9 Investment Lessons To Learn From Navratri

Sonam Srivastava, Founder of Wright Research has won the “Woman Fintech Leader of the Year”by Governance Now and Sri Adhikari Brothers Group yesterday at the BFSI Conclave! Building an AI and Quant Driven investment advisory and portfolio management company has been a rewarding and challenging journey. This award isa testament to Wright’s journey and also a reminder of the unwavering support we have received from our incredible community. Thank you all for being a part of our journey!

9 Investment Lessons To Learn From Navratri

Navratri is more than just a religious observance; it is a vibrant, nine-day festival celebrated with zeal and fervour. It is a representation of the triumph of right over wrong, of light over darkness, and of knowledge over ignorance. There is an overarching theme of reflection and spiritual development as devotees immerse themselves in prayers, dances, and fasts. The festival offers a distinctive viewpoint that goes beyond the spiritual world, despite its deep ties to religious and cultural narratives. Surprisingly, Navratri offers a wealth of information about wealth and money management, drawing comparisons between time-honoured customs and contemporary financial methods.

Navratri Investment Lesson #1: Set Smart Financial Goals

Day 1 of the Navratras focuses on the first form of Goddess Durga, where she is the daughter of the mountains and is awakening to start the journey. Similarly, we can set intentions during this festival for our financial journey should begin with well-defined goals. Ask yourself:

- What is your financial plan?

- What financial goals do you want to achieve?

- What milestones do you want to achieve in the next 1 year, 5 year or even 10 years?

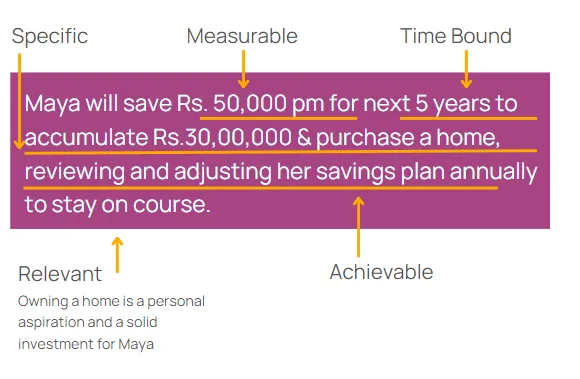

But, how do you make sure your financial goals are set in the right way? Well, you can frame it using the SMART framework which stands for Specific, Measurable, Achievable, Relevant, and Time-bound. Using the SMART framework to define your financial goals, you have a clear plan for achieving your financial goals and your success.

Here is an example of Maya,

- Specific: who wants to save enough money (Rs. 30 Lakhs as equity for down payment) for buying a house.

- Measurable: She plans to do this by saving Rs.50,000 per month

- Timebound: For the next 5 years

- Achievable: She will review and adjust her plan every year as needed accounting for inflation, growth in her savings etc.

- Relevant: Owning a home is a personal aspirational choice and could be a good investment for Maya

Use the SMART Framework to come up with your own financial goals, using the example of Maya above. When you do this, make sure to look at your financial behavior in the past, analyze any patterns, and use insights from this exercise to forecast and track your progress. Take a structured, focused and data-driven approach when coming up with your financial goals, so that you aren’t just dreaming, but are planning for your success!

Navratri Investment Lesson #2: Follow a Disciplined Approach to Your Finances

Second day of Navratras emphasizes Goddess Durga’s discipline, dedication and calmness. It is imperative to work without being moved by your emotions – learn to manage your finances systematically in a structured manner. How can you do this?

Well the first step to a disciplined approach involves crafting a budget. Here’s a budget template you can follow, and I am sure you can find many apps and tools to help you track your expenses and income:

Making a budget isn’t the hard part. The hard part is religiously sticking to it, and resisting the temptation of impulsive spending. Consider it akin to following a tried-and-true strategy for your expenses, ensuring every paisa is accounted for and serves a purpose. But how do you ensure this works practically? How can I stick to the budget I have created? What if I give in?

Well, you should resist impulsive spending to ensure each rupee serves a purpose, it is important to balance this. We are only human – we all will make mistakes. So don’t design a strict and stringent budget that you will not follow. Find the right balance. One way to do this is to have a small component of the budget reserved for small discretionary spending on a regular basis. P.S. it is festival time – so splurge a bit, find things that make you happy, but keep it in control and make sure to track it.

Navratri Investment Lesson #3: Stay Focused on Your Wealth Creation Journey

Third day of Navratras is all about focus. You have your well-defined financial goals and a workable budget that you can stick to. So stick to it! Stay focused on the path that will lead to your financials goals and help in your wealth creation journey!

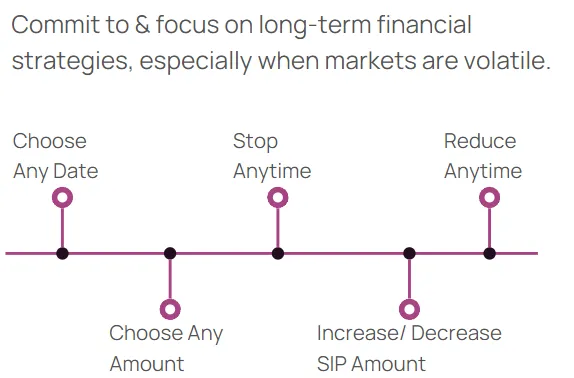

Commitment to long-term strategies becomes important, especially when we consider long-term financial goals and when the markets are unpredictable. Use SIP (Systematic Investment Plans), lumpsum investing when markets are down and STP (systematic transfer plans) to commit and focus on the long term financial goal.

Maintain a laser focus on your long-term financial aspirations, sidestepping the distractions of fleeting market news or the siren call of instant gratification. By keeping your eyes on the prize, you ensure a steady journey towards your financial goals!

Navratri Investment Lesson #4: Save and Invest Wisely

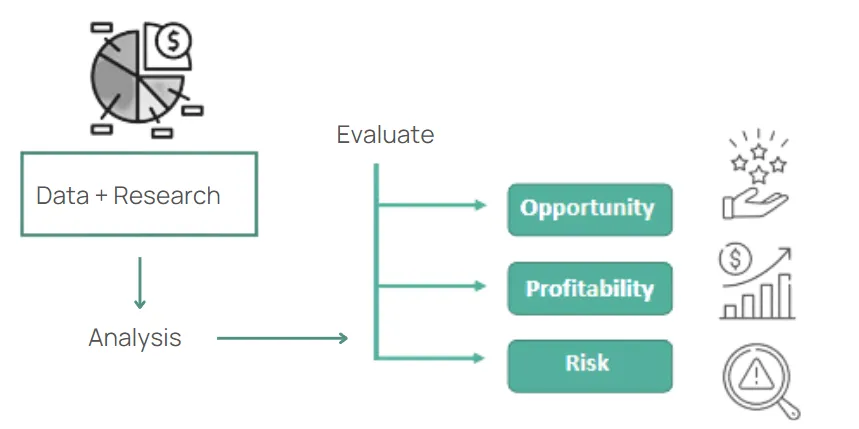

Day 4 is all about foresight and planning. As a company, we focus heavily only quantitative and qualitative research. And this is the advice for day 4 – conduct enough research using data before you invest in any financial product. Do not just follow the whims and fancies of your relatives, your acquaintances or those giving ill advise. Get the right data and research, analyse it to get your own insights and then evaluate the financial product based on the opportunity you get, the profitability of the product and the risk associated with it.

Prioritize building a robust savings foundation, and then venture out into more diversified and alternative investments depending on your risk profile. Rely on evidence-based strategies to guide your investment choices, ensuring each decision is backed by research and not mere hunches.

Navratri Investment Lesson #5: Seek Knowledge and Ask for Guidance

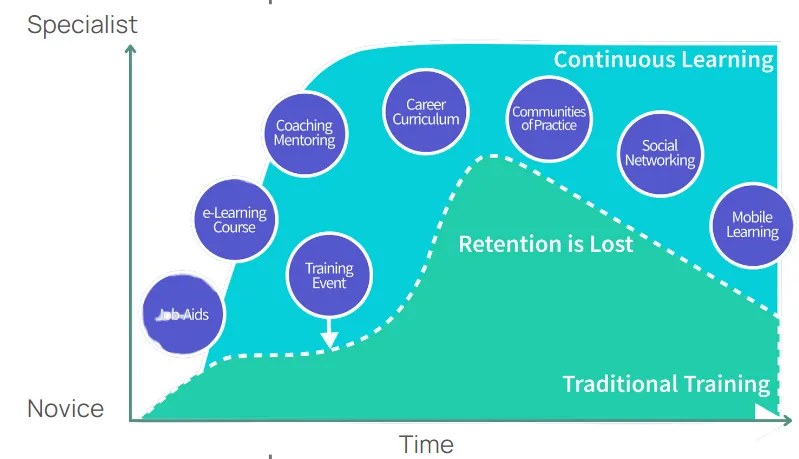

The fifth day is all about continuous learning. Learning, asking for help, getting the right guidance and making sure your on the right path towards achieving your financial goals is important. Financial markets are continuously changing and adapting, factors that are important one day change the next day and there’s a lot of information that is being shared. So make sure to be hungry for knowledge – always be a student that is seeking knowledge and asking for guidance from experts that are all around us. Here’s a quick graph to show you how continuous learning can help ensure and keep you performing at the highest level be it in finance or in any other field.

Financial markets are vast, ever-evolving, and there’s a wealth of knowledge to tap into. Immerse yourself in resources, perhaps dabbling in tools that offer data-driven insights, to build financial knowledge. And remember, when in doubt or faced with complex decisions, seeking expert advice can be invaluable.

Navratri Investment Lesson #6: Diversify Your Investments

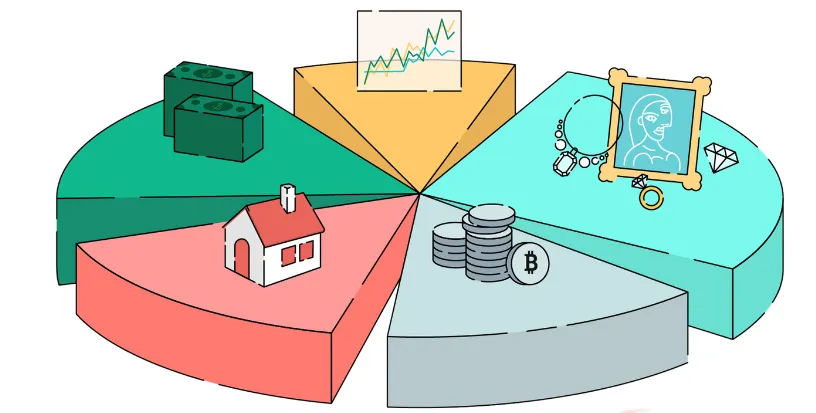

The sixth day is about the wisdom of diversification. By spreading your investments across asset classes, strike the right balance between risk and reward. Dive into past performance metrics and market trends to make informed decisions, ensuring your money is strategically placed to optimise growth while cushioning against potential downturns.

But, also do not just simply rely only on past performance to help you guide your investment decisions. Find new and unique ways of understanding financial markets, the products you are investing in and how you can reduce the portfolio risk.

Navratri Investment Lesson #7: Review and Rebalance Your Portfolio Regularly

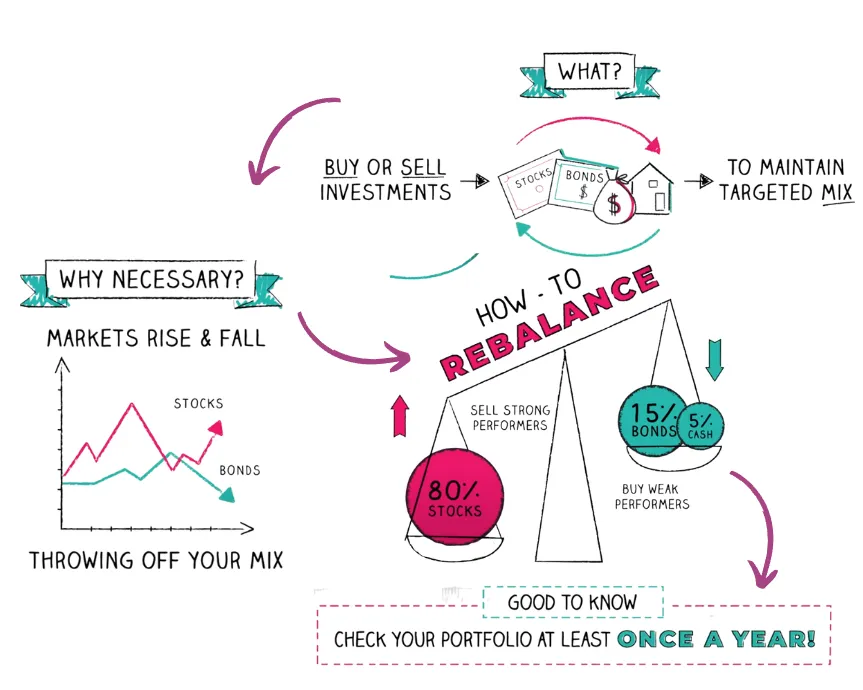

Day seven advocates for adaptability. Good investors are ready for the different flavours of the market – the highs, the lows and the volatility that comes with investing in equity markets. And when such events happen, how we as investors can figure out our path through these varied market conditions. The main point here is to review your portfolio regularly, and especially during such events. And then to rebalance and recalibrate the portfolio and its constituents that can help us with sticking to our asset allocation and financial goals. Here’s a great snapshot from napkin finance that explains this concept:

- Investors buy or sell investments to meet their maintain targeted mix

- When markets rise or fall, it throws off your desired mix since the portfolio constituents prices and allocations will have changed

- And this is where rebalancing comes into play – sell strong performers, buy weak performers

- Regularly review your holdings, ensuring they resonate with your current risk appetite and financial aspirations.

This iterative process, much like refining strategies based on fresh data, ensures your investments are always in sync with your goals.

Navratri Investment Lesson #8: Insure Yourself Optimally

The eighth day highlights the essence of protection. In the same spirit that investment strategies are crafted to buffer against potential downturns, fortify yourself against life’s unpredictabilities.

- Prioritize comprehensive insurance coverage: health, life, and assets.

- Protect yourself and loved ones from unexpected financial challenges.

- Treat insurance as a buffer against unforeseen life events & not investment.

Navratri Investment Lesson #9: Plan for the Unexpected

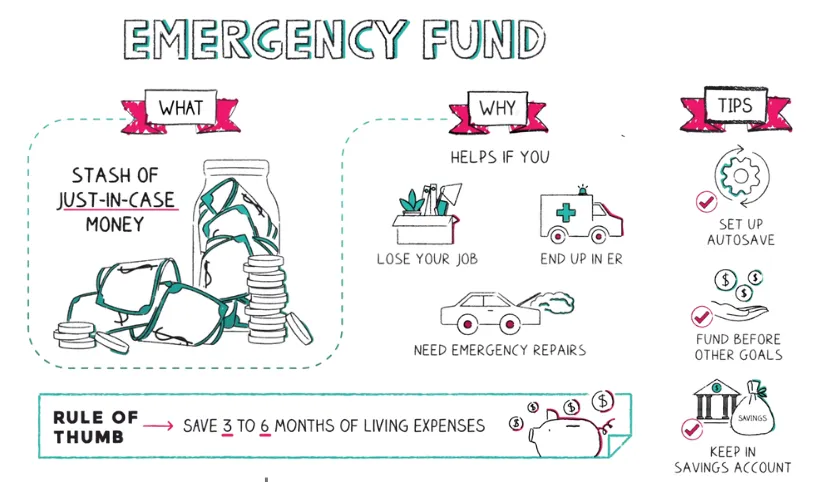

The ninth day serves as a poignant reminder of life’s inherent unpredictability. Just as financial experts employ stress tests to prep for unexpected market twists, fortify your personal finances with an emergency fund. Again here’s a great snapshot from napkin finance which illustrates the what, why and tips for emergency funds.

- What is an emergency fund? Most people may not have enough cash or liquidity when an unfortunate event happens on them or their family members. In such a case, this emergency fund becomes critical.

- Why does it help to build an emergency fund? You can use it in an emergency!

- Tips:

- Set up autosave to get your emergency fund to the right amount

- Build your emergency fund before other goals are built

- And keep it liquid and in safe assets like in a savings account. It is not for investment, but as a last resort.

- Rule of thumb: Save upto 3-6 months of your living expenses as part of your emergency fund.

This safety net ensures you’re poised to tackle unforeseen challenges head-on, safeguarding your financial well-being against life’s curveballs.

Final Thoughts

Navratri, with its rich tapestry of traditions, stories, and rituals, serves as a metaphorical guide for life’s many challenges, including our financial journey. The lessons we derive from this festival are timeless, urging us to approach our finances with the same dedication, discipline, and wisdom as we do our spiritual practices. As the festival culminates in the victory of good over evil, let it also mark our triumph over financial challenges. By embracing the teachings of Navratri, we not only honor the essence of the festival but also pave the way for a prosperous and secure financial future. As we light up our homes and hearts this Navratri, let’s also illuminate our path to financial enlightenment.

Read the full article on Wright Research 9 Investment Lessons To Learn From Navratri

Check out our Navratri special offer, use the code ‘PRIME25‘ to get a 25% discount on the ALPHA PRIME smallcase. This offer is valid until 25th Oct’23, don’t miss this opportunity!

Explore the Alpha Prime smallcase here

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. Visit bit.ly/sc-wc for more disclosures.