Rebalancing Mid and Small Cap Focused Portfolio smallcase

Hello Investors,

Niveshaay has had a fantastic performance in the last quarter! To keep the performance going, your smallcase has been rebalanced keeping in mind the recent market developments.

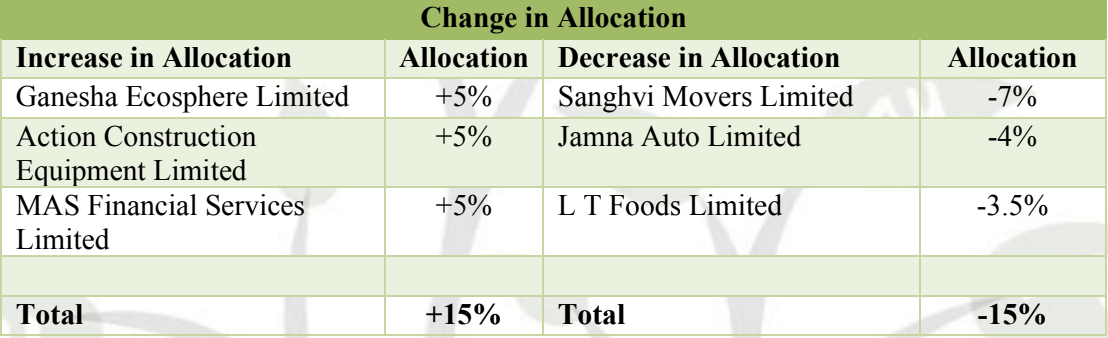

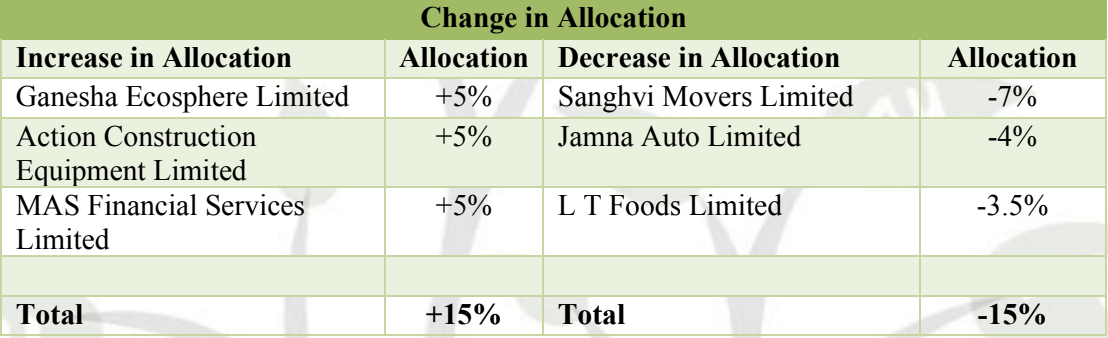

Here is the recommended change in allocation:

Here is the rationale behind the increase in allocation

Why Ganesha Ecosphere Limited?

About the company:

1. The company is into manufacturing of

- Recycled Polyester Staple Fibres

- RPET Yarn: Spun Yarn Products and Filament Yarn Products

2. Installed Capacity

- 6+ billion pet bottles are recycled annually

- 96,600 MTPA capacity of PET waste is converted into quality r-PET fibre

- 7,200 TPA of rPET yarn

- 3,000 TPA of dyed and texturized/twisted filament yarn

3. Export Revenue

- 12.5% in FY22

- 8.0% in FY21

4. Revenue Mix

- 81.5% revenue is derived from RPSF

- 18.5% revenue is derived from rPET Yarn

5. Market Position

- 15% market share in the recycling capacity

6. Plant Location

- 7 manufacturing sites

- Kanpur, Uttar Pradesh

- Rudrapur, Uttrakhand

- Bilaspur, Uttar Pradesh

- Warangal, Telangana

- Nepal

7. Capacity Utilisation

- The company is operating at more than 100% capacity utilization.

Investment Rationale

1. Capacity Expansion in high margin products

a. Warangal, Telangana Unit

- RPSF: 25,000 metric tonnes per annum

- Filament Yarn: 14,000 metric tonnes per annum

- B2B Pet Chips: 14,000 metric tonnes per annum

- Expected Revenue- Rs. 600 crores at full capacity utilization.

- EBITDA Margins- 18-20%

- Commencement: The chip plant was expected to commence in July-22. Fibre and FDY lines would be operational by Sept-22.

- Capex: Rs. 425 crores. The company spent Rs. 300 crores in FY22. The remaining amount would be spent in the current fiscal year

- Savings in freight cost: Rs 2-3/kg

The company owns ~50acre land in Warangal, Telangana through 2 wholly owned subsidiaries – Ganesha Ecopet Private Limited (30 acres) and Ganesha Ecotech Private Limited (20acres). The upcoming 53,000 mtpa facility would be spread across 20 acres of area. The balance 30 acre of land will be utilized for future expansions. The company is expected to double B2B PET chips capacity in next 3 years.

Filament Yarn: Only one-two players are manufacturing recycling filament yarn. Hence, there isn’t much availability. The company plans to supply filament yarn to Zara / Uniqlo to command premium.

The advantage is sourcing raw material from southern region resulting in reducing freight rates. Additionally, there is 75% interest rate subsidy, power subsidy of Rs. 2 per unit and there is refund of state GST along with capital subsidy. All these incentives aren’t included in the expected EBITDA margins guidance.

b. Nepal Unit

- Washing and chip plant

- Expected Revenue: Rs. 75 crores

- Expected EBITDA margins: 18-20%

- Capex: Rs. 40 crores

- Project commenced

Why Nepal ?

- Raw material is 15% cheaper

- Tax rate is 12% for first 5 years

- Ample availability of raw material

c. Kanpur Unit: HDPE pilot plant

- Capacity: 300 tons per month

- Capex: Rs. 30 crores (funded through insurance claim received)

- Plans to ramp upto 1000 tons per annum

- Expected Revenue: Rs. 100 crores

- EBITDA margins guidance: 20%

They plan to start recycling of rigid plastics. The aim is to seize upcoming opportunities for quality products in recycled rigid plastic (HDPE) segment to fulfil the EPR liability of brand owners & manufacturers.

Cumulative expected revenue from the above capex is expected to be around Rs. 750 crores. EBITDA margins is expected to be in the range of 18-20%. Total capex incurred is Rs. 500 crores.

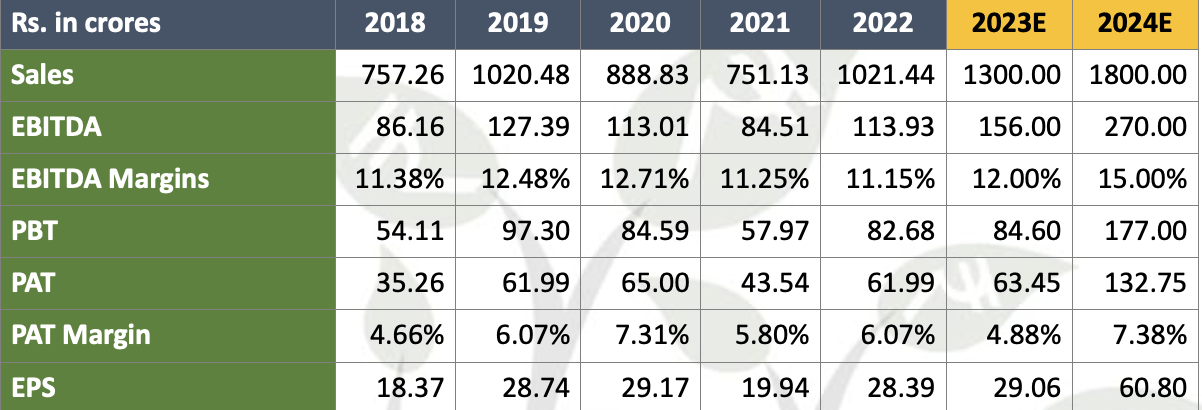

2. Stable Margins in the past, change in product mix and upcoming higher EBITDA margins capex

In the past, the company has been able to maintain stable margins and this is a very important factor to consider in spinning industry.

3. Growing sustainably is on the agenda of almost all corporates and brand owners: Pick up in recycled yarn industry

- Sustainability is at the core of brand owners while planning future growth

- Brand owners are able to charge premium for their products. According to survey- 60% in India are willing to pay premium for sustainable production.

- Initially, recycled yarn was largely prevalent in international market. Now, there is movement in domestic market too. Banswara Syntex Ltd. management in the recent conference call highlighted how they have increased the amount of recycled polyester in their manufacturing process. So far, recycled yarn was considered in India only if it was more competitive, but now other factors are given much more important trslating into higher demand.

- Though the yarn industry is quite volatile and works like a commodity industry, their value-added products would reduce some part of volatility in their yarn business.

4. Revenue Guidance

- FY23- Rs. 1300-1400 crores

- FY24- Rs. 1900-2000 crores

Why Action Construction Equipment Limited?

About the company:

ACE is a material handling and construction equipment manufacturing company offering products with a majority market share in Mobile Cranes and Tower Cranes segment.

1. The company is into manufacturing of

- Material handling and construction equipment such as Cranes, Backhoe, Tractor, Forklift etc.

2. Installed Capacity (Units)

- Cranes – 9,000

- Construction Equipment – 1,500

- Material Handling Equipment – 1,800

- Agriculture Equipment – 9,000

- Total Installed Capacity – 21,300

3. Manufacturing Facilities

- Faridabad

- Palwal

4. Revenue Mix

- Cranes – 68%

- Construction Equipment – 11%

- Material Handling Equipment – 9%

- Agriculture Equipment – 12%

Investment Rationale

1. Margin Expansion expected

Steel contributes around 60% of the total input cost. With cool down in steel prices on account of government decision to impose a 15% export duty on a range of finished steel products. This segment accounted for almost 95% of India’s overall finished steel exports in FY21 and FY22. This can lead to margin expansion as company had taken price hike during the period of steel prices pickup.

Margins are expected to improve from Q2 FY23 onwards as high cost inventory would have passed through the system.

2. Market Leader

The Company has around 63% market share in Pick & Carry Cranes and 60% in Fixed Tower Cranes.

3. Export Opportunity

The company was awarded (in Q1FY23) a contract to set up an assembly plant for manufacturing of tractors, backhoe loaders and fabrication of agricultural implements for the Government of the Republic of Ghana.

The company will set up a plant with capacity of 4500 tractors, 600 backhoes, 600 agricultural equipment’s is implements and 300 tipping trailers annually.

4. Opportunity in the Defence Sector

The company has received an order for supply of 40 Backhoe Loaders from Border Road Organisation, Ministry of Defence.

Why MAS Financial Services Limited?

About the company:

Mas financial services registered as an NBFC in 1995 to serve middle- and lower-income customers.

1. The company is offering

- Micro Enterprise Loan

- SME Loans

- 2W Loans

- CV Loans

- Salaried Personal Loan

- Tractor & Used Car Loan

2. Asset Size & Portfolio Mix

- Total AUM of Rs. 6,246 crore

- 75% of the asset portfolio comprises of MSME loans

3. Operational Strategies

- In-house software team accompanied by outsourcing agencies.

- Servicing the Informal Segment – The company is focusing on retail borrowers who have been overlooked by the formal financial sector

- Target group – Middle and low-income families.

- Local partnership – an extensive network of 151 partners and access to borrowers in the formal and informal sectors of the urban, semi-urban, and rural areas who prefer to deal with local rather than pan-India intermediaries.

Investment Rationale

1. MAS Unique Business Model

MAS operates a unique lending model through which it partners with smaller NBFCs that operate in sectors similar to that of MAS and are present pan-India. Currently, MAS has 149 NBFC & NBFC-MFI partners. The average AUM of these NBFC partners is ~Rs. 200 Cr, and each partner takes loans from 20-25 lending institutions. MAS fulfills between 5-25% of its NBFC partner’s borrowing requirements. The partner selection process is based on the promoter expertise, credit screening procedures, historical credit costs and credit quality, capital adequacy, and profitability.

A portion of these partner NBFCs’ receivables is hypothecated to MAS, which provides coverage for the outstanding loan amount. All the expenses of sourcing the end customers and the risk of default are borne by the partnering NBFC.

Under this model, MAS lends to these NBFC partners at 13-15%, which the NBFC partners further lend to its end-customers at ~21-22%, enabling the NBFC partners to make a spread of 8-9%. The average CoF for MAS is ~8-9%, enabling MAS to earn a spread of 4-5%, with minimal risk of default. The management believes that this model is feasible over the direct selling model as it insulates MAS from the risk of delinquencies and reduces OPEX and credit costs.

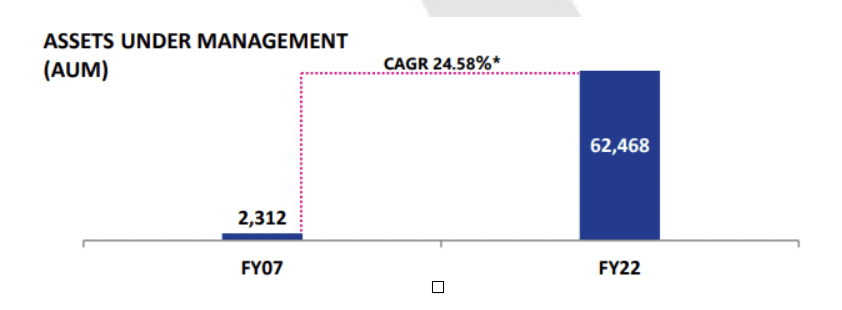

2. Assets Under Management (AUM) Growth

The company has displayed good growth over the years.

Why exit Sanghvi Movers, LT Foods Limited and Jamna Auto Limited?

We are holding Sanghvi Movers in our portfolio since April 2021. This has generated 100%+ returns in the past 20 months. Now, we are shifting our allocation to Action Construction Equipment (ACE) limited.

We have added LT Foods as a tactical allocation in our portfolio for the short term. We are booking profits in the company and shifting allocation to better opportunities in the market.

We are exiting Jamna Auto Limited, as in Q2 FY23 gross profit margin fell to 31.8% from 34.5% last quarter and from 37% in Q2 FY22. Though result was comparatively stable but with commodity prices correcting and Jamna having a complete pass through model with OEM’s, even though volume growth can come but increasing absolute profit would be a challenge. Hence, we are shifting to better opportunities.

Happy Investing!

Mid and Small Cap Focused Portfolio

Mid and Small Cap Focused Portfolio