Expert Analysis of the Global Macro Events & News affecting the Indian Markets

Japan market is back after 33 years – fall from Grace and the tepid comeback

Imagine investing at the peak of the 1990 bubble and parting with your money for 33 years. Japanese markets have defied the concept of ‘stocks always go up’. A large chunk of Japan’s main index’s revenue comes from exports. With the global economy going into a slowdown, how is Japan, which is mainly an exporting country able to screech multiperiod highs?

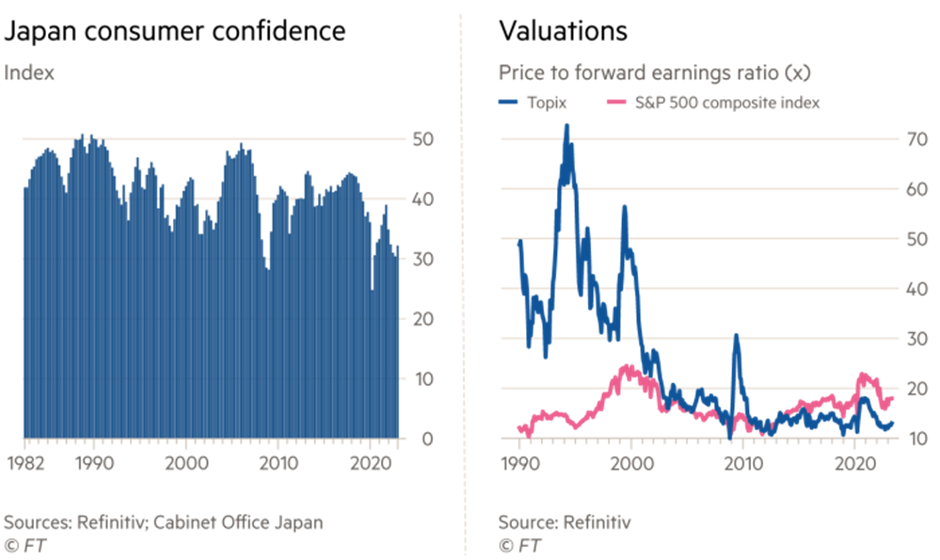

The problem for the Japanese markets isn’t valuation or earnings but mismanagement. For several decades, the corporate governance structure and discipline has been wretched thanks to cross holdings in promoter related companies (the listed public company having holding in several other listed companies), hoarding of cash (just keeping cash on the books without deploying it anywhere), capital inefficiency, and lack of enthusiasm to pursue new avenues of growth.

On the cross-holding aspect, almost 11% of the companies that are listed in Japan have a shareholder who is another listed company holding 30% or more. This figure is 0.9% in the US and almost negligible in India. Take Toyota for example, as of 2020, it held shares in 64 other listed companies and many of these listed companies held Toyota – this is an example of cross holding. This is highly discouraged by investors because companies are trying to hide their flaws and lack of innovation by investing in other companies when their actual business is to run a good business!

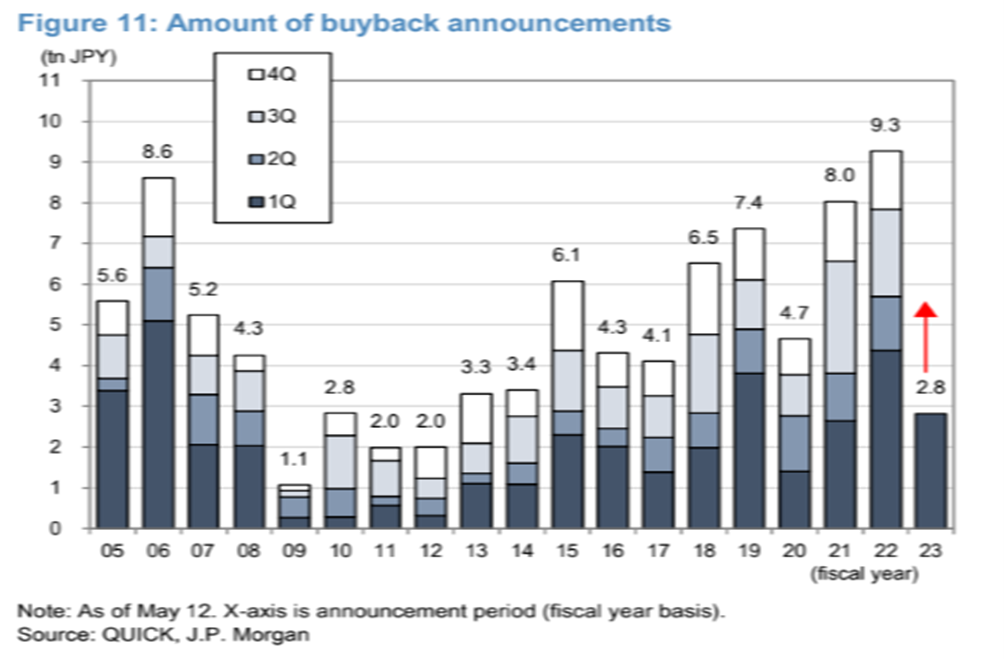

Activist investors (mainly institutions or large individual investors who take a significant stake in an inefficient company in order to streamline the business, improve corporate governance, etc.) have been targeting Japanese companies because of their inefficiency. And this has worked, activist investors like Elliot management have pursued the management to use their excess cash to create shareholder value through share buybacks. Higher the cash (or any other idle current asset like investments for that matter) higher will be the company’s book value and equity, which dampens ‘return on equity’ and ‘Price-to-book’ measure. Hence, if a company were to buy back the shares and reward shareholders, the price to book and return on equity measure improves drastically – this appeals investors.

Institutions are falling out of love with China because of geopolitical and regulatory uncertainties. And at these times, Japan is being considered as a proxy to the Chinese markets that come with lesser regulatory and geopolitical risks.

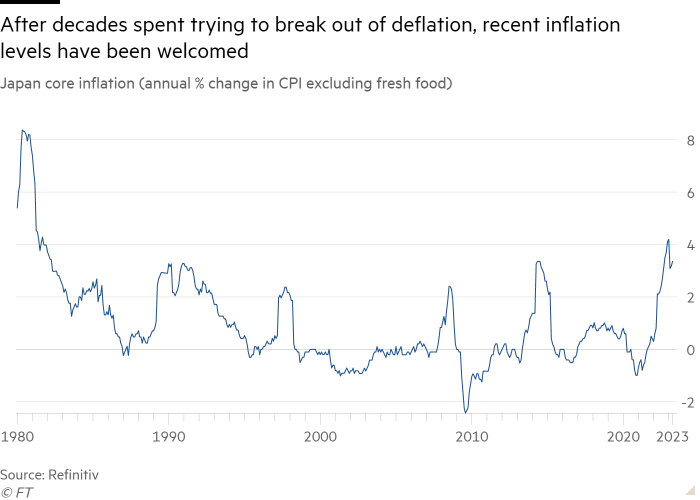

Inflation was negligible until late. Higher inflation means demand is outpacing supply. The central bank has been trying for years to pump up inflation to its 2% target which was last seen in 2015. Now, they have finally succeeded thanks to the war and supply related disruptions. Despite the inflation prints coming down across the world recently, Japan’s core inflation remains well above the 2% target at 3.8%. This is considered positive because it will finally give the companies some latitude in increasing prices.

All said and done, their demographics are extremely unfavorable compared to any developing country. This will affect their economy negatively in the long run, and no matter the intensity of activist investing, inflation or improving corporate governance. A country’s stock market is driven by the performance of the underlying stocks, which is mainly driven by the GDP growth, and population has a crucial impact on GDP growth more than anything else.

Important Economic Events

May 23-US Home sales, April

New Home Sales measures the annualized number of new single-family homes that were sold during the prior month. Shows consumer confidence in the real estate market.

May 24- UK CPI

The CPI is one of the most popular measures of inflation and deflation. Measures the monthly change in prices paid.

May 25- US GDP

Measures a change in input prices of raw, semi-finished or finished goods and services. If input costs rise, some will be absorbed by the producer and some passed on to the consumer.

Company In Focus: Rajapalayam Mills

Whenever we talk about India’s growth story and industries that contribute to it immensely, apart from infrastructure and manufacturing, we also discuss textiles. Textile sector in India has a rich history dating back centuries.

As this is a part of the stock specifics section, we will keep our discussion to that only. But before jumping on to the stock, let us discuss some interesting facts about the textile sector in India.

- India is the world’s second-largest producer of textiles and garments.

- The textiles and apparel industry contribute 2.3% to the country’s GDP.

- Also, it contributes 12% to India’s exports.

Our stock for this week is Rajapalayam Mills. The 89 year old company is based out of Tamil Nadu and is principally engaged in manufacturing cotton yarns and fabrics. It also has 4 manufacturing plants.

Below are a few points that help Rajapalyam to stand out of the crowd.

- Financials- Company has recorded highest ever revenues in Q3 FY 23, with growth of 32% since Q3 of last year. Fabric sales quantity has increased by 122% to 91 lac metres, while sales value has increased by 215% to Rs 122 Cr in FY22

In FY 21-22, the company achieved highest ever sales of 665 Cr, highest EBITDA of 142 Cr (with an increase of 226%), cash profit of 100 Cr and Net profit of 49 Cr.

- Valuation-Investments in Associates

RML has a market capitalization close to Rs. 700 crores. It has stakes in 3 companies: Ramco Cements , Ramco Systems and Ramco Industries Limited. But there’s a twist, if we take the market cap of these companies, RML’s share comes out to be 2500 crores apart from its own value. This is more than its own market cap. Hence, it is not only getting value from its own operations but also from its strategic investments.

- Capacity Expansion- The most interesting thing that caught our eye was its capex plans. Company is planning Capex for forward integration for manufacturing higher margin products – fabrics. They are increasing the capacity by over 110%. With Total outlay of 375 cr funded from internal accruals, term loan from bank and equity, construction is under process and production is expected to start from Q1FY24.

But this isn’t the best part, Order inquiries from existing customers for the expanded fabric division have been so strong that 60% of the expansion has already been booked.

- China+1- With all the heat coming from China+1, Rajapalayam is a clear beneficiary. They are even getting demand from Europe for high end yarns and fabrics as companies are trying to reduce dependency from China.

While analyzing the companies, we give great importance to ESG parameters and Rajapalayam checks out this box. Company owns wind mills, with a capacity of 35.15 MW for captive power consumption in Tamil Nadu.

And this ends our discussion on Rajapalayam Mills Limited. See you next week with a new stock specific, with a new story.

Explore Green Portfolio’s smallcases

Green Portfolio is a SEBI Registered (SEBI Registration No. INH100008513) Research Analyst based at Ground Floor, 7/7, Darya Ganj, Ansari Road, New Delhi, 110002. For more information and disclosures, visit our disclosures page here