Diverging Fortunes: India Soars While Global Markets Sputter, Can Global Equities Be the Antidote?

As the sun sets on another turbulent year for global markets, a beacon of hope shines bright in the east: India’s stock market. While major indices across the world grapple with sluggish growth, inflation, and rising interest rates, the Sensex and Nifty have defied the odds, delivering jaw-dropping returns to investors and solidifying India’s position as a financial powerhouse. But this divergence raises a crucial question: is India’s bull run sustainable, and how can investors navigate the complex dance between India’s robust growth and the potential for a global market rebound fueled by a Fed pivot?

India’s Ascent: A Symphony of Strong Fundamentals and Domestic Tailwinds

India’s market performance is no mere flash in the pan. It’s a harmonious melody played by several instruments:

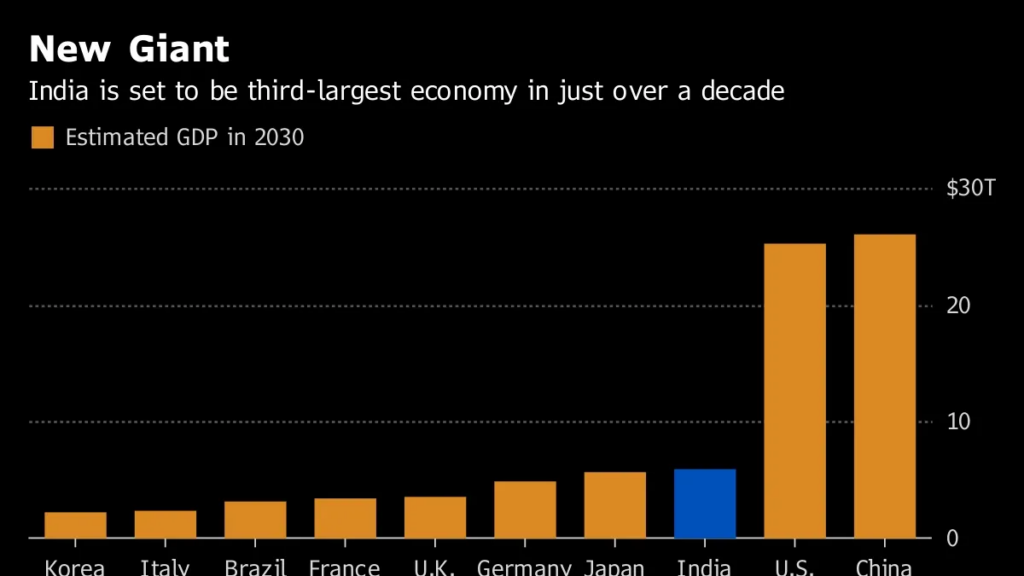

- Macroeconomic Resilience: Despite global headwinds, India’s GDP growth remains one of the highest among major economies, projected at a robust 7.4% for FY23-24. This translates to strong corporate earnings and unwavering investor confidence

- Favourable Domestic Liquidity: Government spending on infrastructure and social programs has injected liquidity into the economy, stimulating activity and boosting profitability.

- Limited Exposure to Global Woes: Unlike export-heavy economies, India’s domestic consumption-driven market has remained relatively insulated from external factors like trade slowdowns and rising interest rates, providing a valuable buffer against global volatility.

Global Malaise: A Perfect Storm Damping Market Sentiment

While India basks in the sunshine, global markets face a tempestuous cocktail of challenges:

- Central Bank Tightening: The Federal Reserve’s aggressive rate hikes to combat inflation have sent shockwaves through global financial systems, triggering capital flight from emerging markets like India and dampening risk appetite.

- Geopolitical Tensions: The ongoing war in Ukraine and escalating trade disputes have injected uncertainty and volatility into the global system, further eroding investor confidence.

- Growth Slowdown: Concerns about a global recession and stagnating economic growth have led to risk aversion and a flight towards safe-haven assets, further pressuring equities.

The Fed Pivot: A Beacon of Hope for Global Markets?

However, recent signals suggest a potential shift in the Fed’s tune. Hints of a slowdown in rate hikes have sparked optimism in global markets, with investors anticipating potential rate cuts in the latter half of 2024. This could trigger a rally in equities, particularly in sectors like technology and growth stocks.

India: A Consolidation Phase on the Horizon?

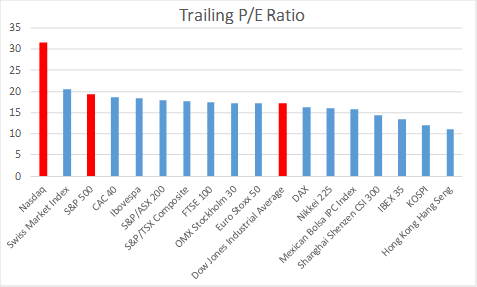

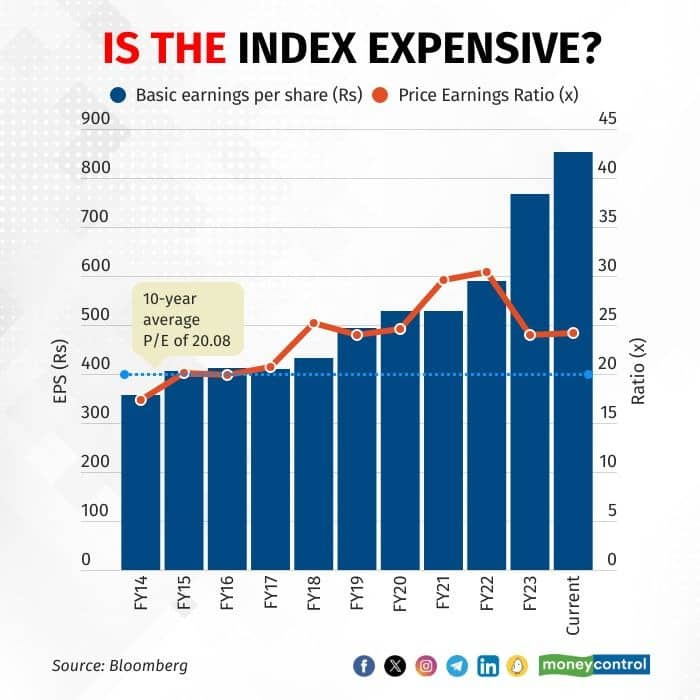

While India’s outperformance has been impressive, there are murmurs of a potential correction. The Sensex currently trades at a significant premium compared to global peers, raising the possibility of a period of consolidation or even a correction, especially if global markets rally on the back of a dovish Fed.

Nifty currently trades at a 22x Trailing PE

The above image is taken from an article on Seeking Alpha (source)

Hedging Your Bets: Global Equities as the Antidote?

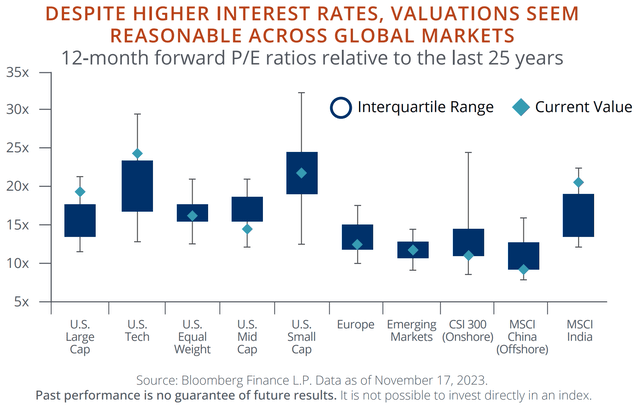

So, what’s an investor to do? This is where the idea of hedging with global equities comes in. While India’s long-term potential remains exciting, incorporating global equities into your portfolio offers several advantages:

- Diversification: It’s the golden rule of risk management. By diversifying across different markets and sectors, you mitigate the impact of any downturns in India.

- Potential Fed Pivot Play: If the Fed pivots, global equities are likely to experience a significant rebound, potentially boosting your portfolio even if India’s market remains flat.

- Untapped Growth Opportunities: While India shines, other markets offer untapped potential. Global equities give you access to potentially undervalued companies and sectors in Europe, Asia, and beyond.

- Portfolio Resilience: A diversified portfolio creates a buffer against unforeseen events. If India stumbles, global equities can help offset losses, and vice versa.

- Market Cycle Navigation: Global markets often move in cycles, with different regions outperforming at different times. By strategically allocating investments, you can potentially ride the wave of each market’s upswing and minimize exposure to downturns.

Embrace the Dance: A Harmonious Portfolio for Uncertain Times

Ultimately, navigating this complex landscape requires agility and a nuanced understanding of both India’s internal rhythms and the global market’s unpredictable melody. Here’s how you can create a harmonious portfolio:

- Maintain a diversified core: Allocate a significant portion of your portfolio to Indian equities, benefiting from its strong fundamentals and long-term growth potential.

- Add a touch of global melody: Incorporate global equities strategically, focusing on sectors and regions likely to benefit from a potential Fed pivot or currently undervalued.

- Stay informed and adapt: Continuously monitor economic developments and market trends, adjusting your allocation as needed to maintain the optimal balance between Indian and global exposure.

Remember, there’s no one-size-fits-all approach. The ideal mix of Indian and global equities depends on your risk tolerance, investment goals, and individual circumstances. But by understanding the strengths and weaknesses of both markets, and by incorporating strategic hedging techniques, you can create a portfolio that dances to the rhythm of both growth and resilience, weathering market storms and capturing opportunities as they arise.

So, embrace the dance. Let India’s vibrant growth be the foundation, while global equities add a touch of international flair. With careful planning and informed decisions, you can navigate the current market divergence and compose a symphony of wealth creation that resonates for years to come.

Check out the New Alpha ETF smallcase

Craving Alpha is a SEBI Registered (SEBI Registration No. INA300017038) Investment Adviser. The research and reports express our opinions which we have based upon generally available public information, field research, inferences and deductions through are due diligence and analytical process. To the best of our ability and belief, all information contained here is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable. We make no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results obtained from its use. This report does not represent an investment advice or a recommendation or a solicitation to buy any securities.