Stainless Steel giant makes shareholders 50% in 3 months

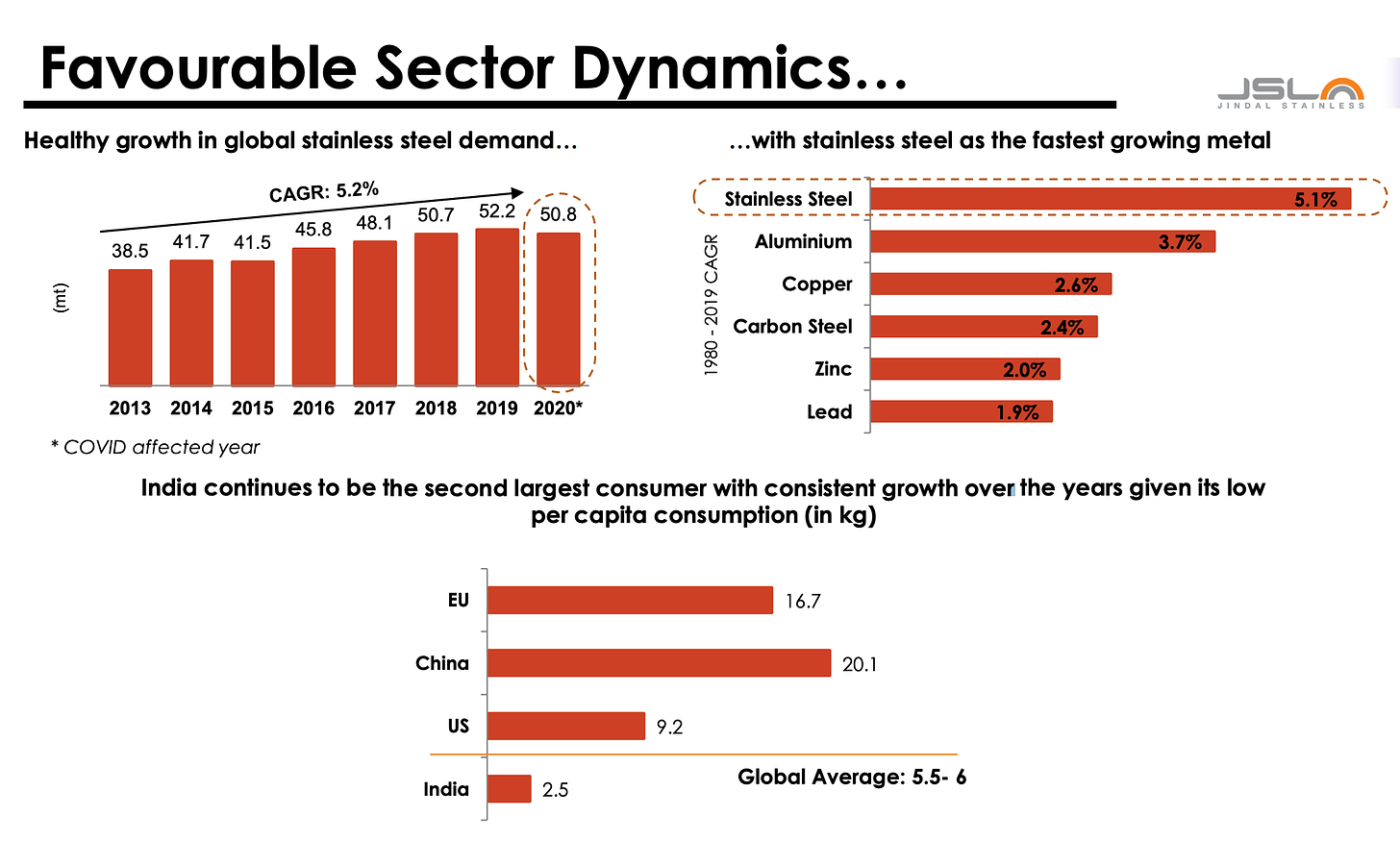

Jindal Stainless Limited (NSE : JSL) a leading steel producer, has shown consistent growth in revenue and profits over the years. With a weight of 9.92%, it is a significant holding in our Sector Advantage smallcase. As the demand for steel increases in the infrastructure and construction sectors, JSL is poised for significant growth in the coming years.

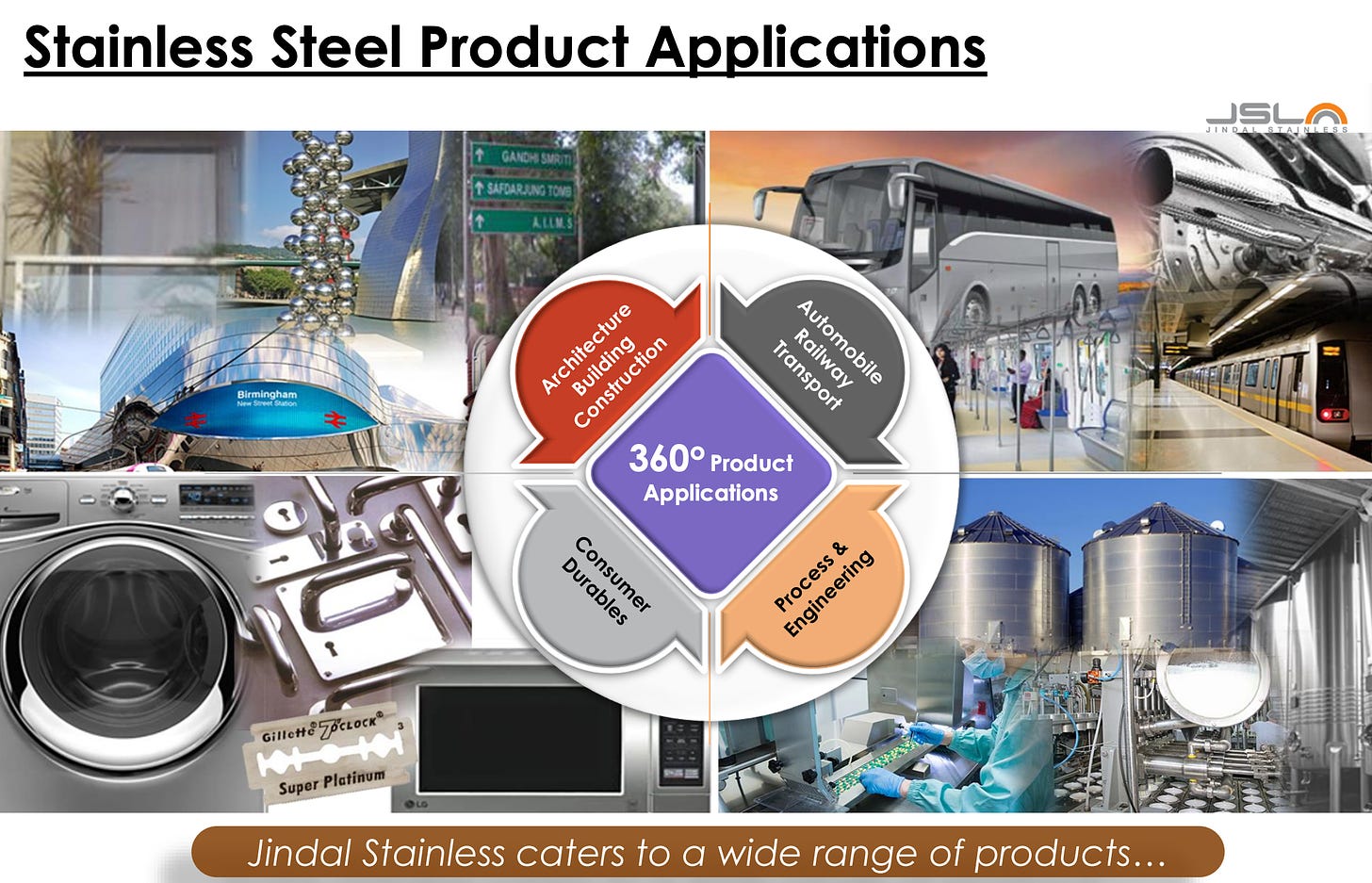

The stainless steel industry is a highly competitive market, and finding a company that has managed to establish a product-market fit in this industry is noteworthy.

Why we added Jindal Stainless Ltd

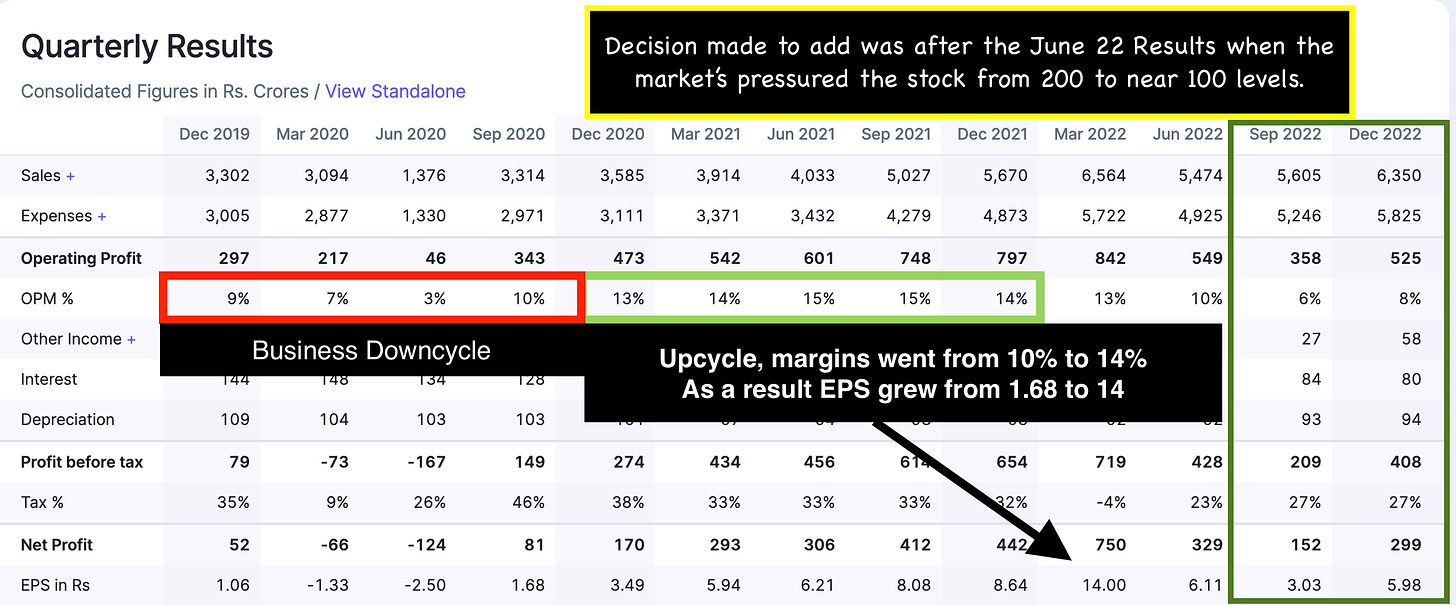

Since 2017 the company has never registered an annual operating margin of below 9% and we were hopeful FY23 would not be the first.

Once our team was able to validate, the company was added to our portfolio end of November ’22, since then the stock has made our shareholders 50% in 3 months.

About JSL

JINDAL STAINLESS STEEL has been able to leverage its robust logistics infrastructure, state-of-the-art machinery, and a well-established distribution network.

Their manufacturing facilities are equipped with the best of European suppliers’ state-of-the-art machinery and engineering, enabling them to produce globally competitive stainless steel products. Additionally, the company’s captive power plant has a capacity of 264 MW and is supplied by BHEL, India.

It’s logistics infrastructure is equally impressive, with in-house railway sidings and close proximity to ports providing strong support for its overall operations. This infrastructure ensures that the company can efficiently transport its products, reducing lead times and optimizing customer service and deliveries. This distribution network allows the company to optimize customer service and deliveries, ensuring that its customers receive their products on time, regardless of their location.

In conclusion, the largest integrated stainless steel company in India has managed to achieve a product-market fit by leveraging its robust logistics infrastructure, state-of-the-art machinery, and a well-established distribution network. With its competitive products and efficient operations, the company is well-positioned to meet the growing demand for stainless steel products in India and around the world.

Subscribe to Sector Advantage smallcase with promocode ALPHA20 for 20% OFF

Craving Alpha is a SEBI Registered Investment Adviser (SEBI Registration No. INA300017038). The research and reports express our opinions which we have based upon generally available public information, field research, inferences and deductions through are due diligence and analytical process. To the best of our ability and belief, all information contained here is accurate and reliable, and has been obtained from public sources we believe to be accurate and reliable. We make no representation, express or implied, as to the accuracy, timeliness, or completeness of any such information or with regard to the results obtained from its use. This report does not represent an investment advice or a recommendation or a solicitation to buy any securities.

Craving Alpha

Craving Alpha