Complete Guide to India’s Renewable and Green Energy Sector: Top Clean Energy Stocks

Global renewable energy production has doubled in the last decade but accounts for only 13% of primary energy consumption, with a 14% rise in energy demand and a 5% increase in emissions; India’s clean energy and renewables efforts, alongside green hydrogen and electric vehicles, are explored with a focus on historical context, regulatory measures, and the aim to achieve net-zero emissions by 2050.

India’s Clean Energy, Electric Vehicles & Renewable Energy Snapshot

India, as the world’s 3rd largest energy consumer, maintains below-average greenhouse gas emissions per capita, despite consistent 6-7% GDP growth, emphasizing the importance of energy security; it ranks 4th globally in installed renewable energy capacity, including hydro, wind, and solar, and is among the fastest-growing markets for electric vehicles (EVs).

Clean Energy & Renewable Energy

- In India, coal contributes 44% to energy consumption, while petroleum accounts for 24%, and natural gas for 6%, posing energy security risks due to high oil and gas imports;

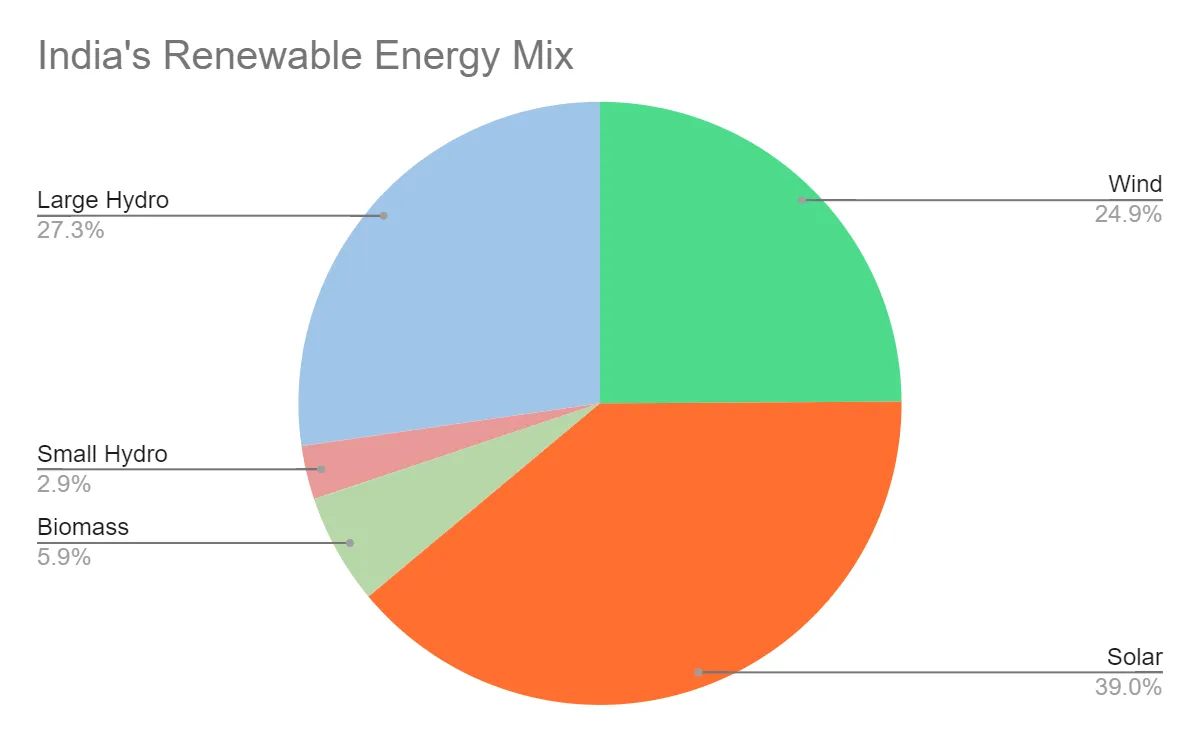

- However, non-fossil fuel capacity has surged by 396% in 8.5 years, with a 9.83% YoY growth in renewable energy additions in 2022, outpacing investments in oil production, and solar energy capacity skyrocketing to 67.07 GW, contributing to a total installed renewable energy capacity of 179 GW as of July 2023.

Electric Vehicles

- In India, 90% of the 2.3 million electric vehicles (EVs) are 2-wheelers or 3-wheelers, with over 50% of 3-wheeler registrations in 2022 being EVs, driven by a $1.3 billion government investment plan, resulting in over 700,000 EV sales in the first half of 2023;

- However, there was a decline in 2-wheeler EV sales in May, June, and July, possibly due to reduced subsidies under FAME for 2.

India’s Clean Energy, Electric Vehicle & Renewable Energy Commitments

India’s ambitious clean energy goals include reducing carbon intensity by <45% by 2030, achieving 50% cumulative renewable electric power by 2030, and net-zero carbon emissions by 2070.

The government plans to achieve these through a 50 GW annual bidding trajectory from FY2024 to FY2028, targeting 500 GW of non-fossil fuel-based capacity by 2030. The National Electricity Plan aims for 277.2 GW peak electricity demand in 2026-27, with 57.4% non-fossil capacity, potentially increasing to 68.4% by 2031-32.

Additionally, 59 solar parks of 40 GW are approved, 30 GW of offshore wind energy is targeted by 2030, and green hydrogen production is set at 5 million tonnes by 2030. India aims to electrify 30% of total mobility by 2030 and invest approximately $266 billion between 2020 and 2030 for EV transition. Projections include 10-12% 2-wheeler EVs, 14-16% 3-wheeler EVs, and 11-13% electric buses by FY2025. The estimated investment opportunity to achieve net-zero emissions by 2070 exceeds $12.7 trillion.

Strong Government Initiatives for Clean Energy & Renewable Energy Development

India has implemented various government initiatives to advance its renewable energy goals, offering incentives for production. These include:

- Allowing up to 100% Foreign Direct Investment (FDI) in renewable energy under the automatic route.

- A $2.4 billion National Hydrogen Mission with a goal to produce 5 million tonnes of green hydrogen by 2030.

- Additional funding of $36 million for hydrogen production.

- Support for 4 GWh of Battery Energy Storage Systems and development of Pumped Storage Projects.

- $1.02 billion for infrastructure supporting 13 GW of renewable energy in Ladakh.

Key policies and schemes include:

- RBI mandates banks to allocate 40% of credit to priority sectors, including renewable energy.

- Jawaharlal Nehru National Solar Mission aims for 20 GW of grid-connected solar power by 2022.

- Perform-Achieve-Trade (PAT) scheme promotes energy efficiency in industries.

- National Hydrogen Mission focuses on generating hydrogen from green sources.

- FAME scheme offers subsidies to boost electric and hybrid vehicle adoption.

- Production-Linked Incentive (PLI) schemes cover solar PV modules, auto, auto components, and Advanced Chemistry Cells (ACC).

- US-India RETAP collaboration prioritizes green hydrogen and wind energy development.

These initiatives and policies play a crucial role in bridging the energy supply-demand gap and achieving India’s net-zero emissions objectives.

Can India achieve Net Zero Emissions by 2050, forget 2070?

India is prioritizing energy security through diversification, including expanding exploration and production, embracing green hydrogen, clean energy, and offshore wind, and transitioning to a net-zero emission economy with reduced reliance on fossil fuels.

New Energy Outlook: India by BloombergNEF has conducted a detailed analysis to understand how India can achieve net-zero emissions by 2050. Here is a summary of the analysis –

- Renewables Dominance: Maximize deployment of solar and wind energy, aiming for a capacity increase to 2,998 GW by 2050, contributing 80% to electricity supply.

- Grid Flexibility: Implement grid flexibility solutions like energy storage (batteries, pumped hydro-storage) and parker gas plants to manage the variability of wind and solar power.

- Investment: Increase annual investment levels to $438 billion (about 5% of GDP) to support renewable energy growth and an additional $870 billion for carbon capture and storage (CCS) to offset fossil fuel emissions.

- Electric Vehicles: Allocate $3.9 trillion for electric vehicle deployment, with falling battery costs expected to accelerate adoption and boost local manufacturing.

- Industrial Emissions: Address rising industrial CO2 emissions by leveraging green hydrogen and CCS technologies, with industrial emissions peaking in 2031 and declining from the mid-2030s.

- Green Hydrogen: Expect a tenfold increase in green hydrogen demand by 2050, particularly in industries like steel through the use of hydrogen-fired direct-reduction furnaces.

While strides are being made, there are several challenges in integrating renewable energy into India’s energy security plan. One of the key obstacles is the high initial capital cost required for setting up renewable energy infrastructure. This is often compounded by regulatory hurdles and land acquisition issues.

- Timely tender completion, risk mitigation during execution, and strengthening the domestic solar supply chain are crucial for renewable projects, as India’s solar module manufacturing capacity is around 20-25 GW, but it heavily depends on Chinese imports for solar cells and wafers, highlighting the need for supply chain fortification, while grid infrastructure modernization is essential to handle renewable energy intermittency.

Top Clean Energy & Renewable Energy Stocks in India

Top Pureplay Clean Energy Stocks #1 – INOX Wind

Inox Wind is an India-based integrated wind energy solutions provider – providing a full suite from manufacturing wind turbine generators to doing EPC, operations & maintenance, wind farm development and more.

- Inox, with a strong order book of 1,327MW, achieved EBITDA positivity in Q1 FY24 after receiving Rs. 500cr in capital infusion from promoters for debt repayment and balance sheet strengthening, aiming to become net debt-free and projecting a Free Cash Flow of ₹600-1000 crore starting from FY25.

- While anticipating increased demand due to stabilized power tariffs and emphasizing innovation and sustainability, though non-compliance issues were reported in June 2023 regarding incomplete simulation tests.

In the past month, Inox’s performance was choppy with -2% returns, while over 6 months it delivered 92% returns, 68% over 1 year, and has a 15.84% CAGR over the long term.

Top Clean Energy Stocks #2 – Suzlon

Suzlon Energy is a renewable energy solutions provider that designs, manufactures, installs and services wind turbines. It is one of the largest wind turbine manufacturers in India and operates in 17 countries across different continents.

- Suzlon holds a 33% domestic market share, boasts 20GW of operational global wind power capacity, and has reduced its leverage from 10x debt/EBITDA to 1x debt/EBITDA through debt restructuring and rights issues, while maintaining a healthy order book at 1.6 GW

- However, it reported a significant 95.8% YoY decline in net profit and a 2% YoY fall in revenue in the June quarter, with a historical track record of financial instability and past instances of defaulting in 2013 and 2019, and its US unit filing for bankruptcy in 2021.

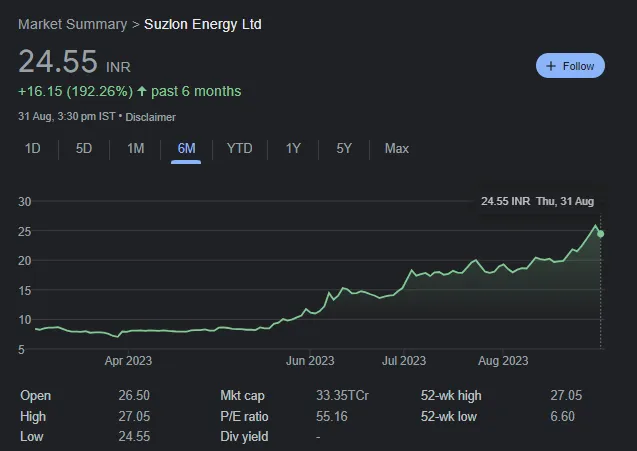

The stock has seen returns of 27.20% in the last month, 192% in the past 6 months, 203% over the last year, and a 30.57% CAGR over 5 years.

Suzlon Energy due to high leverage, regulatory challenges and reduction in demands saw its value drop. Given the last few years have been shaky for the stock, we need to wait and see how sustainable are the earnings of this green energy stock.

Top Clean Energy Stocks #3 – Adani Green Energy Limited

Adani Green Energy is a pureplay clean energy and renewable energy stock. It is part of the larger Adani Group.

- In the June quarter, the company expanded its renewable energy capacity by 43% to 8,316 MW, adding 1,750 MW of solar-wind hybrid capacity, 212 MW of solar capacity, and 554 MW of wind power plants, with a target of reaching 45 GW by 2030;

- It achieved a 70% increase in energy sales to 6,023 million units, a 51% rise in net profit to ₹323 crore, and a 33% growth in revenue to ₹2,176 crore, while EBITDA margin expanded to 95.6% from 58%, and hybrid energy sales surged by 1,546% to 2,206 MW due to capacity addition and improved utilization.

The Hindenburg report prompted Adani Group to focus on deleveraging, reducing its net debt-to-EBITDA ratio from 7.6 times in 2013 to 3.2 times by March 2022, but it has risen to approximately 4.1 during FY23, with a total debt of about Rs. 2.27 trillion; their goal is to bring it down to 3.1 times by FY2024, making this a critical aspect to monitor.

Top Hybrid Clean Energy, Renewable Energy & Green Hydrogen Stocks in India

Top Hybrid Clean Energy Stocks #1 – TATA Power

Unlike many utility companies that are slow to transition away from fossil fuels, Tata Power has been aggressively increasing its renewable energy portfolio.

- Tata Power aims for net-zero carbon emissions by 2045, with a 2.3% CAGR in thermal portfolio growth and an 18.4% CAGR in renewable portfolio growth from March 2015 to March 2023.

- They have a total renewable energy capacity of 7,815 MW, 4,132 MW operational (3,139 MW solar, 993 MW wind), an order book of nearly Rs. 100 billion as a solar EPC company, 100,000 installed solar pumps, solar rooftops in 275 districts, and a 4 GW solar module manufacturing capacity.

Looking at the stock’s performance, Tata Power has generated a return of 20.36% over the past 6 months. On a 1 year horizon the company has performed at a relatively poor 3.79%, however over a 5 year horizon has generated a CAGR of 26.82%.

Short-term performance is declining, but the long-term outlook appears bullish; Q1FY24 shows a 5% YoY revenue increase to ₹15,484.71 crore, 15th consecutive quarterly net profit rise, and a 43% EBITDA growth to ₹3,005 crore.

Top Hybrid Clean Energy Stocks #2 – NTPC

NTPC, India’s largest government-owned power generation company, has a renewable energy subsidiary, NTPC Renewable Energy Limited, which is yet to go public; however, NTPC is not solely a green energy stock as it also operates in non-renewable energy sectors.

- 3.3GW of installed operational renewable energy capacity and 20GW of pipeline capacity

- It plans to set up 16 GW of renewable energy capacity in the next 3 years of which 12GW will be mounted solar, 1GW of floating solar, 3-4 GW of wind.

- It plans to implement 60GW of renewable energy capacity by 2032 and plans to be a major player in the green hydrogen energy and energy storage technology space

Over a 1 month horizon NTPC has performed negatively, giving -2.66% returns, but over a 6 month window it has given 27.23% returns and 36.37% over a 1 year horizon. On a longer term horizon of 5 years, the stock has given only 9.21% which is mediocre.

It reported a 23% rise in consolidated net profit at ₹4,907 crore for Q1FY24. Revenue from operations was marginally lower at ₹43,075.09 crore. Operating margins improved from 17.67% a year ago to 20.72% in Q1FY24.

Top Hybrid Clean Energy Stocks #3 – JSW Energy

JSW Energy is a significant player in India’s power generation sector and a subsidiary of the JSW Group. It has a mixed energy portfolio with 6.6GW of cumulative power generation capacity of which 3.2GW is in thermal energy, 1.4GW in Wind energy, 1.4 GW in Hydropower and 657MW in Solar energy – balance is in under-construction.

- Despite declining net profit and revenue, the company achieved an 18% YoY growth in EBITDA, with a potential Rs 110 crore recovery in the future; power demand remained flat in April and May but rebounded in June and July

- JSW Energy plans to expand its renewable assets to 6,000-7,000 MW, commission a 1GW solar module manufacturing factory, a green hydrogen unit producing 3,800 tonnes/year, and a battery energy storage system by 2025.

The stock has given 18.4% over 1 month and given nearly 50% over 6 months. However on a 1 year horizon, the stock hasn’t given any returns. On a 5 year horizon the stock has delivered a CAGR of 41.73%.

JSW Energy is primarily focused on renewables, maintaining a strong balance sheet with low debt ratios and substantial cash reserves of Rs 2,572 crore as of June 2023, reflecting optimism for future performance.

Top New Entrant Renewable Energy Stocks in India

Top New Entrants Clean Energy Stocks #1 – Reliance Industries

Reliance Industries has decades of experience in gas exploration and production capabilities. It is now looking to foray into green and renewable energy, and like most things Ambani does – this could be a big move.

- Reliance Industries plans to establish a gigafactory for battery production, commercialize sodium-ion battery technology, invest ₹750 billion in a new energy manufacturing ecosystem, and aims for 100 GW of clean energy by 2030, with a vision to make India a leader in green hydrogen production; however, execution and scalability of these ambitious renewable projects pose challenges, and the conglomerate has shown a 13.72% return over 5 years.

Top New Entrants Clean Energy Stocks #2 – IOCL

Indian Oil Corporation is India’s top oil firm. The company is taking significant steps to drive India’s energy transition.

- IOCL is allocating $30 billion for environmental sustainability, expanding into clean energy, collaborating with NTPC to boost renewable capacity by 2.8 GW, planning substantial green energy growth, adding EV charging stations, and pursuing green hydrogen production, all with the aim of meeting 12% of India’s energy needs by 2030.

IOCL’s stock performance shows a 15.66% return in the last 6 months, a 25.09% gain in the past year, but a negative -2.74% return over 5 years due to oil market volatility; while they’re venturing into green energy, risks remain from their fossil fuel portfolio and global market fluctuations.

In FY23, IOCL achieved record-high refinery throughput of over 72.4 million tonnes, a 14% increase in fuel sales, and a rise in petroleum products market share from 40.8% to 42.9%, while also investing a record Rs 35,205 crores in capital expenditure.

Bottom Line

India has made significant progress in renewable energy and electric vehicle adoption, but the path to achieving net-zero emissions by 2050 or 2070 is challenging, highlighting the need for substantial investments, government and private sector commitment, technological innovation, and public awareness to drive this sustainable transformation.

Explore the Wright New India Manufacturing smallcase

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Visit bit.ly/sc-wc for more disclosures.