London Bridge Has Fallen: The impact of the Queen’s death on economy

With landmark events rippling throughout the globe, it’s safe to say that last week has been quite the headliner – possibly the biggest of them all? London Bridge falling – the long-decided euphemism for the death of UK’s longest reigning monarch – Queen Elizabeth II.

Given that the Queen was one of the most important and prominent global figures, it was inevitable that her death have consequences. So, what was the impact on the economy of UK? Does this loss impact India? Read on to find out!

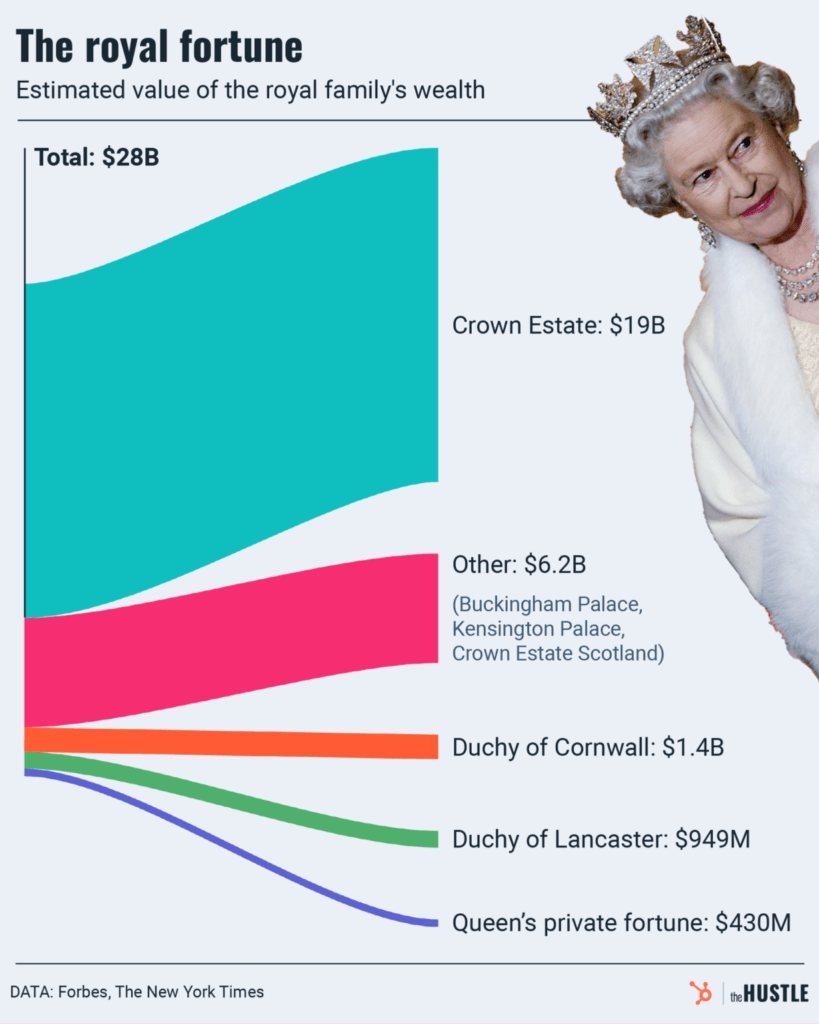

The monarchy’s brand contributes approximately £2.5 billion to the British economy annually. Click To TweetBack in 2017, the royal family stood fourth after Google, Apple, and Amazon, amongst the most valuable in the world, according to a Brand Finance report assessing the monarchy’s capital value. Here’s how rich the monarchy is today –

So, what’s going wrong? The fear lies around the risk posed to the British royal family’s brand image by the loss of its longest-reigning monarch.

The death of the Queen came along with a price tag

The British pound has hit a 37-year low versus the US dollar on the day when the Queen was pronounced dead.

There’s a strong chance that King Charles III will be the first British monarch to pay more than a pound for a dollar, or more than a pound for a euro or both.

The Bank of England asserted that a weaker outlook for the UK economy along with a stronger dollar was putting pressure on the sterling.

Queen Elizabeth II’s passing will likely cost the British economy between $1.6 billion and $7 billion due to all the bank holidays, business closures, funeral costs, coronation costs, changes to passports, military and police uniforms, currency adjustments, and other minor institutional changes, according to the Independent.

Although, inbound tourism is expected to increase as foreign nationals make their way to pay their respects and experience this slice of history.

Other nations’ currencies that feature the queen — from Australian, Canadian and Belizean dollars will also be updated with the new monarch’s image, but the current $20 bills with the Queen’s face will continue to be legal tender in all these countries.

Did you know?

Guinness World Records lists Queen Elizabeth II as having featured on at least 33 different currencies at one point, more than any other monarch.

Britain’s crises

A cost-of-living crisis and an energy crisis are already biting many households and small businesses, with prices for food and fuel spiralling in part due to Russia’s invasion of Ukraine.

The long-term impact could be the demise of low-value coins, changes to the postal service and a shake-up of Royal Warrants.

The Royal Warrant which gives corporations the chance to claim the monarch’s seal of approval led to a 10-per cent boost in revenue for around 800 British firms bearing the mark. But now the royal warrant’s continuation looks bleak or will take time till the new monarch approves all these firms and their products.

In time, new Charles III coins will be stamped. Businesses still largely wedded to cash may be in for a shock, as the production of new currency will lead to the demise of lower-value coins.

Also, the cost of the Royal Family to British taxpayers has increased by 145% since 2014 and this amount is only believed to continue increasing in the coming years which will be an added burden on the heads of the Britons.

How’s India being impacted?

Back in 2000, Britain’s economy was more than three times the size of India’s. By 2019, India had surpassed Britain in the rankings, according to World Bank figures.

The United Kingdom remains one of the largest investors in India out of all the G20 member nations with British companies employing close to 800,000 people in the country (as of 2017).

It was only two weeks back when India surpassed the UK and joined the top five economies of the world. Now, there lies a lot more ahead for the Indian economy which has set its gun on joining the top three economies of the world over the next few years.

Markets Last Week

|

|

|

|

Tweet of the Week

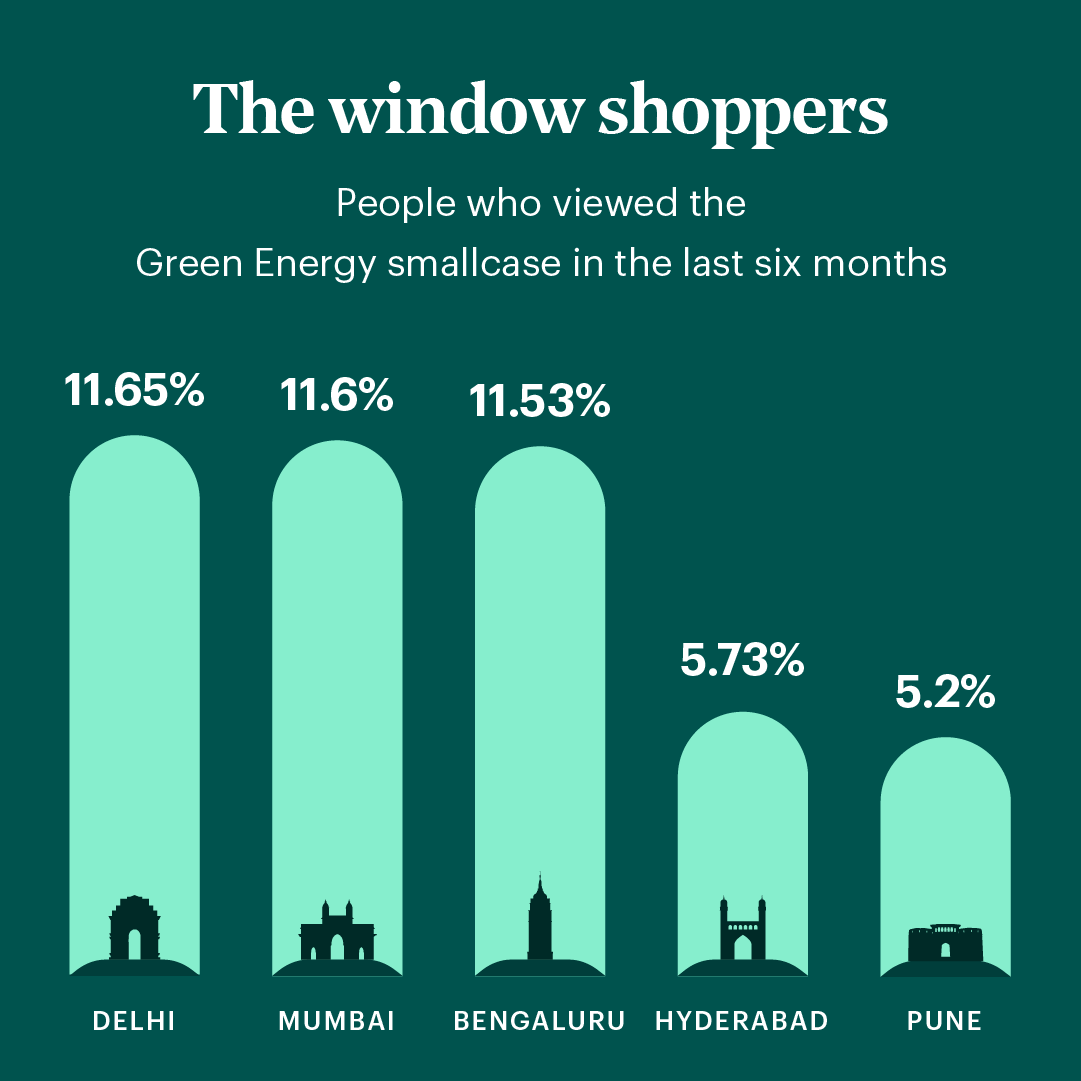

Is your city topping the sustainability charts? Does your city actually end up investing in greener alternatives after having shown interest? Find out below 👇🏽

This week, we’ve been…

Watching On the Morning You Wake (to the End of the World) on Storyville by BBC: Storyville on BBC brings to you some of the most brilliant documentaries out there! This episode talks about how on the morning of 13th January, 2018, Hawaiians were suddenly confronted by an urgent nuclear threat.

Listening to the Business Breakdowns podcast: Do you know how Polaroid monopolised the instant photography industry, and its founder Edwin Land became Steve Jobs’ hero? This podcast is all about breaking down some of the strongest brands in the world and featuring their lessons or secrets to learn from.

Until then, you ensure you’re hydrated and invested. Have a great week ahead!