The secret of success : Casino Math

Momentum Investing is popular among investors aiming to take advantage of upward trends in stock prices. The concept behind momentum investing is simple: buy stocks that are rising and sell those that are falling. In this article, we will explore Mi MT Allcap strategy, which has been highly successful since its inception in 2018. We will analyse its transaction history and understand why it has been a winning strategy.

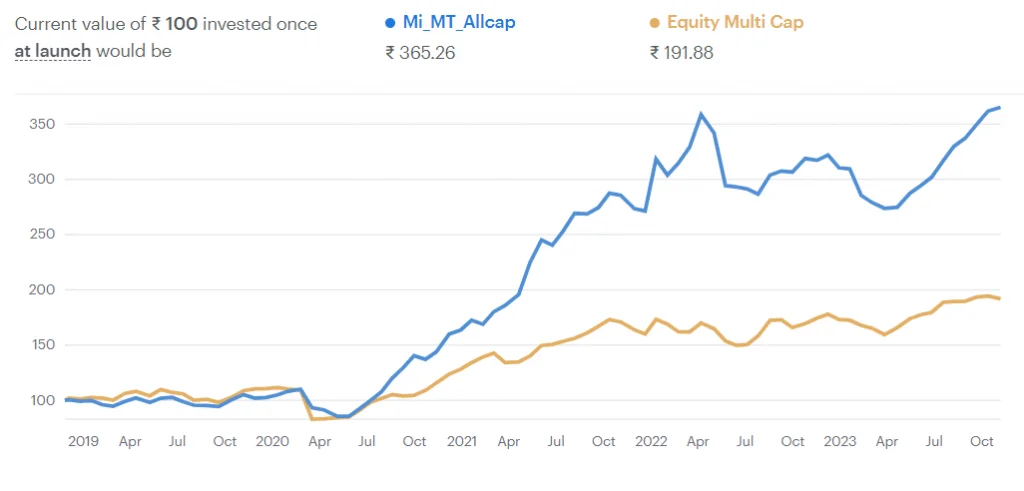

Mi MT Allcap : 265% gains compared to 91% gains on the CNX 500 index

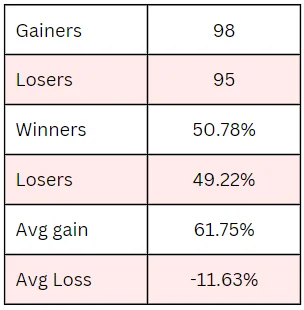

This strategy has executed a total of 193 transactions over a span of five years. Out of these transactions, 51% have been winners, while 48.7% have been losers. This means that this strategy has been correct only slightly more than half the time. However, the key to its success lies in the fact that the average gain on a winning trade is 61%, while the average loss on a losing trade is only 11.7%.

In other words, even though Mi MT Allcap has an almost equal number of winners and losers, the size of the winners outweighs the size of the losers. This is the crux of momentum trading: letting your winners run and cutting your losers short. By doing so, you can achieve net gains even with a relatively low success rate.

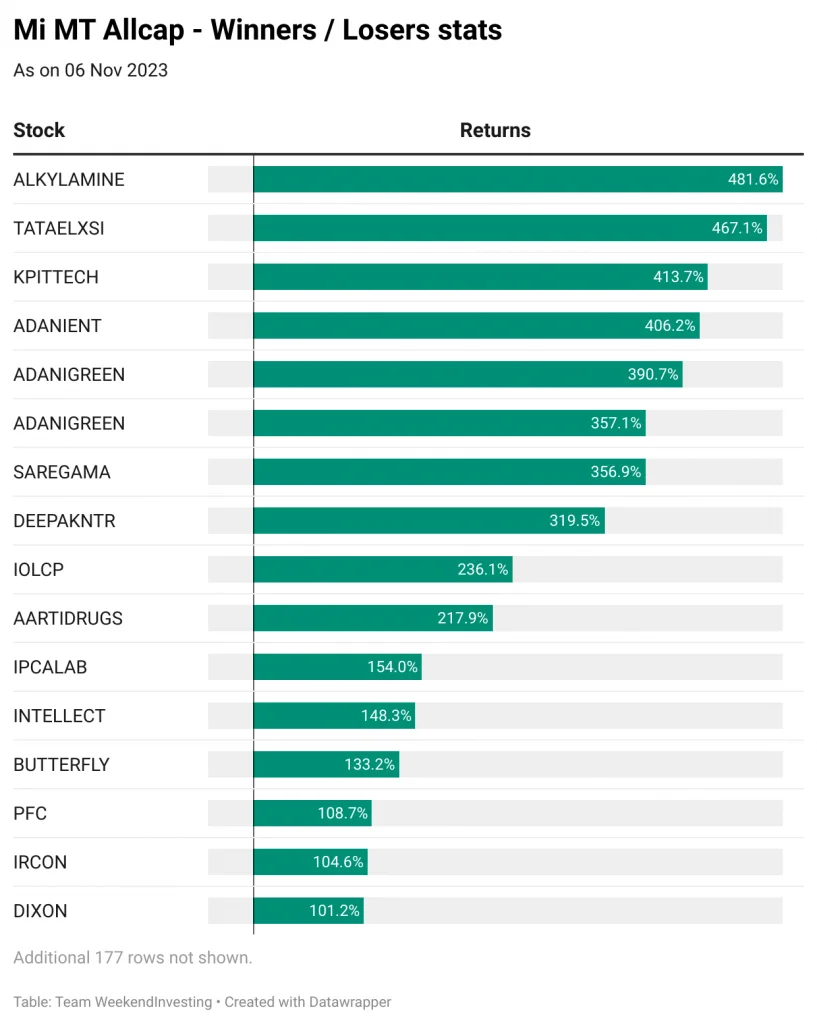

Let’s take a closer look at some examples of successful trades on Mi MT Allcap strategy.

Let’s take a closer look at some examples of successful trades on Mi MT Allcap strategy. Alkyl Amine, for instance, has been the biggest winner to date with a staggering 481% gain. Other notable winners include Tata Elxsi (467%), KPIT (400%), Adani Enterprises, and Adani Green. Adani Green, in particular, was sold partially when it exceeded a certain threshold and then completely sold off at 390 levels.

Additionally, numerous stocks have yielded gains ranging from 100% to 90%, with a significant number falling in the 40% to 50% range. Many others have delivered gains in the 30s, showcasing the strategy’s ability to capture profitable opportunities across various price ranges.

While there have been a few stocks that showed minimal gains or losses, the majority of trades resulted in a closing price near 0% to 25%.

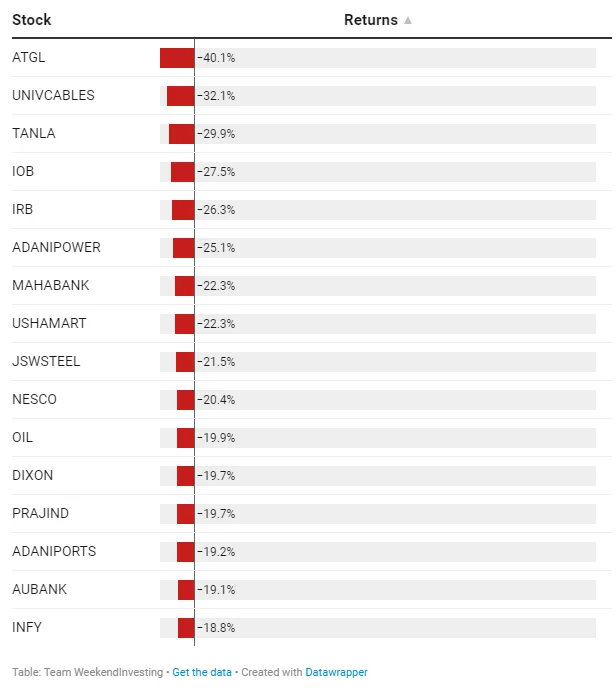

While there have been a few stocks that showed minimal gains or losses, the majority of trades resulted in a closing price near 0% to 25%. Only a handful of stocks experienced larger losses, such as IRB, IOB, TANLA, Universal Cables, and ATGL.

The statistics of this strategy reveal an essential aspect of any trading methodology—the casino math. Simply put, it recognizes that the probability of winning is not the sole determining factor in your overall outcome. What matters most is how much you win when you win. In the case of the Mi MT Allcap strategy, the average gains on winners far outweigh the average losses on losers.

This insight serves as a valuable lesson for investors, regardless of their preferred trading style. Whether you are a momentum trader or practise any other strategy, it is crucial to prioritise the magnitude of your winning trades. Even if your success rate is not exceptionally high, ensuring that your average winner is significantly larger than your average loser can lead to overall profitability.

Liked this story and want to continue receiving interesting content? Watchlist Weekend Investing smallcases to receive exclusive and curated stories!

Explore Mi MT All Cap smallcase by Weekend Investing here, use code DEEPAWALI20 for FLAT 20% Off

WEEKENDINVESTING ANALYTICS PRIVATE LIMITED is a SEBI registered (SEBI Registration No. INH100008717) Research Analyst