Momentum + Value Investing has been checked off your list ✔️

Now what’s next?

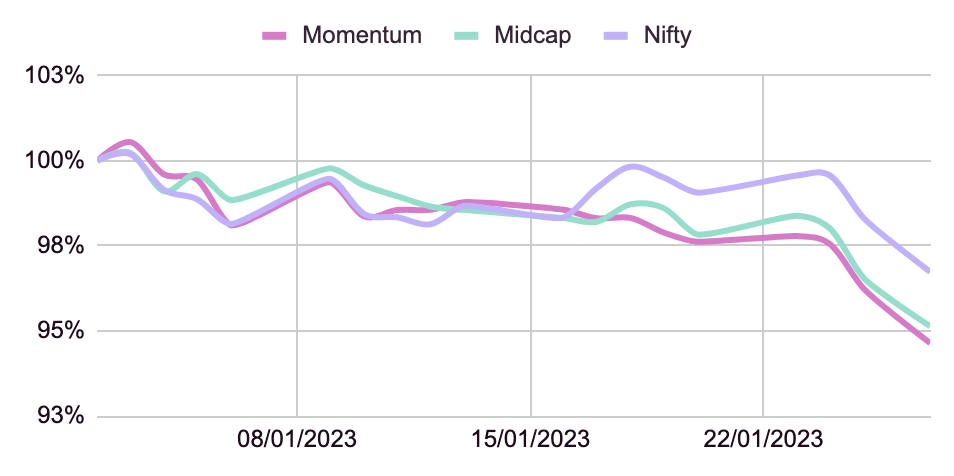

You are invested in Windmill Capital’s Value & Momentum smallcase.

Kudos on investing in fairly valued, growing companies whose prices have been witnessing positive momentum!

Are you asking yourself: What next?

Windmill Capital currently offers 15 smallcases as a part of their smallcase subscription, ranging from high-volatility, pure-equity strategies to low-volatility, asset allocation models.

Too many to choose the ideal options from right?

Rest assured, we have done the legwork on best-fit smallcases to invest in next, based on your original investment in Value & Momentum…

#1 Dividend Stars smallcase : Secondary Income in addition to Capital Appreciation

How do you make money from investing in stocks? If you answered – ‘from an increase in the stock prices’ you’re right, but not completely. There’s one more way to earn money from stocks besides price appreciation – dividends. Dividends are a share of net profit which the company distributes to each shareholder.

A company is not liable to pay dividends but when it does, it can be a sign of a stable and growing business. It usually signals to the market that the company has enough cash to not only invest in its own growth but also distribute the excess to its shareholders.

However, when looking to invest in dividend paying stocks, you shouldn’t make investment decisions based on one-time dividend payout. Companies that provide regular dividend payouts and dividend growth tend to have a stable business model and endure economic cycles better are the way to go.

Note: Investors need to consider the fact that pure equity smallcases with a concentration of mid and smallcap stocks has a significant risk in the short term and is only suitable for long-term investors with a higher risk appetite.

#2 Growth at a Fair Price smallcase : High Growth companies available at Fair Valuations

Growth companies are usually defined as companies that have higher earnings growth as compared to their competitors. These companies operate in fast-growing industries and usually do not pay dividends as the earnings are reinvested to fuel growth. Hence, the return on growth stocks usually comes from appreciation of stock prices rather than dividends.

These stocks can be an excellent investment opportunity for investors looking to outperform the market. However, growth stocks can command high valuations which may not be justifiable sometimes. At Windmill Capital, we believe that investors should buy stocks at justifiable valuations.

That’s why we have created ‘Growth at Fair Price’, a portfolio of growing stocks which are trading at fair valuations and have been witnessing an upward momentum in their price.

Note: The smallcase predominantly has a mix of large and smallcap stocks. Pure-equity strategy like this one comes with the risk of significant drawdowns in the short-term and is suitable for long-term investors with a higher risk appetite.

Chances are, you might have already made the right call and invested in one of these already!

With just 1 Windmill Capital subscription, you get access to the above two and 12 other diverse smallcases to invest in!

A total of 15 smallcases are a part of the Windmill Capital Subscription Bundle, providing great value at just ₹ 6000 for 1 year subscription or ₹ 2000 for 3 months

So, what are you waiting for? Get your Windmill Capital smallcase subscription today.

Happy Investing!

Explore Windmill Capital smallcases

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy / sell any security or financial products.

Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital Team

Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. For more information and disclosures, visit our disclosures page here –https://windmillcapital.smallcase.com/#disclosures