The Tipping Point for BHEL: A Turnaround or Just Another Bump?

Could Bharat Heavy Electricals be entering a renaissance period, or is this just a brief respite? Let’s dissect this recent phenomenon with discerning lenses.

Snapshot of the Momentous News

The Groundbreaking Order: BHEL recently bagged a colossal order from NTPC to build a 2×800 MW supercritical thermal power project in Chhattisgarh. With the total project cost estimated at INR 15,600 Crore, the street expects the order’s value for BHEL to be around INR 11,000-12,000 Crores.

Order Inflow: Notably, the company has recorded an order inflow of over INR 35,000 Crs. in FY24. Cumulative projections suggest an inflow of INR 1.8trn over FY24-26E (Estimated by the Market), transforming the outlook for BHEL’s margins and EPS.

Multiple Growth Avenues: Apart from thermal power, BHEL is diversifying into railways, defence, and renewable energy.

👉 Before you brush this off as just another order win, let’s consider why this might be a watershed moment for BHEL.

Mapping the Landscape

Revival of Thermal Power Sector: Let’s walk down memory lane. The early 2010s heralded an era of renewable energy focus in India. Yet, here we are, circling back to thermal power projects. Why?

The Indian economy is roaring ahead, with 8-10% growth in power consumption year-over-year.

There needs to be more than renewable energy to meet the demand. Hence, thermal energy is back in the limelight, with around 20 GW orders in the pipeline.

Holistic Growth Approach: Why put all your eggs in one basket? BHEL’s new strategy aims for a diversified portfolio, targeting lucrative sectors like railways and defence.

Riding the Growth Wave: In line with India’s burgeoning economy and manufacturing sector, a growth in power consumption by 8-10% appears inevitable. A diversified BHEL stands to reap the benefits.

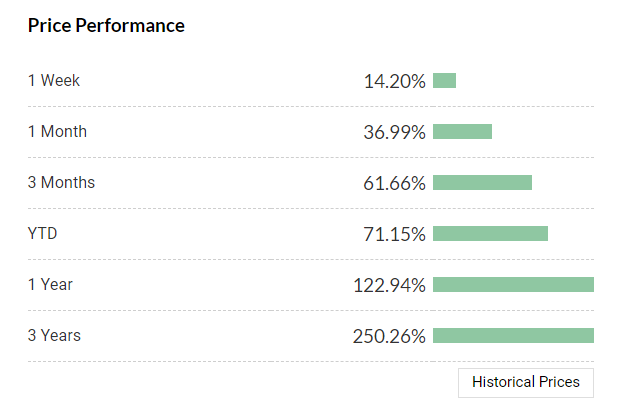

Stock Performance

Actionable

Watch the Order Book: Maintain a close eye on BHEL’s order book growth and execution speed.

👉 A Note of Significance: BHEL is a Quantace PSU Stars smallcase constituent. And this is where things get interesting.

Liked this story and want to continue receiving interesting content? Watchlist Quantace smallcases to receive exclusive and curated stories!

Disclaimer: This is not an investment advice.

Check out Quantace PSU Stars smallcase here

Karthick Jonagadla•SEBI Registration No: INH000008312

D4 Plot 265, Ujjwal CHS, Gorai 2, Borivali West Mumbai 400092