$285B Global Wipeout: Why IT, Tech Stocks Got Hit by Claude AI’s New Tool

In a bizarre situation, global tech stocks lost an astonishing $285 billion in market value virtually overnight on February 4, as investors scrambled to sell anything exposed to software or IT services. The trigger was an unlikely source: a newly launched ‘agentic’ AI assistant from Anthropic called Claude Cowork.

Amid the news of the new tool, the market reaction was swift. In the US, tech-heavy Nasdaq 100 slid sharply intraday, with Nvidia and Microsoft falling close to 3%, while enterprise software names like Salesforce and Adobe sank around 7%.

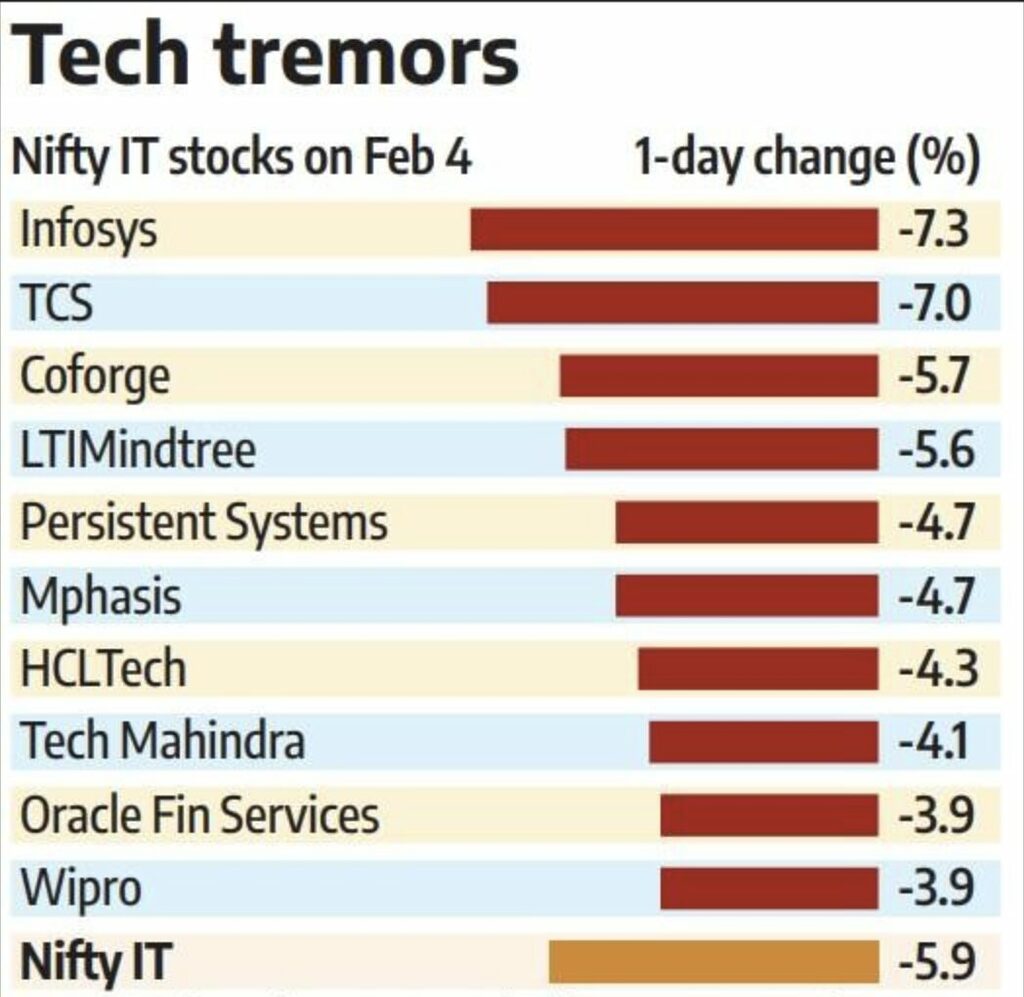

Back home, the Nifty IT index plunged around 6% on February 4, in its worst single‑day fall since the COVID-19 crash, wiping out roughly ₹1.9–₹2 lakh crore of market value. Names like Infosys, TCS, HCLTech, LTIMindtree, Coforge and Mphasis were down 5–7% in a matter of hours.

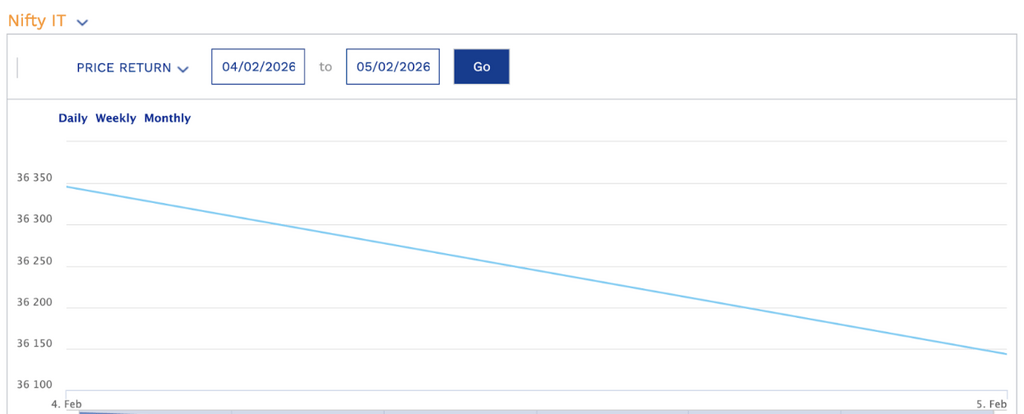

If you look at the Nifty IT index chart for that day, you’ll see a sharp, almost vertical intraday drop as panic selling kicked in, before some stabilisation later.

Analysts quickly coined a dramatic name for the episode: “SaaSpocalypse”. It’s the fear that AI agents could become so capable that they don’t just assist software companies, but replace what SaaS products and IT vendors do for their clients.

So what is Claude Cowork, why did it spook Wall Street and Dalal Street, and what should a long‑term investor actually do about it? Let’s break it down.

Claude Coword: New Scare for Tech Companies

Anthropic’s Claude Cowork is essentially a supercharged AI coworker. An AI assistant that can collaborate with people on workplace tasks. Unlike a normal chatbot that just answers questions, Cowork is an “agentic” AI platform capable of autonomously executing multi-step workflows on a computer.

On top of that, Anthropic released around 11 role‑specific plug‑ins for Cowork, including:

- Legal operations: Reviewing contracts and NDAs, flagging risky clauses

- Financial analysis: Building models, summarising reports, analysing data

- Sales and marketing: Drafting campaigns, analysing customer data

- General workflow automation: Coordinating tasks across tools and documents

Crucially, these agents do not just assist humans inside existing software. In many demos, they go directly to files, emails or web tools and complete the job end‑to‑end.

One particular plugin immediately set off alarm bells: the Claude Legal Assistant. Essentially, it can handle a lot of the grunt work junior lawyers or legal software might do, at a fraction of the time and cost. Anthropic issued a disclaimer that any output should be vetted by licensed attorneys and that the tool isn’t providing official legal advice. But that fine print did little to calm the market.

That is what triggered the scary question in investors’ minds:

“If a single AI agent can review contracts, build basic models and automate workflows, why would clients keep paying for multiple software subscriptions or large teams of IT service employees to do the same thing?”

And thus, the fear of “SaaS is dead” and “IT jobs are gone” really took hold.

How the AI Shock Unfolded

The sell-off began in Europe and the US first, and quickly spread globally.

- In London, shares of RELX (owner of LexisNexis) plunged ~14% in a single day

- Thomson Reuters, a major provider of legal and financial information, saw its stock crater 16–18%, marking its worst one-day fall ever

- Enterprise software leaders Salesforce and ServiceNow each dropped ~7%

- Adobe also slid ~7%

- Microsoft, Nvidia, Meta, and Oracle declined 2–3%, contributing to a broader Nasdaq pullback

This sudden market reaction highlighted a stark new reality for investors: AI advances are coming faster than expected, and even “safe” business models can be upended in a really short time.

Back home, the shockwave hit India’s $180 billion IT services industry.

Nifty IT 1-Yr Trajectory

But why did India react so sharply?

- High dependence on US tech spending

A large share of Indian IT revenue comes from US and European clients, especially in software, BFSI (banking and financial services) and consulting. If investors think US software companies will see margin pressure or slower growth, they automatically worry that IT vendors and consultants could face slower deal wins or pricing cuts.

- Overlap of services with what Cowork automates

Many of the workflows Anthropic showcased are exactly the kind of repetitive knowledge work where Indian IT companies employ large junior teams. If AI can handle more of this, the fear is that demand for “body‑shopping” or traditional implementation services might shrink.

FYI: Body-shopping refers to the IT staffing practice of hiring temporary employees through an agency to fill short-term project needs, offering quick, flexible, and often offshore-based talent.

- Sentiment shock on top of an already nervous sector

Even before this event, markets were debating whether Indian IT growth would slow as clients digested earlier digital‑transformation spends. The Claude Cowork news acted like a spark.

Are these AI Fears Justified?

The market reaction was arguably an overkill, and some of these stocks rebounded slightly the next day. But this is where things get nuanced, and where long‑term investors need to zoom out.

Several analysts and industry leaders have pointed out that:

Enterprise AI adoption is slow and complex

Cognizant’s CEO, for example, pushed back against the panic, noting that large companies cannot flip a “magic switch” and replace entire IT stacks overnight. Integrating AI agents into real‑world workflows involves data security, compliance, legacy systems and change management, problems that can take years to solve.

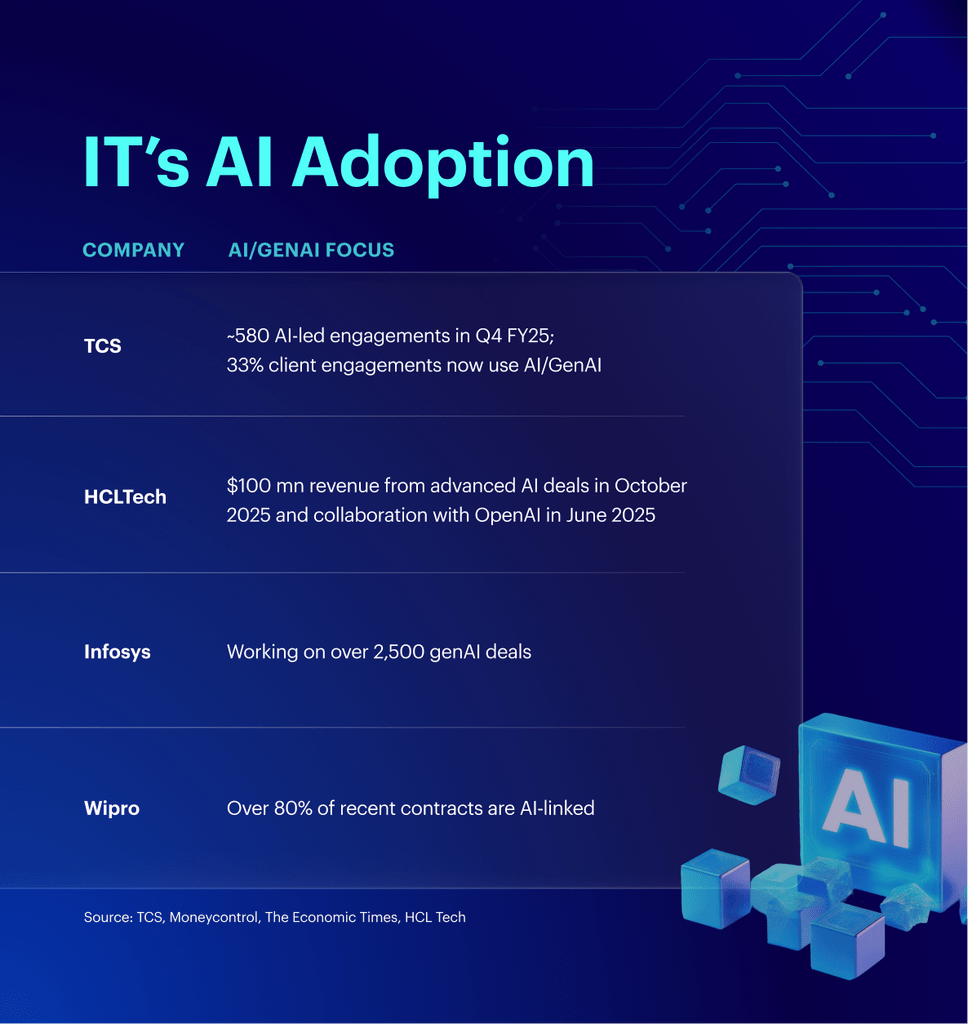

AI can be an opportunity for IT, not just a threat

If clients need to redesign their processes around AI, someone has to do that consulting, integration, governance and security work. Well‑positioned IT firms can pivot from being coding factories to becoming “AI transformation partners”, helping enterprises orchestrate and govern multiple AI agents safely.

History offers useful parallels. When cloud computing took off in earlier 2010s, there was a similar fear that traditional IT services and on‑premise software would die. Some companies did struggle, but others reinvented themselves as cloud migration specialists and did very well. The winners were the ones who adapted the fastest.

What this Means for Indian IT Investors

Three key points matter more than the scary headlines:

Yes, disruption risk is real

AI agents like Claude Cowork are not hype; they are already competitive with junior professionals and basic software in certain tasks. Over the next 5–10 years, some traditional IT and software business models will come under pressure.

But change rarely happens overnight

The market reaction reflects panic and forced selling as much as genuine re‑pricing. Client contracts are multi‑year, CIOs are cautious, and regulators are still figuring out AI rules. That gives time for both IT firms and employees to adapt, upskill and reposition.

Valuations and expectations may reset

AI disruption forces investors to re‑examine those assumptions. Research estimates that AI-led engagements account for about 74% of large contracts signed over the past few quarters.

Bottomline

For investors, this sudden AI shock is a reminder that technology disruptions are real. Does that mean one should dump all tech stocks? Probably not. But it does reinforce the importance of a long-term, diversified approach.

Rather than betting on any single software vendor, turn to stock baskets like model portfolios on smallcase that spread exposure across the theme while managing risk.

These portfolios, curated by SEBI-registered investment experts, help ensure that even if one segment falters due to new tech, your overall investment is less impacted by the broader trend. The key for us as investors is not to panic-sell on sensational headlines, but to stay informed and keep our holdings balanced and future-ready.

Disclaimer: This analysis is for educational purposes and does not constitute investment advice. Market conditions can change, and past performance is not indicative of future results. Investors should conduct their own research and/or consult a certified financial advisor before making investment decisions.