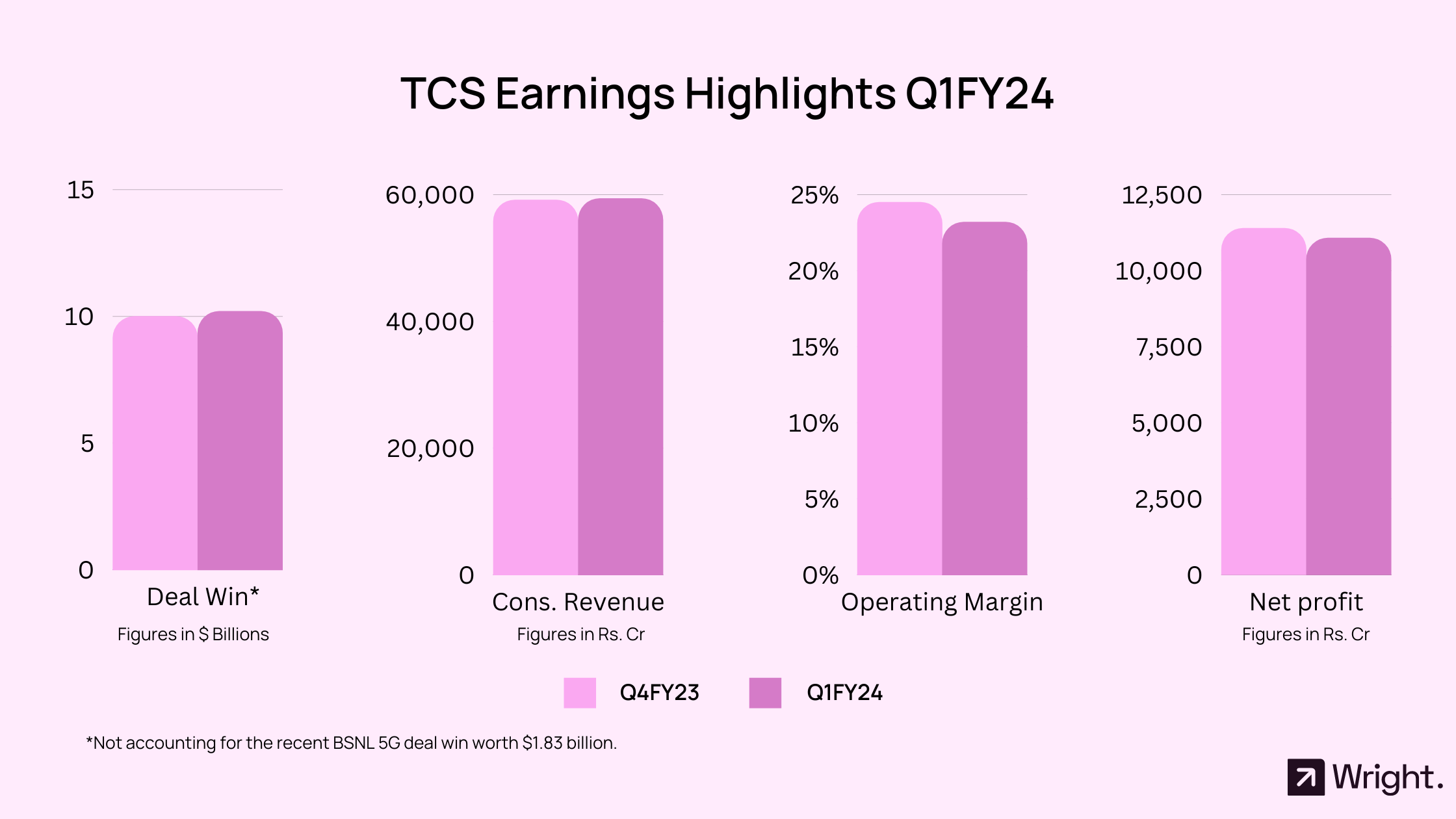

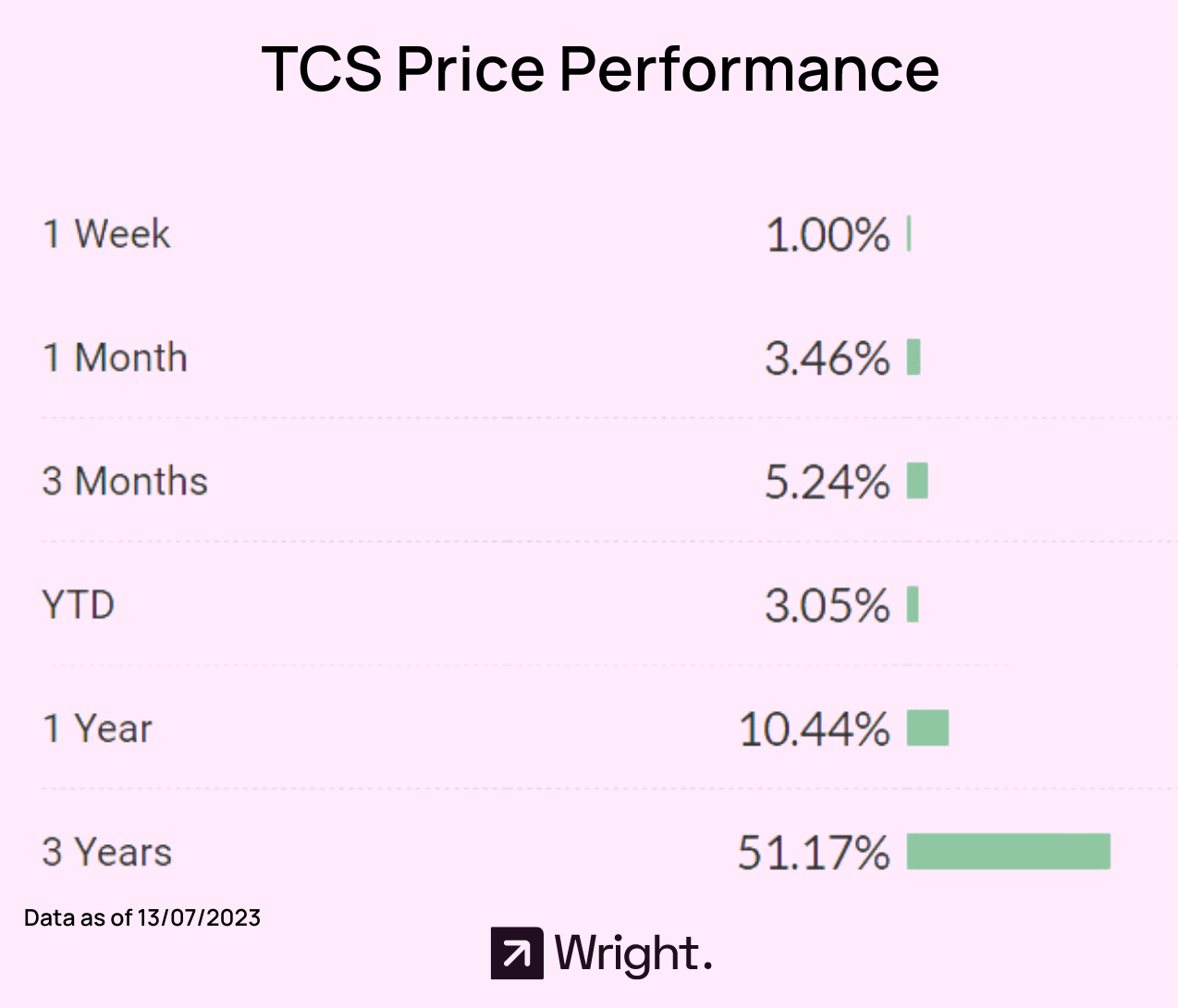

TCS Earnings Q1 FY24: Resilience Amid Global Challenges

Despite a challenging quarter globally, TCS, the largest software services exporter in India, exceeded muted analyst expectations with a 16.8% growth in net profit and a 12.5% rise in revenue from operations. Although there was a slight decrease in profits compared to the previous quarter, TCS demonstrated resilience and promising growth. However, the company’s operating profit fell by 5% and operating margin declined from 24.5% to 23.2% in Q1FY24, indicating pressure on profitability due to factors such as salary hikes and macroeconomic headwinds, resulting in a 130 basis point drop in margin. The salary hikes alone accounted for a 200 basis point impact on the operating margin.

Tata Consultancy Services (TCS) has demonstrated a strong performance in Q1FY24, with a total contract value (TCV) of $10.2 billion, excluding the recent BSNL 5G deal win worth $1.83 billion. This robust TCV indicates a healthy demand for TCS’s services and promising future revenue streams. Furthermore, TCS’s competitive edge in the UK Life and Pensions market is reaffirmed by securing the UK NEST deal worth $1 billion. While growth in the BFSI sector has been modest and contributions from other areas limited, the life sciences segment has shown potential. TCS’s top management’s optimistic outlook and focus on emergent technologies, particularly generative AI, demonstrate their commitment to innovation and strategic investments in new technologies, positioning TCS as a forward-looking company aiming to sustain its leadership position in the market.

Despite a challenging global economic environment, TCS’s solid market position and ability to navigate difficult market conditions are evident in their Q1FY24 performance. However, the drop in margin suggests the need for strategies to improve profitability in the future. Overall, TCS’s strong TCV, successful deal wins, and management’s focus on innovation contribute to a positive outlook for the company, signaling its resilience and adaptability in a competitive market.

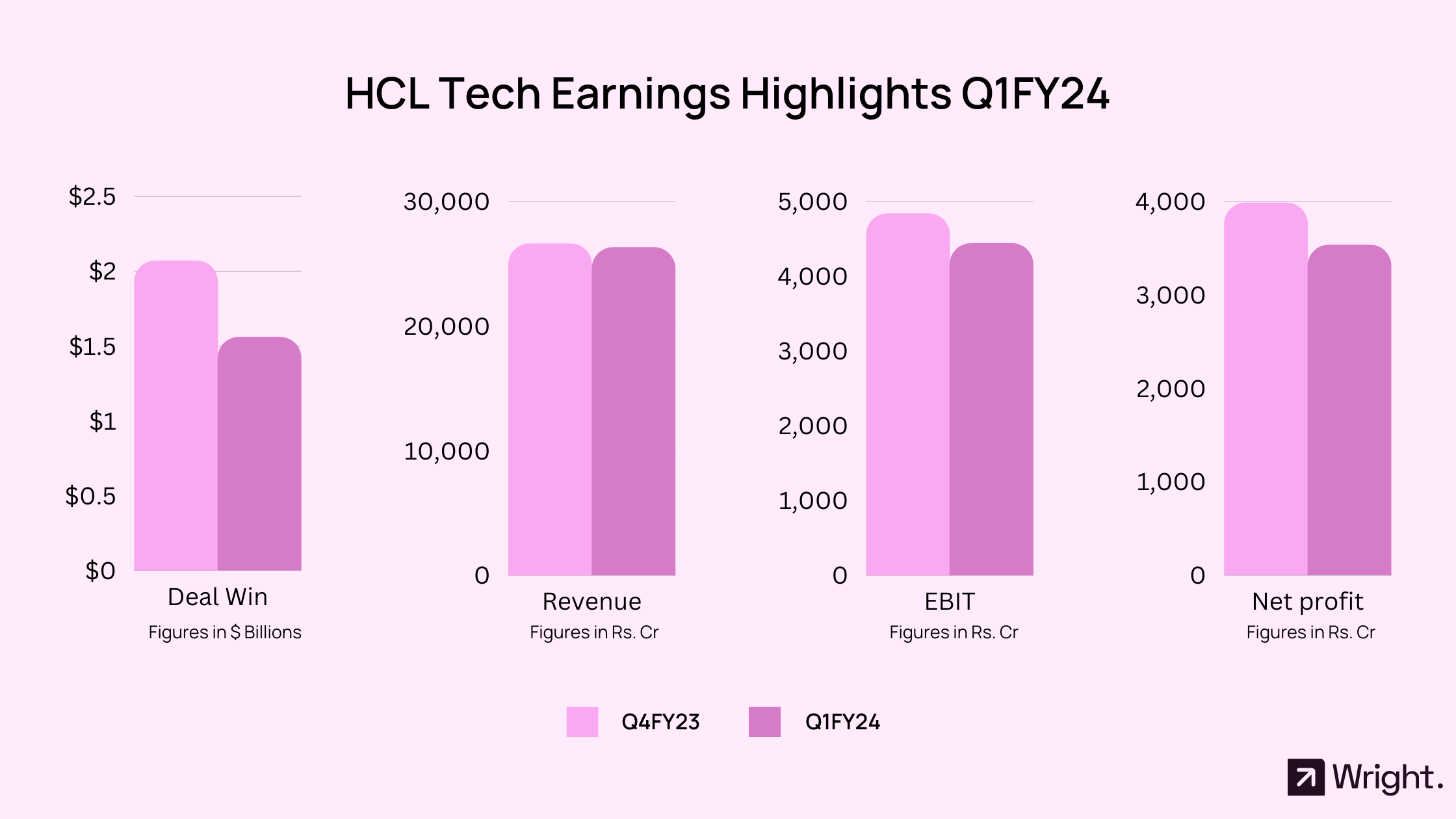

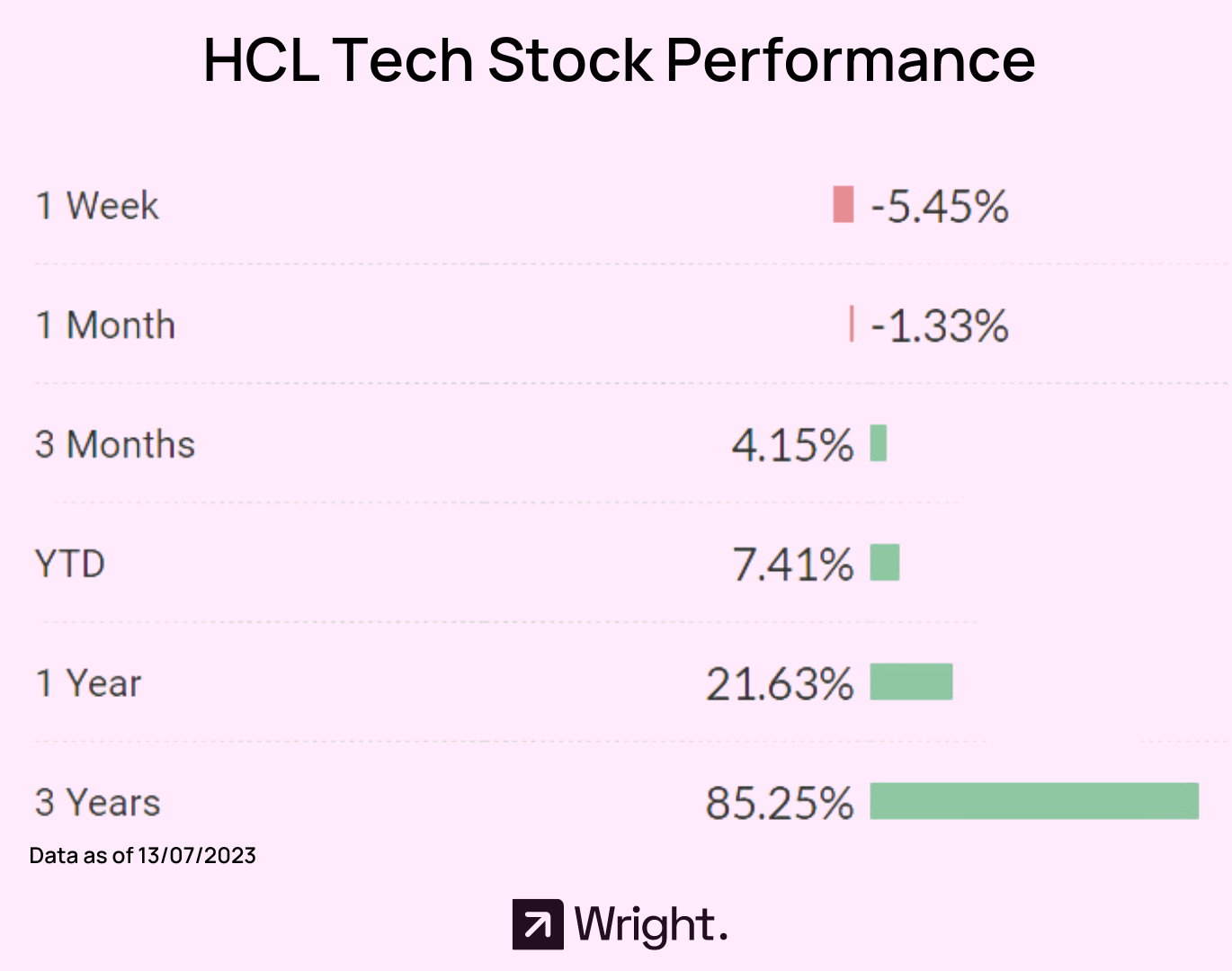

HCL Earnings Q1 FY24: A Mixed Bag

HCL Technologies’ Q1 FY24 performance shows a mix of robust YoY growth and sequential downturns. The company reported a promising 7.6% YoY growth in net profit, but saw an 11.2% sequential drop. While its consolidated revenue showed a healthy YoY increase of 12%, the quarterly results indicate a minor sequential decline of 1.2%. This can largely be attributed to deal ramp-downs in sectors like Hi-tech and telecom.

HCL Technologies’ Q1 FY24 performance displayed a mixed picture with robust year-on-year (YoY) growth but sequential downturns. The company reported a promising 7.6% YoY growth in net profit but experienced an 11.2% sequential drop. Consolidated revenue showed a healthy YoY increase of 12%, but there was a minor sequential decline of 1.2%. The operating margin slipped from 18.25% to 16.9% in Q1 FY24, indicating a compression in profitability. The company has also deferred annual salary review and compensation revisions by a quarter, further impacting operating margins.

In terms of verticals, engineering and R&D services witnessed a 5.3% decline in revenue quarter-on-quarter (QoQ), while IT and Business Services saw a marginal uptick. Deal wins also decreased compared to the previous quarter.

The CEO’s commentary highlights the company’s efforts to cope with a challenging demand environment. The assurance that other verticals will pick up, supported by large deals offsetting cuts in discretionary spending, brings some optimism. HCL Technologies retained its guidance of 6-8% constant currency revenue growth for FY24 and an operating margin of 18-19%, indicating confidence in its business strategies for the fiscal year.

While there’s no denying that HCL Tech’s Q1 FY24 performance shows some signs of struggle, with profit and revenue taking a hit, the management’s outlook indicates that the company is actively navigating these challenges. However, their strategies would need to be monitored closely in the forthcoming quarters for signs of actual recovery and growth.

Wipro Q1 FY24 Earnings: A Mix Bag of Performance and Bold Future Investments

The Azim Premji-backed IT giant reported a consolidated net profit of ₹2,870.1 crore, an 11.95% YoY increase, suggesting a strong ability to manage costs and maintain profitability even in the face of weakened demand. In terms of revenue, the company reported a 6.0% YoY growth, reaching ₹228.3 billion ($2.8 billion). The IT Services segment revenue saw a slight increase of 0.8% YoY to $2,778.5 million. This slow growth was anticipated, given the ongoing economic headwinds, and should be viewed as a positive indicator of Wipro’s resilience.

The decrease in Non-GAAP constant currency IT Services segment revenue by 2.8% QoQ, however, indicates a slowdown that needs to be closely monitored in the coming quarters. Conversely, the YoY increase of 1.1% is in line with the broader IT services industry’s performance. The Total Bookings and large deal bookings numbers, $3.7 billion and $1.2 billion respectively, were up by 9% YoY. These figures highlight Wipro’s ability to secure major contracts in a competitive environment, setting the stage for potential future revenue growth.

Looking ahead to Q2 FY24, Wipro expects the IT Services business segment revenue to fall within the range of $2,722 million to $2,805 million. This prediction translates to a sequential guidance of -2.0% to +1.0% in constant currency terms. This cautious stance reflects the ongoing macroeconomic uncertainties and the potential impacts on Wipro’s business. Wipro’s management has acknowledged the reduction in clients’ discretionary spending but also highlighted the company’s new business momentum. Future revenue environment might be softening, Wipro’s strategy of bolstering AI capabilities is likely to set it on a promising path, strengthening long-term growth potential.

Notably, Wipro announced a significant $1 billion investment in AI over the next three years. This capital will be dedicated to strengthening the company’s foundation in AI, data, and analytics capabilities, and constructing new consulting capabilities. The company has also unveiled Wipro ai360, an AI-first innovation ecosystem, promising to train its entire workforce of about 250,000 employees on AI within the next 12 months. These initiatives place Wipro at the forefront of the AI revolution, driving innovation, and fostering an AI-centric culture internally.

In conclusion, Wipro’s Q1 FY24 performance was a blend of resilience, strategic growth initiatives, and some minor challenges. The company’s strategy of focusing on AI and operational improvements seems to be laying the groundwork for sustainable growth in the future, but the softening revenue environment could pose challenges. Thus, Wipro’s management would need to continue leveraging their strengths and address any vulnerabilities to navigate the path ahead.

Tier 1 vs Tier 2 IT Companies

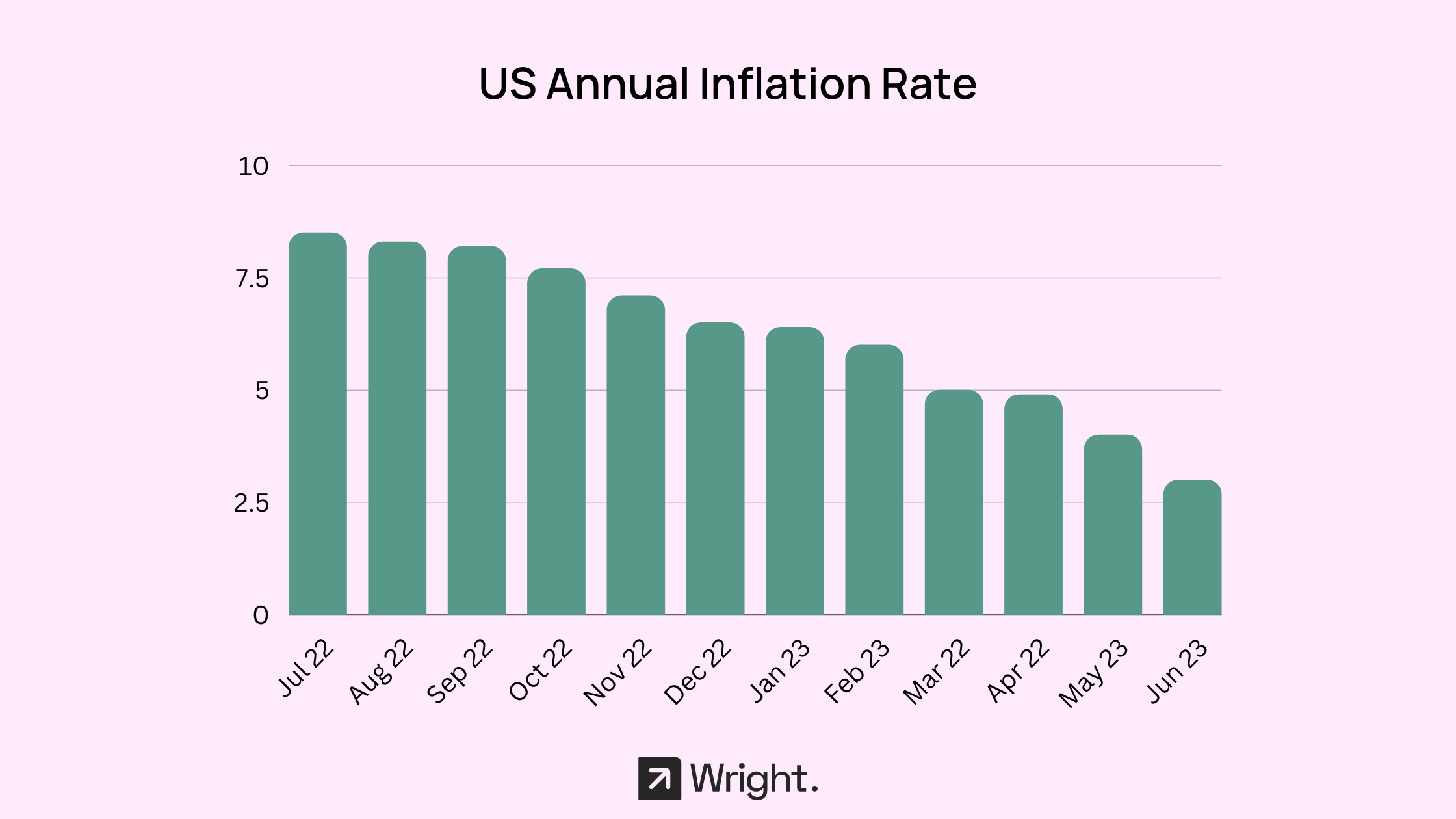

Analysts expect Tier-2 IT companies to outperform Tier-1 peers in terms of QoQ revenue growth. Tier-2 companies are predicted to achieve a 2.8% growth, while Tier-1 companies are expected to lag behind at 0.2%. Despite this expectation, brokerages tend to favor Tier-1 companies due to their anticipated better profit margins, even if their revenue numbers might disappoint. Wage hikes and weak topline are expected to exert margin pressure on IT companies, although some companies like LTI Mindtree are expected to show margin expansion. The global economic factors, including inflation, can significantly impact the business environment. The US inflation rate cooled to 3% annually in July, potentially leading to the US Federal Reserve meeting its long-term inflation target of 2% sooner than expected.

In summary, Tier-2 IT companies are expected to outperform Tier-1 peers in terms of QoQ revenue growth, but Tier-1 companies are still preferred due to anticipated better profit margins. Wage hikes and weak topline might pressure margins, but some companies may showcase margin expansion. The global economic factor of inflation, which cooled in the US, can impact the business environment.

Such dynamics bear significant implications for the Indian IT sector, given considerable exposure of Tier 1 IT companies to US markets. The cooler-than-expected inflation in the US could moderate the urgency of rate hikes, offering some relief to IT companies contending with cost pressures and potentially affecting the sector’s earnings in the coming quarters

What to expect this earnings season for the IT Sector?

While the immediate outlook seems challenging, it’s crucial to remember that the IT sector remains at the heart of digital transformation efforts worldwide. The demand for new technologies such as cloud, artificial intelligence , cybersecurity, and digital transformation initiatives continues to grow. The need for these services might alleviate some of the pressures faced by the sector, providing future revenue visibility

In a challenging global economic environment, the Indian IT sector’s Q1 FY24 performance shows signs of resilience, adaptability, and strategic foresight. Despite pressures on profitability and slowdowns in certain verticals, companies are actively navigating these challenges, focusing on innovation and strategic investments in emerging AI technologies. The forthcoming quarters will be critical to watch as they may provide a clearer indication of actual recovery and growth in the sector.

The path to recovery for the IT sector remains a subject of debate. Some analysts predict a quicker recovery by the second half of this fiscal, while others anticipate a more gradual recovery, extending into FY25. This divergent outlook reflects the uncertainties that still surround the sector.

Therefore, as we navigate through this earnings season, it would be wise to adopt a cautious yet optimistic approach. It’s worth noting that these cycles of ups and downs are inherent to any industry, and what matters most is the industry’s ability to adapt and innovate amidst these challenges.

Stay tuned for updates as the sector’s heavyweights, TCS and HCL, have released their results, and Wipro is set to announce theirs shortly. These announcements will undoubtedly offer a more precise understanding of the current state and the future direction of the Indian IT sector.

LIVE WEBINAR + Q&A with Sonam Srivastava & Smallcase on Unleashing the Power of Momentum: Factors to Consider before Investing in Small Cap

Check out Wright Research smallcases here

Liked this story and want to continue receiving interesting content? Watchlist Wright Research smallcases to receive exclusive and curated stories.

Disclosure:

This is not an investment advise.

Disclosures: https://www.smallcase.com/manager/wright-research#disclosures

SEBI Registration Details: Corporate Registered Investment Advisor | Company Name: Wryght Research & Capital Pvt Ltd Reg No: INA100015717 | CIN: U67100UP2019PTC123244. For more information and disclosures, visit our disclosures page here.

Wright Research

Wright Research