Indian Electric Vehicle Sector Booming: EVs Tipping Point

In 2022, India marked a significant milestone with electric vehicle sales crossing 1 million units that is an monthly average registration of 83,585 electric vehicles. Are we nearing a tipping point?

We can draw a lot of parallels between the current EV market in India and Japan’s booming ICE (Internal Combustion Engine) vehicle industry throughout the 20th century. Japan had invested substantially to provide a robust foundation for Toyota, Honda to become global automotive giants. Today, India is also investing heavily in EV infrastructure, development, manufacturing and more, with strong government initiatives & incentives. Strong domestic markets and significant export potential helped move Japan to the forefront of global automotive industry and it even broke into tough, heavily entrenched markets like US. Similarly, India with its colossal population, demographic benefit and an expanding middle class, is on the brink of experiencing significant growth in its EV market as vehicle affordability, infrastructural development and resource security advance.

Tipping points are characterized by price thresholds that catalyze widespread adoption. For instance, when we look at green energy, a tipping point could be when installing new solar farms becomes financially more viable than establishing new coal plants. This will boost demand for solar installation for utility companies, private companies etc. So, is the current EV market in India at the tipping point? Will EV vehicle sales in India rise significantly? What will happen to electric vehicle sector stocks?

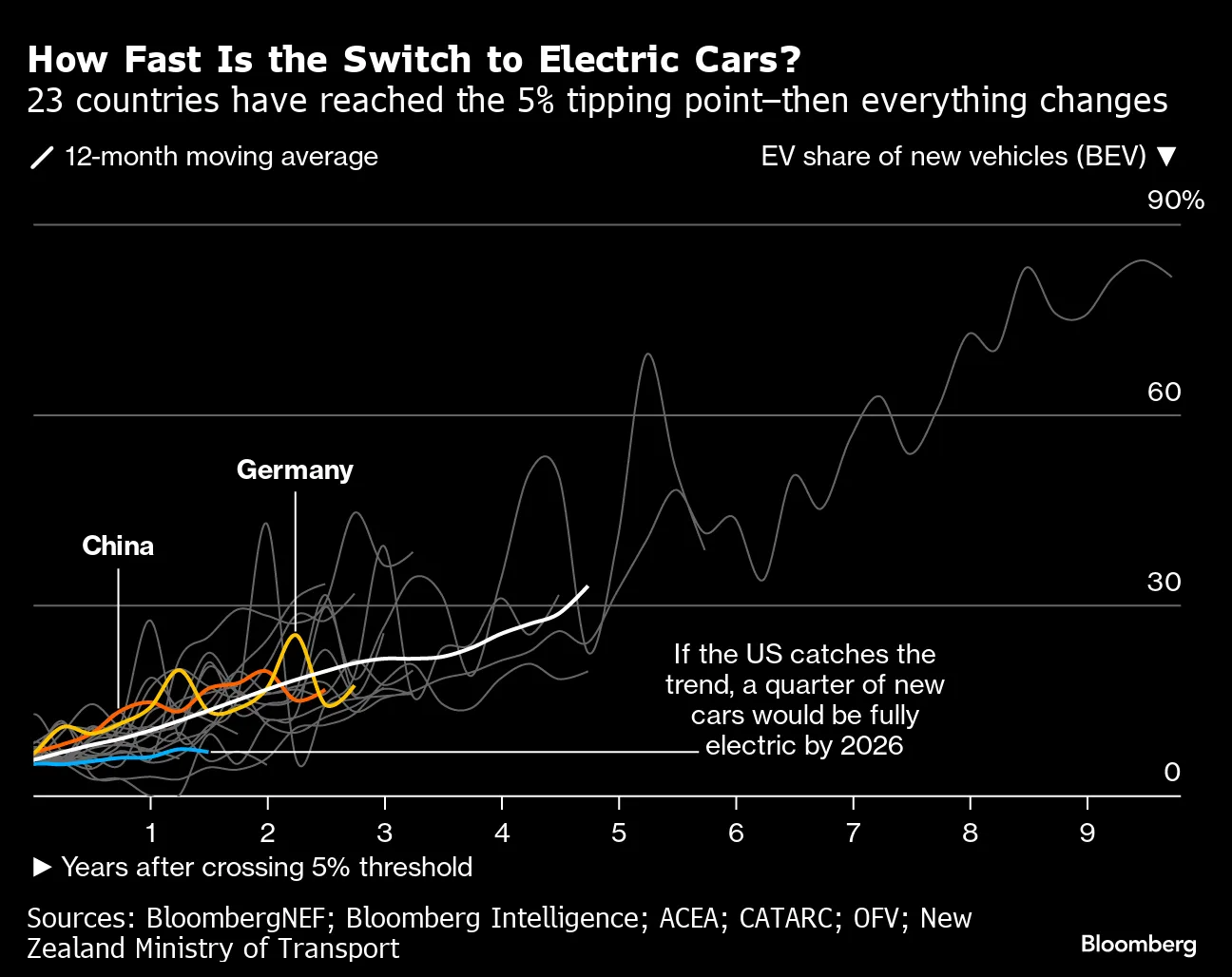

5% New Electric Vehicle Sales Threshold

Electric Vehicles (EVs) adoption is rising worldwide. When we look at the adoption cycle for electric vehicles, there is a strategic inflection when new car sales for electric vehicles reaches 5%. Bloomberg conducted a detailed study 1 year ago and found 19 countries had crossed this electric vehicle tipping point. As of September 2023, 24 countries such as US, China, Canada, Australia, Spain, Thailand, Hungary etc. have surpassed this pivotal milestone. These early adopters have seen a jump in electric vehicle sales as a percentage of total new vehicle sales increasing from 5% to 25% within 4 years.

Based on historical data, this 5% electric vehicle sales threshold marks a critical juncture in the adoption of new technology – a similar S-shaped curve is seen when other new technologies were in early stages of adoption such as smartphones, LED bulbs etc. Essentially this S-shaped curve means that there is a shift from early adopters to mass mainstream consumer acceptance for this new technology.

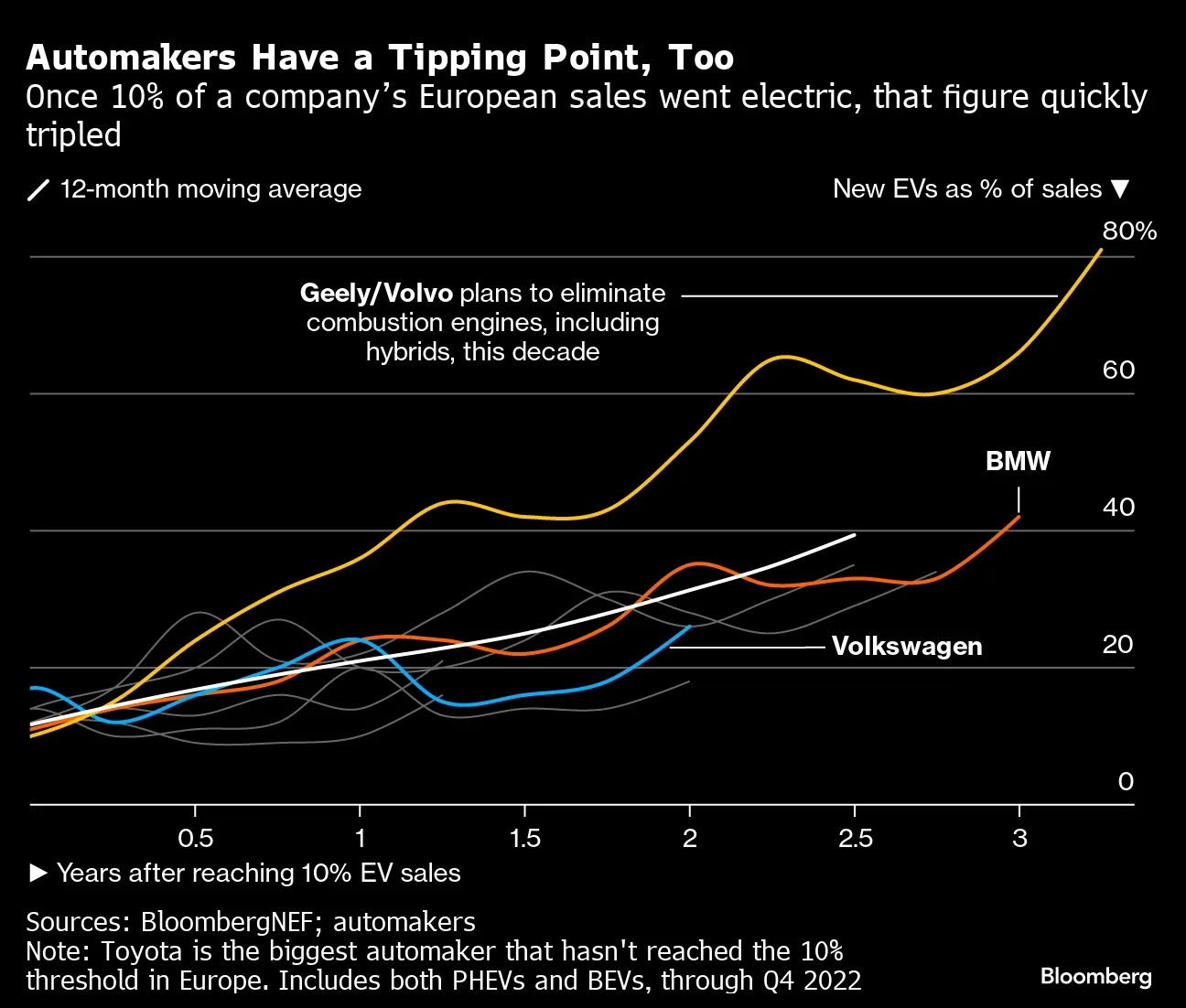

EV Manufacturers Tipping Point

Traditional automobile manufacturers also face an uphill battle in these early adopter countries – challenge of preemptively investing in EVs before demand fully materialises.

-

Substantial reconfigurations in manufacturing facilities and supply chains and holistic redesigning of vehicles with electrification at the forefront

-

Tesla nearly went bankrupt to manufacturer its Model 3 in 2017 but strategically scaled production past 5,000 cars per week at which point the company felt a positive cycle of lower costs, higher volumes and economies of scale take effect

This brings us to the next tipping point, specifically for electric vehicle manufacturers when EVs are 10% of their quarterly sales. European data shows that this increases 3x in under 2 years. In the graph below, we can see BMW, Volkswagen, Volvo and other saw their new EV sales increase manifolds within a first 2 years. Volvo saw a massive increase within just the 1st year and this speaks to the company’s focus on eliminating combustion engines and hybrids from its car lineup by 2030.

Electric Vehicle Sector in India

India is showcasing promising signs of becoming a pivotal player in the EV adoption landscape. Investments from domestic automakers like Tata Motors, Mahindra, Maruti, Ola, Ather, and even interest from Elon Musk to not just manufacture electric vehicles in India but also sale of Tesla shows a positive sentiment for India’s electric vehicle sector. The government has also made significant strides towards fostering an EV-friendly market in India. With its extensive automotive market not just in 4 Wheelers but in highly popular 2W and 3W segments along with commercial vehicles, India’s transition to EVs could be a critical juncture in global EV adoption. Let’s look at the current EV market in India in depth-

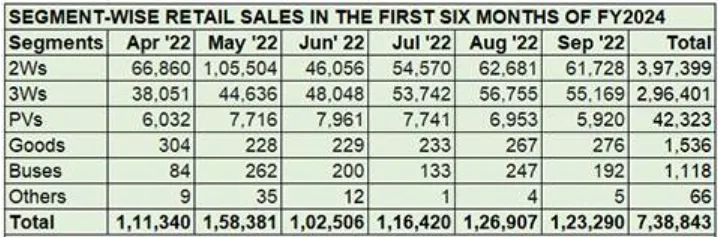

Rise in EV Sales in India

-

838,766 units sold in the initial 7 months of CY2023, representing 82% of the previous annual record of 10,24,806 units in CY2022.

-

A governmental vow to build a formidable EV fleet by 2030 is catalysing this upward trajectory.

-

In Q1 FY24, EVs accounted for 3% of new car sales, a statistic that doubled in just a half-year span.

-

Electric 2 and 3 wheelers have driven sales in the first half of CY 2023, with 2 wheelers at 58% and 3 wheelers at 36% of the EV market share.

-

Conversely, electric cars and SUVs have a mere 5.5% market share with 46,163 units sold.

Will EV vehicle sales in India rise?

EVs will help expedite achieving India’s carbon reduction targets: 45% reduction in the economy’s carbon intensity by 2030, and net-zero emissions by 2070. Nitin Gadkari, Minister of Road Transport and Highways, expressed his desire to position India as a dominant player in the global automobile market. The unrelenting surge in EV sales, crossing the 100,000-unit mark consistently for 12 months straight since October 2022, was seemingly undeterred even by a 25% slash in the FAME subsidy on e-two-wheelers in June.

-

Growing incentives provided by the Indian government for EVs especially when compared to the tapering of incentives in regions like China, the UK, and Europe.

-

In FY23, EVs represented approximately 1% of the passenger vehicle market, and about 5% in electric two-wheelers.

-

In H1 FY2024 alone, the EV market experienced a 51% YoY sales increase, attaining almost 740,000 units.

-

Government aims to boost these figures to 30% for private cars and a staggering 80% for 2 wheelers by 2030.

-

A robust 158,381 units were sold in May 2023, as buyers sought to avail the incentives before the subsidy reduction.

-

Surprisingly, even with a 56% MoM plunge in e-two-wheeler sales post-June, an impressive 225,035 units were still sold from June to end-September 2023, indicative of a resilient and maturing market.

Is the current EV market in India at the tipping point?

India’s EV sector has surmounted hurdles posed by challenges like limited charging infrastructure and high upfront EV costs (largely attributable to battery prices). With steady progress and at the existing double-digit growth rate, reaching the 1.5 million unit sales mark in FY2024 seems plausible, translating to a commendable 27% YoY growth against FY2023’s 11,83,166 EVs sold. This benchmark would significantly propel EVs from their current 5.30% share of the total India auto market (based on FY2023’s 22.31 million automobiles sold across various fuel types).

To achieve this 1.5 million sales landmark for FY2024, approximately 760,000 more EVs would need to find buyers from October 2023 to March 2024. Hitting this ambitious target seems within reach when we look at the boost expected from the upcoming festive season. Parallel development in EV charging infrastructure and continual focus on localisation by OEMs to reduce costs and enhance affordability, underscores a pivotal shift in India’s vehicular landscape. Especially as battery prices are anticipated to gradually decline, a surge in demand across EV segments is expected to follow.

-

EV policy, inaugurated for three years in August 2020 and recently extended for an additional six months as its revision is pending, set an ambitious goal: 5 lakh new e-vehicle registrations in five years and having 25% of new vehicles sold be electric by 2025.

-

Consumer trends are showing that there is a growing appetite for newer models and EV variants, while enthusiasm for diesel vehicles is diminishing.

EV Sales Numbers for Delhi – Delhi’s consumers prefer EVs

-

Delhi witnessed a 20% boost in electric vehicle (EV) sales during the initial 6 months of the current fiscal year, compared to the analogous period in FY 2022-23.

-

Diesel vehicle sales plummeted by over 24% between April and September of this year compared to the same span in the preceding fiscal.

-

Purchases of EVs were 32,400 units until September 30, 2023 v/s 26,936 units last year.

-

Diesel cars saw a decline in registrations, falling from 8,393 last year to 6,344 this year during the aforementioned period.

-

Approximately 11% of total vehicle registrations in Delhi between April and September of this year were electric.

-

New vehicle sales are typically higher in the second fiscal half due to the festive season, appealing schemes, and discounts

246.3% Increase in Export of Indian EVs

With a competitive EV manufacturing ecosystem that marries quality with affordability, India is strategically positioned. In H1 FY24, India’s EV export market grew 246.3%, with significant interest from Nepal & Europe.

-

Rs 7,988.62 lakhs of EV exports in 2022 to an impressive Rs 21,391.40 lakhs in 2023. However, June did see a sharp 74.75% decline.

-

Nepal, France and Germany had high Indian EV imports.

-

China and the UK had a consistent appetite for Indian EVs, albeit with fluctuations in quantities.

-

Vietnam, Brazil, Guatemala, and Australia also imported Indian EVs

-

Maldives, US, Canada, New Zealand, and Portugal haven’t imported anything substantial this year

An upcoming festive season which has traditionally seen an uptick in vehicle purchases, could see similar impact on EV sales in India. Large automotive companies are doing new EV announcements. However, in this nascent growing sector adaptability of these companies is important, especially for smaller and newer players. Ongoing global challenges, particularly around component availability, necessitate strategic foresight and planning to mitigate impactful disruptions.

Read the full article on Wright Research Indian Electric Vehicle Sector Booming: EVs Tipping Point.

Wright Research Telegram and Youtube Channel

Join our Telegram Channel to get daily morning market updates. Subscribe to our Youtube Channel to learn about all things investing, understand sector performance, get key insights into new topics like concentrated portfolio, quantitative investing and more!

We are conducting a Live Stream this Sunday at 11:30 AM to talk about Market Volatility , Market Corrections , Rebalancing Strategy, Portfolios and a Live AMA (Ask Me Anything). Want to submit questions? Drop them here

Explore Wright Research smallcases here

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Visit bit.ly/sc-wc for more disclosures.