Emerging Market Stocks: A New Era of Growth & Opportunities

The recent downgrade of the US credit rating by Fitch to ‘AA+’ has had widespread consequences on global markets, with a ripple effect even reaching emerging markets such as India. On August 2nd, the Indian market experienced a sharp drop, mirroring the reactions in other Asian and European markets. The downgrade’s immediate impact was a reflection of the underlying concerns about the US’s fiscal challenges, including rising debt levels and the projected risk of recession.

However, emerging countries like India are uniquely positioned in this scenario, showcasing resilience and attracting attention as a promising destination for global investments. Several factors contribute to India’s appeal despite the downgrade’s global implications. The country’s economic reforms over the last decade, robust earnings momentum in various sectors, and a favorable inflation trajectory have strengthened its position in the international arena. Moreover, India’s strategic alignment with the multipolar world dynamics, coupled with a decline in its correlation with external factors, has significantly diminished its vulnerability to global economic shifts.

The downgrade in the US credit rating , while posing challenges for the US bonds and treasury bills, is also seen as an incentive for global investors to explore diversification. The necessity for investors to consider emerging markets, particularly India, stems from the potential growth opportunities and the prospect of superior returns. Investment strategies that reflect this shift are evidenced by entities like Morgan Stanley upgrading India to ‘overweight’ and recognizing its promising demographic profile. All of this raises the question, do emerging markets like India present a better opportunity amid global changes?

Emerging market stocks are catching the eyes of investors around the globe, signaling a shift from bonds to stocks as growth bets return. This shift is influenced by a combination of macroeconomic factors, promising growth forecasts, and a burgeoning confidence in emerging economies. Here’s an in-depth look into what is causing this shift and why emerging-market equities such as India, China, Egypt and more are suddenly so appealing.

From Bonds to Stocks: A Momentous Shift

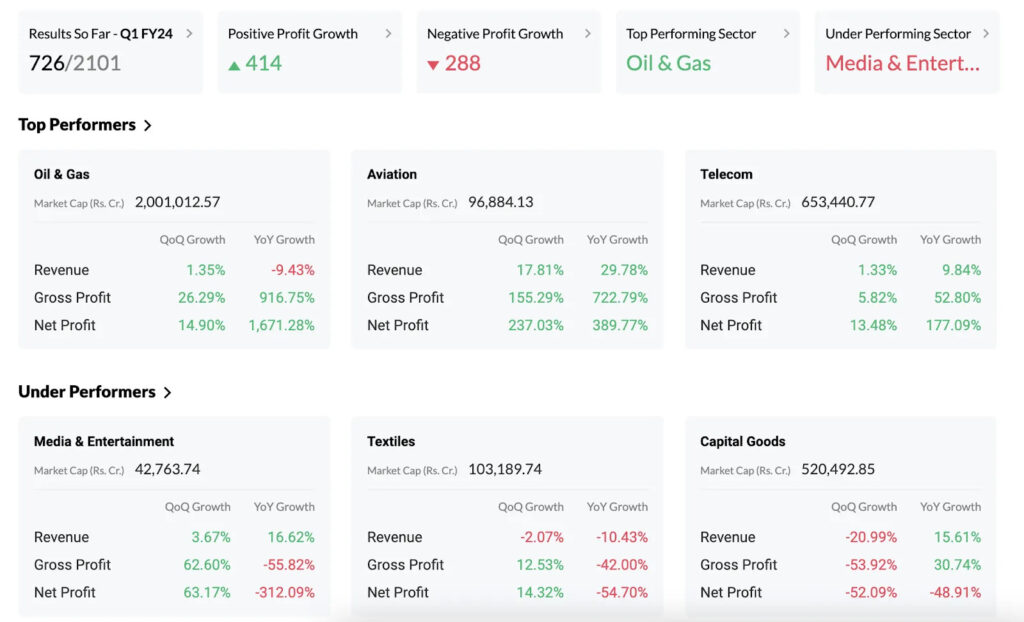

Investors in emerging markets have traditionally been drawn to local-currency bonds, which were considered a standout trade. However, since July, equity benchmarks have outperformed local-currency bonds, signifying an essential change in investment patterns.

For instance, the MSCI Emerging Markets Index rallied almost 6% last month, the best performance since January. Conversely, indexes of dollar and local-currency EM debt gained less than 2%. It appears that stocks are not only catching up with bonds but overtaking them.

According to reports, emerging-market equities absorbed $4.1 billion in the week to August 2nd, showing that traders are already starting to chase the rally. While some investors argue that bonds still have potential, the bigger gains are predicted to come from stocks.

China Or India? How To Invest In The Coming Asia Boom

The world’s eyes are firmly set on the East as India and China emerge as the giants of the investment landscape. Both nations boast impressive growth narratives, but how should investors navigate these promising markets?

ndia has now edged past China with a population of 1.43 billion, making it the world’s most populous country. With a young workforce, India’s share of global equity market capitalization is expected to quadruple by 2075, reaching parity with China at 12%. Meanwhile, the US share is projected to halve.

India: The Young Giant

India’s growth is propelled by friendly relations with the West and a young, vibrant workforce. Goldman Sachs expects India’s economy to grow 6% to 7% annually, outpacing China’s, driven by increased consumer spending and emerging middle-class demand beyond essentials. Manufacturing shifts from China are also favoring India, making it one of the best structural growth stories globally.

Efforts by the Indian government to encourage investment are gaining traction, with more global companies like Apple and Tesla looking to India for their manufacturing needs. This trend of increasing foreign inflows is projected to continue.

Recently, Morgan Stanley has upgraded India to ‘overweight’, which signifies a growing optimism towards the Indian economy. The reasons cited for this upgrade include sustained superior dollar EPS growth against emerging markets and a promising demographic profile that supports equity inflows. According to Morgan Stanley, India’s economy is experiencing a surge in foreign direct investment, with the country leveraging multipolar world dynamics to its advantage. India’s economic indicators continue to show resilience, with the country on track to achieve a forecasted 6.2% GDP growth.

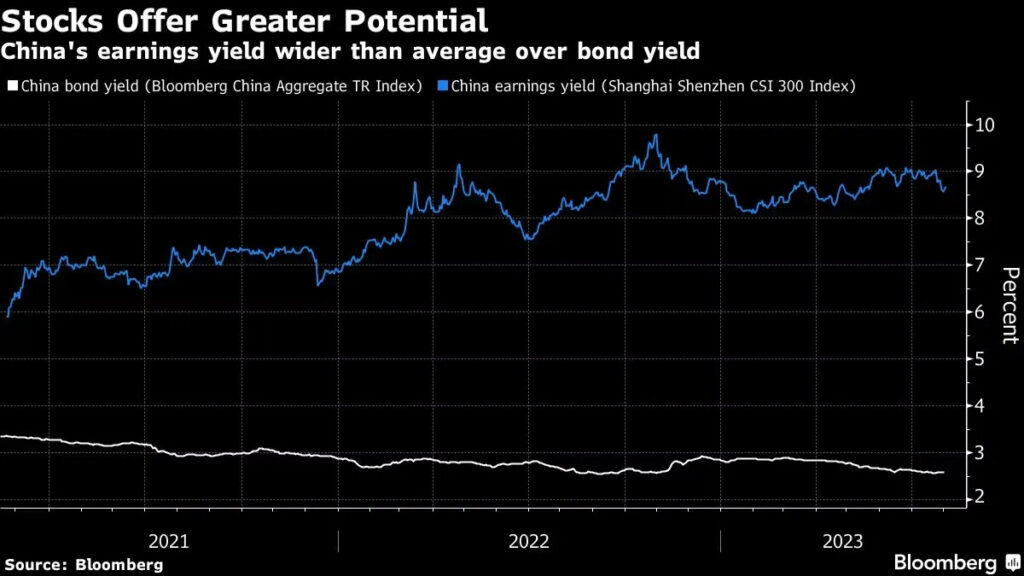

China: The Seasoned Player

As the world’s second-largest economy, China showcases a vast consumer market and cutting-edge manufacturing. Although its aging population could potentially hinder growth, the country’s focus on domestic consumption, industrial upgrade, and embracing new technologies could drive future prosperity. China’s equity valuations are currently low, making it attractive for the next 12 to 24 months.

Morgan Stanley has downgraded China to ‘equal-weight’ due to concerns over growth and valuation. This move underlines the comparative advantage that India currently holds in the global market scenario.

Both Markets: Scale, Growth, and Profitability

Investors don’t necessarily have to pick one over the other, as both markets follow their dynamics. Demographically, India might be in a better place, but the size of the Chinese market keeps it highly relevant. The two markets provide a combination of scale, growth, and profitability, catering to various investor preferences and risk profiles. While China focuses on domestic consumption and technological advancements, India’s booming population and growing affluence are driving its investment landscape. Portfolio managers and investors see opportunities in both markets, with sectors like technology, finance, real estate, and consumer goods expected to reap the benefits of these shifts.

The choice between China and India isn’t binary; both have their unique advantages. What’s paramount is a well-calibrated, research-driven approach, understanding regional dynamics, economic policies, market trends, and valuations. India or China? It might not be a question of either/or but rather a strategic blend of both, leveraging the best of what these rising Asian giants have to offer. Whether it’s internet bets like Tencent and Trip.com or the Indian conglomerate Reliance Industries, there’s something for every portfolio in the coming Asia boom.

Looking Forward

Various emerging markets are facing pivotal moments with upcoming data and policy decisions. From China’s complex economic indicators to Egypt’s inflation battle, India’s cautious monetary stances, Mexico’s inflation balancing act, and Turkey’s return to economic orthodoxy, the global economic landscape is entering a critical phase. These elements will significantly influence both domestic and international financial markets, making them key areas to watch for investors and policymakers. Let’s understand some key upcoming events – India: Reserve Bank’s Decisions & China: Bracing for Key Economic Data.

Liked this story and want to continue receiving interesting content? Watchlist Wright Research smallcases to receive exclusive and curated stories.

Check out Wright Research smallcases here

Live AMA – Sonam X Smallcase

We also conducted a Live AMA for our audience – and it was great! We had the largest live audience till date. We answered so many pressing questions that you all had for us. And we are humbled by the love you showed me, Wright Research and Smallcase. Here are some of the key points we discussed:

✅US Credit Rating: Understand the effects of the US credit rating downgrade on Indian small-caps and how to navigate the risks.

✅India Growth Story: Explore the future of India’s economy and technology endeavors.

✅Investment Strategies: Lumpsum vs SIP, rebalancing the right way, and more!

✅Special Segments: Exciting questions on our favorite investment themes, personalities, trends, and more!

✅Ask us anything: Rallying markets vs stagnant markets, PMS – Who is it for & how to invest in it, smallcap rally, Alpha Prime success and much more! Watch the full video here –

If any of these resonate with you, please do watch it. Also don’t forget to drop us a message – we love to read them!

Since we also celebrated our anniversary, here’s a special discount code you can use for subscribing to any of our portfolios and smallcases – WRIGHT4Y30 You will get 30% off on subscription fees!

SEBI Registration Details: Corporate Registered Investment Advisor | Company Name: Wryght Research & Capital Pvt Ltd Reg No: INA100015717 | CIN: U67100UP2019PTC123244. For more information and disclosures, visit our disclosures page here.