Dilemma of Portfolio Diversification: Understanding Concentrated Portfolios with Wright Research

Looking at people’s portfolios is routine for us. Last week, I looked over at my friend’s portfolio and it had over 100 stocks in it. Is 100 stocks too many? Is there such a thing as an over-diversified portfolio? Does concentration work better than diversification? Let’s look at it.

In our world, diversification is known as the “only free lunch” – if you don’t know anything about investing, you will start with understanding diversification – add more stocks to diversify your portfolio as a failsafe way to mitigate risk. Of course, it is a bit more complicated than that, but for a layman that’s the gist of it. Now when we are constructing a portfolio, we try to optimize risk against the reward. As we add more stocks into a portfolio, the magic of diversification helps reduce the risk of holding any 1 stock i.e. stock specific risks decrease.

Here are a few scenarios –

- High Prospective Returns Across the Board: When there are ample opportunities in the market with promising returns, diversification is beneficial. Since adding a new stock into a portfolio can improve returns without increasing the risk. In such markets, spreading investments is not just safe, but advisable

- Diminishing Returns with Each New Investment: When each new investment promises a lower return for a given risk than the last, diversification can be detrimental. In such scenarios a concentrated portfolio could provide better returns.

- Excess Diversification Hurts Returns, Rather than Reducing Risk: When the number of stocks are so many, that it becomes difficult to track or conduct deep research as an individual – there is a problem. This problem gets worse, if each stock added is of lower value than what is already present in the portfolio. In such scenarios, reducing to an optimal level is probably the right approach.

- If you have a robo-advisory service like Wright Research , then this analysis is much easier since we run several algorithms, quantitative research, deep ML & AI Models to do our analysis – Technology does help solve part of the problem for point 3 above.

Concentration vs Diversification: How many stocks is too many?

It depends. Fund managers may call a 25-35 stock portfolio as ‘concentrated,’ and anything over 45-50 as being over-diversified and some others may think 10-20 stocks is concentrated, and anything over 35 is excess diversification. In both scenarios 100 does sounds like too many. Here’s the findings from a research paper from John Wiley & Sons, 2016 –

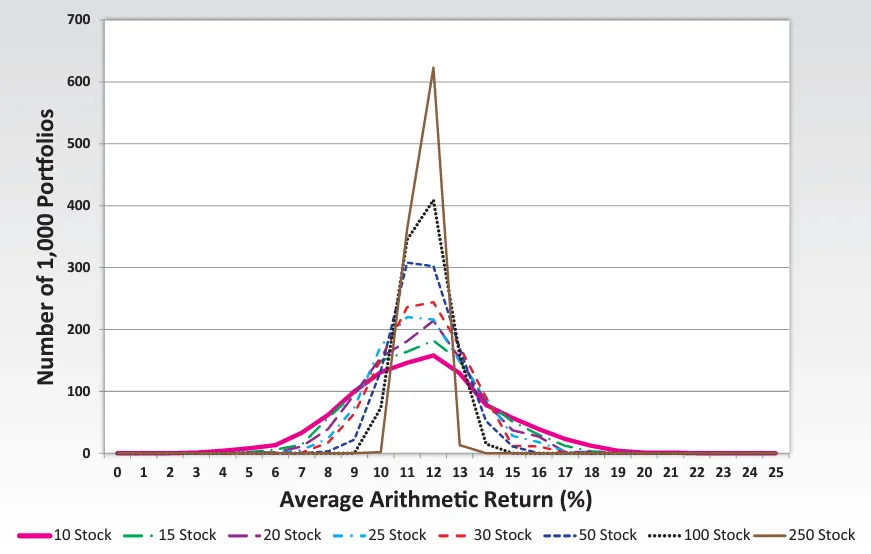

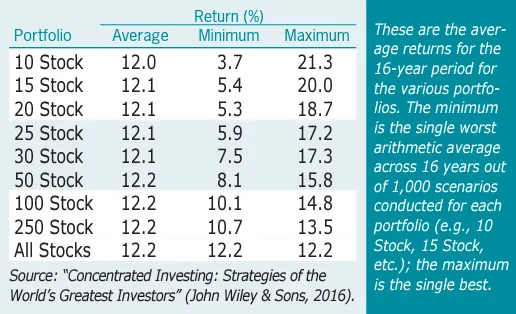

- The study analyzed average returns of portfolios containing between 10 and 250 stocks, randomly selected from the S&P 500 index.

- They created 1,000 portfolios for each of the 8 different sized portfolios starting from 10 stocks to 15 stocks, 20, 25, 30, 50, 100 upto 250 stocks.

- Unsurprisingly, portfolios comprising 250 stocks closely matched the performance of the S&P 500 equal-weight index, suggesting lower volatility.

- In contrast, the pink line is shorter and wider for the 10-stock portfolios meaning it had a much broader range of returns, indicating a higher potential for divergence from the index performance.

- The 10-stock portfolio generated a lowest return of 3.7% and the highest return of 21.3% while the 250 stock portfolio generated the lowest return of 10.7% and the highest return of 13.5%.

The ideology behind concentrated investing really stemmed from Sir John Maynard Keynes, an economist and the author of “The General Theory of Employment, Interest and Money”,1936, and Benjamin Graham, author of the pivotal book “Security Analysis”, 1934. This extract from Keynes, in a 1934 letter, shows his thoughts about a concentrated portfolio –

“As time goes on, I get more and more convinced that the right method in investment is to put fairly large sums into enterprises which one thinks one knows something about and in the management of which one thoroughly believes. It is a mistake to think that one limits one’s risk by spreading too much between enterprises about which one knows little and has no reason for special confidence… there are seldom more than two or three enterprises at any given time in which I personally feel myself entitled to put full confidence.”

Over time, other investors such as Warren Buffett, Charlie Munger and others have followed and stuck by the concentrated portfolio approach. As of May 2023, 63% of Berkshire Hathaway’s investment portfolio of $333.4 Billion was comprised of just 3 stocks. The mantra for proponents of concentrated investors is – Hold fewer but stronger stocks for longer periods to both mitigate risk and amplify returns.

Alpha Prime: How is a concentrated portfolio made?

The potential to generate alpha in our Alpha Prime strategy comes from a blend of expert portfolio design, experienced investment management, sophisticated quantitative models, and the use of AI technology for advanced market forecasting. We consciously forego certain diversification benefits to unlock higher potential returns for our investors. The following components form the core of our investment universe:

- High momentum stocks for higher returns

- Rigorous selection process identifying 10 stocks from top 500 companies

- Use of AI Technology to identify market trends, anticipate market shifts, and adjust our portfolio strategy.

- Risk optimization to balance reward-to-risk ratio

- Diversification in a concentrated portfolio by not overly relying on any single stock or sector

- Systematic deallocation in high-risk market scenarios

Liked this story and want to continue receiving interesting content? Watchlist Wright Research’s smallcases to receive exclusive and curated stories!

Explore Alpha Prime smallcase here

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors. The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy/sell or the solicitation of an offer to buy/sell any security or financial products. Users must make their own investment decisions based on their specific investment objective and financial position and use such independent advisors as they believe necessary. Refer to our disclosures page, here.

Wryght Research & Capital Pvt Ltd•SEBI Registration No: INA100015717

103, Shagun Vatika Prag Narayan Road, Lucknow, UP 226001 IN

CIN: U67100UP2019PTC123244