Embracing Uncertainty: How Global Turbulences are Opportunities for Long-Term Investors

In the dynamic world of finance, it’s often said that uncertainty and volatility are the only constants. Over the years, global events such as the Covid-19 crisis, the Russia-Ukraine conflict, and the ongoing Israel-Middle East conflict have tested the resilience of financial markets. While these uncertainties may create short-term tremors, they also present intriguing opportunities for long-term investors.

And, India’s decade is yet to begin 🙂

In this blog post, we will explore how these global uncertainties have, in many cases, affirmed India’s position as a compelling investment destination, with a focus on recent developments in the economy

– Covid-19 Crisis:

The Covid-19 pandemic sent shockwaves throughout the global financial landscape. Stock markets plummeted, businesses shuttered, and economies contracted. However, it is during times of crisis that innovative solutions emerge. In India, the crisis accelerated the digital transformation, leading to the growth of IT and technology sectors. Companies like Infosys, TCS, and Reliance Jio have become global leaders in their respective industries.

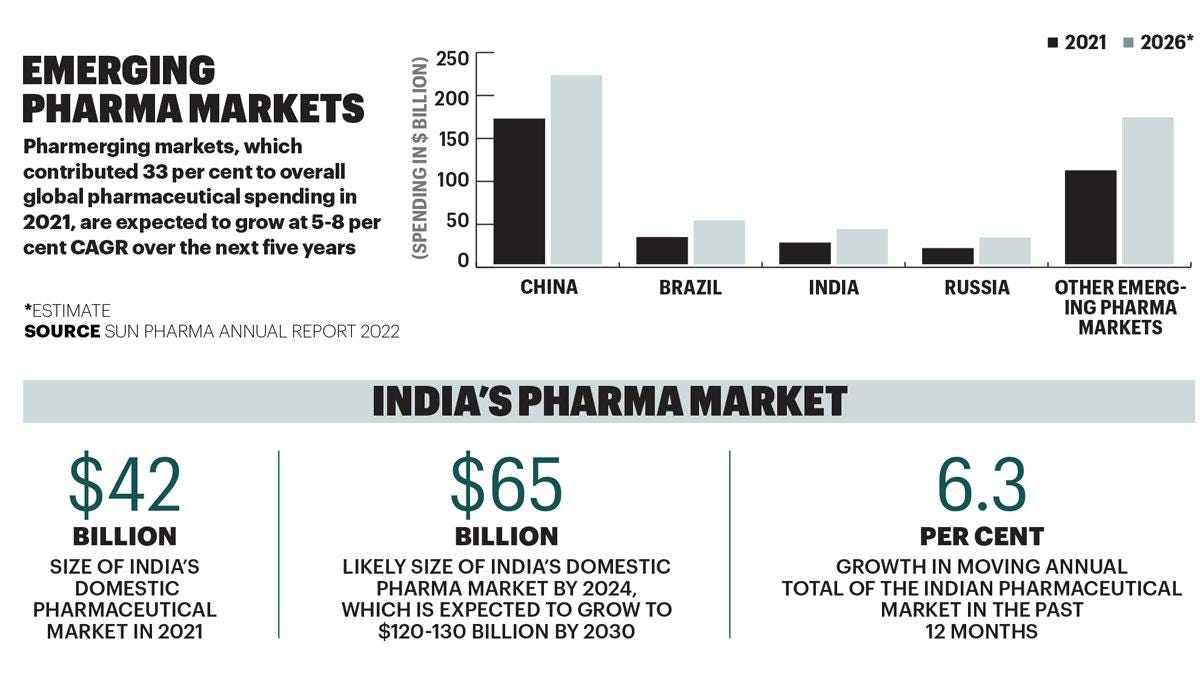

India’s pharmaceutical industry, is now referred to as the “pharmacy of the world,” showcased its importance by producing critical medicines and vaccines for the global market. This presented an immense opportunity for investors, highlighting India’s capabilities and attracting foreign investments.

– Russia-Ukraine Conflict

Geopolitical tensions can introduce instability to the global markets, and the Russia-Ukraine conflict is no exception. As international relations fluctuate, it’s essential to consider the broader economic implications.

India’s diplomatic strength has played a pivotal role in navigating such international tensions. By maintaining cordial relations with both Russia and the West, India has positioned itself as a safe and attractive investment destination. Furthermore, the diversification of its energy sources and its emerging defense industry adds to India’s resilience in the face of global uncertainties.

Interestingly, during the year 2022-23, Indian investors lost more money when the FED decided to increase interest rates at their most aggressive pace yet

– Israel and the Middle East Conflict

The Middle East has long been a region fraught with political instability and conflict. India’s approach to the Middle East crisis has been guided by pragmatism and diplomacy. India’s energy and trade relationships with countries in the region have remained stable. As the world looks for ways to diversify supply chains and reduce geopolitical risks, India’s strategic location and diplomatic finesse are gaining recognition.

In recent times, India’s budding tech startups have also been able to tap into the vast potential of the Middle East markets, further strengthening the economic ties. This not only mitigates risks but also presents opportunities for substantial growth.

Diplomacy as a Strength

India’s strength in managing global uncertainties can be attributed to its diplomatic acumen. By balancing relations with different global powers and maintaining a non-aligned stance, India has ensured that its economic growth is not hampered by political animosities. This strategic positioning has established India as a safe haven for international investors.

The RBI’s Move to Remove ICRR Mechanism

The recent decision by the Reserve Bank of India (RBI) to remove the Incremental Cash Reserve Ratio (ICRR) mechanism is a significant development. This move will release substantial liquidity into the market, further fuelling the capital expenditure (capex) cycle. The increased liquidity is expected to boost investments and propel economic growth.

Global Negative Cues and India’s Internal Strength

Global cues, like inflation worries, international conflicts, and supply chain disruptions, might create short-term fluctuations in the market. However, India’s internal strengths, including a large and diverse consumer base, a vibrant entrepreneurial ecosystem, and a resilient banking system, position it favorably to weather such storms. These internal strengths have already made India a preferred destination for foreign direct investment (FDI) in various sectors.

Positive Outlook for September Quarter Results

As India’s economy continues to recover from the Covid-19 pandemic, the outlook for the September quarter results remains optimistic. Several industries, including manufacturing, IT, and healthcare, are expected to show robust growth. This augurs well for investors looking for long-term opportunities in the Indian market.

In conclusion, global uncertainties have a way of unearthing opportunities for long-term investors. The Covid-19 crisis accelerated digitalisation and showcased India’s pharmaceutical capabilities. India’s diplomatic prowess in navigating international tensions and its strategic positioning in the Middle East reinforce its image as a stable investment destination. The recent RBI decision to remove the ICRR mechanism and the positive outlook for the September quarter results add to the conviction that India is a compelling destination for long-term investments.

Despite global negative cues, India’s internal strengths and positive economic outlook reaffirm its position as a resilient and promising market. It’s no wonder that investors are keen to capitalize on the opportunities that arise during times of uncertainty. In the current scenario, buying the dips in the Indian market could prove to be a smart long-term investment strategy.

Explore Tiny Titans smallcase here

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary. Refer to our disclosures page, here.

CRAVING ALPHA LLP•SEBI Registration No: INA300017038

MARTIN BURN BUILDING, 4TH FLOOR ROOM 19, 1 RN MUKHERJEE ROAD KOLKATA, WEST BENGAL, 700001