Wright Balanced🎯Multi Factor REBALANCED

(01 March 2023)

Amidst volatility in the market, we are adding IT, Healthcare, Autos Components and reducing Metals, Insurance and Rails.

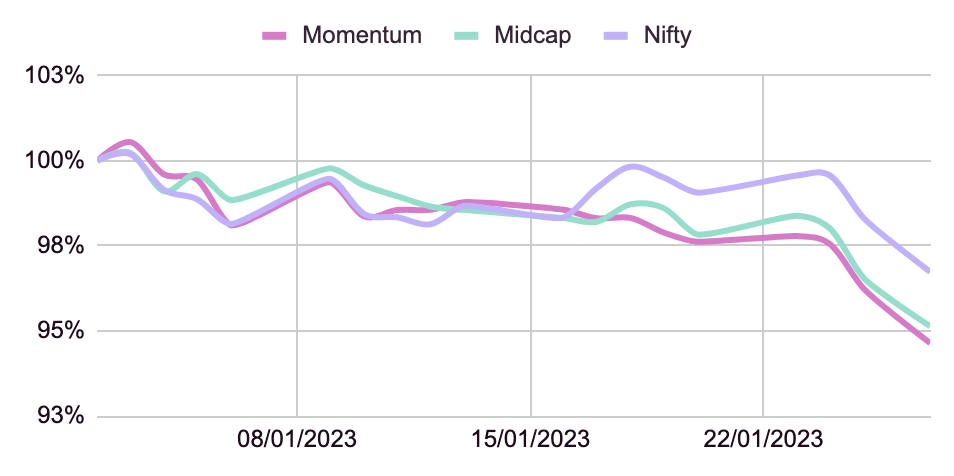

Performance

The portfolio remained flat and suffered due to the allocation to insurance stock GICRE which was impacted by the budget.

In light of the shift that has happened in the markets, we are adding and removing the following stocks

Our current sector & stock allocation

Asset Allocation is one of the most important tools to fight volatility

It’s like a recipe where you mix different ingredients in the right proportions to create a dish that’s both tasty and healthy or like managing a cricket team where you need a healthy mix of batsmen like Virendra Sehwag with a patient one like Rahul Dravid to build a strong team.

The right asset allocation not only reduces the risk in our portfolios but also wins over a non-diversified portfolio in terms of returns in the long term.

Asset Allocation at Wright

Before people knew us for Wright Momentum, people knew Wright due to our robust Asset Allocation during the 2020 Covid crash. Yes, that’s right!

When the market crashed 15%, our Balanced Multi-Factor, the flagship portfolio, only saw a drawdown of 15% and therefore built up a significant outperformance. This was the first instance when people recognized our philosophy, and while we thought that the March 2020 crash would decimate the then 8-month-old Wright, we saw our user base grow multifold in light of the crash! It was one of the moments that instilled the confidence to survive for team Wright.

Obviously, we did not do any magic to outperform. It was all the benefits of tactical asset allocation. Our portfolios has high bond and gold allocation even before the crisis and as the markets dipped we deallocated further to save up on the risk.

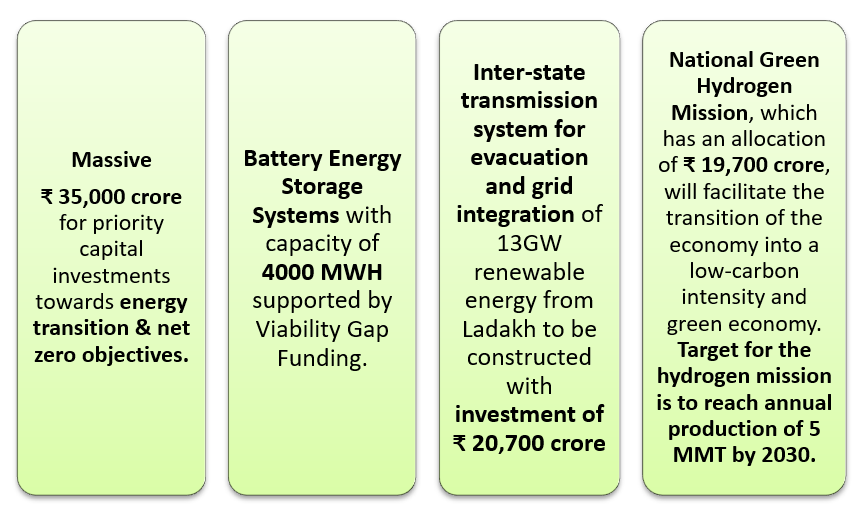

Ideal Asset Allocation

The latest balanced multi-factor portfolio has allocations to stocks that have strong management quality and exposure to North American markets. Our portfolio also has sizable gold allocation and some bond exposure. We would see the allocations suitable for bearish markets continue in the upcoming period as well.

How to Invest in Asset Allocation by Wright?

Check out the Balanced Multi Factor strategy, this strategy is a moderate risk strategy which aims to outperform in all stages of the market cycle using dynamic allocation to various factors and asset classes based on the changing market regime.

Wright Research

Wright Research