Windmill Capital Investor Letter – September 2025 Edition

Here’s to a bright and prosperous festive season for you and your loved ones. 🪔

September brought policy shocks, sector-specific updates, and market resilience. Windmill Capital also covers practical applications of AI in investing and highlights unique smallcases in the mix.

Markets Last Month 📆

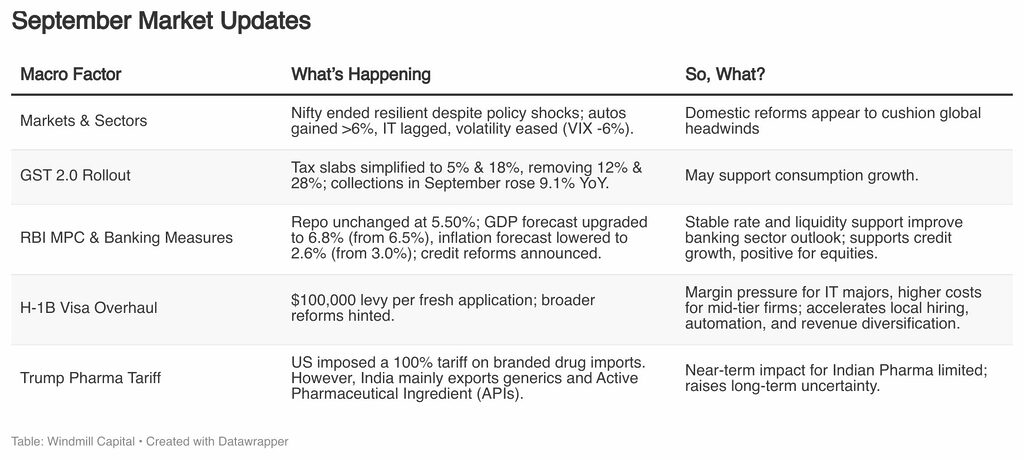

Many stories broke out in September, we covered the top 5 with biggest impact: volatility cool down, RBI stance, GST 2.0 impact on India’s growth story, H1B visa rehaul and tariff on branded pharma.

TL;DR

1. Markets in September: Volatility Cools, Confidence Returns

September was a month of policy-driven volatility for Indian equities, yet markets ended on a resilient note. The Nifty 50 closed the month modestly on the back of a few supportive reforms. The index was supported by strong participation from financials, autos, and metals.

Sectorally, the Nifty Auto index outperformed, gaining over 6% during the month as GST rate cuts and festive season demand lifted sentiment. In contrast, IT remained subdued, reflecting investor caution around the U.S. H-1B visa overhaul and slowing global tech spending. FMCG stocks recovered marginally as GST rationalisation offered a tailwind, although rural demand recovery remains patchy.

Volatility eased, with the India VIX falling about 6%, suggesting improving investor confidence. Mid-caps and small-caps also stabilised after an earlier correction, benefiting from sector rotation.

Overall, the market narrative has shifted from external risks, U.S. tariffs and visa changes to domestic policy support. With GDP growth upgraded and inflation under control, India stands at a crucial crossroads and seems ready to break through.

2. GST 2.0 Reshapes India’s Growth Story

From September 22, India rolled out GST 2.0, a major reform that rationalised the earlier multi-slab system into just two rates: 5% and 18%. The elimination of the 12% and 28% brackets simplifies compliance, reduces classification disputes, and creates a more consumption-friendly tax architecture. For businesses and consumers alike, this is a structural turning point.

Early signs are encouraging: September’s gross GST collections rose 9.1% year-on-year to ₹1.89 lakh crore, reflecting both festive demand and improved compliance. For sectors like FMCG, autos, and consumer durables, the tax cut on previously higher-slab goods directly lowers prices, spurring demand, especially in rural markets. The auto index, for instance, surged nearly 6% in September, highlighting investor optimism.

For the broader economy, GST 2.0 addresses two key pain points: complexity and uneven input tax credit chains. By streamlining, it enhances working capital cycles for MSMEs and improves the ease of doing business. Analysts also expect the reform to cushion India’s domestic economy against external tariff shocks, such as those emanating from the U.S.

3. RBI Holds Rates, Opens Credit Floodgates

The Reserve Bank of India’s Monetary Policy Committee (MPC) kept the repo rate unchanged at 5.50% in its October 1 review, while maintaining a “neutral” stance. What caught markets’ attention, however, were the slew of banking and financial sector measures aimed at deepening credit markets and supporting growth. The RBI upgraded FY26 GDP growth to 6.8% and revised inflation estimates down to 2.6%, signalling confidence in the economy’s resilience despite global headwinds.

Key policy moves included easing acquisition financing rules, expanding the scope for loans against shares, refining ECB and FEMA frameworks, and encouraging greater participation in corporate bond markets. Together, these initiatives are designed to improve liquidity, support capital expenditure cycles, and enhance transmission of monetary policy. Importantly, they also align with the government’s broader push to formalise credit flows and reduce dependence on traditional bank lending.

For Indian banks, the reforms improve flexibility in corporate lending, potentially boosting fee income streams. NBFCs and bond markets could see greater traction as well. Markets responded positively, with bank and financial indices leading gains post-policy. Over the medium term, a stable rate environment coupled with structural reforms sets the stage for credit growth without stoking inflation, positive for equities and the broader economy.

4. H-1B Overhaul Puts Indian IT on Notice

The U.S. government’s overhaul of the H-1B visa program, beginning with a one-time $100,000 fee on fresh applications and hints of broader reforms, has put India’s $283-billion IT services industry on notice. For decades, the sector has thrived on a hybrid model of offshore development complemented by onsite project execution via H-1B visa holders. With ~70% of H-1B visas historically going to Indians, the financial and strategic implications are significant.

In the near term, the cost of sending employees onsite will rise sharply, denting margins for IT majors like Infosys, TCS, and Wipro. Mid-tier IT firms, which rely even more heavily on the visa route, could be disproportionately hit. To mitigate, companies will double down on local hiring in the U.S., expand nearshore delivery centres in Mexico and Eastern Europe, and automate more roles. While this cushions client delivery, it adds structural costs.

For the Indian economy, the long-term impact is twofold. First, it accelerates the shift toward higher-end digital, cloud, and AI work delivered offshore from India, a segment that supports higher wages domestically. Second, it forces IT firms to diversify revenue geographies beyond the U.S. For equity markets, valuations may compress in the short term, but secular growth drivers remain intact.

5. Pharma Tariff Shock: What Trump’s Move Means for India

The Trump administration’s decision to impose a 100% tariff on branded and patented drug imports into the United States from October 1 has created ripples across global pharmaceutical supply chains. While the immediate impact on Indian drugmakers appears limited, since India predominantly exports generics and APIs to the U.S., the move signals a more aggressive stance toward foreign drug imports. This introduces a layer of uncertainty for Indian pharmaceutical firms that are actively trying to climb the value chain with complex generics, biosimilars, and specialty drugs.

Investors initially reacted by pulling down pharma stocks on fears that the tariff line could widen in scope. If future classifications tighten, India’s $20-billion+ pharma export industry could face pricing pressures and higher compliance costs. Moreover, multinational pharma companies with Indian subsidiaries may reassess their U.S. supply models, potentially shifting more R&D and manufacturing to domestic or allied markets.

On the flip side, the tariff may accelerate opportunities for Indian generic players as U.S. healthcare systems look for cost-effective alternatives. Over the medium term, India could benefit as a preferred partner for affordable medicines, but the sector must brace for heightened volatility and regulatory risks. For investors, pharma is entering a more geopolitically sensitive zone. This article covers more about this issue.

Windmill Wisdom 🦉

Focusing on Three Unique Investment Strategies ✨

A closer look at Windmill Capital’s Horizon, Business House, and Growth & Value Multicap smallcases; what makes them unique. Read Report →

What AI Really Means for Investing? 🤖

From stock selection to risk monitoring, AI is reshaping investing, but AI is not implemented the way you might be thinking. See how Windmill Capital utilises AI in investing. Explore →

If there’s a topic you’d like us to cover in future newsletters, tell us here.

Disclaimer: Investment in securities market are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL (in case of IAs) and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

The content in these posts/articles is for informational and educational purposes only and should not be construed as professional financial advice and nor to be construed as an offer to buy /sell or the solicitation of an offer to buy/sell any security or financial products.Users must make their own investment decisions based on their specific investment objective and financial position and using such independent advisors as they believe necessary.

Windmill Capital Team: Windmill Capital Private Limited is a SEBI registered research analyst (Regn. No. INH200007645) based in Bengaluru at No 51 Le Parc Richmonde, Richmond Road, Shanthala Nagar, Bangalore, Karnataka – 560025 creating Thematic & Quantamental curated stock/ETF portfolios. Data analysis is the heart and soul behind our portfolio construction & with 50+ offerings, we have something for everyone. CIN of the company is U74999KA2020PTC132398. For more information and disclosures, visit our disclosures page here.