The Good Bad and Ugly weekly review : 5 Dec 2023

Markets this week

Nifty had a remarkable week, climbing from 19,800 to 20,260 registering a gain of about 460 points and closing at an all-time high. The weekly candle that initially concerned bulls was quickly recovered in the following weeks, demonstrating the importance of following the price for market success.

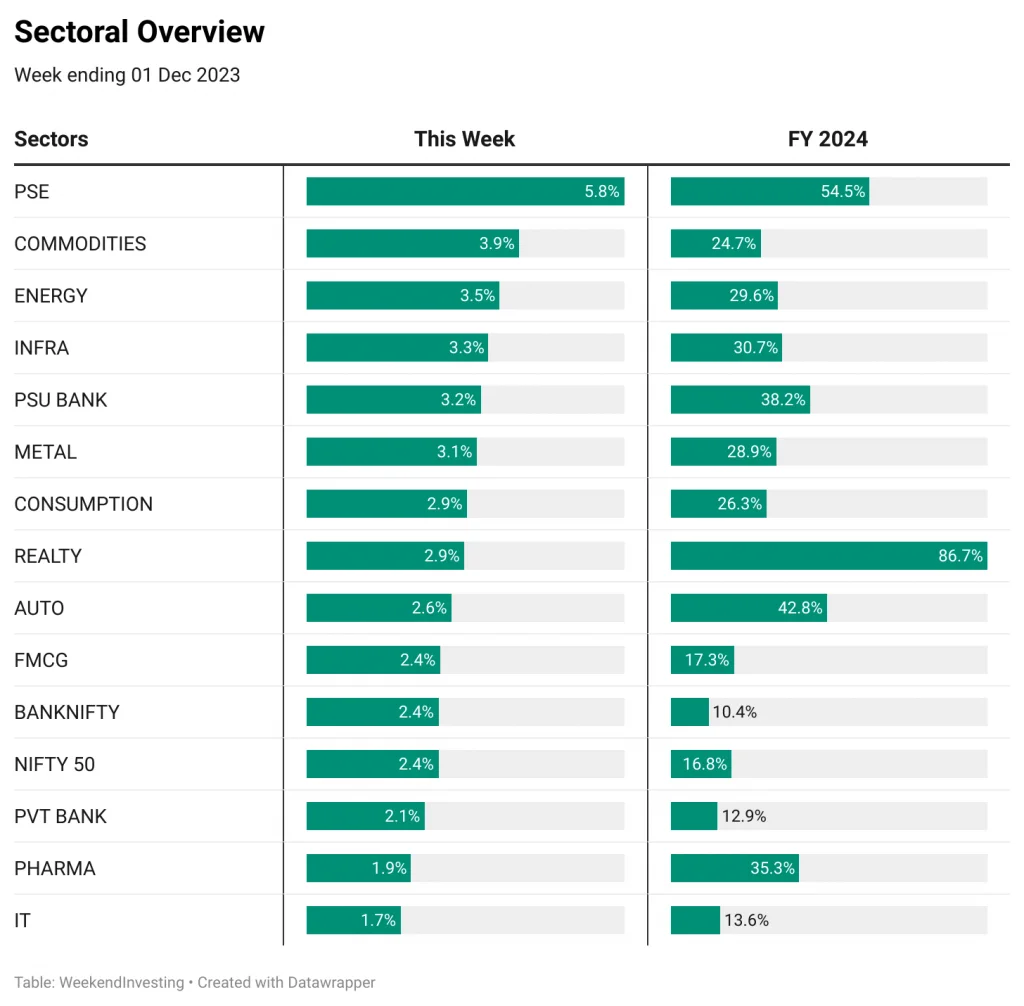

Sectoral Overview

Looking at sectoral performance, real estate stocks topped the charts with a phenomenal 86.7% gain in FY 24, followed by public sector enterprise stocks at 54%. These sectors, which may have been overlooked in the past, have shown exceptional returns during this period.

Autos, PSU banks, pharma, commodities, energy, and infrastructure stocks have also performed well, with gains ranging from 30% to over 40%.

In the weekly performance table, almost every sector experienced positive growth during the week, with the weakest performer still gaining 1.7%.

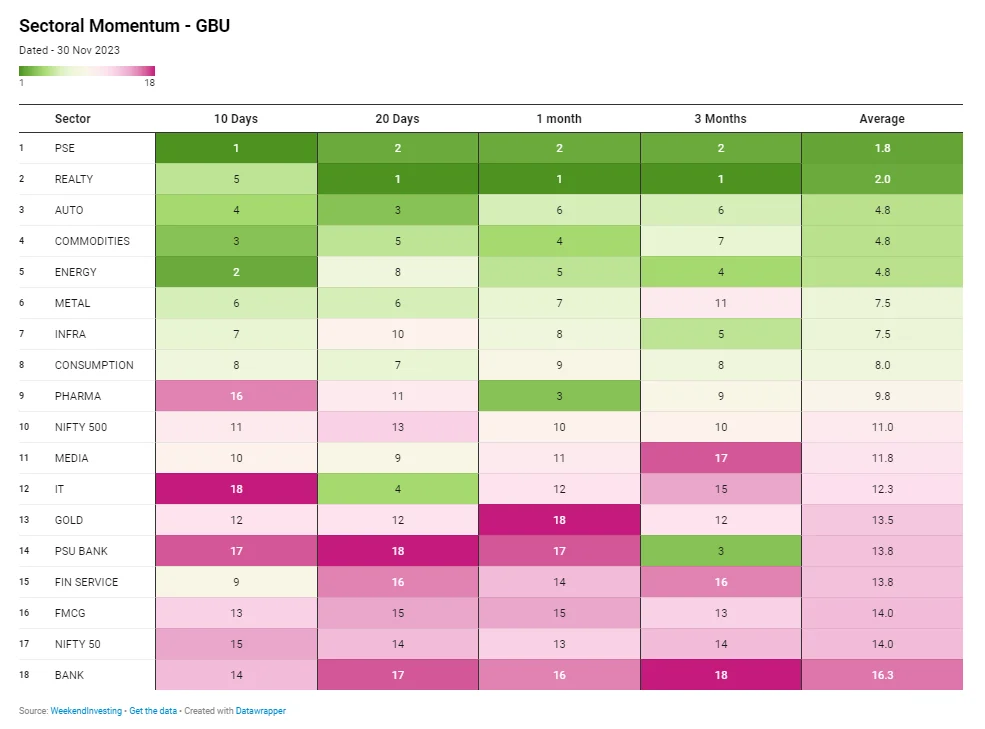

The short-term momentum is particularly strong for public sector enterprise stocks with real estate slipping to second rank behind the former.

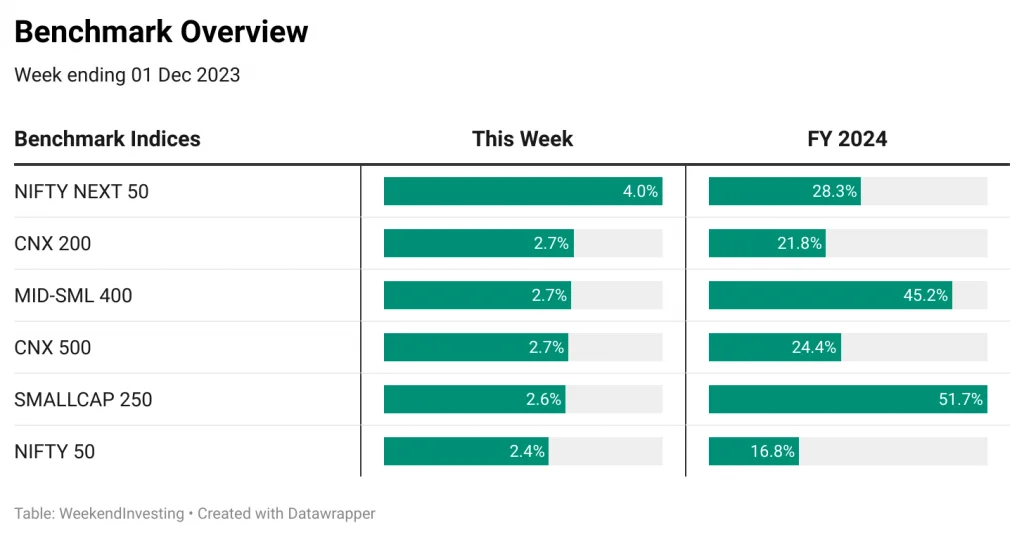

Benchmark Indices Overview

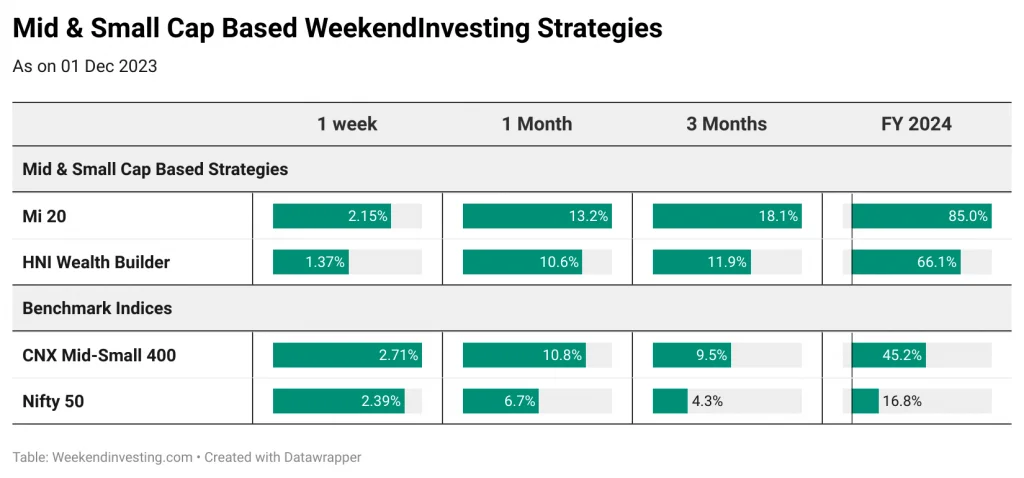

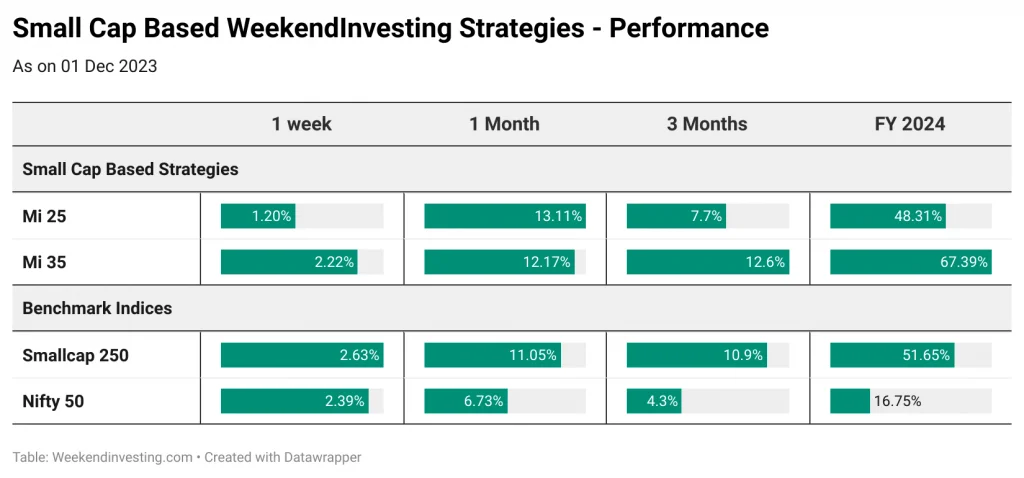

Nifty Next 50 index outperformed other indices, gaining 4% for the week while Nifty 50 recorded a 2.4% gain. Small-cap 250 and Mid-small 400 registered impressive FY 24 gains of 52% and 45%, respectively while The CNX 500, CNX 200, and Nifty Next 50 indices all rose by around 25%.

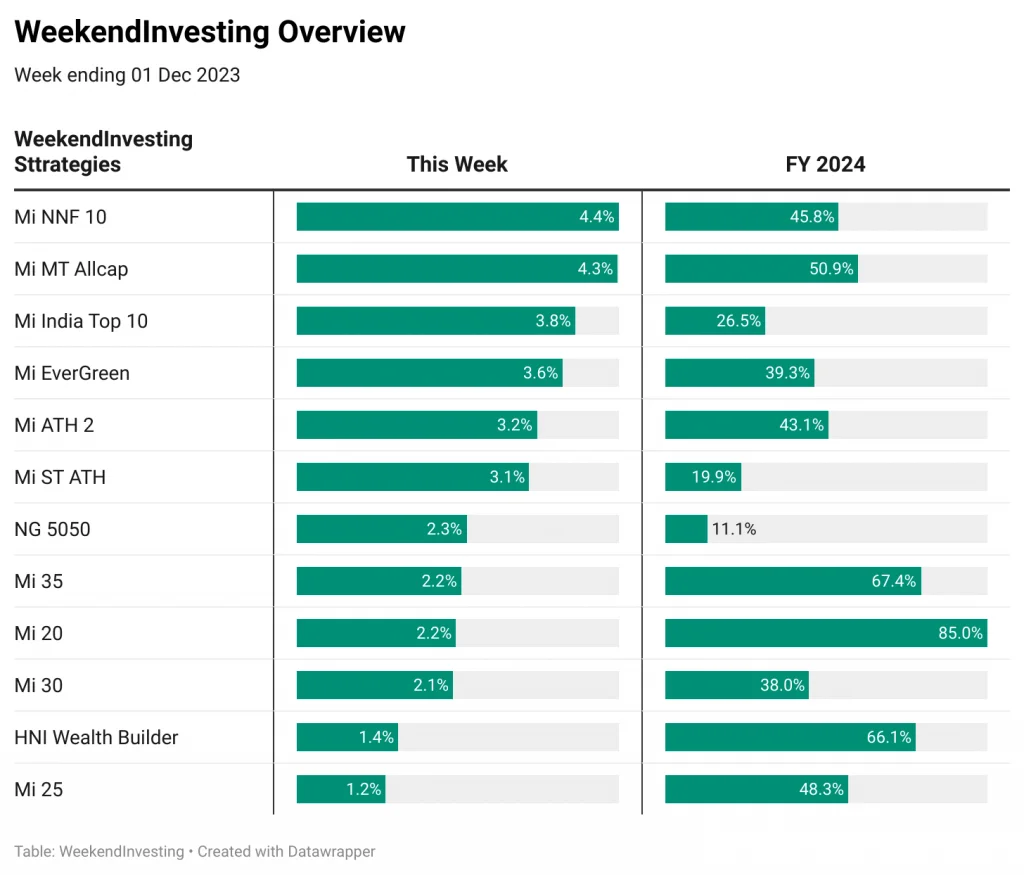

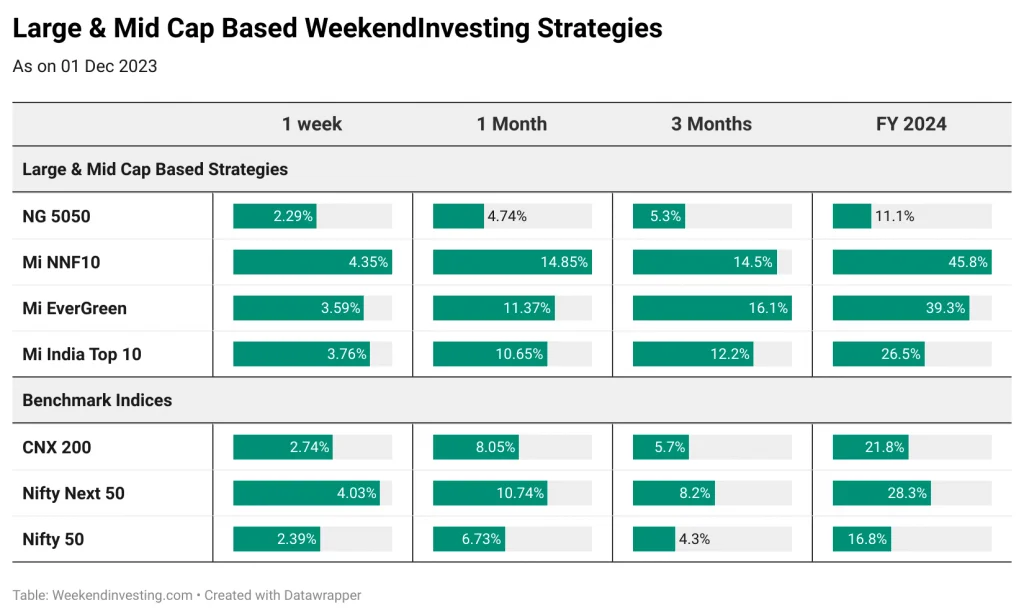

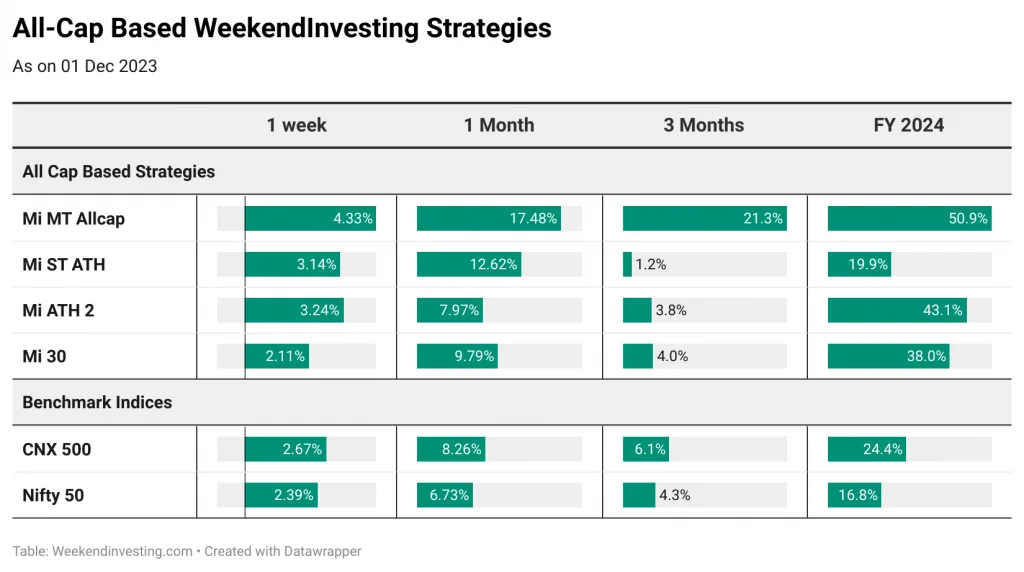

WeekendInvesting Overview

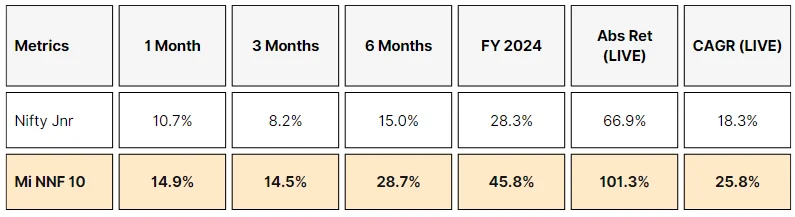

Mi NNF 10, which focuses on the top trending stocks in the Nifty Next 50 universe, recorded a massive gain of 4.4%. Similarly, the Mi India Top 10 strategy gained 3.8% this week. These strategies have exhibited exceptional performance during the financial year, with NNF Ten delivering a 51% return and Mi India Top Ten recording a 26.5% gain.

Other strategies such as Mi Evergreen, Mi ATH, Mi35, Mi20, and HNI Wealth Builder have also shown positive returns ranging from 3.2% to 3.8% this week. These strategies exhibit the power of momentum investing and debunk the myth that diversification leads to loss of returns.

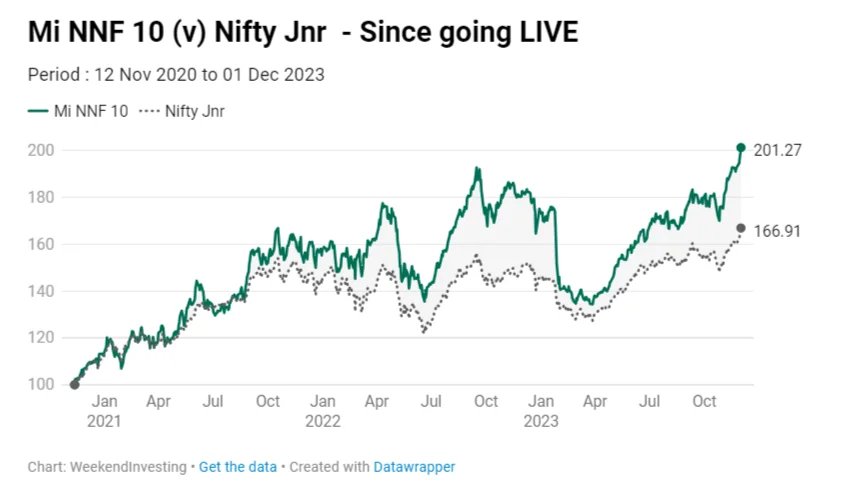

SPOTLIGHT – Mi NNF 10 scores a splendid 2x !

The spotlight of the week is on Mi NNF 10, which has doubled its performance since its launch in November 2020.

Despite two drawdowns and market volatility, the strategy has consistently bounced back and outperformed expectations. This highlights the importance of staying invested for the long term and having faith in the momentum approach.

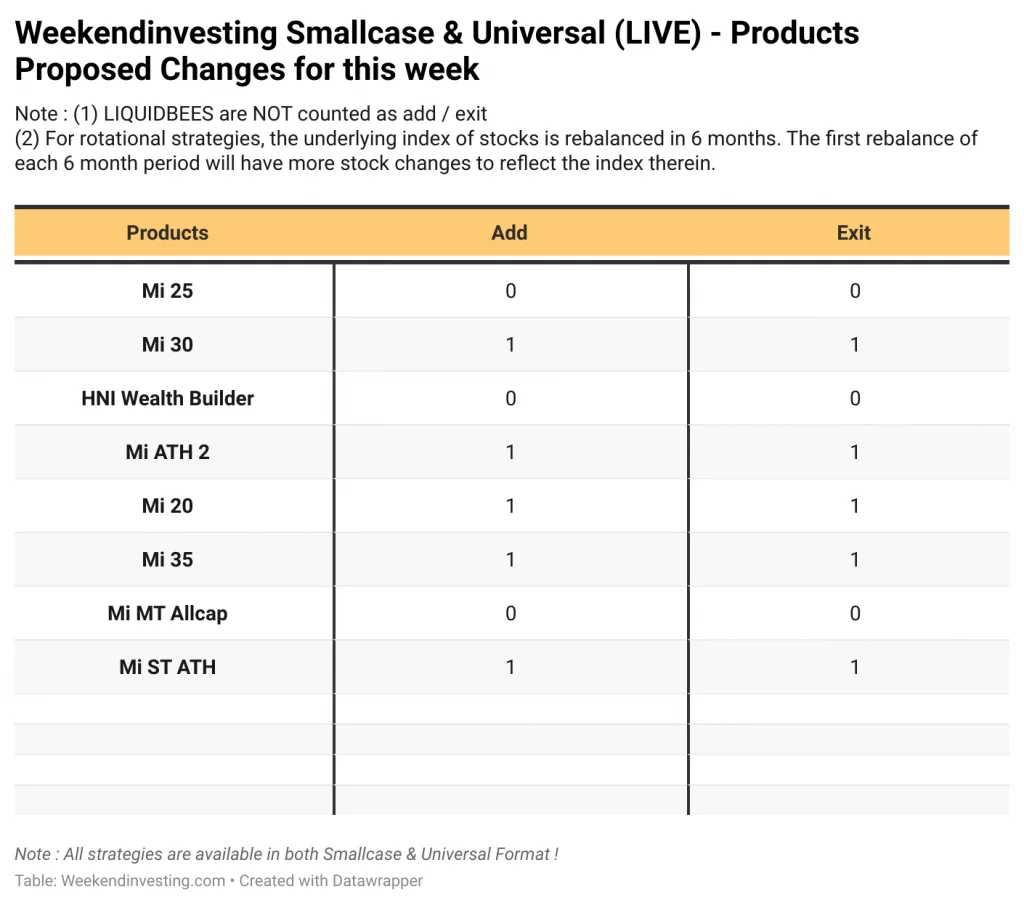

Rebalance Update

We give advance notice here on the upcoming changes in your smallcase for Monday. This advance notice can be used to ignore Monday’s update if there is no change. If there is a change indicated you can use the smallcase app or log in to weekendinvesting.smallcase.com to see the rebalance. A backup email is sent by mid-day Monday if you have not rebalanced by then and yet another one a day later.

Note: We are not including LIQUIDBEES as an ADD or an EXIT count.

WeekendInvesting Strategies Performance

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Check out Weekend Investing smallcases here

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst