Rebalance Update – Balanced Multi-Factor

No Gyan, Only Data!

Confused? Speak directly to the expert!

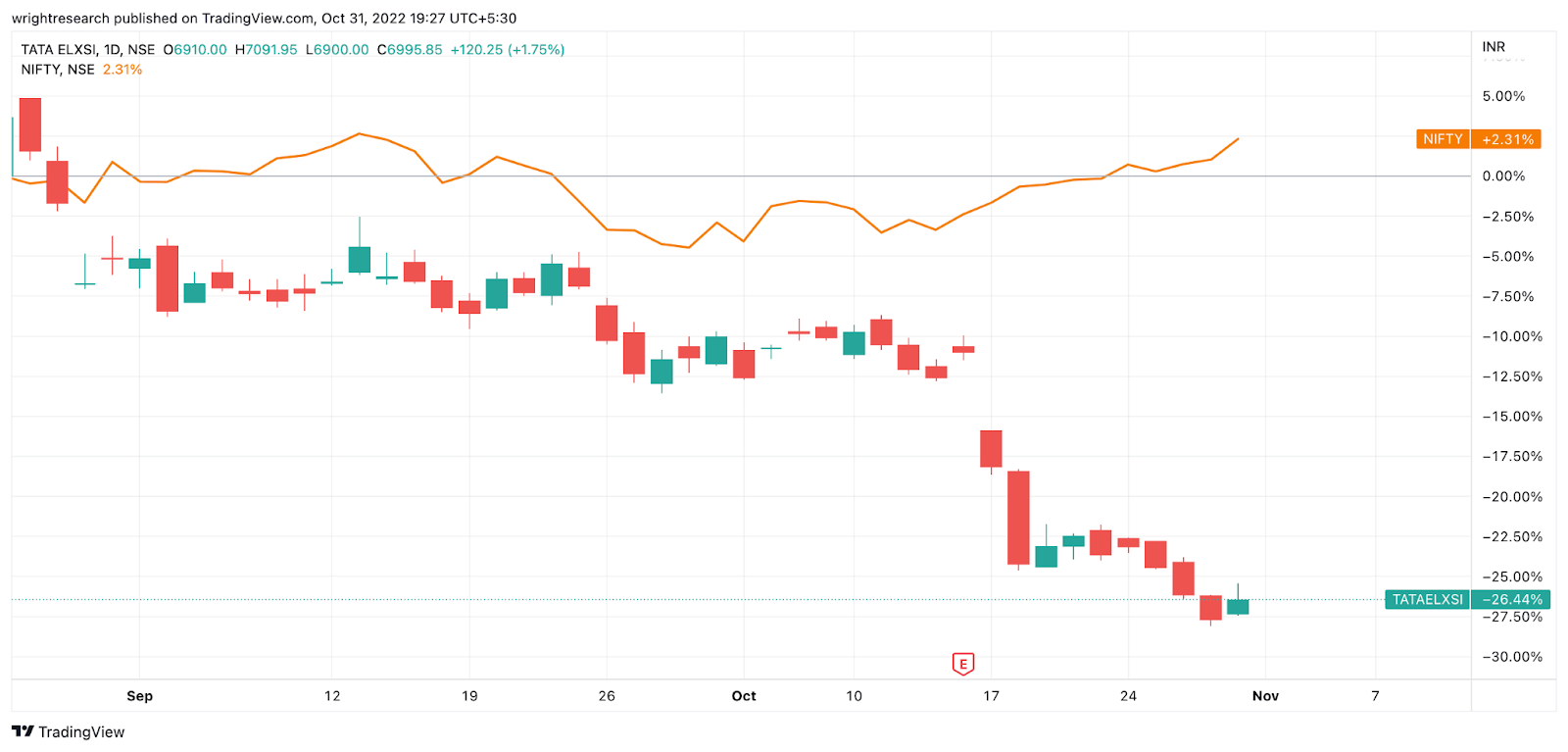

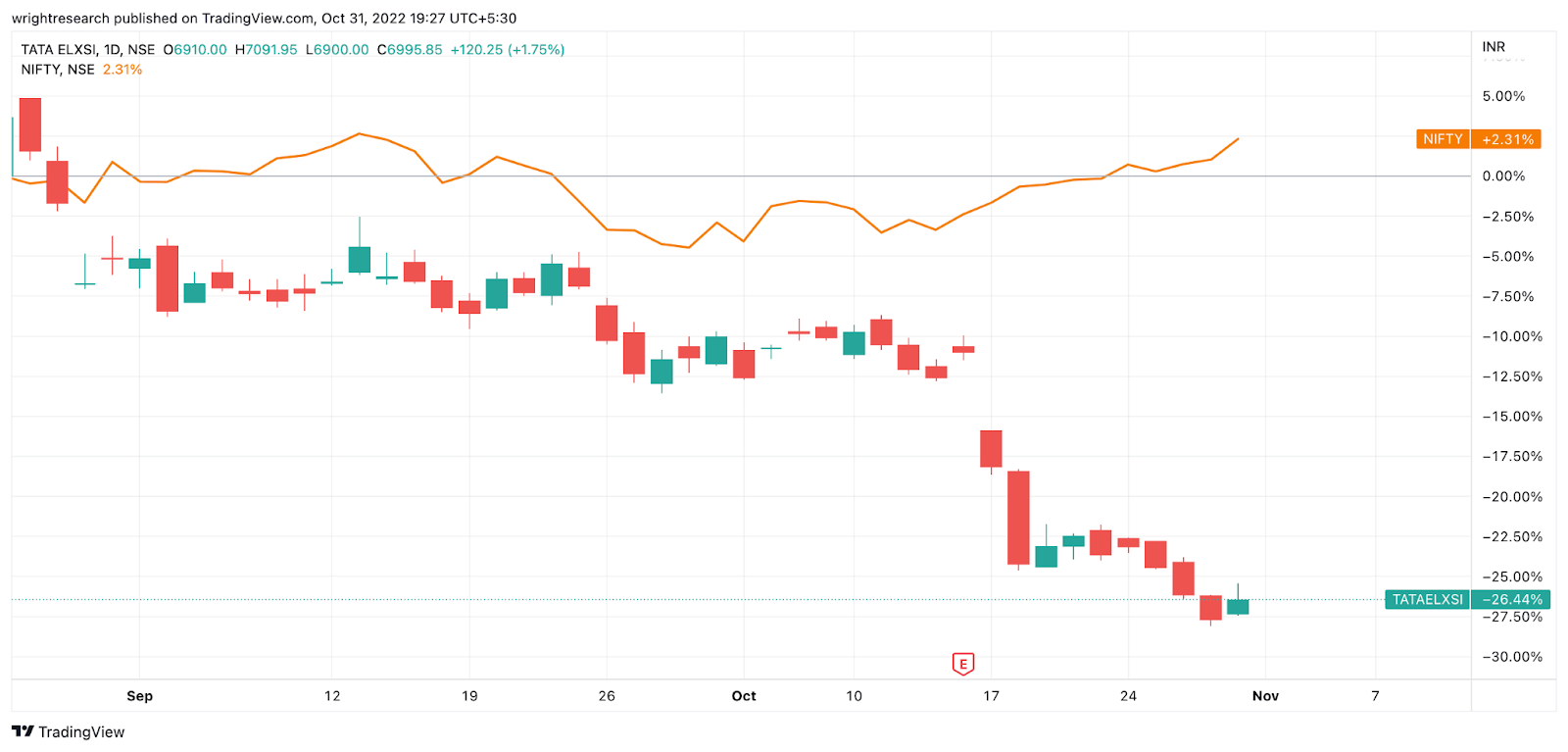

This month our multi factor model shows allocation to High Quality and High Momentum. The last month was spoiled by the crash in Tata Elxsi which is exited.

Why did we not exit Tata Elxsi earlier? The stock was one IT stock that stayed robust in all volatility and significant crash happened over 2 days around the stock’s results and was a tough call. The stock has been a source of major outperformance in our portfolio over the last couple of years.

You live and you learn.

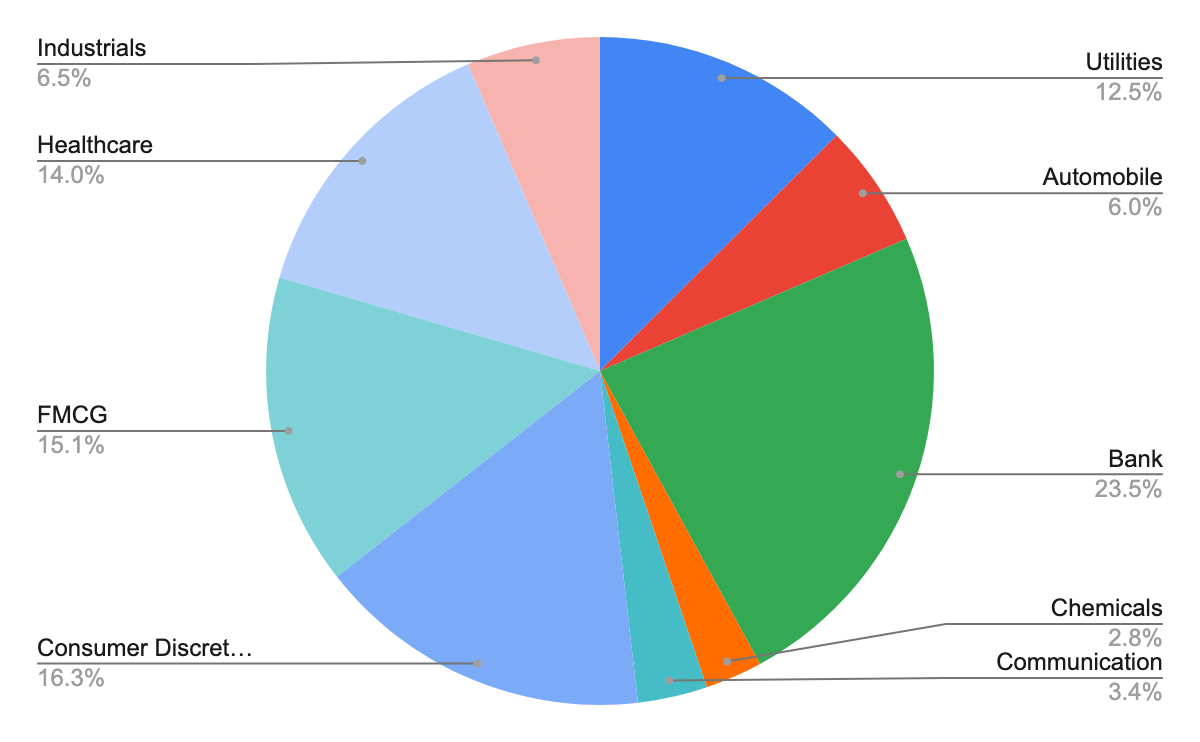

We are exiting Tata Elxsi, Hindustan Unilever and LT Gilt Bees. We have no allocation to IT sector now and Banks have highest allocation.

We are adding Bank of baroda, Power Grid and Max Health into the portfolio.

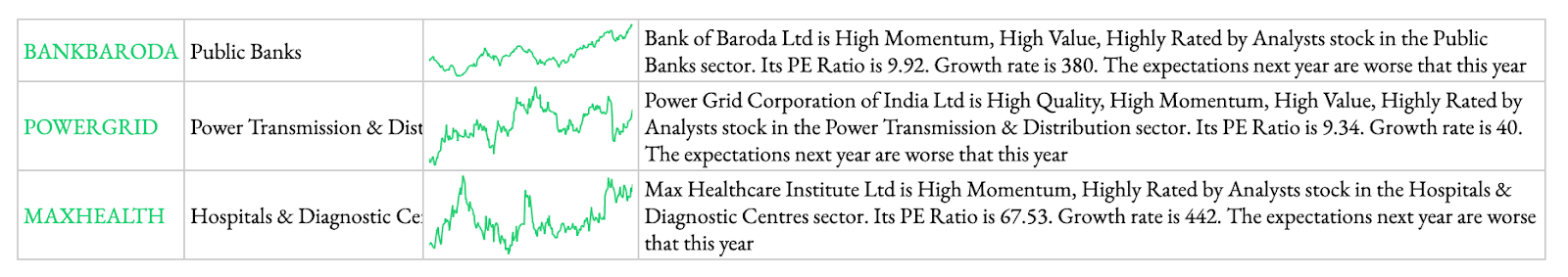

Additions:

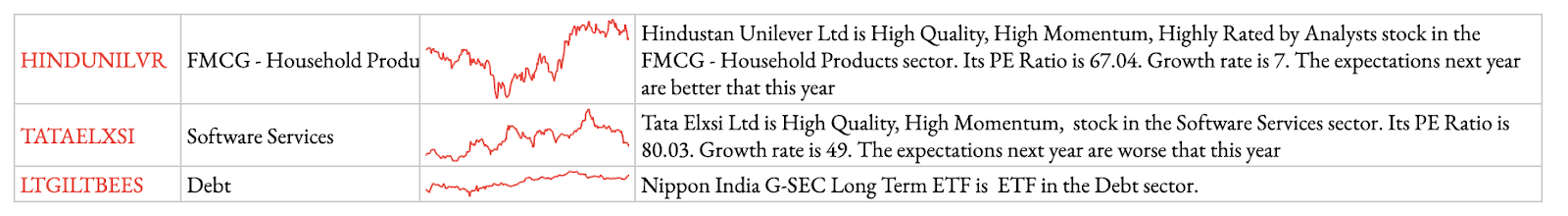

Deletions:

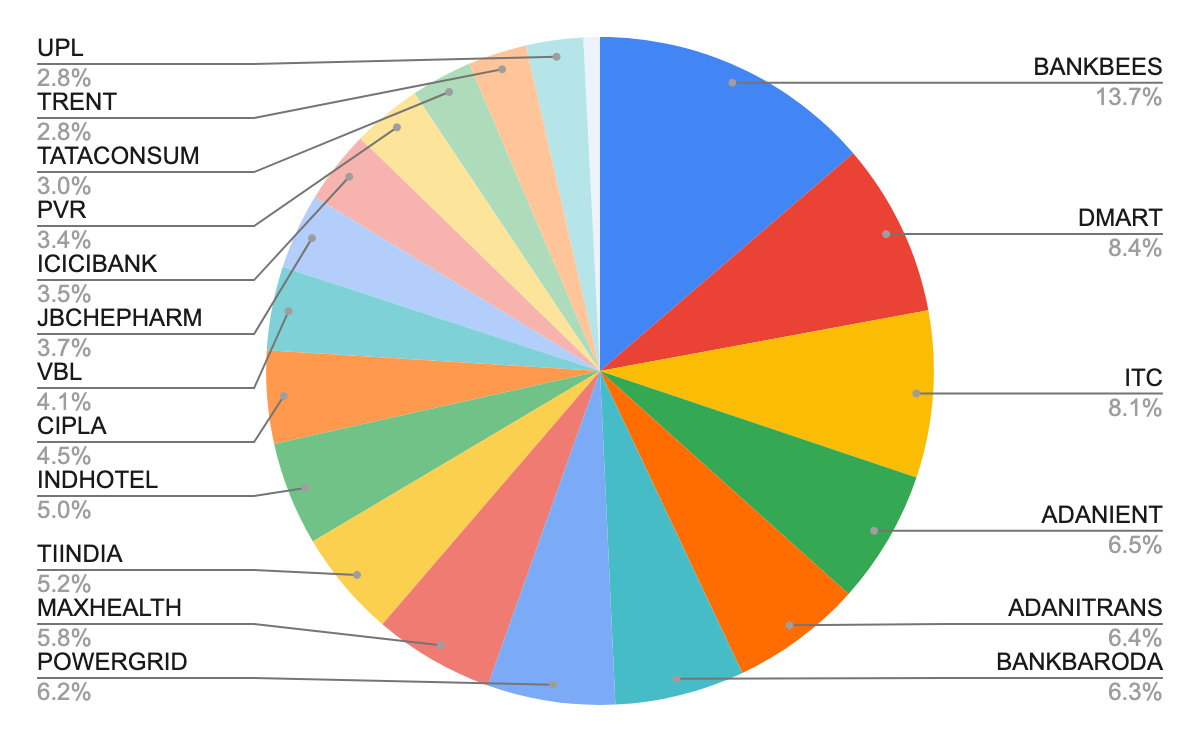

Stock Allocations:

Sector Allocations:

Looking to understand more about the current market scenario? Here’s our mantra for this week – no gyan, only data!

Are you tired of all the investment gyan ever present on the internet? I know that I am. Every other investment manager is rattling off about the long-term story and the strength of the Indian market. So we thought that this week, we would not join the bandwagon!

In this post, we will cut the noise with some high-quality data on the following:

- The impact of the festive season

- What’s happening in the Banking sector?

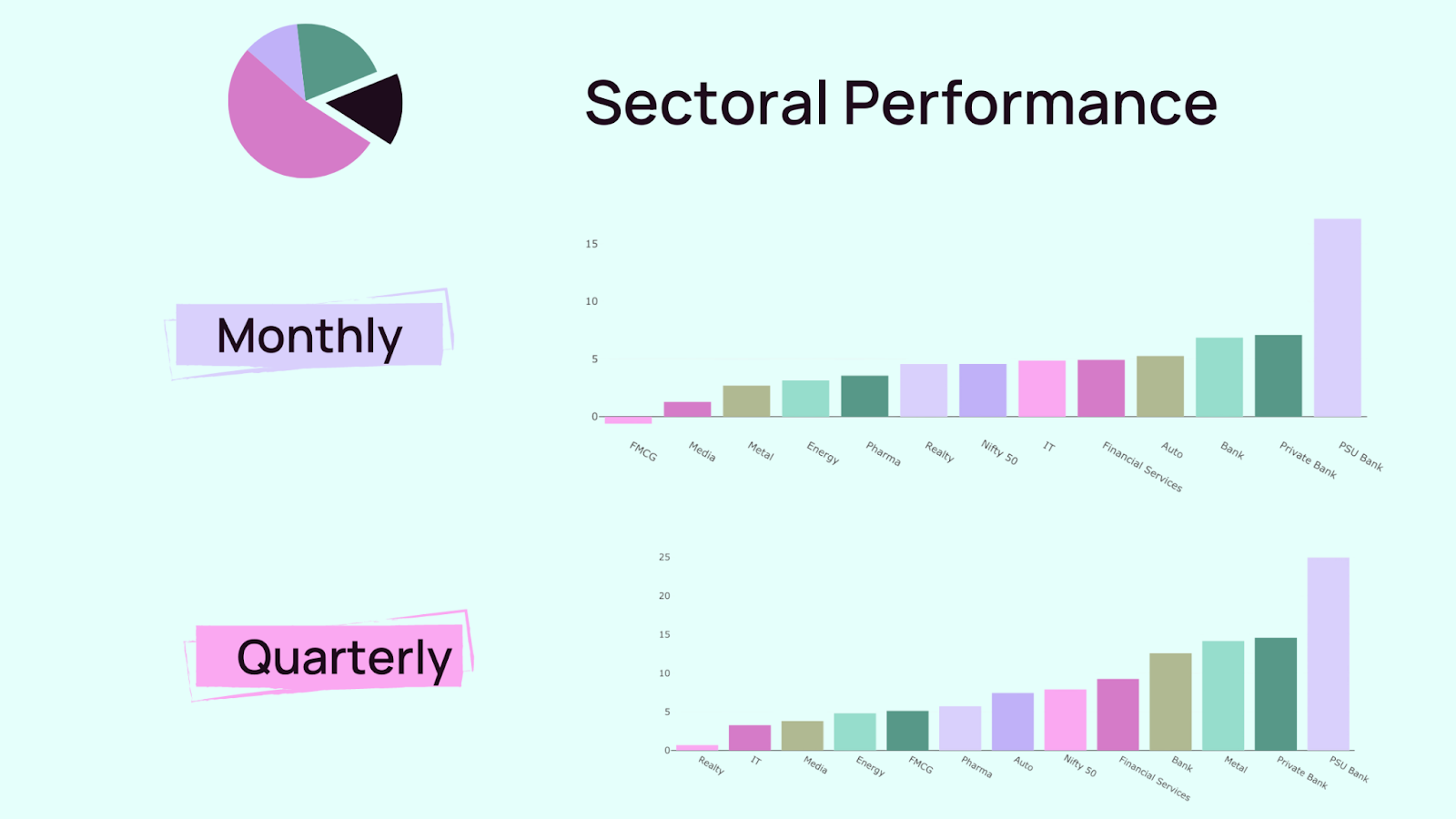

- Sectoral trends

- India vs Global markets

- Global Tech Meltdown

So here we go!

Happy Diwali for the Auto Season

Diwali came with a bang for the auto sector. Over four lakh buyers bought their dream car in 32 days between Navratri and Diwali to fulfil their personal mobility needs. This sale figure was 30% higher than the festive season last year.

This year’s festive season is considered the first normal season experienced by the industry with zero restrictions since Covid-19 hit in 2020.

These numbers prove that the consumer sector of our large economy is getting from strength to strength and is the best place to buy.

Banks – Earnings

Banks have wowed everyone with their earning numbers. The credit in the banking sector has jumped nearly five-fold to 9.3 trillion rupees between the April-September period from 1.7 trillion rupees a year ago, according to the Reserve Bank of India.

Banks are also posting impressive numbers on Diwali. Top banks have given 20-70% growth in earnings this season and a 20-50% growth in net interest income. The deposit rate has lagged behind the credit growth rate, though. The growth is expected to continue in the next quarter.

The performance of the Banking sector is a testament to these numbers. PSU Banks are leading the pack in terms of returns, and Private Banks are close behind. Sustained growth in the banking sector hints at a string economy, which is not bad news.

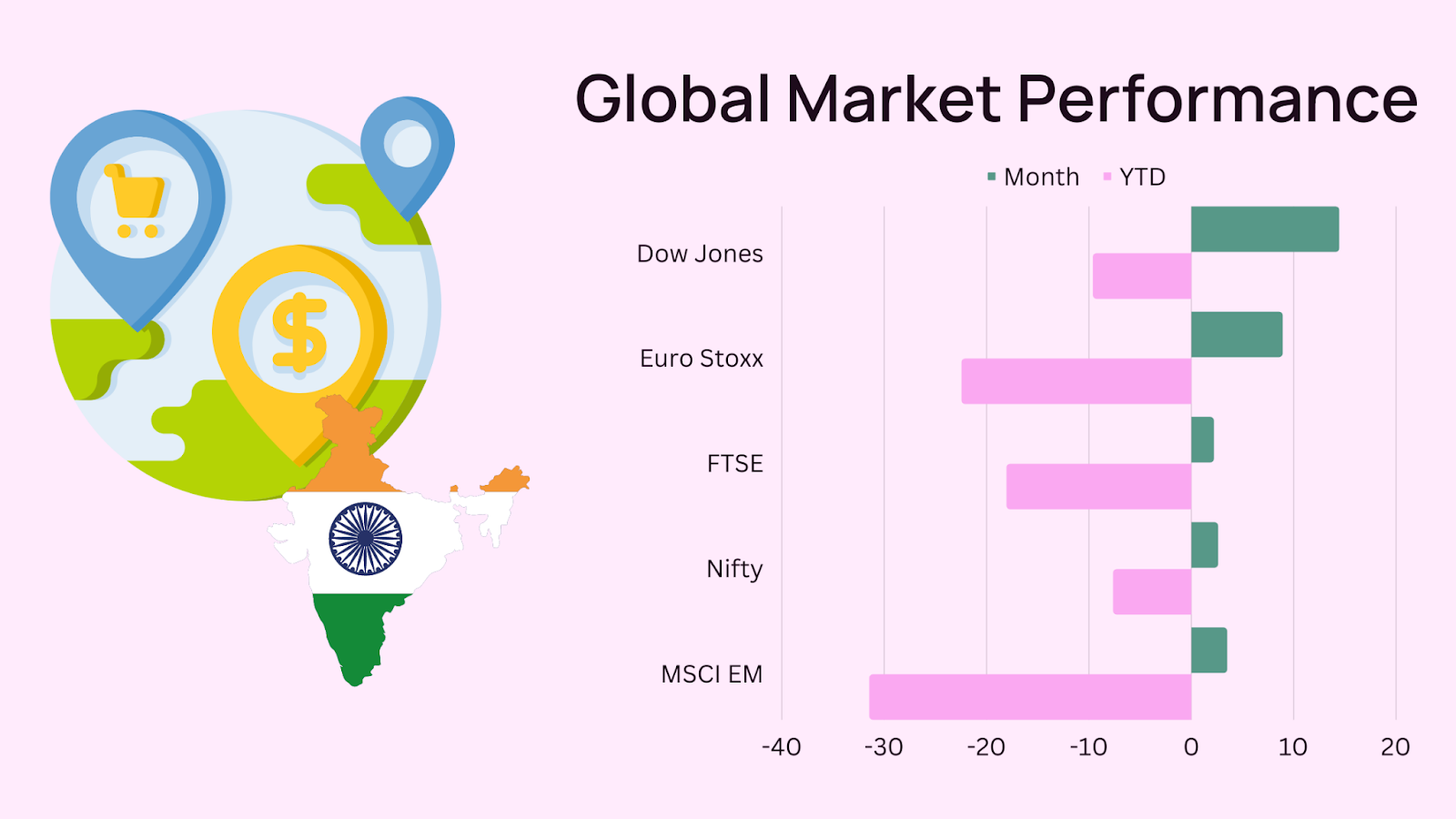

Indian performance relative to the world

The global market picked up at a more rapid pace than India over the last month, but India is still in the lead on a YTD basis. Emerging markets continue to be laggards, and India, as an exception, has outperformed EMs by 25%.

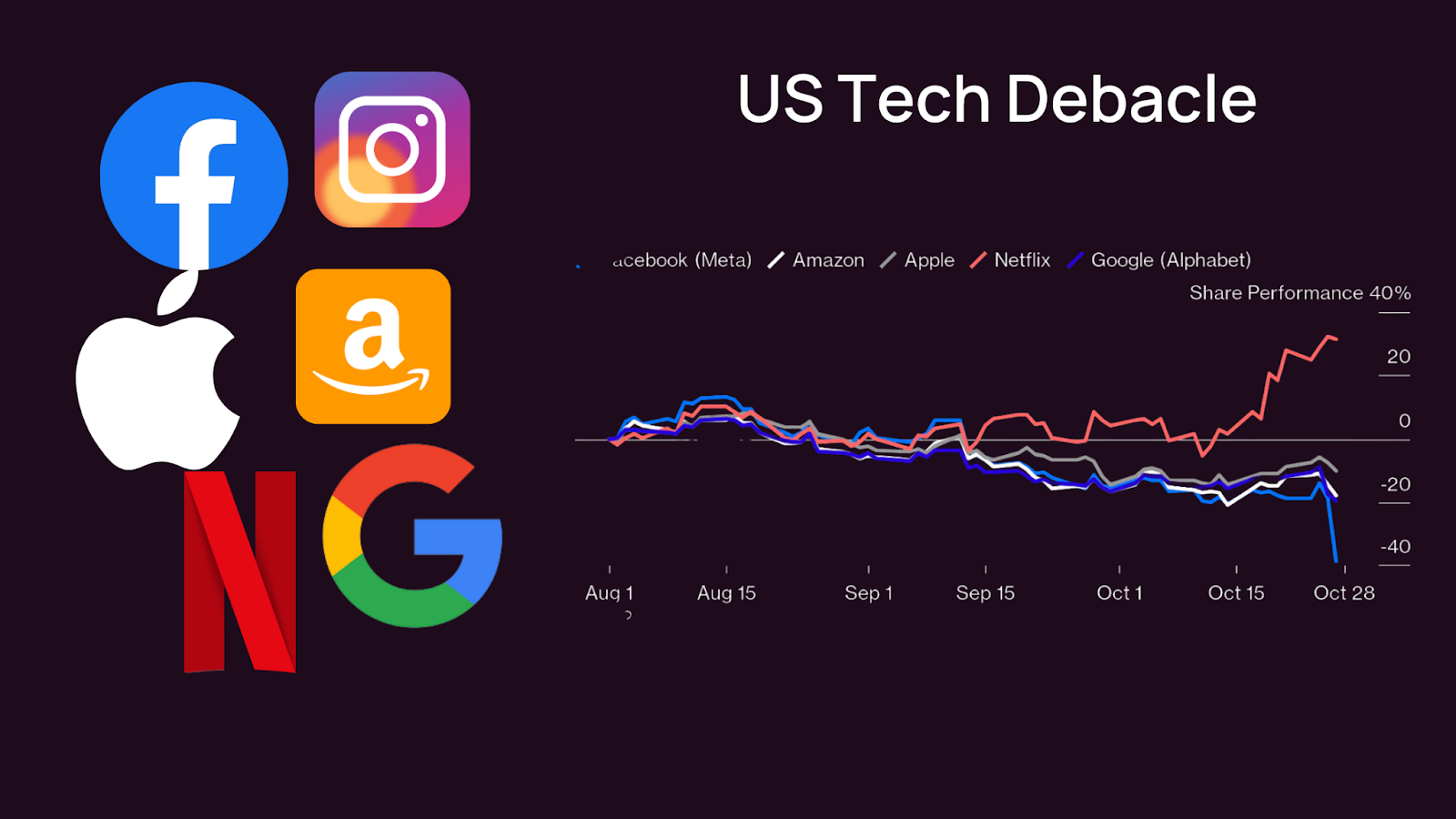

Global Tech Meltdown

The US Tech sector continued the meltdown. Everyone from semiconductors to social media to the cloud has cut down future projections, delivered abysmal growth, and seen the prices tank. Apple and Microsoft remain robust, and Meta has had the worst meltdown. The industry is hit by a strengthening greenback, supply-chain snarls, inflation yet to be controlled and economic growth figures that look increasingly grim.

What to watch out for next week?

The ongoing quarterly earnings season, the Reserve Bank’s special meeting of its rate-setting committee and the U.S. Fed interest rate decision are the significant events that would dictate trends in the equity market this week.