What is Quantitative Trading? | Quant Investing

The financial world has witnessed an evolution in trading approaches, leading to the rise of quantitative trading, an intriguing contrast to traditional trading methods. Let’s embark on a detailed exploration of quantitative trading and its various facets.

Read the full story on Wright Research’s blog.

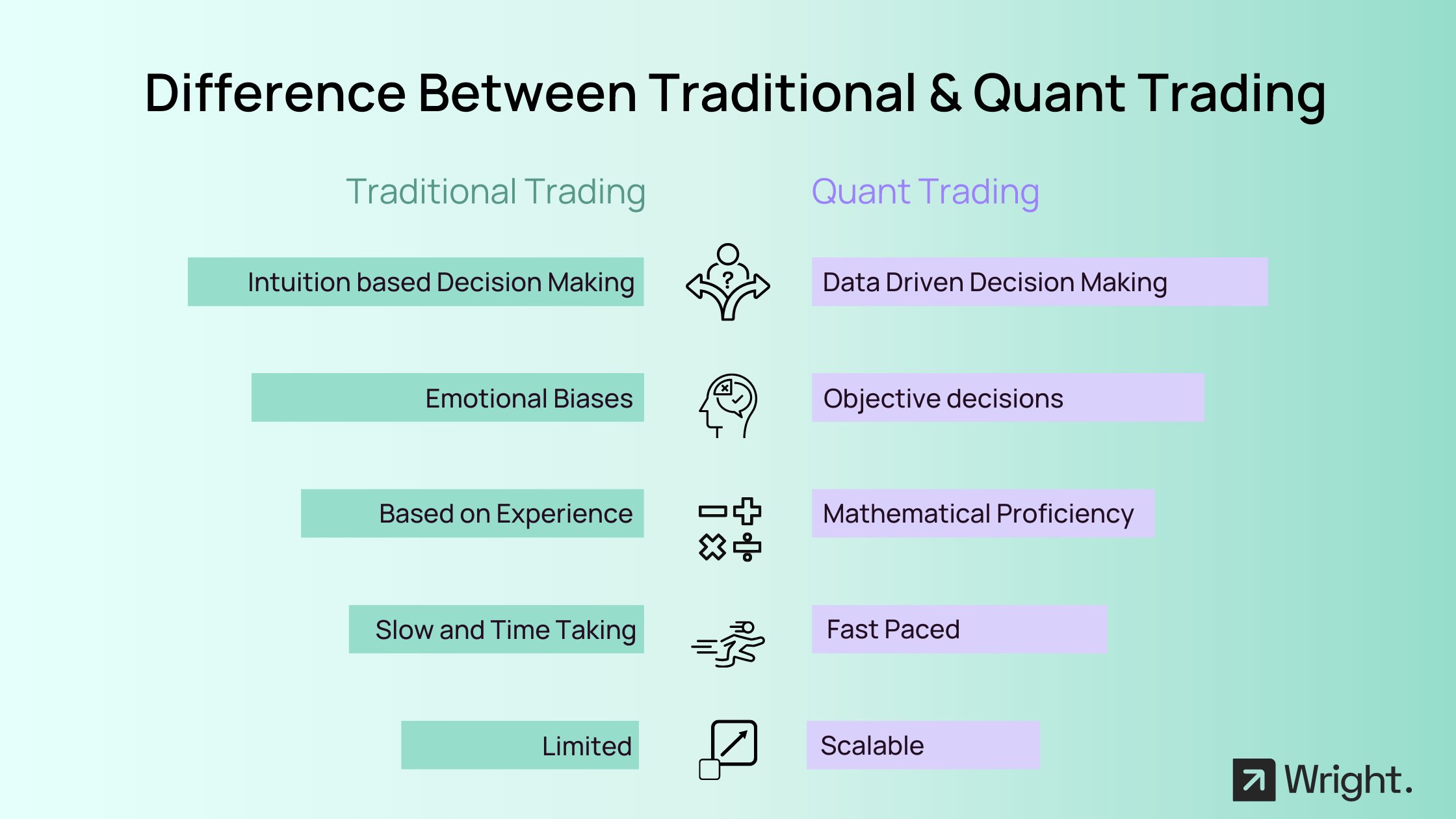

Quant Traders vs Traditional Traders

Traditional traders and quantitative traders represent two distinct breeds of market participants. Traditional traders often rely on intuition, experience, and subjective judgement. They interpret market news and events, conduct fundamental analysis, and follow market trends to make trading decisions.

In stark contrast, quantitative traders turn to data, mathematics, and computational power to guide their trading. Their strategies are formulated based on empirical evidence rather than subjective opinions. Through a blend of statistics, financial knowledge, and computer algorithms, they dissect market dynamics and seek profitable opportunities. This scientific approach lends itself to more objective and potentially profitable trading decisions.

Use of Systematic Trading

The heart of quantitative trading lies in its systematic nature. Quant traders develop intricate algorithms designed to implement trading strategies automatically. These algorithms, powered by high-speed computers, analyze market data in real time, confirm or refute market sentiments, and decide optimal points of entry and exit for trades.

This systematic approach counters human biases that can often skew judgement. Emotions such as fear and greed are taken out of the equation, leading to decisions based purely on the statistical likelihood of profit. The data-driven and emotionless nature of systematic trading often contributes to more consistent and reliable trading outcomes.

Testing and Skepticism

A defining characteristic of quantitative trading is its commitment to constant testing and skepticism. Much like scientists in a lab, quant traders don’t take their models at face value. They subject their strategies to rigorous backtesting using historical data, cross-validation using out-of-sample data, and forward testing in real-time market conditions.

Quant traders maintain a pragmatic understanding that no strategy is infallible. They are conscious that even a historically successful model may cease to be profitable due to evolving market conditions, regulatory changes, or shifts in economic landscapes. This awareness drives them to consistently refine and adapt their strategies.

Skills and Background

The domain of quantitative trading demands a robust skill set. Quant traders typically possess a strong foundation in mathematics and statistics. Many come from academic backgrounds such as mathematics, engineering, or physics which equip them with analytical skills and a problem-solving mindset.

Beyond academic qualifications, quantitative traders need a deep understanding of financial markets. Mastery over financial derivatives, corporate finance, risk management, and trading instruments is crucial. Additionally, proficiency in programming languages like Python, R, and C++ is required to develop and implement complex trading algorithms.

Focus on Constraints – Costs & Liquidity

The financial markets that quantitative traders choose to operate in are typically highly liquid. This is because executing large orders in illiquid markets can lead to substantial price slippage, adversely impacting the profitability of their strategies.

Additionally, quant traders meticulously account for transaction costs in their models. These costs, which include broker commissions, bid-ask spreads, and market impact costs, can significantly eat into trading profits if not properly managed. Therefore, an integral part of algorithm design involves minimizing transaction costs and optimizing trade execution.

Hypothesis Testing

The development of a quant strategy often begins with a hypothesis about market behavior. This could be an assumption about price patterns, market anomalies, relationships between different assets, or any other conceivable market pattern.

Quant traders test these hypotheses using historical market data and robust statistical techniques. They evaluate the strength of the hypothesis, assess its statistical significance, and gauge its profitability. If the hypothesis stands the scrutiny, it is incorporated into a trading strategy; otherwise, it’s back to the drawing board.

Diversification and Risk Management

A critical principle that quant traders abide by is diversification. They aim to build portfolios composed of a variety of uncorrelated or weakly correlated assets. This diversification reduces the portfolio’s vulnerability to market shocks affecting a particular asset or sector.

Quant traders are well aware of the limitations of statistical modeling in predicting all market events. Therefore, risk management is a key component of their strategies. They employ techniques such as portfolio optimization, position sizing, stress testing, and VaR modeling to manage risk effectively.

Myths about Quant Trading

Quantitative trading is often shrouded in myths and misconceptions. Let’s debunk some common misconceptions and shed light on the realities of this approach:

- Myth 1: Quantitative trading is a “black box” with no transparency.

Reality: Quantitative strategies have well-defined processes and methodologies. Transparency can be achieved through clear documentation and open communication, providing insights into the strategy’s logic and implementation.

- Myth 2: Quantitative strategies are overly complex and require advanced mathematical knowledge.

Reality: Basic understanding of statistics and financial concepts, combined with available technology, can enable individuals to engage in quantitative trading successfully.

- Myth 3: Quantitative trading eliminates the need for human judgment and expertise.

Reality: Quantitative trading complements human judgment and expertise. Skilled professionals apply their expertise in design, interpretation, and adaptation of strategies.

- Myth 4: Quantitative trading is purely focused on short-term gains and lacks long-term investment value.

Reality: Quantitative strategies can incorporate both short-term and long-term perspectives, allowing traders to pursue investment value over time.

- Myth 5: Quantitative trading strategies guarantee consistent profits.

Reality: No trading strategy guarantees consistent profits. Risk management and adaptation are integral to navigate changing market conditions.

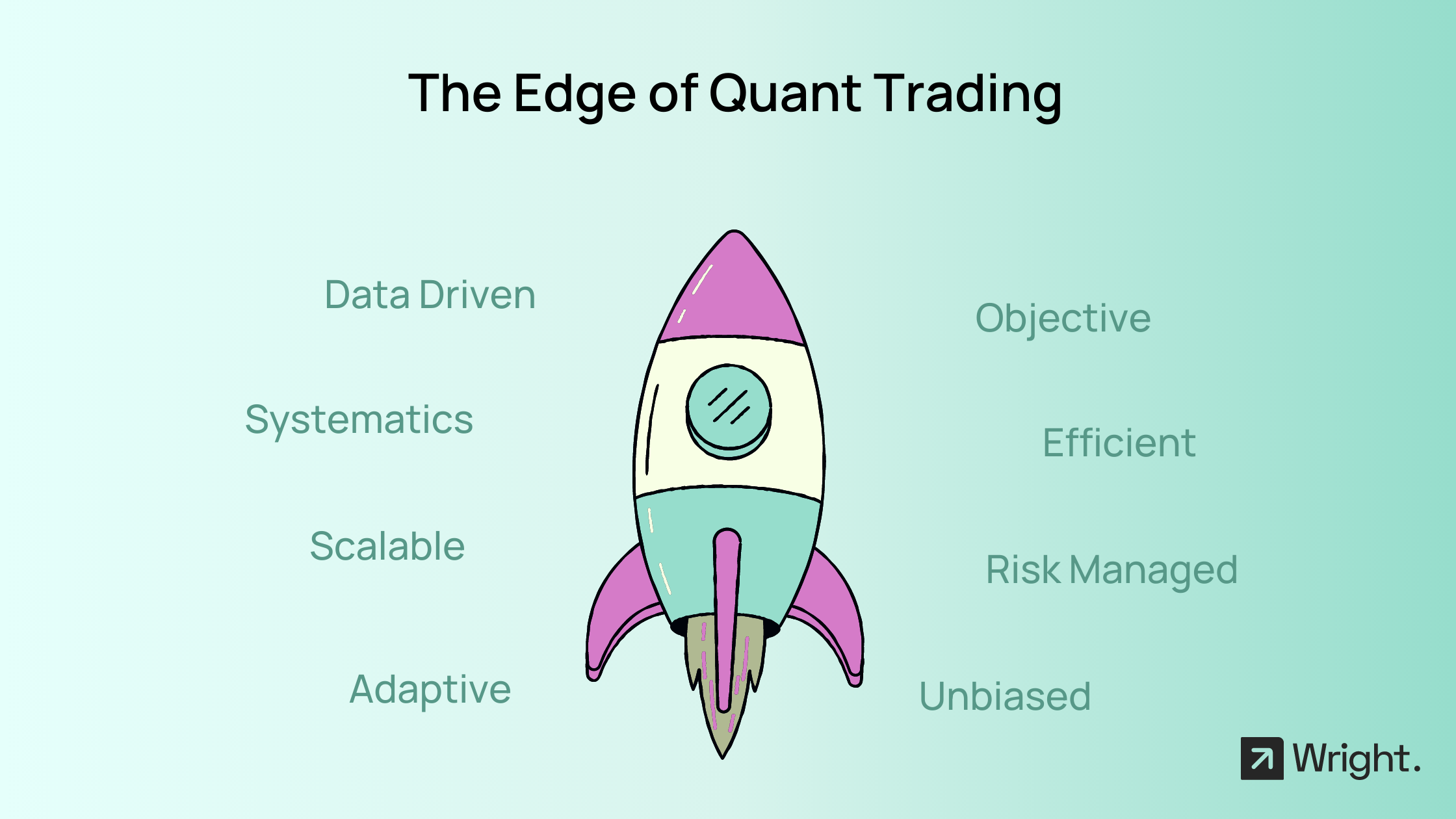

Edge of Quant Trading

Quantitative trading offers distinct advantages that give quant traders an edge:

- Data-Driven Decision Making: Quantitative traders make informed decisions based on data analysis, enabling objective choices driven by empirical evidence.

- Speed and Efficiency: Automation and algorithmic strategies allow quant traders to execute trades swiftly and efficiently, reducing delays and enhancing execution.

- Scalability: Quantitative strategies are scalable, enabling traders to handle large volumes of data and execute trades across multiple markets and assets simultaneously.

- Risk Management: Quantitative trading emphasizes risk management through statistical models and techniques, protecting against significant losses.

- Adaptability and Flexibility: Quant traders can adjust their models to account for changing market dynamics, capturing emerging trends and adjusting approaches accordingly.

Quantitative trading, in contrast to traditional methods, relies on data, mathematics, and algorithms to make objective decisions. It employs systematic trading, using algorithms to analyze real-time market data and reduce biases. Quant traders constantly test and refine their strategies to adapt to changing market conditions. Skills in mathematics, statistics, and financial markets are crucial, as is a focus on constraints like transaction costs and liquidity. Hypothesis testing and risk management are key components of quant trading. Common myths include lack of transparency and complexity, but quant strategies are well-defined and accessible. Quant trading offers advantages such as data-driven decision making, speed, scalability, risk management, and adaptability. However, no strategy guarantees consistent profits. Embracing the scientific approach of quant trading can bring efficiency and sophistication to trading.

Wright Research

Wright Research