Wonderla Holidays – Proxy on Growing Spending Power

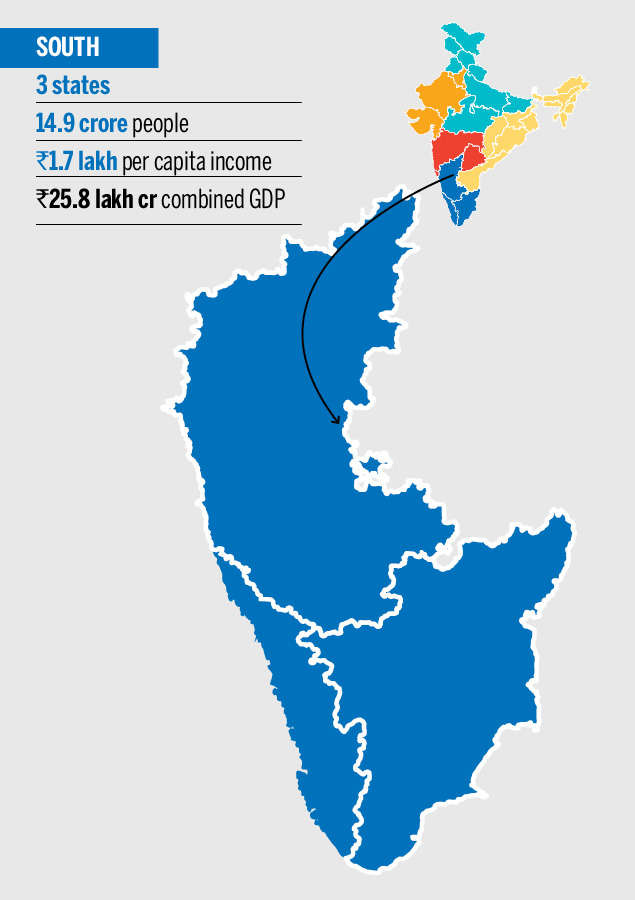

Wonderla Holidays Limited (Wonderla) is a leading amusement park operator in India. The company operates three amusement parks in Kochi, Bangalore, and Hyderabad. Wonderla is known for its thrilling rides, water slides, and family-friendly attractions. The parks are also known for their cleanliness and safety standards.

Company Overview

Wonderla was founded in 2000 by Mr. Kochouseph Chittilappilly. The company started its operations with a single amusement park in Kochi. Over the years, Wonderla has expanded its operations and now operates three amusement parks and one resort in India. Wonderla has a strong focus on customer satisfaction.

Industry Outlook

The Indian amusement park industry is expected to grow at a CAGR of 15% over the next five years. This growth is expected to be driven by the following factors:

- Increasing disposable incomes: The disposable incomes of Indians are increasing, which is leading to increased spending on leisure and entertainment.

- Growing middle class: The Indian middle class is growing rapidly, which is creating a larger customer base for amusement parks.

- Rising urbanization: The Indian population is becoming increasingly urbanized, which is leading to increased demand for amusement parks and other recreational activities

Investment Thesis

Wonderla is a well-established company with a strong track record of growth and profitability. The company is well-positioned to benefit from the growth of the Indian amusement park industry. Wonderla also has a number of competitive advantages, such as its strong brand presence, loyal customer base, and high-quality rides and attractions

Financial Performance

Wonderla has a strong track record of financial performance. The company’s revenue has grown at a CAGR of 17% over the past 3 years (since covid-19 lockdown). The company’s profit after tax has grown at a CAGR of 45% over the same period.

They had one of the strongest quarterly revenues in Q1 FY24 at 185 Crore. TTM the company has recorded one of their strongest ever revenue numbers at 463 Crores

Valuation

Annual PAT for FY23 was 149 Crores, where as they have generated PAT 84 Crore for Q1FY24. This implies a PAT of 196Cr for FY24, valuing the company at 23x PE (f).

The company has historically traded at a median PE of 23x.

Risks to Consider

The following are some of the risks associated with investing in Wonderla:

- Cyclical industry: The amusement park industry is cyclical. This means that the company’s performance could be affected by economic downturns.

- Competition: Wonderla faces competition from other amusement park operators in India.

- Seasonality: The company’s revenue is seasonal, with the highest revenue generated during the summer holidays and on weekends. (June Qtr)

Wonderla is a well-established company with a strong track record of growth and profitability. The company is well-positioned to benefit from the growth of the Indian amusement park industry. Wonderla also has a number of competitive advantages, such as its strong brand presence, loyal customer base, and high-quality rides and attractions.

Wonderla is a compelling investment opportunity for investors looking for exposure to the growing Indian amusement park industry.

Liked this story and want to continue receiving interesting content? Watchlist Craving Alpha’s smallcases to receive exclusive and curated stories!

Explore Tiny Titans smallcase here

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary.