Latest Updates from Craving Alpha’s Sector Advantage smallcase

- New Minimum Investing Amount – Sector Advantage smallcase is now more accessible then ever!

- Stock Story – RHI Magnesita, this little-known company doubled in value in one year, and is a leading wealth creator for the investors in our Sector Advantage smallcase

- Subscription Fees due for revision – In line with the performance expectations of the smallcase, the subscription fees will be raised by 40%-50% in February 2023. This is your chance to subscribe to the Sector Advantage smallcase before the fees go up!

Minimum investment reduced by 74% to make it more accessible to a wider range of investors

Addressing the feedback of making the minimum investment of our best performing smallcase lower than what it was, we are excited to announce that the minimum investment for our flagship, best-performing portfolio- Sector Advantage has been significantly reduced from 200,000 to 52,000. This change was made due to the removal of a stock that, while it had performed well in the past, is no longer meeting our performance expectations.

We are proud to say that our portfolio is pro-active in responding to feedback from our clients and spinning out underperforming stocks. This is one of the key ways we ensure the success of our portfolio. By removing stocks that are no longer meeting our performance expectations, we aim to help investors book profits where necessary and compound on growth stories. This is an example of how our portfolio takes into account the feedback from clients.

We understand that investing can be a daunting task, especially for those who are new to it. That’s why we are committed to making our portfolio as accessible as possible, while still maintaining the highest level of performance. We also make sure that our clients have access to our team of investment professionals who can answer any questions they may have and provide them with the support they need to make informed investment decisions.

RHI Magnesita (NSE: RHIM)

RHI Magnesita has achieved a strong product-market fit in the Indian cement and steel industry

The company’s refractories are known for their excellent performance and durability, making them a great choice for the demanding conditions of the cement and steel industries. The Indian cement and steel industry has been expanding rapidly in recent years, driven by a growing population and increasing infrastructure development. This expansion has led to a corresponding increase in demand for refractories, the materials used to line the high-temperature equipment in these industries. RHI Magnesita, a leading global supplier of refractories, has been well-positioned to benefit from this trend.

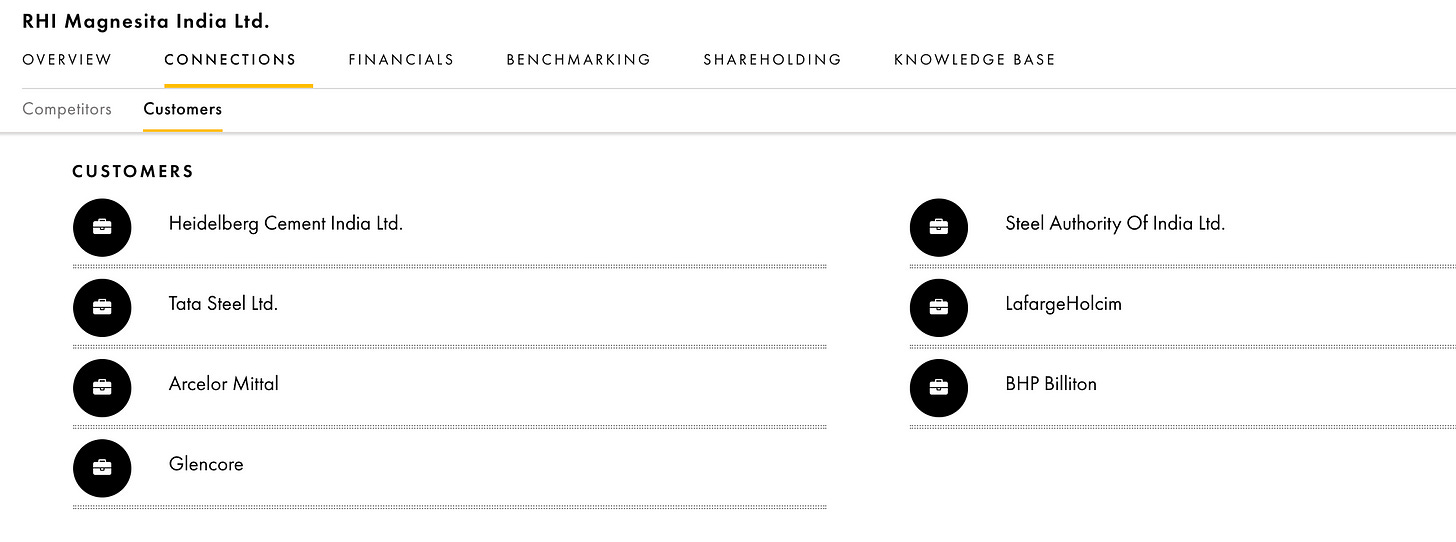

The company has been the preferred producer for many of the largest cement and steel players in India.

In addition, RHI Magnesita’s commitment to sustainability and innovation has also helped it to stand out in the Indian market. The company’s products are designed to be energy-efficient and to reduce emissions, which is becoming increasingly important for the cement and steel industries in India, where regulations are becoming stricter.

With the Indian cement and steel industry expected to continue expanding in the coming years, we believe that RHI Magnesita is well-positioned to continue benefiting from this trend.

The Sector Advantage smallcase invests in great companies like RHIM that have found their “product market fit” across a handful of sectors so you can capitalize on the “Indian Growth Story” without being worried about missing any key industry.

Check out the Sector Advantage smallcase

Craving Alpha in recent news

- ET Markets | Budget 2023: 7 reforms we want from the Finance Minister

- How to pick stocks | Podcast with UpSurge featuring Mayank Mehra

- ET Markets | Craving Alpha’s Investment Tips for 2023

Craving Alpha is a SEBI Registered (SEBI Registration No. INA300017038) Investment Adviser. The research and reports express our opinions which we have based upon generally available public information, field research, inferences and deductions through are due diligence and analytical process. To the best of our ability and belief, all information contained here is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable. We make no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results obtained from its use. This report does not represent an investment advice or a recommendation or a solicitation to buy any securities.