Windmill Capital Investor Letter – June 2025 Edition

Silver hit ₹1L, interest rates dropped, and our EV theme hit a speed bump. Here’s your June market wrap by Windmill Capital.

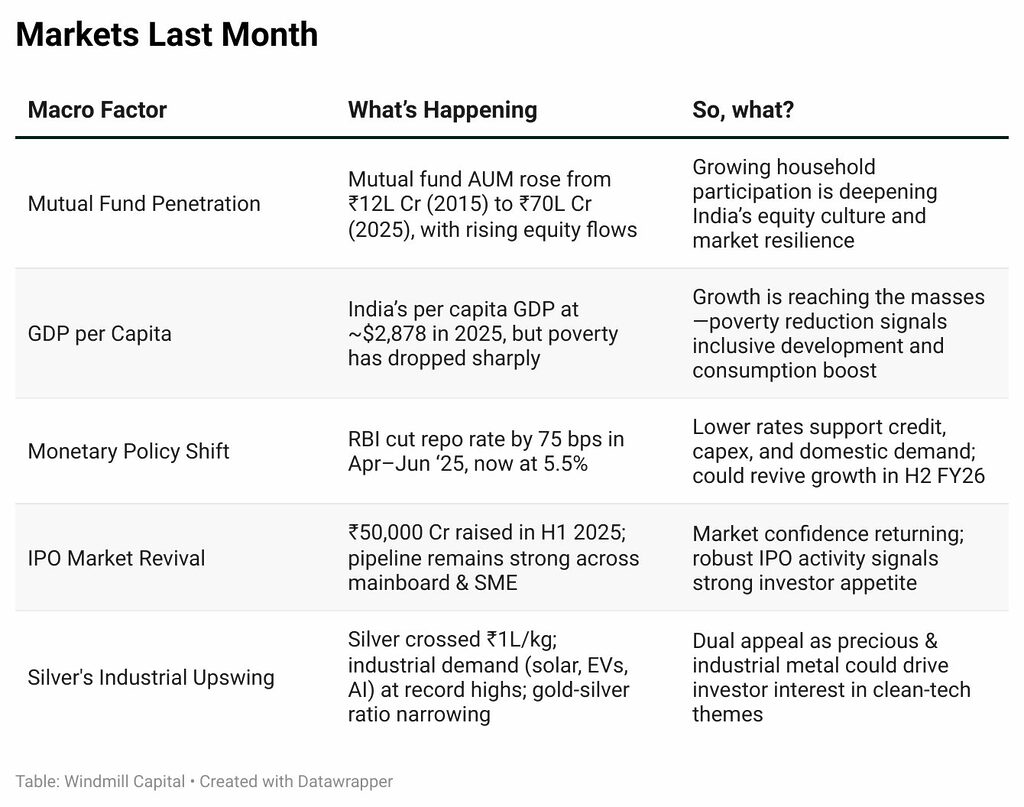

Markets Last Month 🗓️

From a boom in mutual fund participation to a revived IPO market, the Indian economy is showing signs of deepening financialization. Here are five signals worth tracking.

Tl;DR

1. Mutual Funds Are Reshaping Indian Equity Ownership

We recently explored the increasing financialization of household savings in India, with mutual funds becoming a popular vehicle for equity investments. The industry’s assets under management (AUM) have surged from ₹12 lakh crore in February 2015 to over ₹70 lakh crore by March 2025, a more than fivefold jump in just ten years. A significant portion of this capital is flowing into equities, as illustrated in the chart below.

What does this mean?

Each black line within the colored bar in the chart represents mutual fund holdings across listed Indian companies, segmented into four percentile ranges: 0–25%, 25–50%, 50–75%, and 75–100%. The line within each bar marks the 50th percentile or the median. To minimize data distortion, the top and bottom 1% of companies have been excluded.

For a straightforward interpretation, focus on the trend of the median line, which reflects how average mutual fund holdings across the broader market have evolved. Notably, there’s a clear upward shift starting from November 2023, indicating a rising trend in mutual fund ownership.

This suggests growing retail and institutional investor confidence in equities and the Indian economy, reinforcing the expanding role of mutual funds in channelling household savings into capital markets.

2. From Scale to Substance: Is India’s Growth Becoming More Inclusive?

India’s status as the world’s fourth‑largest economy masks a more nuanced story of economic well‑being: per-person output remains modest. With a nominal GDP per capita of approximately $2,878 in 2025, India still ranks around 136th globally, underscoring a vast gap between aggregate size and individual living standards.

Yet recent growth dynamics have been encouraging. Between 2022 and 2023, GDP per capita rose by roughly 5.5%, from $2,353 to $2,481, after a 5% increase the previous year. This momentum reflects resilient consumer demand, vibrant services exports, and ambitious infrastructure spending.

What About Poverty?

Despite India’s modest per capita output, poverty reduction has been striking:

- Extreme poverty ($2.15/day):

Fell from 16.2% in 2011–12 to just 2.3% in 2022–23

270 million people moved out of deepest deprivation - Moderate poverty ($3/day):

Dropped from 27.1% to 5.3% in the same period - Lower-middle-income poverty ($3.65/day PPP*):

Halved from 62% to 28%, lifting ~378 million people - Multidimensional Poverty Index (a composite measure of deprivations across health, education, and standard of living, developed by OPHI & UNDP, and adapted by NITI Aayog):

Declined from 53.8% (2005–06) to ~15.5% (2022–23)

*PPP is Purchasing Power Parity. It tells you how far your money would go in another country, after adjusting for local prices.

What does this mean?

While India’s per capita GDP still trails many emerging peers, consistent gains in income and poverty reduction suggest that growth is finally translating into tangible uplift. Still, with over 75 million people living below $3/day, the inclusion journey is far from over. But the trajectory is promising: India is steadily moving from macroeconomic muscle to shared prosperity.

3. Is RBI on the move?

In June 2025, the Reserve Bank of India (RBI) cut the repo rate by 50 basis points (bps), bringing it down to 5.5%. This follows a smaller 25 bps cut in April. In total, the RBI has reduced rates by 75 bps in just two months, marking a clear shift towards supporting growth as economic momentum slows.

The RBI’s own projections show GDP growth of 6.5% for FY26 and inflation at 4%, comfortably within the 2–6% target band. With inflation easing from earlier highs, the central bank sees room to lower interest rates and boost credit demand without stoking price pressures.

What This Means:

- For the Economy:

Lower interest rates make borrowing cheaper for businesses and consumers. This should encourage higher investment, especially in housing, infrastructure, and manufacturing. Consumers may also spend more, supporting domestic demand, which has been sluggish recently. - For GDP Growth:

A 100 bps cut, since the start of the year, alongside recent income tax cuts, could help revive growth after signs of a slowdown. The twin push, fiscal and monetary, aims to arrest the slight slowdown in our GDP growth and keep India on track to remain the fastest-growing major economy. - For Stock Markets:

Lower rates are generally good for equities. They reduce the cost of capital, improve corporate earnings potential, and make stocks more attractive than fixed-income assets.

In summary, the RBI’s back-to-back rate cuts signal a policy pivot to support growth. If inflation stays under control and demand picks up, these moves could help the economy bounce back strongly in the second half of FY26.

4. Is the IPO flavour back?

After a significant lull in India’s primary market over the last few quarters, finally, activity has returned to this market. India’s primary market action has been exceptionally robust in the first half of 2025, with companies raising a record-breaking amount of capital. Across both the mainboard and SME (Small and Medium Enterprises) platforms, over 100 companies have tapped the public markets, collectively raising close to ₹50,000 crore.

The mainboard segment has been the primary driver of this fundraising boom. In the first six months of 2025, 19 companies raised a historic ₹45,375 crore, the highest-ever amount mobilized in the first half of any calendar year. This surge was significantly powered by a few mega-issues, with the largest being the HDB Financial Services IPO, which alone raised ₹12,500 crore, accounting for over 27% of the total mainboard fundraising. Other substantial offerings included those from Schloss Bangalore (₹3,500 crores) and Dr. Agarwal’s Health Care (₹3,027 crores), indicating strong investor appetite for large, well-established companies. The SME segment has also witnessed a flurry of activity, with 82 companies raising approximately ₹3,645 crore in the same period.

Given markets have stabilized and much of the negative news is behind, companies would feel much more comfortable to debut amidst such a market environment. And we’re not just talking about the backward-looking scenario. The pipeline for the IPO market in the coming times also remains pretty strong.

As per a Fortune India article

‘74 companies, including big names such as JSW Cement, Hero Fincorp, NSDL, Vikram Solar, and LG Electronics India, proposing to raise ₹1.21 lakh crore, have Sebi’s nod and are waiting to hit the market; another 67 companies, looking to raise about ₹96,560 crore, are awaiting Sebi’s approval, data compiled by Prime Database showed. In addition, around 84 startups aiming to raise around ₹1.77 lakh crore are preparing to file their offer documents in the near future, said Pranav Haldea, managing director, Prime Database Group.’

What does this mean?

After a long pause, India’s primary markets are clearly back in action. The strong showing in H1 2025 signals renewed investor appetite, favourable market conditions, and growing confidence in India Inc. The healthy IPO pipeline across sectors ranging from legacy businesses to digital-first startups suggests that the next few quarters could see continued capital formation and greater retail participation. For investors, this is a space to watch not just for listings, but also for signals on where the economy and sentiment are headed.

5. What Silver’s Rally Really Tells Us

In a historic milestone, silver prices crossed ₹1,00,000 per kilogram in June 2025, marking the first time the metal has breached this level in recorded history. While gold has been steadily climbing, silver is now catching up with the Gold/Silver ratio recently dropping to 91.5 from a May peak of 100. For context, this ratio, which shows how many grams of silver one can buy for a gram of gold, has a 10-year average of around 81. That suggests silver still remains undervalued relative to gold, despite its recent surge.

But this rally isn’t just about catching up. Silver is increasingly being seen as a metal of the future. Over 52% of its demand comes from industrial uses, particularly in clean energy technologies, solar panels, electric vehicles, and now even AI-driven electronics. According to the World Silver Survey 2025, industrial silver demand rose 4% last year to a record 681 million ounces. Even more critically, demand is expected to outpace supply for the next five years.

India has played a role too. Government duty cuts on silver imports have spurred demand for both industrial and jewellery use. However, investment and silverware demand fell in 2024, keeping overall demand growth moderate.

What does this mean?

For investors, silver now sits at an interesting intersection: it’s both a precious metal and an industrial commodity. As the world pivots toward sustainability and digital infrastructure, silver’s shining moment may just be getting started.

Quant smallcases Rebalanced; Logic Explained 🔧

The monthly rebalance for our quant smallcases is now live. We’ve outlined the key changes and the rationale behind them for each smallcase below.

Windmill Wisdom 🧠

Are We Power-Ready for the EV Boom? ⚡

With electric vehicle sales rising fast, is India’s power grid up to the challenge? A closer look at where we are and what needs fixing.

👉 Explore what the data says

If EVs Are the Future, Why Did This Theme-based smallcase Drop 35%? 📉

A candid take on what went wrong, what’s cyclical vs structural, and whether this correction is a buying opportunity.

👉 Read why this smallcase is in focus

Microfinance in Reset Mode 🔧

After a period of hypergrowth and a short, sharp shock, the sector is rebalancing. Here’s what’s changing and why it matters.

👉 Read full story

AMA with Naveen 🎥

Missed our latest Ask-Me-Anything? Catch highlights as Naveen KR unpack recent market trends and investor questions.

👉 Watch video

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of a SEBI recognized supervisory body (if any) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary. Windmill Capital Team: Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.